Best Brokers With INR Accounts 2026

Whether you’re an Indian trader or dealing in high-volume INR trades, having a trading account denominated in Indian Rupees (₹) can help you avoid currency conversion fees and simplify your transactions.

Explore our choice of the best brokers with INR accounts, personally tested by our experts.

Top 6 Brokers With INR Accounts 2026

After running hands-on tests of 140 brokers, we’ve identified the 6 best brokers for INR trading accounts:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Why Are These Brokers With INR Accounts The Best?

See why we think these are the top trading platforms for accounts based in Indian Rupees:

- Interactive Brokers is the best broker with an INR account in 2026 - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

How Safe Are These Brokers Offering INR Trading Accounts?

Explore the steps our leading brokers take to safeguard your Rupees:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| eToro USA | ✘ | ✘ | ✔ | |

| Plus500US | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ |

Mobile Trading Comparison

See how these brokers with INR accounts fared in our tests of their apps:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ |

Are The Top Brokers For INR Accounts Good For Beginners?

Beginners should use brokers with demo trading before depositing Rupees and other features for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| eToro USA | ✔ | $100 | $10 | ||

| Plus500US | ✔ | $100 | Variable | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots |

Are The Top Brokers For INR Accounts Good For Advanced Traders?

Experienced traders should look for powerful tools to upgrade the trading environment after depositing Rupees:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

Compare The Ratings Of The Top Brokers That Accept Indian Rupee Accounts

Discover how the top INR trading account providers scored in vital areas after our evaluations:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| eToro USA | |||||||||

| Plus500US | |||||||||

| OANDA US | |||||||||

| FOREX.com |

Trading Fees Comparison

Depositing to a INR account is low-cost, however trading fees add up so here's how the top firms measure up:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| NinjaTrader | ✘ | $25 | |

| eToro USA | ✔ | $10 | |

| Plus500US | ✘ | $0 | |

| OANDA US | ✘ | $0 | |

| FOREX.com | ✘ | $15 |

How Popular Are These Trading Platforms With INR Accounts?

Many traders prefer the most popular brokers that have trading accounts in Indian Rupees (the most users):

| Broker | Popularity |

|---|---|

| Plus500US | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Open An INR Trading Account With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Why Open An INR Trading Account With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

Why Open An INR Trading Account With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

Cons

- Average fees may cut into the profit margins of day traders

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

Why Open An INR Trading Account With Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

Why Open An INR Trading Account With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- The broker offers a transparent pricing structure with no hidden charges

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

Why Open An INR Trading Account With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

How Did DayTrading.com Choose The Best Brokers For INR Accounts?

To identify the top brokers with INR accounts we:

- Leveraged our directory consisting of 140 brokers and trading platforms;

- Pinpointed those offering a trading account based in Indian Rupees for hassle-free transactions;

- Ranked them by their rating, combining 200+ data points per provider with our personal testing observations.

What Is A INR Trading Account?

An INR account is a trading account in which the balance is denominated in Indian Rupees (₹).

This means that the cash you hold or instruments you trade will be displayed in INR. It will also be the currency used for establishing margin requirements – a popular approach used by day traders in India.

If you deposit in another currency, such as US Dollars, your capital will automatically be converted into INR (which may incur fees).

How Do I Open An INR Trading Account?

Start by selecting a broker that offers INR-denominated accounts and meets your trading needs.

With the rise in retail trading in India and increasing demand for Demat accounts, many brokers now support INR-based trading, making it easier than ever to find a suitable provider.

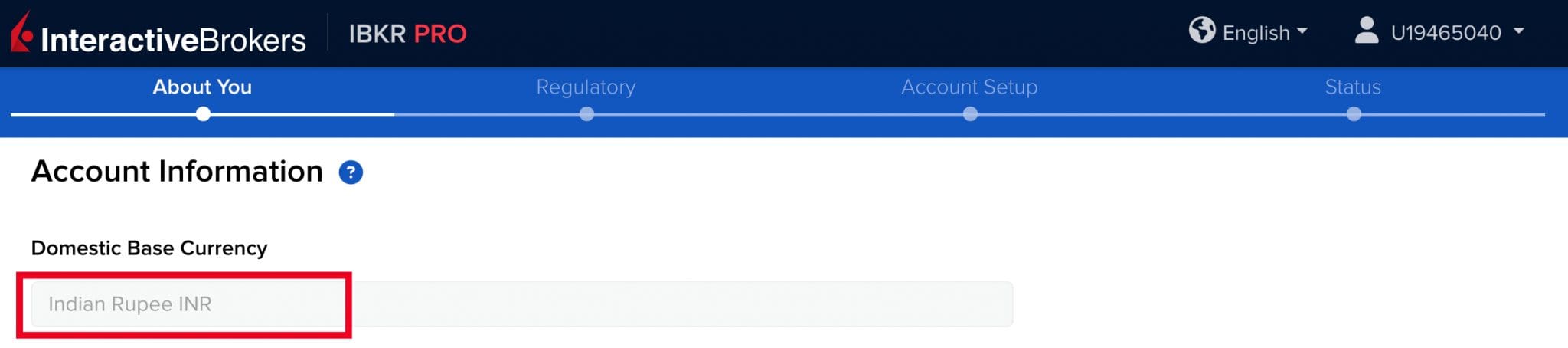

Once you’ve chosen a broker, simply select ‘INR’ as your base currency during the account setup process. For example, below you can see where I signed up for an INR account at Interactive Brokers.

Do I Need An INR Trading Account?

This account may be appropriate if:

- You live in India and earn money in INR as it’s economical to operate a trading account in the same currency.

- You frequently trade currency pairs that contain the INR, such as USD/INR and EUR/INR, because it reduces the need for conversion and associated charges.

- You actively trade Indian equities listed on the National Stock Exchange of India as transactions are often faster and you don’t need to manage multiple currencies and exchange rates.

How Can I Check If A Broker Offers An Account In Indian Rupees?

Use these straightforward steps, which we took to check all our suggested trading platforms offer an INR account:

- Go to the account types page on the broker’s website to find a selection of ‘base currencies’.

- Confirm that ‘INR’ is available as a supported account currency for your country.

- Open a live or demo account and select ‘INR’ as your base currency.

Pros & Cons Of INR Trading Accounts

Pros

- Our tests show brokers with INR accounts often tailor their trading services to Indians in other ways, for example, providing localized customer support (available at Interactive Brokers) and Islamic accounts (Islam is India’s second-largest religion).

- They can reduce conversion fees when trading in Rupees. This can save frequent traders, such as day traders, money as if you want to deposit INR to an account based in the USD, for example, some firms like IG charge 0.8% on top of the prevailing exchange rate from various banks.

- For Indian day traders, they offer a convenient way to manage a high volume of trades and costs in a familiar currency, helping not to overwhelm newer investors especially.

- While USD remains the dominant base currency (offered by over 90% of trading platforms that we’ve tested), INR is increasingly being supported by top brokers catering to the Indian market.

- Some brokers we’ve evaluated support fast, secure and low-cost deposits via local payment solutions like UPI, IMPS, bank transfers, and e-wallets for INR-based trading accounts.

Cons

- Although there’s an increasing number of trading platforms with INR accounts, they are still pretty uncommon (less than 10% of brokers we’ve evaluated).

- While the INR is a fairly stable currency (among its least volatile in the last 20 years according to Business Standard), maintaining balances in it may open you up to any fluctuations caused by changing oil prices for instance (India is a major oil importer).

- The Indian Rupee still has relatively limited trading volumes compared to the likes of the US Dollar and British Pound, in part due to its status as an emerging economy and strict capital controls, so short-term trading the INR with other currencies may result in wider spreads.

- Trading in popular international assets, such as US equities, may result in a conversion fee if your cash is in INR.

FAQ

How Much Does It Cost To Open A Trading Account Based In Indian Rupees?

You’ll need up to 250 USD or INR equivalent in February 2026 to open a trading account based in Indian Rupees following our evaluations of 140 brokers, over 10 of which support INR trading accounts.

However, Interactive Brokers stands out with no minimum deposit in INR, making it the best option for budget traders.

What Do I Need To Open An INR Brokerage Account?

Most brokers require the following to open an INR trading account:

- Basic contact details like name, email, and phone number.

- Photo ID such as Aadhaar card, passport, or driver’s license.

- Proof of address like a recent utility bill or bank statement.

Is My Money Safe In An INR Brokerage Account?

Your funds are more secure with a reputable, regulated broker, but safety depends on:

- Top brokers keep client funds separate from company funds to prevent misuse.

- Use trusted payment options like UPI, IMPS, and bank transfers.

- Look for firms with negative balance protection so you can’t lose more than your deposited Rupees.

- Some brokers offer investor compensation schemes in case of insolvency, though Indian retail traders don’t typically have access to schemes that are common in regions like the EU (€20,000 through ICF) and UK (£85,000 through FCS).

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com