Best Brokers For Short Selling 2026

Short sellers aim to profit from market downturns. We’ve found the best brokers for short selling by assessing key factors: markets available to short, fees on short positions, platform quality, account minimums, and our trust in the broker.

Best Brokers For Short Selling 2026

These are the 6 best platforms based on our findings, offering either direct short selling or short selling through products like CFDs:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

Exness

Exness -

5

IC Markets

IC Markets -

6

RoboForex

RoboForex

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - When we tested Interactive Brokers, short selling across stocks, forex, and CFDs was highly flexible. Borrow costs were transparent and often lower than most competitors we tested, averaging around 0.015% daily on forex CFDs and about 1.1% for equity CFDs, and restrictions were minimal. IBKR’s platforms and market data are also a step above much of the competition, making it ideal for advanced traders who rely on precise, tactical short-selling strategies.

- NinjaTrader - In our evaluations, NinjaTrader stood out for how easy it made short selling across futures and forex CFDs. Borrow costs were reasonable, roughly 0.02% daily on forex CFDs and around 1.3% for futures and equity CFDs. For those short selling through futures products, it provides more instruments and specific tool than almost every other firm we tested.

- Plus500US - When we tested Plus500US, short selling was straightforward - just sell to open on futures contracts like micro equity indices and crude oil, then buy to close. Because these are futures, there are limited borrow/locate hassles or borrow fees; costs are transparent (commission + exchange/NFA fees), margin updates in real time, and the web platform has a unique design that's genuinely intuitive and complete with integrated research tools..

- Exness - When we put Exness to the test, short selling was straightforward across forex and CFDs, with very competitive borrow fees of about 0.03% daily on forex CFDs and around 1.5% for equity CFDs. The platform handled high-volatility moments without hiccups, and restrictions were limited, giving traders freedom to act quickly.

- IC Markets - In our hands-on testing, IC Markets delivered smooth short selling with ultra-low borrow costs averaging around 0.02% daily on forex CFDs and roughly 1.2% for equity CFDs on most forex and CFD instruments. Restrictions were minimal, allowing rapid reactions to market swings. Execution was consistently fast, even during busy sessions, making short positions more precise.

- RoboForex - During our tests with RoboForex, short selling across forex and CFD markets felt seamless. Borrow costs were reasonable, they averaged roughly 0.035% daily on forex CFDs and about 1.8% for equity CFDs, and restrictions rarely got in the way of swift trades. Hands-on testing showed RoboForex is a solid choice for traders who like to move quickly against the trend.

Best Brokers For Short Selling 2026 Comparison

| Broker | Short Selling Rating | Minimum Deposit |

|---|---|---|

| Interactive Brokers | / 5 | $0 |

| NinjaTrader | / 5 | $0 |

| Plus500US | / 5 | $100 |

| Exness | / 5 | Varies based on the payment system |

| IC Markets | / 5 | $200 |

| RoboForex | / 5 | $10 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- Plus500 added prediction markets to its 'Plus500 Futures' platform in February 2026, with event-based trades covering 10 categories, from financials to politics, including short-term opportunities with intraday contracts that expire after just 15 minutes.

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

Comparing Short Selling Brokers

Based on our exhaustive tests, the best brokers for short selling are trusted and offer a range of markets, low fees, excellent platforms, and accessible minimum deposits.

We unpack these comparison factors and our methodology below.

Trust

When we put together this list, our top priority was choosing trustworthy short selling brokers.

Only those who meet our stringent trust standards, including having up-to-date regulatory credentials and earning a solid reputation with our in-house experts, make the cut.

- eToro continues to distinguish itself through its stellar record with 25+ million users and authorization from multiple tier-one regulators including the US SEC and UK FCA.

Markets

Short selling brokers provide opportunities to profit when an asset’s price decreases, either through products like contracts for difference (CFDs) or by directly loaning the asset, such as stocks, to traders to rebuy later at a lower price.

We look for short selling brokers that offer a diverse range of markets, ensuring traders can capitalize on shorting opportunities across company shares, stock indices, currencies, or crypto tokens.

- AvaTrade excels for its extensive market offerings, allowing short positions through CFDs across 1,250+ stocks, indices, forex, commodities, and cryptocurrencies.

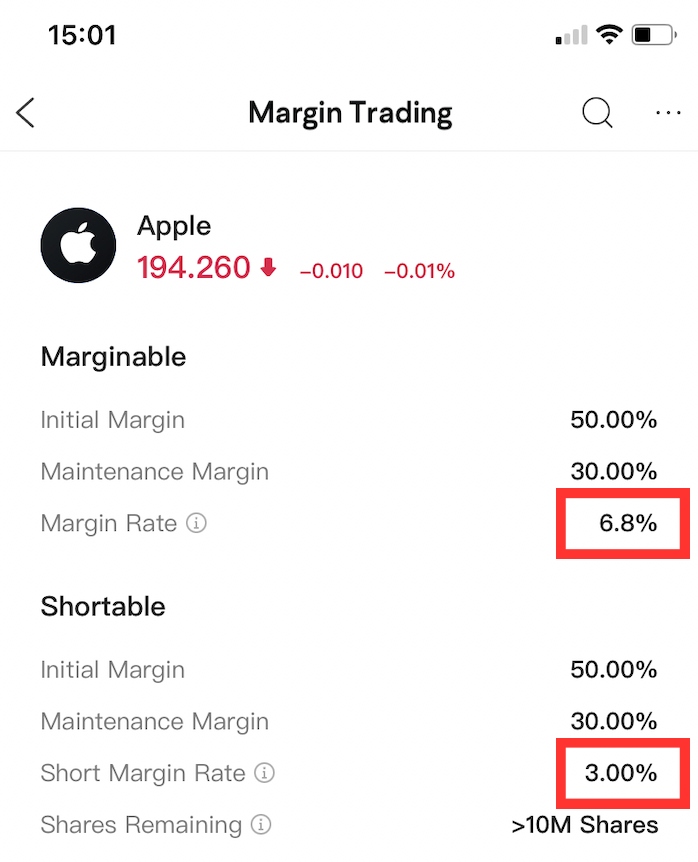

Fees

Short selling can involve certain fees including transaction costs, interest charged on borrowed funds, as well as standard interest rates on margin accounts.

We only select short selling brokers that offer highly competitive rates, but more than this we seek out those that offer good value for money by reviewing the total costs and how the services on offer weigh up.

Brokers frequently adjust their rates, so we also periodically review pricing structures to make sure short sellers have the latest information.

- Moomoo shines for its low fees with zero commissions and competitive short selling rates that vary depending on daily market supply.

Platforms

Traders need a fast, smooth and responsive platform or app to get the best results while short selling.

However, what separates the best short selling brokers for us is their valuable insights into securities that can be shorted, including the quantity available and alerts to significant changes in short interest rates and costs, to support decision-making.

- Interactive Brokers stands out with its comprehensive IBKR’s Securities Loan Borrow (SLB), offering real-time updates on shortable quantities, live and historical borrowing rates, and more throughout the day.

Account Minimums

Brokerages with low minimum deposits are the most accessible and allow traders of all stripes to test out brokers’ services and start shorting securities before risking substantial capital.

Recognizing the potential of margin trading for short sellers with limited funds, we favor brokers offering minimum deposits of $500 or less.

- Webull excels as one of the most accessible short selling brokers with no minimum deposit.

Methodology

Compiling our list of the top short selling brokers involved a 5-step, hands-on approach:

- Regulatory credentials – We went beyond the details advertised, verifying each broker’s license on the relevant agency’s website to ensure it was valid.

- Trading fees – We compared fees comprehensively – examining commissions, interest on borrowing, and any additional costs – to ensure brokers offer a cost-effective environment for short sellers.

- Platform quality – Putting platforms and tools to the test, we actively placed paper trades, assessing their suitability specifically for short selling.

- Trading markets – We investigated the markets and instruments available for short selling to ensure users have ample trading opportunities.

- Account opening – Recognizing the importance of accessibility, we verified that the minimum deposit required to open an account was reasonable, helping new short sellers get started.

FAQ

What Is Short Selling?

Short selling involves borrowing an asset to sell it in a bet that its price will drop, allowing you to buy it back at a later date and pocket the difference in price (minus any fees).

Alternatively, short sellers can speculate on falling prices using derivatives like contracts for difference (CFDs), whereby you don’t take ownership of the underlying asset.

Can Anyone Short Sell?

Thanks to the wide availability of online brokers, it is easier than ever to short stocks and other securities today. If you are able to sign up with the brokers on our list, then you can start short selling.

What Are The Benefits Of Short Selling?

Shorting can be a lucrative trading strategy when it comes off. Asset prices do not normally rise indefinitely, and short selling gives traders an opportunity to anticipate price drops and make money from the inevitable.

What Are The Risks Of Short Selling?

If you had bought one Bitcoin in 2019 for $5000, the maximum amount you would have risked losing was $5000 if the price went to zero. But in fact, the price rose to a peak above $60,000, so if you had shorted Bitcoin you would have potentially lost more than $55,000 (excluding any fees).

This illustrates how a short trade can be riskier than a straightforward buy, as there is no limit to how high an asset’s price can rise.