Forex Trading in Brazil

While forex trading is less prevalent than other investments like stocks and bonds, its popularity is increasing in Brazil. Indeed, Brazil is a significant player in the forex market, contributing $21 billion to the global foreign exchange market in 2022, according to the latest Triennial Survey from the Bank for International Settlements (BIS).

However, Brazil has a history of currency controls and capital restrictions, which can impact forex trading. You need to be aware of any regulatory changes that could affect your ability to trade.

This guide breaks down the essentials of forex trading in Brazil, equips you with actionable tips, and helps you to navigate the market with an example trade.

Quick Introduction

- Brazilians can trade Brazilian real (BRL) against other currencies, notably USD/BRL, plus key pairs like EUR/USD, USD/JPY, and GBP/USD.

- The Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários, or CVM), is the central regulatory authority overseeing financial markets, including forex trading.

- In a move to protect investors, Brazil has restricted CFDs (contracts for difference) – a popular way to day trade currencies. This applies not just to Brazilian firms, but also any foreign company targeting Brazilians.

Top 4 Forex Brokers in Brazil

Our latest findings reveal these 4 platforms are a cut above for forex traders in Brazil:

How Does Forex Trading Work In Brazil?

Forex trading in Brazil involves buying and selling currency pairs in the foreign exchange market, such as USD/BRL (US dollar/Brazilian real), to make money from price fluctuations.

To start trading currencies online in Brazil, you’ll need to:

- Open an account with a forex broker – Choose a CVM-regulated firm for local protections.

- Deposit funds – Opt for a broker with a BRL account to reduce conversion fees.

- Execute trades – Your broker will provide a desktop, mobile, and/or web-based platform.

Is Forex Trading Legal In Brazil?

While forex trading in Brazil isn’t illegal, Brazilian brokers need a CVM license, which excludes CFDs. There are only a few online brokers based in the country.

Brazilian residents looking to trade forex CFDs might turn to brokers regulated by other, potentially less prominent, financial authorities or unregulated ones.

You should be aware that unregulated brokers are a gamble. They expose you to potential fraud and make it much harder to get your money back if something goes wrong.

Is Forex Trading Taxed In Brazil?

Forex traders in Brazil are subject to taxes on their profits. These profits are considered taxable income, but the specific tax type depends on how the trading is conducted.

Individual traders will likely have their profits taxed under income tax (Imposto de Renda), with rates based on their income bracket.

Forex traders in Brazil can often deduct trading-related expenses from their taxable income, including trading platform fees, internet costs, and other related expenses. It may also be possible to offset trading losses against profits in the same tax year, reducing the overall tax liability.

I recommend consulting with a Brazilian tax professional to ensure compliance with Brazilian tax regulations and navigate the specific implications of your situation.

When Is The Best Time To Trade Forex In Brazil?

While there’s no single ‘best time’ to trade forex in Brazil, some factors can influence your decision.

For many Brazilian traders, the sweet spot lies between 9:00 and 13:00 local time. This window coincides with the overlap between the London and New York sessions, which boast the highest global trading volume. This translates to tighter spreads and potentially more opportunities to capitalize on market movements.

Ultimately, the best time to trade is when it works for you. If you have a busy day job, overlapping evenings during the New York session might be your best bet. However, remember that these peak hours can also be more volatile.

If you’re new to forex trading, consider starting with less volatile times like the Asian open (around 21:00 local time) or using a demo forex account before risking real capital.

Example Trade

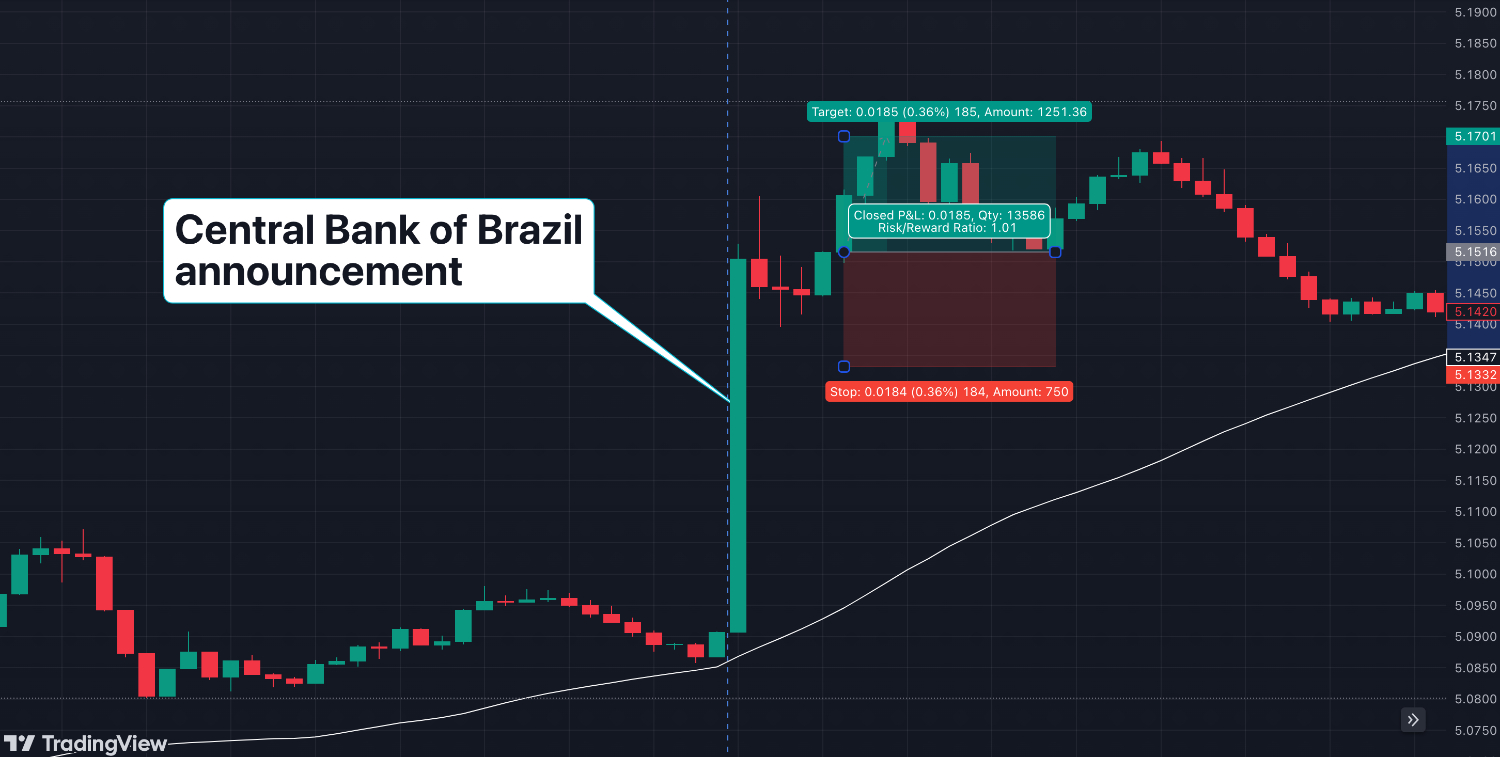

This scenario explores a day trading strategy for the USD/BRL currency pair.

Event Background

On the day of the trade, the Central Bank of Brazil released its latest interest rate decision, announcing an unexpected 25bp cut of the benchmark Selic rate to 10.50% (rather than opting for another 50bp step).

Interest rate changes significantly impact currency values, and a lower rate typically leads to a weaker currency since it reduces the return on investments denominated in that currency.

Interpretation Of Data

Interpreting the unexpected rate cut, I understood that the Central Bank was likely concerned about economic growth and was trying to stimulate the economy.

This decision likely led to a depreciation of the BRL against the USD. I saw this as a potential opportunity to trade the USD/BRL pair, anticipating that the USD would strengthen against the BRL in the short term.

Trade Entry

First, I analyzed the market’s initial reaction to the announcement. I noticed a spike in the USD/BRL pair, indicating that the market reacted to the news. The USD/BRL pair was trading above its 50-day moving average, so I confirmed a bullish trend.

I decided on my entry point to enter the trade when a 15-minute candle closed after the initial significant move, suggesting further upward momentum. With the current exchange rate at 5.15 and my expectation to rise to 5.17, I entered a long position on the USD/BRL pair.

Trade Exit

I set a target exit point based on my analysis to manage my trade. I aimed to exit when the USD/BRL reached 5.17. To protect against excessive losses, I placed a stop-loss order below a recent support level for a 1:1 risk-to-reward trade.

I monitored the trade closely as the market reacted to the rate cut, preparing to adjust my exit strategy if new information or market conditions arose.

Once the USD/BRL hit my target of 5.17, my take profit order was triggered, and my profit was secured. Alternatively, if the market moved against me and hit my stop-loss at 5.13, it would have been out of the trade at a loss.

Post-Trade Analysis

After exiting the trade, I reviewed the outcome. As I made a profit, I evaluated what factors contributed to the success. I would also have identified what went wrong if it was a loss. I considered whether my interpretation of the economic data and the technical indicators was accurate, and I determined whether my entry and exit points were well chosen.

I detailed the forex trade, including my rationale, execution, and outcome. This helped me build a database of insights for future trades, allowing me to systematically approach forex trading around significant economic announcements and increase my chances of making informed and profitable trades.

Bottom Line

Forex trading is rising in Brazil, but it’s a market with unique considerations. Unlike most countries, trading forex CFDs comes with restrictions, so extra caution is needed. As a result, many Brazilians turn to overseas brokers, but they can be risky and expose you to potential scams.

Brazil’s dynamic economic and political climate can also lead to high market volatility, making forex trading potentially lucrative and demanding for beginners. Additionally, remember that profits from trading currencies online are subject to taxation in Brazil.

Recommended Reading

Article Sources

- Comissão de Valores Mobiliários (CVM)

- Central Bank of Brazil

- Imposto de Renda

- Bank for International Settlements (BIS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com