Book Skew (Quantitative Trading)

Book skew is a concept derived from the market microstructure that quantitatively measures the imbalance between the buy and sell sides of the order book in financial markets.

Specifically, it refers to the discrepancy between the resting bid depth () and the resting ask depth () at the top of the order book.

This discrepancy is important in quantitative trading for several reasons that we’ll explore.

Key Takeaways – Book Skew

- Predictive Insight

- Book skew offers a real-time gauge of market sentiment.

- Helps traders predict short-term price movements based on the imbalance between bid and ask volumes.

- Cost Efficiency

- Understanding book skew can lead to more cost-effective trading by timing orders to coincide with favorable liquidity conditions.

- Reduces market impact and slippage.

- Strategy Optimization

- Incorporating book skew into algorithms enhances HFT and non-HFT strategies by providing a layer of market analysis for optimizing order execution.

- Example Book Skew Algorithm

- We create a basic example of how book skew can be turned into trading rules.

Book Skew Definition

Book Skew = log(vb) – log (va) = log(vb) / log(va)

Interpretation & Application

The book skew is calculated by taking the logarithmic difference between the bid depth () and the resting ask depth ().

Logarithmic Differences

The choice of logarithmic differences, as opposed to simple differences, is primarily to scale the values appropriately.

This reflects the order of magnitude and makes the skew measurement more manageable and interpretable.

Positive Book Skew vs. Negative Book Skew

A positive skew indicates a higher depth on the bid side, suggesting stronger buying pressure, which could lead to price increases.

Conversely, a negative skew suggests stronger selling pressure, potentially leading to price decreases.

Intuitive Interpretation of Book Skew

The skew is designed such that positive values intuitively align with expectations of rising prices.

Strategic Implications

Trading Rules

A trading strategy might employ book skew as a signal to initiate trades – buying when the skew exceeds a certain positive threshold () and selling when it falls below a negative threshold ().

This rule capitalizes on the premise that an imbalance favoring the bid side is indicative of upward price momentum and vice versa.

We’ll do an example of a book skew algorithm below – i.e., how it can be turned into a trading rule.

Sentiment & Demand Dynamics

The reliance on book skew as a trading signal is predicated on the assumption that the depth imbalance between the bid and ask sides of the order book reflects underlying market sentiment and demand dynamics.

Higher bid depth is interpreted as a sign of higher demand and a bullish market sentiment, which could lead to price appreciation.

Lower Transaction Costs

Incorporating book skew into trading strategies can potentially lower transaction costs by guiding traders to commit to orders when the book skew is favorable.

The metric can help capitalize on more efficient market entry or exit points.

Relevance for Non-HFT Traders

This approach could be relevant even for non-HFT (high-frequency trading) traders as well.

It may allow them to time their trades more effectively even if they’re not trading at the sub-second level

It may help avoid periods of unfavorable skew that may result in less optimal execution prices.

Importance in Quantitative Trading

Market Sentiment Indicator (at the Micro Level)

In the context of quantitative trading, book skew serves as a real-time market sentiment indicator that can be algorithmically monitored and acted upon.

By quantifying the imbalance in order depth, traders can gauge short-term directional biases in market prices.

Influence on Trading Strategies

The integration of book skew into quantitative models allows for the dynamic adjustment of trading strategies based on immediate market conditions.

This can potentially improve returns or reduce risk based on current buying or selling pressure.

Book Skew & Interaction with Market Depth + Market Impact

Book skew, reflecting the imbalance between buy (bid) and sell (ask) orders, interacts closely with market depth, which indicates liquidity and potential price movement upon order execution.

In HFT strategies, understanding this skew is important for anticipating market impact – the change in price due to large orders (especially important for large traders).

A favorable book skew suggests an opportunity to execute large orders with minimal market impact, optimizing entry and exit points.

Successful HFT strategies, therefore, integrate real-time analysis of book skew and market depth to minimize slippage (the difference between expected and executed prices) to help with efficient trade execution and managing transaction costs effectively.

This synergy between book skew, market depth, and market impact is fundamental to reducing transaction costs and improving profitability through precise, algorithm-driven decisions.

Book Skew & How to Integrate Transaction Cost Factors

Integrating transaction cost factors into book skew analysis improves trading strategies by accounting for the real cost of execution (rarely done in more academic models).

To do this, adjust the skew threshold to include expected transaction costs:

- widen the threshold for markets with higher costs

- this ensures trades are only executed when the anticipated market movement justifies these expenses

For instance, if the cost is high, a larger positive skew is required before buying to make sure the expected profit exceeds the transaction cost.

Similarly, adjust sell-side strategies to account for costs.

This helps to optimize trade timing and execution to preserve profitability in a cost-sensitive environment.

Book Skew Trading Algorithm Rule

Below is a simple Python script that calculates the book skew based on synthetic bid and ask depth data.

This example generates synthetic data to represent the top-level bid and ask depths of a trading book and then calculates the book skew.

Keep in mind that this is a basic illustration intended for educational purposes.

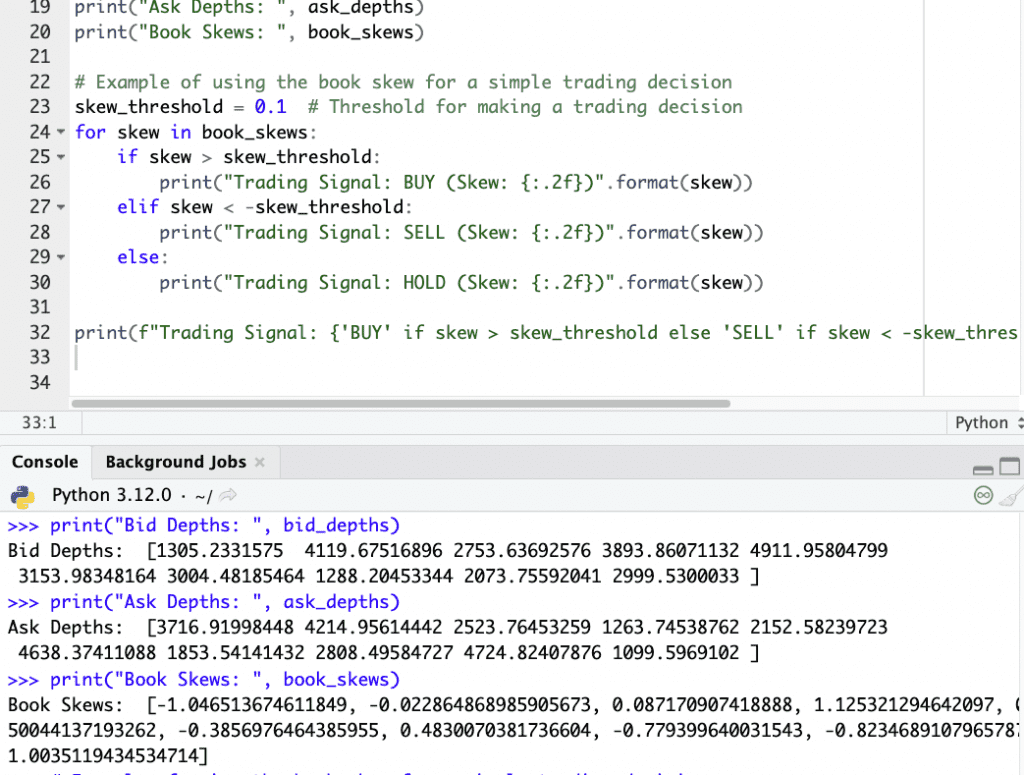

import numpy as np

# Generate synthetic bid & ask depth data

np.random.seed(7)

bid_depths = np.random.uniform(low=1000, high=5000, size=10) # Random bid depths

ask_depths = np.random.uniform(low=1000, high=5000, size=10) # Random ask depths

def calculate_book_skew(bid_depth, ask_depth):

"""

Calculate the book skew as the logarithmic difference between bid and ask depth.

"""

return np.log(bid_depth) - np.log(ask_depth)

# Calculate book skew for each pair of bid & ask depth

book_skews = [calculate_book_skew(bid, ask) for bid, ask in zip(bid_depths, ask_depths)]

# Print the results

print("Bid Depths: ", bid_depths)

print("Ask Depths: ", ask_depths)

print("Book Skews: ", book_skews)

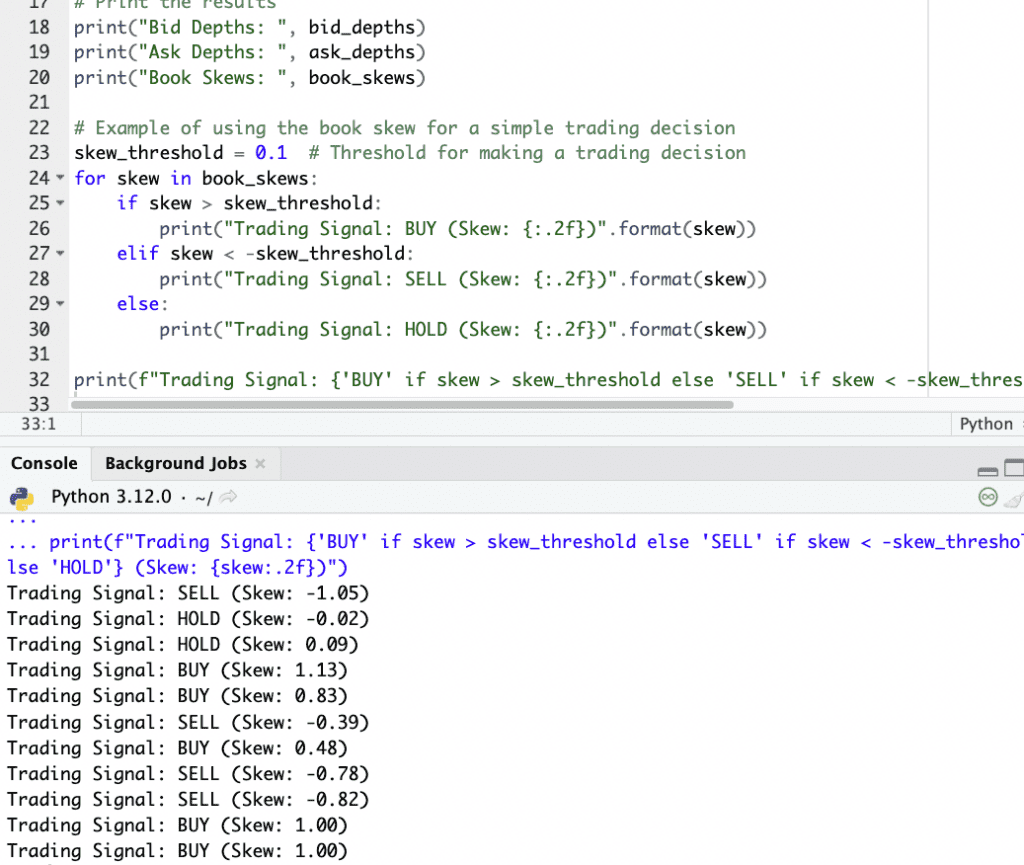

# Example of using the book skew for a simple trading decision

skew_threshold = 0.1 # Threshold for making a trading decision

for skew in book_skews:

if skew > skew_threshold:

print("Trading Signal: BUY (Skew: {:.2f})".format(skew))

elif skew < -skew_threshold:

print("Trading Signal: SELL (Skew: {:.2f})".format(skew))

else:

print("Trading Signal: HOLD (Skew: {:.2f})".format(skew))

In this script we:

- Generated synthetic data for bid and ask depths.

- Defined a function to calculate the book skew from the logarithmic differences of bid and ask depths.

- Calculated the book skew for each synthetic data point.

- Determined simple trading signals (BUY, SELL, or HOLD) based on a predefined skew threshold.

To apply this in a real-world scenario, replace the synthetic data generation with real-time data retrieval from a market data source.

Output & Results

Here, we have Bid Depth, Ask Depths, and Book Skew figures:

And the trading signals generated from this:

Conclusion

Book skew is a concept in quantitative trading that offer information on market microstructure to inform trading decisions on small timeframes.

Its utility lies in its ability to quantify market sentiment and imbalance in real-time.

It can enable traders to align their strategies with immediate market trends.