Bonus Issue

A bonus issue is common among British companies, wherein free additional shares are added to the positions of existing shareholders. Bonus issues are synonymous with scrip issues or capitalization issues.

Top Stock Trading Brokers

Why Do Companies Offer A Bonus Issue?

Companies will generally do it as an alternative to issuing dividends. Instead they will issue out extra equity in the company by tapping into existing cash reserves. This is done to keep a balanced capital structure, or the right proportion between debt and equity.

If a company is overleveraged – that is, too much debt relative to equity – this will decrease its credit rating as cash flow or income relative to debt decreases. This makes debt more expensive.

On the other hand, if a company is underleveraged – that is, too much equity relative to debt – it may be paying too high of a rate on its overall capital. Debt is cheaper than equity, given debtholders are paid first in the hierarchy of a hypothetical liquidation bankruptcy scenario. This means debtholders hold less risk relative to stockholders within the same company and therefore demand less of a return on their capital.

The optimal capital structure for a company can be determined via financial modeling. A profitable, 100% equity company should have a very good credit rating given it holds no debt and therefore has no credit risk.

But as it takes on debt, credit quality decreases as it now needs to use an increasing portion of its cash flow – or take on further debt – to pay down principal and interest. At a certain point, the cost of taking on more debt will be higher than the cost of equity. The inflection point at which this occurs will be an indication of its optimal capital structure.

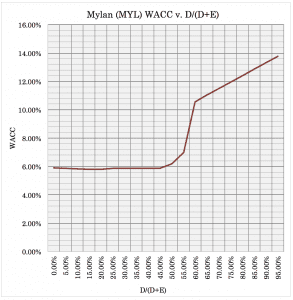

Here is an example of pharmaceutical maker Mylan’s (MYL) capital structure curve. The vertical axis shows the cost of financing or weighted average cost of capital (“WACC”). The horizontal axis shows the optimal capital mix in terms of debt as a percent of equity. This shows that the company is best leveraged up to around 45% of its overall capital base.

After that, the cost of debt rises due to materially enhanced credit risk and its overall cost of capital increases.

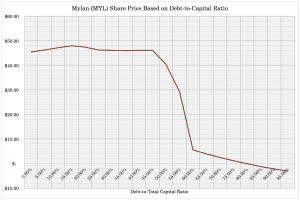

Cost of financing matters, as its WACC is the discount rate used to calculate the present value of its cash flows, which determines the fundamental value of its stock. As a denominator term in the calculation, a higher WACC decreases the present value of cash flows. This, in turn, makes its stock and the value of the company lower.

The correspondent share price graph for Mylan (MYL) would look as follows:

Companies will generally underleverage in order to have a buffer room in the event of a drop in the stock or economy. This would effectively make debt a greater fraction of the company’s capital base.

When a company feels it might be advantageous to decrease its leverage while providing income to shareholders, it may use a bonus issue to accomplish this. For example, it may offer one bonus share for every ten shares held by current shareholders.

A bonus issue also increases a company’s market capitalization, which can provide the cosmetic effect of making it seem larger and more valuable. This can capture investor or analyst interest. At the same time, since companies must dip into their cash reserves to create the shares, this may lead to lower dividend payments in the future.

Difference Between A Bonus Issue and Stock Split

Bonus issues differ from stock splits in a few ways.

A stock split doesn’t increase market capitalization; it merely changes the share count. Splitting into more shares is generally done to decrease the value of a stock to make it more appealing to retail investors and diversify the shareholder base.

A stock split also doesn’t increase or decrease a company’s cash reserves, unlike the decrease associated with bonus issues.

Reverse stock splits also occur on occasion, normally after a stock has decreased in value for some period of time. If a share falls below $5 per share, there are restrictions against trading it in some investment vehicles. This can cause a drop in demand for it, lowering the share price further.