Bond Vigilantes

Bond vigilantes refer to market participants who effectively self-regulate interest rates via the buying and selling of bonds in accordance with their perceived intrinsic value.

“If the fiscal and monetary authorities won’t regulate the economy, the bond vigilantes will,” says economist Ed Yardeni on Bloomberg.

The Best Recommended Bonds Brokers

While it is the job of central bankers to set the short-term overnight interest rate – a rate off which the rest of the curve is theoretically set – policymakers can sometimes error or make policy independent of a data-based standard (e.g., political pressure).

When interest rates are set too low, for example, this generally leads to excessive lending demand from public and/or private entities. This can lead to excessive spending, causing inflation from an upward pressure on prices.

This adversely affects fixed income securities due to the fixed payout scheme wherein higher inflation eats into its return and erodes its value. Bond investors will react by selling bonds as a way to essentially communicate that higher compensation will be demanded in order to hold the bond. Yields rise as prices fall. This has the self-regulatory effect of making borrowing more costly and tamps down on the demand for credit.

Similarly, if interest rates are too high, this can negatively impact credit creation. When the investing public believes that the central bank has set rates too high, a yield curve inversion could occur – that is, long-term bond yields will be below those of short-term yields.

Banks, who follow a business model of borrowing short-term funds and lending them at higher rates where they can generate a profit off the spread, will have difficulty generating net interest income in such an environment. When lending is constrained and capital and liquidity dry up, the economy can contract.

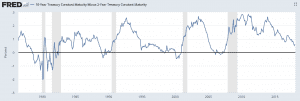

This is typically why yield curve inversions are taken as a signal that a recession might be near. But not all yield curve inversions produce a subsequent recession. In the US, the past five recessions (shown in shaded areas below) have been accompanied by eight yield curve inversions (when the 10-year minus 2-year spread falls below zero (black line)).

It is also not an inevitability that a yield curve inversion will occur before a recession as a type of signal or reliable forewarning. All twelve US recessions from 1955 forward were preceded by a yield curve inversion. However, all six recessions following the Great Depression were not preceded by a yield curve inversion.