Bond Auction

When governments want to raise money, they do so through a bond auction by issuing bills (typically short-term) and bonds (longer term – maturities can reach 30 years or more).

Top Bonds Brokers

Bond auctions are a way for the public to invest in sovereign debt and are coordinated via central banks. In the US, Treasury bills (maturity of under one year), notes (1-10 year maturity), and bonds (10+ year maturity) are issued. The US Treasury market’s depth is currently over $20 trillion, or close to 70% of the market capitalization of the US stock market. This makes it the deepest and most liquid bond market in the world, and also largely considered the safest.

The central government must first specify the purpose of the issuance as a legal matter. Oftentimes, an auction is held to plug funding gaps – i.e., a budget deficit/shortfall – but can also be used to finance public projects, such as national infrastructure.

Type Of Bond Issue

When a central bank is considering a new bond issue, it conducts a survey of several banks and other market participants over what type of issue might be most preferred. In large issuances, the government will hold an auction. During this process, multiple underwriters will participate in the bidding process. The government will work with a special bond counsel to get the legal framework and procedural necessities in working order.

In US Treasury bond auctions – and commonly in others – multiple underwriters will attend a public meeting to submit purchase proposals and an auction occurs before all bonds are distributed.

In the case of a single underwriter, a purchase proposal will be submitted containing information about the principal amount of bonds, the interest rates to be paid on these bonds, the amortisation schedule involving coupon payments, and any prepayment options. Such a proposal is subject to negotiation and approval of final terms.

Closing documents are then submitted to confirm final terms, details, and procedures. The underwriters then wire the funds obtained from the issuance to the paying agent, who allocates the bond securities to the appropriate parties while seeing that the funds are distributed in accordance with the intended use of the bond issue.

Bond Auction: Use for Day Traders

The public is invited to take place in the bond auctions of many developed market countries, including for US Treasuries. The process is run through what are called competitive or non-competitive bids. Competitive bids involve the auction participant specifying a rate, yield, or discount margin that would be acceptable to buy a bond. Non-competitive bids involve a process where the rate, yield, and discount margin are accepted at whatever level the auction dictates.

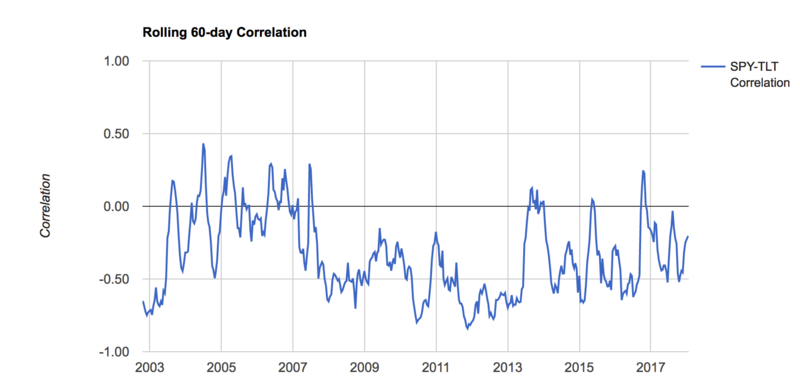

Developed market bonds are also an important component of risk diversification. US Treasuries of 7+ year durations have correlations of -0.40 to -0.50 with developed market stocks and can be a hedge against a market downturn. The diagram below shows how the correlation between the S&P 500 (as represented by its ETF equivalent SPY) and 20+ year US Treasuries have varied over time.