Bitcoin ETFs: What Are They & Where Can I Trade Them?

After years of anxious anticipation, in January 2024 US regulators pressed the launch button on spot Bitcoin exchange-traded funds (ETFs). These products enjoyed huge attention from traders and attracted cumulative inflows of $1.9 billion in their first three days of trading alone.

But how do these cryptocurrency-backed financial instruments work, what are the risks and rewards for short-term traders, and which are the best Bitcoin ETF brokers?

Quick Introduction

- Traders can deal in exchange-traded funds (ETFs) that are based on spot Bitcoin prices, providing additional ways to capitalize on crypto markets beyond directly buying or trading Bitcoin.

- The spot price of Bitcoin refers to the current market price at which the digital asset can be bought or sold for immediate delivery and settlement.

- ETFs can be simpler and more secure than buying Bitcoin itself, though you won’t own the cryptocurrency and be able to spend it.

- Also, for short-term strategies like day trading, crypto CFDs provide greater leverage and speculation on upward and downward movements.

Best Brokers for Bitcoin ETFs

Our comprehensive assessment shows that these platforms are best for trading Bitcoin ETFs:

What Are Bitcoin ETFs?

ETFs are financial vehicles that are traded on stock exchanges. They are a type of pooled investment that tracks the performance of an underlying group of securities. These can include stock indices, currencies, commodities and bonds.

In the case of Bitcoin ETFs, the fund provider will buy a certain amount of the digital currency on behalf of the fund’s investors.

When the value of the digital currency rises the ETF will follow suit, while it will fall when Bitcoin prices recede.

What Bitcoin ETFs Can I Buy?

Funds that deal in Bitcoin futures contracts have been around since 2021. Bitcoin futures are derivative products that require a specified amount of Bitcoin to be purchased within a pre-selected timeframe and at a certain price.

Traders have also been able to get exposure to Bitcoin by buying funds that hold shares in cryptocurrency mining companies. The Valkyrie Bitcoin Miners ETF, for instance, has holdings in tech stocks like Marathon Digital Holdings and Riot Blockchain and was launched in 2022.

The process of launching ETFs based on spot Bitcoin prices has been far rockier, by comparison…

After years of trying to convince the Securities and Exchanges Commission (SEC), financial institutions finally got these vehicles – which are based on the market price of Bitcoin for immediate settlement and delivery – approved for trading by the US regulator on January 10, 2024.

Below you can see the 11 spot Bitcoin ETFs that received the initial green light.

| Issuer | ETF |

|---|---|

| BlackRock | iShares Bitcoin Trust |

| Fidelity | Wise Origin Bitcoin Trust |

| Ark Invest and 21Shares | ARK 21Shares Bitcoin ETF |

| Franklin Templeton | Franklin Templeton Digital Holdings |

| VanEck | VanEck Bitcoin Trust |

| Invesco and Galaxy | DigitalInvesco Galazy Bitcoin ETF |

| Wisdom Tree | WisdomTree Bitcoin Trust |

| Bitwise Asset Management | Bitwise Bitcoin ETF |

| Valkyrie Digital Assets | Valkyrie Bitcoin Fund |

| Grayscale Investments | Grayscale Bitcoin Trust |

| Hashdex | Hashdex Bitcoin Futures ETF |

How Do Spot Bitcoin ETFs Work?

Trading of Bitcoin ETFs can be quick and easy thanks to their listing on regulated stock exchanges. The following example shows how a trade in one of these financial instruments could go.

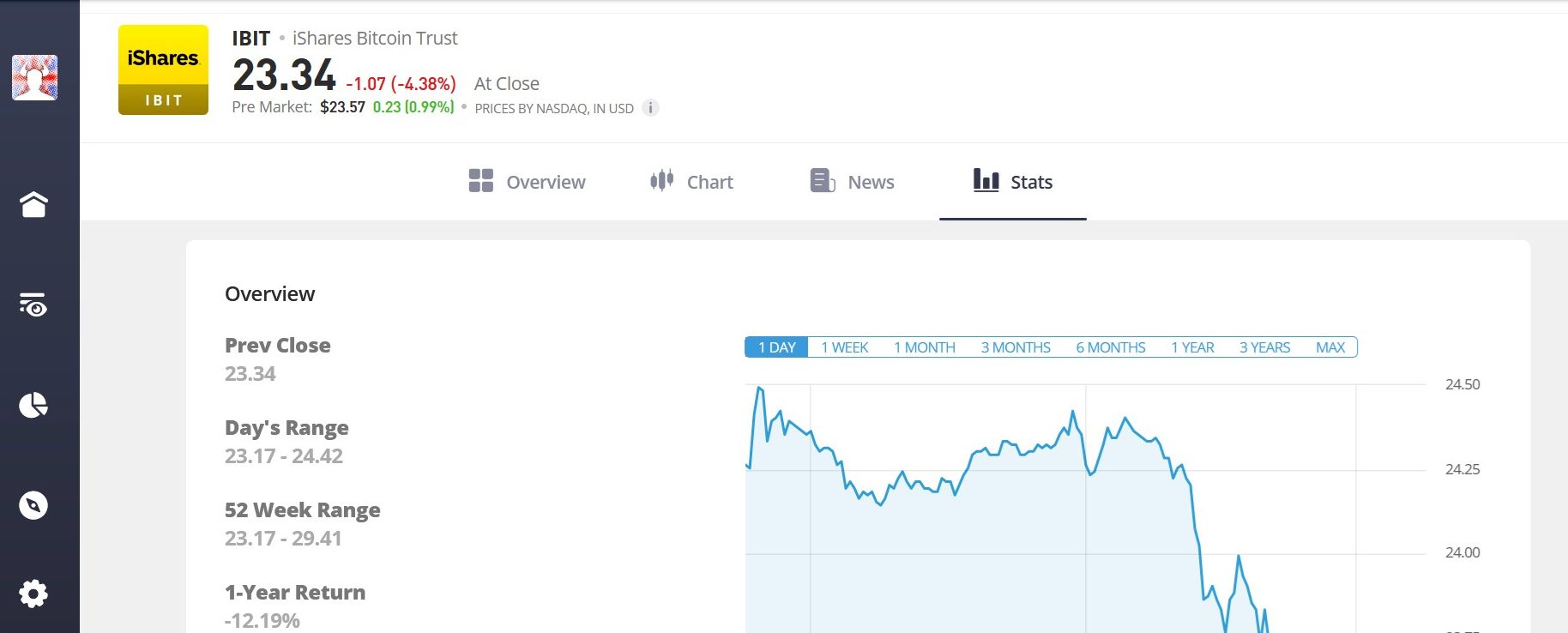

Let’s say that I expect Bitcoin prices to rise and am thinking of buying an ETF to capitalize on this. While I have a lot to choose from, I’ve decided to plump for the iShares Bitcoin Trust operated by BlackRock, and available at eToro.

I’m attracted by the product’s ultra-low charges. A temporary waiver on full-fat fees means that I’m charged just 0.12%.

Furthermore, buying an ETF from a reputable financial provider like BlackRock gives me, as a trader, excellent peace of mind.

As you can see, shares in this ETF are currently trading at $23.34 each. I decide to invest $3,000 in the product which gives me 128 shares and change of $12.48 (eToro doesn’t charge me a commission on trading ETFs).

Now let’s fast forward and see how the fund is performing. Good news! Bitcoin values have risen on hopes that the Federal Reserve will cut interest rates, and speculation that more Bitcoin-based ETFs could be launched shortly.

These drivers have pushed the price of the iShares Bitcoin Trust to $27.12 a share. At this point, I decide to sell up and book a tidy profit of $483.84 ($27.12 – $23.34 * 128 shares).

A Booming Product?

Some analysts believe that these spot-based Bitcoin ETFs could attract up to $100 billion of inflows during 2024 alone.

So financial services providers geared up to take advantage of this potential money spinner, one that threatens to take a huge chunk out of other crypto-based funds.

In late January 2024, VanEck announced that its VanEck Bitcoin Strategy ETF – which invests in cryptocurrency-backed futures contracts — would be closing its doors. The company said it made the decision based on factors including “performance, liquidity, assets under management, and investor interest.”

Which Fund Should I Choose?

There are several things that you need to consider when deciding which Bitcoin ETF to trade:

- The reputation and credibility of the issuer

- How the fund manages custody of the Bitcoin (some use a third party, while others have their own custody solutions)

- The liquidity of the Bitcoin ETF, which can influence dealing expenses and ease of trading

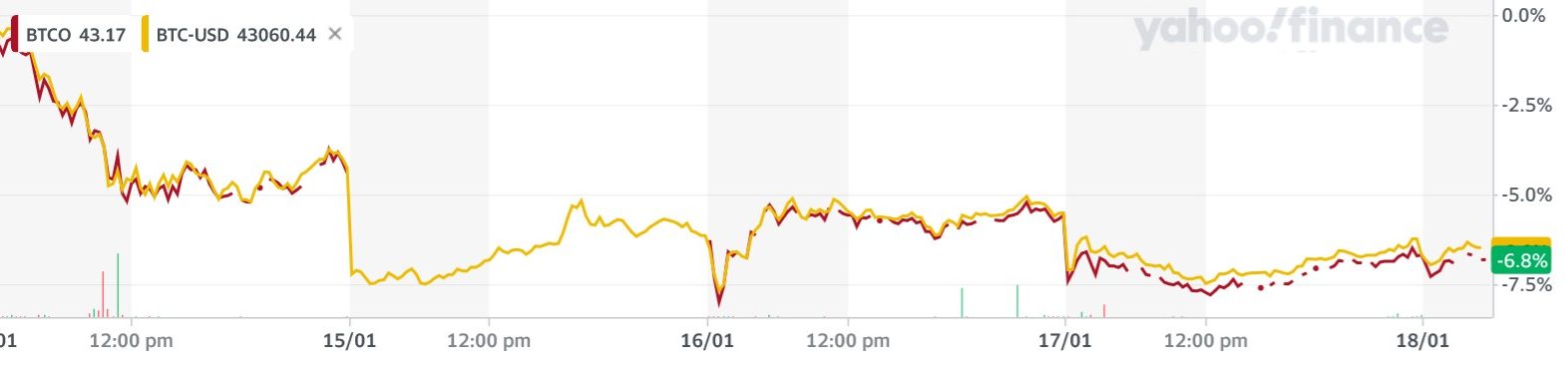

- How closely the fund tracks movements in Bitcoin prices

Management charges are another important thing to think about, as they can have a substantial impact on my eventual returns.

Costs can vary wildly between spot Bitcoin ETFs: they range from 1.5% on the Grayscale Bitcoin Trust, to 0% on Fidelity’s Wise Origin Bitcoin Trust.

I think ETFs that specialize in spot Bitcoin may be a better option for traders as they charge lower fees than funds that deal in futures contracts.

Many fund issuers offered reduced fees to encourage early adopters. But these are due to rise as interest picks up. Keep a close eye on how these charges change, as they will impact your overall profitability.

Why Buy Bitcoin ETFs Instead Of Bitcoin?

At this point, you may be asking why I should trade a Bitcoin-backed ETF instead of just acquiring the cryptocurrency itself. Well, trading a fund rather than buying the digital currency has numerous advantages:

1) Convenience

ETFs are traded on stock exchanges, which means they are easily accessible for short-term traders through normal brokerage accounts.

Buying Bitcoin directly is much more complex and often involves setting up a cryptocurrency wallet, finding an exchange, and linking your trading and banking accounts.

2) Safety

If I purchase Bitcoin, I can store it in a cryptocurrency wallet and/or hold it on the exchange through which I purchased it (if this service is offered).

This arguably offers less security as the cryptographic code (or key) I use to access my Bitcoin can be easily lost or stolen, which leaves me in danger of losing some or all of my assets.

Additionally, crypto exchanges have demonstrated an impressive track record for fraud, mismanagement and total collapse, as seen by FTX in 2022 and QuadrigaCX in 2019, to name just a few.

3) Regulation

Bitcoin ETFs are highly regulated and closely monitored by government bodies, which in turn helps protect traders from shady business practices.

Owners of these vehicles don’t have to worry about losing their money if another scandal materializes. It’s estimated that up to $8.9 billion worth of customer assets are still missing following the FTX collapse, for instance.

4) Liquidity

As ETFs are traded on major stock exchanges, you can usually enjoy better liquidity than if they traded Bitcoin on a specialist crypto exchange.

This can reduce dealing costs owing to narrower bid and ask spreads. It may also make it simpler to enter and exit positions – a critical consideration for short-term traders.

It’s important to remember, however, that buying and selling Bitcoin itself also has advantages over dealing in crypto-backed ETFs.

These include lower fees; the availability of 24/7 trading; and removing the threat of tracking errors, where the fund fails to accurately track changes in the prices of the digital currency.

Buying an ETF instead of Bitcoin also means an investor cedes control of the actual Bitcoin to the fund manager. However, the issuers of these instruments are highly regulated institutions, so I don’t think traders should be too concerned about this.

Pros and Cons of Trading Bitcoin ETFs

Pros

- Cryptocurrency prices – and by extension financial products that are related to them, like ETFs – can be extremely choppy at times. This can provide short-term traders with regular opportunities to make profits.

- Cryptocurrencies are a unique asset class whose performance is not always correlated with that of other markets (like stocks, forex and commodities). This means that they can help traders to hedge risk by performing differently from the rest of their portfolios.

- Themes like the growing digital economy and fears over inflation mean digital tokens like Bitcoin could explode in popularity. This in turn could pave the way for traders to rack up large gains.

Cons

- While the Bitcoin ETFs themselves are regulated by the SEC, concerns around the legitimacy of cryptocurrencies continue to circulate. This creates lasting uncertainty over the long-term outlook for Bitcoin prices and, by extension, the future value of these funds.

- While price volatility in crypto markets can create added earnings opportunities for short-term traders, it can also lead to higher risk, extra stress and reduced liquidity.

- Traders can primarily make money with spot Bitcoin ETFs when the cryptocurrency is rising. This differs from funds based on Bitcoin futures (like the ProShares Short Bitcoin Strategy ETF), which allow traders to make money even when currency prices fall.

- Bitcoin CFDs also remain very popular with day traders looking to speculate on both rising and falling prices with leverage, which can multiply returns (and losses).

Bottom Line

Spot Bitcoin ETFs could prove a watershed moment in the trading of the digital currency. Some market commentators believe that their introduction could even take the price of Bitcoin to the next level.

But traders need to remember that any crypto-based financial instrument is highly risky. Prices are extremely volatile, and the long-term survival of digital currencies is by no means a certainty.

As with any trading instrument, individuals should not trade these instruments with funds that they cannot afford to lose.

If you do want to trade Bitcoin ETFs, we recommend Interactive Brokers and eToro. Both offer terrific trading platforms, competitive fees and multiple funds to choose from.

Article Sources

- Spot bitcoin ETFs draw nearly $2 billion in first three days of trading - Reuters

- Guide To Investment Strategy: How To Understand Markets, Risk, Rewards And Behaviour – The Economist, Peter Stanyer And Stephen Satchell

- Economics: A Complete Introduction – Teach Yourself, Thomas Coskeran

- New York Times - FTX Collapse

- New York Times - QuadrigaCX Collapse

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com