Ban – How To Avoid The ESMA Ban On Binary Options

A ban on binary options has been in place since 2nd July 2018 in Europe. The European regulator, ESMA placed a temporary ban on binaries, and they’ve been effectively banned across EU countries since then. EU traders can avoid the ban, however, and continue trading. So what are the options for traders impacted by the ban?

Top Brokers For Binary Options Trading

Binary Ban Explained

The European Securities and Markets Authority (ESMA) implemented a ban on binary options in July 2018. They were convinced that this measure would protect consumers and resolve the deluge of complaints they had received over the previous decade.

The number of frauds linked to binary options was huge, and rather than prosecute the scams, ESMA decided instead to simply halt the supply and marketing of binary options “to retail traders”.

The ban was originally implemented temporarily, for three months. It also coincided with restrictions on CFD and Forex trading in Europe.

National Bans

The ESMA’s temporary EU-wide ban on binary options starting 2 July 2018, eventually expired on 1 July 2019 and was not renewed. Instead, individual European Union member states adopted their own permanent national bans on binary options for retail investors. These national measures remain in effect and are enforced by each country’s financial regulator.

The shift from a temporary EU-wide ban to permanent national restrictions reflects ESMA’s decision to allow member states to implement tailored protections. For example, the UK Financial Conduct Authority (FCA) confirmed a permanent ban on 2 April 2019, stating that all firms acting in or from the UK (then still an EU member) are prohibited from selling, marketing or distributing binary options to retail consumers. The FCA estimates this permanent ban could save retail consumers up to £17 million per year. Similarly, France’s Autorité des Marchés Financiers (AMF) implemented a permanent national prohibition effective 2 July 2019, and Germany’s BaFin announced permanent restrictions also effective 2 July 2019, mirroring the approach taken by other EU member states.

How To Avoid The Ban

Traders actually have a few choices when it comes to trading from within the EU. There are positives and negatives to all of them, but it is possible for traders to carry on, and that is the important thing.

Firstly, trading with an unregulated broker that still accepts EU traders is to be avoided at all costs. One side-effect of the ban is that many consumers have been inadvertently ‘pushed’ towards unregulated firms. This is not a safe route. Here are some methods to continue trading in a safe, legal way.

Alternative Products

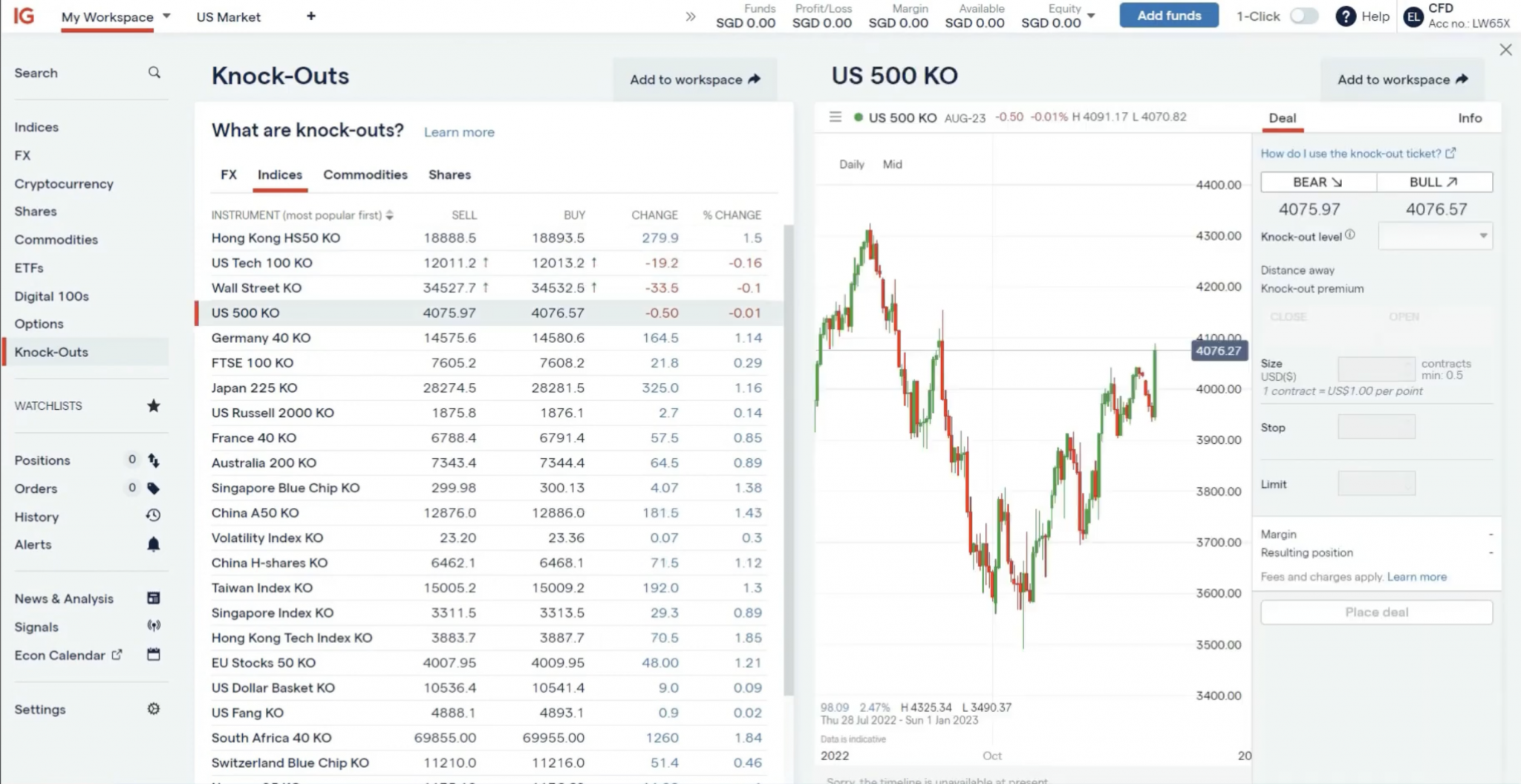

Many reputable brokers have created new products to fill the gap left by the ban. IQ Option created FX Options and IG offer Knock-outs, for example. While these are not strictly ‘binaries’, they share many traits and similar strategies will work on both.

Deriv is another broker that offers some innovative products that might appeal to binary options traders, such as synthetic indices and accumulator options.

Brands are looking at new products all the time, so look out for marketing information.

Non-EU Branches

One less well known choice for traders, is to move their account to a regulated arm of their existing broker. That is right, you might be able to carry on with your existing broker…

There are two key points here. Firstly, this is only possible where the broker has multiple regulated brands, in other words, separate brands in each jurisdiction (or off-shore). For example. Some brands have different registered companies, regulated separately – “XXX Europe Ltd” for example, but with “XXX Malaysia Ltd” as well.

It is possible for you to request an account with the Non-EU or off-shore branch of the business. ESMA allow this to happen – but brands are not allowed to market the possibility. The request has to come from the trader, and not be prompted by the firm themselves or marketing sources.

Use A Professional Account

This choice will only be available to certain traders. Basically, if a trader registers as a professional, they are saying they are experienced enough to trade high risk / high reward products like binaries, and acknowledge that in doing so, they give up regulatory protection. (Note ESMA specifically reference “retail traders” in their ban – not professional traders.)

To register as professional, traders must prove a certain level of trading experience (one year in a financial service role for example). They must also prove a certain level of trading capital (500k) – though this can be spread between multiple accounts.

In addition to opening up binary options again, registering as a professional will also mean traders can trade CFDs and Forex with much higher levels of leverage. The trade off is that professional traders lose regulatory protection.

Conclusion

So there we have it. The binary options ban does not have to mean the end of you trading binaries. If the ban stops uninformed traders getting their fingers burnt – but experienced traders can carry on using them, then the industry, while smaller, will be better off long term.