Binary Options Hedging

Binary options hedging is a strategy that retail traders can use to offset losses. Here, we list the best techniques, explaining how hedging works with detailed examples. We’ve also covered the best online brokers that support binary options hedging strategies.

Binary Options Hedging Brokers

List all Binary Options Brokers

How Hedging Works

Binary options hedging is a method of reducing your potential losses when making a trade. Hedging is important when trading with binary options, in particular, because you can lose your entire investment in a single contract.

Rather than choosing between a call or a put, you essentially enter both positions for the same underlying asset and expiration time. The key is that the two positions have different strike prices, such that both can end up in the money.

For the case of a high/low binary options trade, hedging would require the call position strike price to be lower than that of the put position. In effect, this creates a version of a boundary binary option. In this situation, at least one of your two positions will always be in the money, so any returns can help to reduce the magnitude of any loss.

Example

A simple high/low trade can be used as an example of how binary options hedging can work. Assume an asset is currently being traded at $5 a share and its price is trending upwards. You wish to capitalise on this trend and invest $100 into a call position with a strike price of $10.

To protect yourself against losing this entire $100 investment, you could also enter a put position with a strike price of $14, investing $100. Both positions expire at the same time and have a payout of 80%. If at expiration, the underlying asset is valued at $15, then only the put position ends out of the money and you lose the $100 you invested.

However, the call position ended in the money and returned $80, meaning a net loss of only $20, rather than $100. If the underlying asset’s price was $13 at expiration time, then you earn a profit of $160 as both positions ended in the money.

Binary Options Hedging Strategies

There are a few popular binary options hedging strategies available. Find a technique that you are most comfortable with. If you are unsure, then practise using a free demo account.

Two Binary Options Trades

High & Low

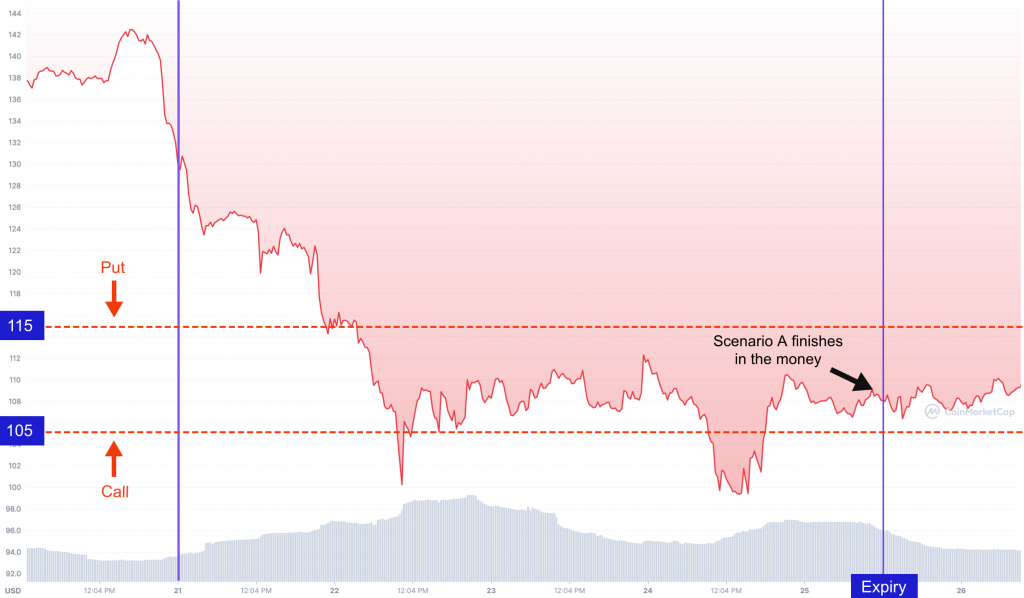

For this example, the price history for Litecoin (LTC) will be used. In this situation, you enter both a call and a put position, with an expiration time as marked in blue on the chart.

- A – For a put strike price of $115 and call strike price of $105, you are in the money for both

- B – For a put strike price of $105 and a call strike price of $95, you are only in the money for the call position

- C – For a put strike price of $125 and a call strike price of $115, then you are only in the money for the call position

Only in scenario A do you make a profit, as indicated in the image below. In situations B and C, you make a loss but you do not lose your full investment.

Touch & Low

It is also possible to hedge binary options using a touch position and a low position. For example, you would enter a touch position for a given strike price and then a put position for a higher strike price.

Let’s look at another historical LTC price chart. Again, you can see the trade entry and expiry points indicated in blue on the chart.

- A – For a touch strike price of $136 and a put strike price of $146, you are in the money for both positions

- B – For a touch strike price of $144 and a put strike price of $150, you are only in the money for the put position

- C – For a touch strike price of $132 and a put strike price of $136, you are only in the money for the touch position

Again, you only make a profit in the first situation because the touch price was reached within the life of the trade and the market also remained below the put strike price at expiry. This is shown in the image below. In the second and third situations, you make a net loss, though a smaller amount.

A Binary Option & Stock Trade

You can also use binary options to hedge a long position with a stop-loss. To achieve this, you enter a put position with a strike price equal to the stock purchase price. You need to purchase a sufficient volume of put binary options, such that any losses incurred (if the stop-loss limit is reached) are covered by the binary options profits. Of course, this will eat into your profits if the stock increases in value, however, the main benefit is covering large losses.

Going back to our first LTC chart, if you were to purchase 1 LTC at midday on the 20th with a stop loss of $130, then a binary option put would protect you from the losses.

In the second LTC chart, if you purchased a stock at midday on the 10th and then sold on the 14th, you would make a profit of $10. However, because of the binary option put ending out of the money, your net profit is less than this.

Advantages

There are a few ways that binary options hedging can benefit your trading experience:

- Hedging is a way to reduce your total loss per trade

- The strategy is generally simple to understand

- Hedging is relatively easy to implement

Disadvantages

However, it’s important to be mindful of the drawbacks:

- Hedging generally reduces total profits

- You must consider the brokerage fees, as they can further eat into profits

How To Get Started

To start hedging binary options, you first need to create an account with a brokerage that offers binary options trading. For US-based customers, this is only allowed on regulated platforms. Note that UK retail customers cannot access onshore binary options products because the FCA has banned them.

You should also conduct your own research into finding suitable opportunities for binary options. While hedging can reduce your loss per trade, you are still at risk of making losses. This means you still should perform your own due diligence on prospective assets. To help with this, you could adopt a binary options swing trading strategy.

A strategy will help to keep yourself concentrated on what trades you want to make, rather than carelessly entering positions you otherwise should not. To practise your best binary options hedging strategy, you can create a demo account. Many platforms offer a free demo account where you can make trades with simulated digital funds in a risk-free environment. Once you feel confident, you can start making trades with real capital.

Final Word

Binary options trades can be risky due to their ‘all or nothing’ nature, however, introducing hedging can help to mitigate some of this risk. Rather than losing your entire investment, you could only lose a fraction. While binary options hedging does reduce the total possible profit, the benefits arguably outweigh the risks.

Note, it is important you remember that binary options hedging strategies are not always profitable.

FAQs

Where Can I Learn More About Binary Options Hedging?

Online you can find books, ebooks, training courses and tutorials; all of which provide helpful insights into binary options and hedging. YouTube is another good source of information with some channels hosting trading sessions. Social media can also be helpful to discuss strategies with other traders but be aware you may not always be talking to an experienced trader.

Is It Possible To Practise Binary Options Hedging?

Yes, you can use a demo account to practise binary options hedging before using real capital. Most good brokerages offer a free demo with no time limit, meaning you can test out your hedging strategies for as long as you need.

What Are The Different Types Of Binary Options For My Hedging Strategy?

There are several types of binary options but the most common are: high/low, touch/no-touch and range/boundary. Whilst they may seem simple to grasp, it is important to do thorough research and understand how losses can be incurred before committing to trades.

What Is The Difference Between A Call And A Put?

A call is when you believe the asset’s price will be greater than the strike price. A put is when you believe the asset’s price will be less than the strike price. Using both when hedging means you can potentially reduce losses.

How Does Binary Options Hedging Work?

Binary options hedging involves entering both binary options positions, but overlapping the strike prices. This is so that at least one will always be in the money at the expiration time.