Binary Options Examples

Examples of binary options trades can help beginners choose the right type of contract for their investment style and objectives. In this guide, we look at binary options trading examples to show how various contracts and payouts work. In doing so, we also cover the pros and cons of different binaries. Use this guide to kick-start your binary options trading journey.

Binary Options Brokers

How Binary Options Work

Before we look at examples of specific binary options trades, it is important to understand how exactly binaries work…

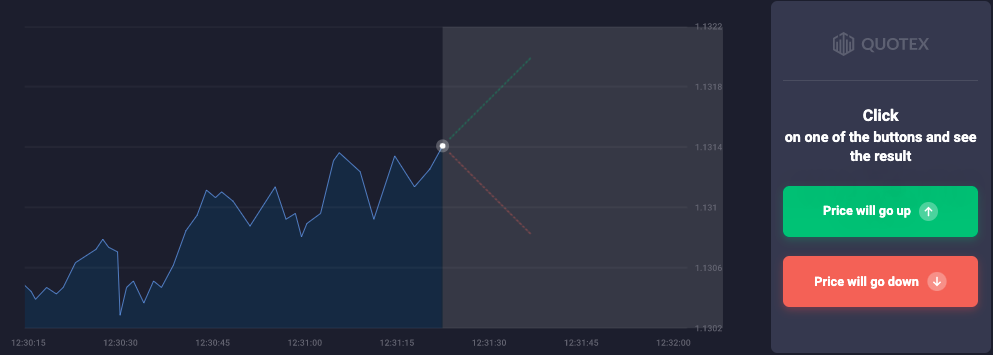

Binary options are a form of derivative trading where an investor speculates on the future price of an underlying asset, such as gold, over a fixed period. Importantly, binary options offer a straightforward ‘yes or no’ proposition – will the price of the asset rise or fall over the one-hour contract period, for example?

Binary options are also known as ‘all or nothing’ trades. This is because correct predictions finish ‘in the money’ and earn traders a predetermined payout (often around 70%), while incorrect predictions expire ‘out of the money’ and mean traders lose their initial stake.

Products vary as we outline in the binary options examples below, however, the key question is ultimately whether the price of an asset will rise or fall over the contract period.

Note, expiry times can range from 15 seconds up to a full day, a week, or even several months.

Binary Options Examples

Now that we have covered the basics, let’s look at some examples of binary options trades to bring the theory to life…

High/Low

In this classic binary options contract, traders simply predict whether the underlying asset’s value will be higher or lower than its current price at the point of expiry. Investors who think an asset’s price will increase from the current value enter a ‘call’ position, while those who think it will decrease make a ‘put’ trade. This binary options contract is also known as an Up/Down or Over/Under trade.

Example

Let’s say a trader wants to speculate on the price of Apple stock. With the announcement of a new product launch imminent, the investor believes the price will rise in the next hour. With that in mind, the trader stakes $100 with their binary options broker and makes a ‘call’ trade. The broker offers a 75% payout.

The trade is entered at 10:37 AM with a strike price of $142.64 and it expires at 11:37 AM. The price fluctuates within the hour reaching a low point of $140:98 at 11.09 AM but at 11:37 AM, the value is $146.73.

Because the value is above the strike price at the expiry, the contract finishes ‘in the money’. As a result, the broker automatically credits the trader’s account with their $100 deposit plus $75 in profit.

Note, if a trader had entered a ‘put’ position they would have lost their stake even though the price dipped within the hour. This is because, with a High/Low contract, it is the price at expiry that determines whether the trader made a winning or losing bet.

Boundary

Let’s take a look at another binary options trading example, but this time on a ‘boundary’ contract.

With this type of binary option, traders speculate whether the value of an asset will finish inside or outside of a pre-agreed range. This type of trade is particularly popular with traders speculating on more stable assets because the boundary gives the asset’s price movement flexibility to move somewhat while remaining ‘in the money’. Boundary contracts are also known as Range or In/Out binary options.

Example

A commodities trader believes the price of gold will stay relatively stable in the next 30 minutes. They invest $100 with their broker who offers a 70% payout. The contract starts at 3:10 PM and expires at 3:40 PM.

In this binary options example, the upper price limit is $1,845.00 and the lower limit is $1,840.00. This is the boundary that the price must finish within for the trader to win the bet.

At 3:40 PM, the price of gold is $1842.67, falling inside the boundary and earning the trader $170 ($100 stake plus $70 in profit).

Note, if the price had finished at $1,148.00, for example, the value would have fallen outside of the boundary and the investor would have lost their $100 stake.

Touch/No Touch

In this binary options contract, traders speculate whether an asset’s price will reach/hit a pre-determined value, set either higher or lower than its current value.

This type of contract can be separated into ‘touch’ and ‘no touch’ binary options. With the former, the trader bets the predicted price will be reached, while in the latter, they believe the price won’t hit the pre-defined level.

With ‘touch’ options, payouts are immediate once the price has been hit – the investor does not need to wait until the expiry.

Example

In a ‘touch’ binary options example, a crypto trader thinks the price of Bitcoin will fall to $20,000 in the next 5 minutes. The current price is $20,050. The trader invests $100 and the broker offers an 85% payout. The investor enters the touch position at 10:05 AM with the expiry at 10:10 AM.

At 10:07 AM, Bitcoin’s value falls to $20,000. The ‘touch’ has, therefore, taken place, and the trader wins the bet. The broker issues $185 to the trader ($100 stake plus $85 profit).

Note, if a trader had taken out a ‘no touch’ binary under the same conditions, they would have lost their stake when the price hit the $20,000 mark.

How To Use Binary Options Examples

Binary options trading examples are a valuable resource for aspiring investors. They offer several advantages:

- Selecting your preferred binary options contract – Reviewing binary options examples can help you decide what type of contract best suits your goals and risk appetite.

- Selecting your preferred trading strategy – Binary options examples can expose you to different strategies to help you find an approach that you are confident with.

- Prevents trading mistakes – Understanding binary options examples can help beginners get to grips with different contract options so they can make more informed investment decisions. Traders with a better understanding of the financial instrument they are using are more likely to place winning trades.

- Promotes awareness of market activity – Using examples of binary options can help you identify suitable market opportunities. Do you think a particular precious metal will rise in value, for example? Do you think it will remain within a slim price bracket? Perhaps you think it will fall and hit a specific price level? Reviewing real-life binary options examples can provide insights into how certain markets perform.

Final Word On Binary Options Examples

Reviewing binary options examples can be helpful for beginner traders. They help traders new to the financial instrument understand how different contract types work, as well as payouts and expiries. See our list of binary options trading examples above to support your investing journey.

FAQs

What Resources Provide Examples Of Binary Options?

Multiple online resources provide binary options examples. This includes trading websites, blogs and forums, as well as YouTube channels and social media pages. Try and find examples of strategies and markets that align with your objectives.

Why Should I Look At Binary Options Examples?

Researching binary options trading examples can help traders fully understand how different contracts work and which products may best suit their style and strategy. Examples are also a useful way to determine if this high-risk/high-reward derivative matches your risk appetite.

Are Binary Options Legal?

Yes, however, restrictions differ between countries. For example, in India, they are completely legal, while in the US only exchanges regulated by the Securities Exchange Commission (SEC) can offer binary options to retail investors. Fortunately, traders in regions with restrictions can sign-up with offshore platforms. See our list of top binary options brokers here.

Is Binary Options Gambling?

Due to their win-or-lose design, many refer to binary options as a modern-day example of gambling. However, investors with deep market insights and knowledge approach binary options with a professional mindset and a carefully thought-through strategy. With this in mind, some experienced traders make money trading binary options.

How Safe Is Trading Binary Options?

Binary options trading is a good example of a high-risk/high-reward financial product. The built-in yes/no proposition means that clients can lose their entire stake if they make an incorrect prediction. Alternatively, some brokers offer payouts in excess of 100% for correct predictions. This fixed risk and reward make them popular with retail traders. Importantly, make sure you sign up with reliable and top-rated brokers.