Bestinvest Review 2025

Awards

- Boring Money Best Buy ISA winner 2023

- Boring Money Best for Beginners winner for 2023

- Forbes Advisor - 2022 Best for low-cost Ready-made Portfolios

- Bestinvest 2022 Stock & Share ISA Innovation

- Best Junior ISA

- Bestinvest voted Best ISA Provider 2020

- Best Low-cost SIPP Provider 2018

- Bestinvest wins Best Online/Execution-only Stockbroker 2017

Pros

- Self-directed trading plus ISAs and managed portfolios

- Trustworthy firm with regulatory oversight from the FCA

- Free financial planning and coaching

Cons

- No margin trading

- High fees for some portfolios

- Few payment methods

Bestinvest Review

Bestinvest is an all-in-one investment solution with a range of services including online trading, money-saving planning tools, and expert advice. The company aims to make investing affordable and accessible for everyone with share dealing accounts, flexible ISAs, and ready-made portfolios. This Bestinvest review will cover mobile app compatibility, fees and charges, minimum investment amounts, top performing funds, and more.

Company Details

Bestinvest was established in 1986, providing trading and investment services for 35+ years. The brand has backing from its parent company, Evelyn Partners, one of the largest wealth management companies in the UK.

The brokerage has an impressive 46,000+ registered customers, with over £3 billion in assets under management (AUM). Its services include:

- Goal planning tools

- Access to expert insights

- Free investment coaching

- ISA, SIPP and VCT accounts

- Personalised financial advice

- Ready-made investment portfolios and fully flexible accounts

The company has been recognised with a list of 20+ industry awards including the Forbes Advisor Best for Low-Cost Ready-Made Portfolios 2022, the Finder Innovation Awards for Stocks & Share ISA Innovation, and the Boring Money Best Award for Beginners 2023.

Bestinvest is regulated by the Financial Conduct Authority (FCA) in the UK.

Products & Markets

Bestinvest offers 3000+ UK funds, shares, trusts, and ETFs. You can add these to an ISA, SIPP, or Investment Account. On the downside, forex, commodities and cryptocurrencies are not available.

- Investment Funds – Invest in 1000+ fund pools including unit trusts, OECIs and commercial property

- UK Shares – Buy and sell thousands of UK stocks including Aviva, Goldman Sachs, JP Morgan, and Legal & General

- US Shares – Buy and sell hundreds of US shares with no online dealing fees including Microsoft, Apple, and Tesla

- ETFs – Trade hundreds of exchange-traded funds (ETFs) including the Vanguard S&P 500 UCITS ETF GBP and the iShares Core FTSE 100 UCITS ETF

- Investment Trust – Purchase shares in an investment trust through a pooled account. Trusts are available across different sectors and regions such as emerging markets, bonds, and real estate

- VCTs – Invest in small or upcoming UK businesses via Venture Capital Trusts (VCTs) and benefit from no capital gains tax and tax-free dividends. Current listings include Octopus Titan VCT Plc and Albion VCT

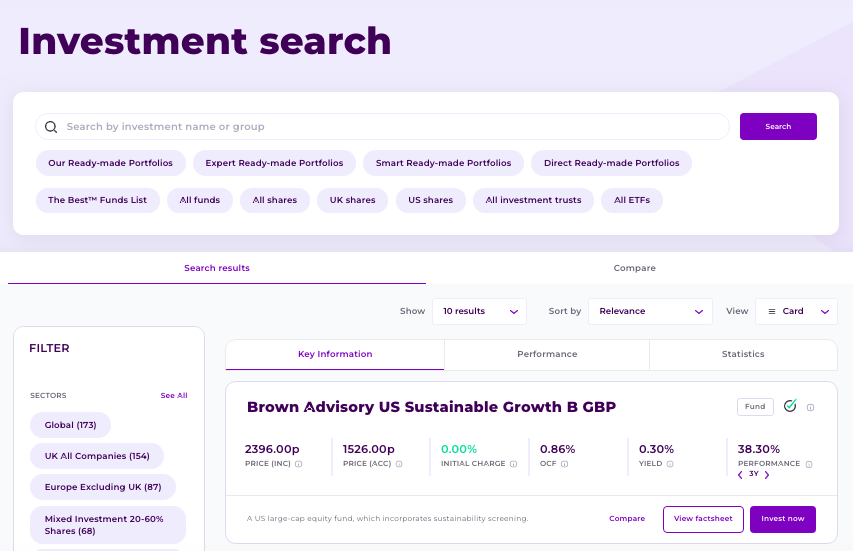

Use the investment search tool to filter and find products to put money in. You can screen assets by key information, performance statistics, and average yield to name a few.

Bestinvest Platform

The Bestinvest platform is relatively basic. The client area provides an account overview and performance chart which can be filtered by timeframe (one week to five years). You can also book coaching appointments and set monetary goals.

Helpfully, the majority of financial information including product data and investment ideas is available without needing to register for access to the platform.

How To Place An Order

- Select the Bestinvest login icon from the top of the broker’s website

- Select ‘Add Cash’ from the top right of the client area

- Fund your trading account

- Select ‘Invest’ from the top right of the client area

- Filter by product sector, investment name, yield, or popular investments

- Click the purple ‘Invest Now’ icon on the product page

- Enter the investment details in the window pop-out

- Select ‘Continue’

- Review the trade details and select ‘Confirm’

Mobile App

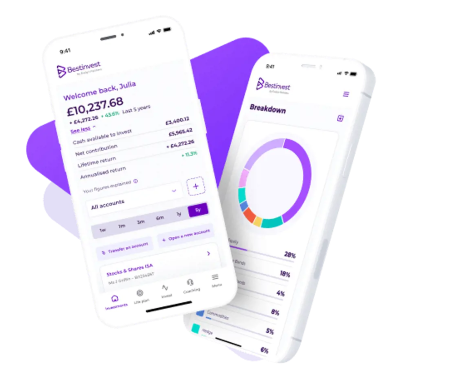

Bestinvest offers a free mobile app, available to download on iOS and Android (APK) devices. The application is user-friendly while providing all the functionality of the web-based dashboard. You can open new accounts, check live investments, deposit funds, buy and sell financial products and use money planning tools.

The mobile app can help UK traders stay up to date with the latest investment insights, trends, and news whilst on the go. All data and personal information is synced between the platforms so you never miss out on opportunities and you can review your account performance 24/7.

Use your Bestinvest login credentials to access the app dashboard.

Fees & Costs

When we used Bestinvest, we were impressed with the transparent fee schedule. There are no charges to open an account, transfer funds to a live profile, or use the platform and app.

Fees do vary by product type, though clients are rewarded with cheaper prices for higher account balances. There are no inactivity charges. Telephone orders are liable for a £30 fee per transaction.

US Shares & Ready-Made Portfolios

- Investments up to £250,000 – 0.2% annual fee

- Investments between £250,000 and £500,000 – 0.2% annual fee

- Investments between £500,000 and £1,000,000 – 0.1% annual fee

- Investments over £1,000,000 – No annual fee

Alternative Investments

- Investments up to £250,000 – 0.4% annual fee

- Investments between £250,000 and £500,000 – 0.2% annual fee

- Investments between £500,000 and £1,000,000 – 0.1% annual fee

- Investments over £1,000,000 – No annual fee

Dealing Fees

- Buying and selling funds – No fee

- Share dealing (e.g. Stocks & ETFs) – £4.95 per trade

- US share dealing – No fee

- US foreign exchange fee – 0.95%

Importantly, Bestinvest provides cheaper share dealing fees vs competitors like Vanguard at £7.50 per transaction or Hargreaves Lansdown at £11.95 per transfer.

Users can also benefit from interest paid on cash held in investment accounts. Rates vary according to the custodian and are paid monthly. While using Bestinvest, we were offered a 3.1% interest rate.

Note, it is your responsibility to adhere to UK tax requirements.

Leverage

Bestinvest does not offer leveraged trading. Accounts must be funded with your own capital. As a result, the broker is less suited to short-term trading and investors looking to speculate on derivatives like CFDs.

Bestinvest Accounts

Bestinvest offers a range of account types alongside investment coaching, financial advice, and planning tools. This includes ISA accounts, investment profiles, and SIPP accounts.

All customers have access to the same financial dashboard, regardless of account type.

ISAs

The Bestinvest stocks & share ISA (individual savings account) is available to UK residents. Customers can invest in a wide range of shares, funds, investment trusts, and bonds, and benefit from tax-free gains.

Currently, UK individuals can invest up to £20,000 and up to £9,000 into a Junior ISA per tax year.

- Custom Portfolio – Invest in 1600 funds, UK shares, trusts, and ETFs

- Junior ISA – Suitable for the parents or guardians of children under the age of 18

- Ready-Made Portfolio – Professionally created portfolios split into three categories; Expert, Smart and Direct for different goals

Investment Account

Create a custom portfolio and invest in thousands of funds, UK shares, trusts, and ETFs. As a Bestinvest trader, you have the flexibility to invest as much or as little as desired.

Similar to the ISA account, ready-made portfolios are available for individuals needing guidance or expert analysis. These are ideal for beginners. There are seven portfolios balancing risk, growth opportunities, and expected return timelines.

SIPPs

Self-Invested Personal Pension (SIPP) plans provide an account where you can contribute toward your future. Bestinvest pension accounts are available as individual SIPP accounts or junior SIPP profiles for children.

You have full control over pension investments including access to a variety of tradable products and income drawdown options.

Bare Trusts

A bare trust financial arrangement allocates a share of money or alternative assets to people, typically juniors. When setting up a bare trust, the account holder is liable for all decisions including appointing a beneficiary and when benefits are distributed.

Contributions are tax-free and there is no maximum value that can be held.

How To Register For An Account

It is relatively quick and easy to open a Bestinvest account – the process took our team 5-10 minutes.

You can create a new profile or transfer funds from an alternative provider. You will need your National Insurance Number to get started.

- Select ‘Open An Account’ or ‘Transfer An Account’ on the Bestinvest website

- Click ‘Let’s Start’

- Choose who the account is for (personal or child)

- Create a profile by choosing a username, password, and security PIN, and click ‘Continue’

- Enter your personal details including name, date of birth, telephone number, and address, and click ‘Continue’

- Choose an account type

- Link an existing bank account

- Fund your profile

Eligibility requirements:

- You must be a UK resident

- You must be at least 18 years old

- You must be a UK tax resident if opening an ISA account

Payment Methods

Deposits

There is no minimum deposit requirement to fund a Bestinvest account, though direct transfers via a payment card or initiating monthly regular investing will require a £50 minimum payment.

Deposits can be made via bank wire transfer or debit card. Payments via a debit card are typically available instantly. Bank wire transfers made directly to an ISA, Investment, or SIPP account will be processed within one working day. Same-day CHAPS payments can be requested before 3 PM (via phone or email). A £35 fee applies.

You can also transfer investments from a competitor profile by using the ‘Transfer an Account’ icon on the Bestinvest homepage. Follow the instructions to complete the transaction.

How To Make A Payment

- Login to the Bestinvest dashboard via bestinvest.co.uk or the mobile app

- Click on your account to deposit funds

- Select the ‘Add Cash’ logo and then ‘Add Cash’

- Follow the on-screen instructions to add the payment details

- Click ‘Confirm’

Alternatively, traders can initiate a payment over the phone via the Bestinvest customer service number.

Withdrawals

Bestinvest does not charge transfer out fees. Money will be available within three to five working days, which is in line with competitors.

On the downside, withdrawals can be made via BACS transfer only.

Demo Account

Bestinvest does not offer a demo account. However, as there is no minimum deposit, users can sign up and explore dashboard features before transferring funds.

Bonuses & Promotions

The brand does not offer traditional bonus incentives, however, there are occasional rewards. Bestinvest offers up to £1000 cashback for full account transfers from an alternative provider. This includes £100 cashback for a £1000 transfer and £300 for a £20,000 transfer.

Additionally, Bestinvest runs a refer-a-friend program with a £100 reward for new customers introduced to the brand. Note, the new user must deposit and invest at least £1000 within the first 120 days.

Make sure you review the terms and conditions of promotions before signing up.

UK Regulation

Bestinvest is a trading name of Evelyn Partners Investment Management Services Limited. The company is regulated by the UK’s Financial Conduct Authority (FCA). All customer funds are held separately with a custodian, SEI. SEI Investments (Europe) Limited is also authorised and regulated by the FCA.

The FCA is a highly regarded financial agency, with rigorous compliance requirements for member firms. This is a good sign that the brokerage is legitimate and trustworthy.

Customers can also access compensation from the Financial Services Compensation Scheme (FSCS), with protection up to £85,000 in the case of business insolvency.

Additional Features

Bestinvest offers an excellent range of extra tools and features, designed for both beginners and experienced investors:

Education

The official website hosts a wealth of educational guides and resources. Categories are specific to trading styles; ISAs, investments, and pensions. Topics include asset allocation models, smart portfolios, and filtering the recommended funds list.

The information is easy to read, with no complex financial jargon, plus integrated YouTube video support.

Investment Coaching

A key benefit of Bestinvest is access to qualified financial planners that can offer support on investment goals. All customers get a free 45-minute session to discuss investment plans.

Personalised investment advice is available for a one-off fee of £295 (investment goal planning) or £495 (portfolio health check) per session. Though, for individuals investing £50,000+, this service is provided for free.

News & Insights

Our experts were impressed with the news updates and financial insights. There is a wealth of articles, investment outlooks, planning advice, market news, and downloadable podcasts to stay up to date with the latest information. You can also sign-up for a weekly newsletter delivered to a registered email address.

Ultimately, Bestinvest provides ample support to help you choose the best investments specific to your goals or interests. This includes the creation of useful investment lists like ‘The Best Funds List’, ‘Spot the Dog’, and ‘Ethical and ESG Investing’.

These have been created by the brand’s team of experts, indicating the top and bottom-performing funds, popular stocks, and assets based on independent fund research. The ‘Spot the Dog’ tool is particularly useful, utilising statistical data to identify underperforming products.

Customer Support

Bestinvest customer support is available Monday to Friday 7:45 AM to 6 PM (GMT) and Saturday 9:30 AM to 1:30 PM (GMT). You can contact the broker-dealer via email, telephone, live chat, or postal address. Our experts found the support staff knowledgeable and helpful upon testing.

Contact details:

- Telephone Contact Number – 020 7189 9999

- Email Address – Enquiry form only, via the ‘Contact Us’ webpage

- Live Chat – Available via the ‘Help’ icon on the bottom right of the website

- Postal Address – Online Investment Service, Bestinvest, Second Floor, Liver Building, Pier Head, Liverpool, L3 1NY

Alternatively, the website hosts a comprehensive FAQ area with topics including account eligibility, application forms, charges and fees, and details on how to transfer money in and out of a Bestinvest account.

Security & Safety

The brand has a dedicated cyber security team and fraud protection protocols to safeguard customers’ personal information and money. Security measures include regular system audits, full website and email data encryption, plus compliance with industry guidelines.

New users are also required to set a PIN. This is part of the brand’s two-step login process, which is used alongside the username and password sign-in requirements.

Bestinvest Verdict

Bestinvest is a good investment platform offering a range of tools, features, and financial products. Retail investors can trade thousands of assets alongside pension and ISA accounts. The financial guidance is also excellent, with free coaching sessions and personalised advice.

On the downside, the platform is better suited to longer-term investors than short-term traders looking for leveraged instruments.

FAQ

Is Bestinvest Safe?

Bestinvest provides a relatively secure investment environment for traders. The company employs multiple fraud protection services and client safeguarding initiatives, including data encryption and two-step PIN login. The investment platform is also regulated by the FCA in the UK.

Is Bestinvest Regulated By The FCA?

Yes, Bestinvest is a licensed entity of Evelyn Partners Investment Management Services Limited, authorised and regulated by the UK’s Financial Conduct Authority (FCA).

Is Bestinvest Good?

Bestinvest is an excellent investment platform with a range of account types, trading products, education, and specialist guidance. Other customer reviews are also positive, praising the expertise of the brand’s financial planners and the usability of the platform and mobile app.

Does Bestinvest Have An App?

Yes, Bestinvest offers a free mobile app, available to download on iOS and Android (APK) devices. It provides all the features of the web-based dashboard, including account overviews, deposits and withdrawals, and order capabilities.

Who Owns Bestinvest?

Bestinvest is a trading name of Evelyn Partners Investment Management Services Limited. The firm is registered with the UK’s Financial Conduct Authority (FCA).

Top 3 Alternatives to Bestinvest

Compare Bestinvest with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

Bestinvest Comparison Table

| Bestinvest | Interactive Brokers | Dukascopy | Firstrade | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 3.6 | 4 |

| Markets | Stocks, ETFs, Trusts, Funds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | £0 | $0 | $100 | $0 |

| Minimum Trade | £50 | $100 | 0.01 Lots | $1 |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SEC, FINRA |

| Bonus | £100 – £1000 Cashback | – | 10% Equity Bonus | Deposit Bonus Up To $4000 |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | TradingCentral |

| Leverage | – | 1:50 | 1:200 | – |

| Payment Methods | 2 | 6 | 11 | 4 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Bestinvest and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Bestinvest | Interactive Brokers | Dukascopy | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Bestinvest vs Other Brokers

Compare Bestinvest with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Bestinvest yet, will you be the first to help fellow traders decide if they should trade with Bestinvest or not?