How To Become A Successful eToro Popular Investor

This guide to becoming a successful eToro Popular Investor explains how the platform works, the pros and cons of becoming a strategy provider, plus tips for gaining visibility and winning followers.

Quick Introduction

- eToro allows skilled traders to earn extra income by attracting followers who replicate their trades.

- Popular Investors receive a monthly payment based on their total assets under management, plus any profits generated from their own trading.

- There are several requirements to become a Popular Investor, including having a balance of $1000+ and two months of trading on the platform.

- Gaining visibility and attracting followers on eToro requires a strategic approach that combines skill, engagement, and authenticity.

The Rise Of eToro

eToro has garnered significant popularity due to its innovative approach to social trading.

Its platform combines traditional financial markets with a social networking interface, allowing users to follow and replicate the trades of experienced investors, thereby democratizing and simplifying the investment process for newcomers.

The platform’s wide range of tradable assets, commission-free trading on stocks, and user-friendly interface make it accessible to a global audience.

Additionally, eToro’s incorporation of popular financial instruments like cryptocurrencies has attracted a younger and tech-savvy demographic.

This unique blend of social interaction, diverse investment opportunities, and ease of use has contributed to eToro’s widespread appeal and popularity in the realm of social investing.

Becoming An eToro Strategy Provider

As a skilled trader, you can showcase your expertise and potentially earn additional income beyond your trading gains by becoming a strategy provider on eToro.

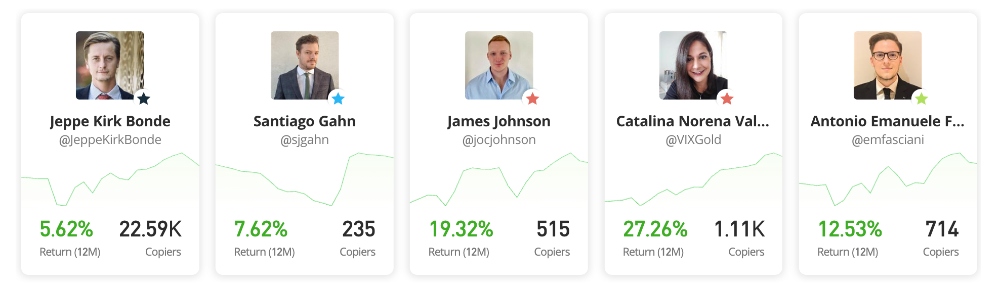

Establishing yourself as a Popular Investor offers several compelling benefits. Firstly, your trading activity is visible to the entire eToro community, allowing you to amass a following of copiers who choose to replicate your trades.

For every copier, you earn a monthly payment based on your total assets under management (AUM), in addition to any profits you generate from your own trading.

Secondly, achieving Popular Investor status on eToro grants access to enhanced exposure and recognition within the trading community. Becoming a top-performing Popular Investor means you will receive special promotional efforts from eToro, further increasing your visibility and credibility.

This recognition can lead to an even larger copier base, thus boosting both your monthly earnings and the potential to attract more substantial investment.

Additionally, you can fine-tune your risk settings and customize your trading preferences while still maintaining control over your investment strategies.

What Are eToro’s Requirements For Strategy Providers?

To become a Popular Investor on eToro, you typically need to:

- Maintain a minimum equity of $1,000 in your trading account

- Have a minimum of two months of trading history on the platform

- Consistently engage with the eToro community by sharing insights and updates about your trading activities

- Trade a diversified portfolio

- Maintain a low-risk score

- Have a verified profile

Meeting these requirements helps demonstrate trading proficiency and social engagement, increasing the likelihood of gaining a following and becoming a Popular Investor on the platform.

However, it’s important to note that specific requirements may vary, and we recommend referring to eToro’s guidelines for the most up-to-date information.

15 Tips For Winning Followers

Here are my top tips to help you gain copy traders on eToro:

#1 Make A Good First Impression

Create a comprehensive profile that highlights your trading expertise, strategies, and goals.

Use a professional photo and provide a succinct biography that showcases your experience.

#2 Target Consistent Performance

Your trading performance is a critical factor.

Aim for consistent positive returns to build a reliable track record that attracts potential copiers.

#3 Communicate Transparently

Be transparent about your trading strategies, risk management practices, and market insights.

Regularly update your profile with informative posts, analysis, and explanations behind your trades to engage and educate your followers.

#4 Diversify Your Portfolio

Offer a diversified range of assets in your portfolio.

This not only reduces risk for your followers but also attracts a broader audience interested in different markets.

#5 Practice Good Risk Management

Emphasize responsible risk management.

Demonstrate that you prioritize capital preservation and manage risk through the use of stop-loss orders and appropriate position sizing.

#6 Take A Stable Approach

Stability in your trading approach helps establish your credibility.

Avoid drastic changes in your trading style that could confuse or alienate your followers.

#7 Educate Your Followers

Provide educational content that helps your followers understand trading concepts, market trends, and economic indicators.

This showcases your expertise and positions you as a valuable resource.

#8 Engage Your Followers

Engage with your followers by responding to comments, questions, and messages.

Building a sense of community can foster loyalty and attract more followers.

#9 Share Performance Statistics

Share your performance analytics, including historical trades and performance charts.

This adds credibility and transparency to your track record.

#10 Provide Regular Updates

Regularly update your feed with informative posts, trade analyses, and market insights.

This keeps your profile active and engages your audience.

#11 Network With Popular Investors

Connect with other Popular Investors and traders on the platform.

Collaboration and mutual support can help increase your visibility.

#12 Track Current Events

Stay informed about the latest market news and trends.

Sharing timely insights can position you as an authority in your chosen markets.

#13 Take A Long-Term View

Focus on building a long-term relationship with your followers.

Prioritize sustainable trading strategies that provide consistent gains over time.

#14 Publish Video Content

Consider creating video content explaining your trading decisions, strategies, and market analyses.

Videos can be more engaging and help convey complex information effectively.

#15 Promote Your Profile

Promote your eToro profile on your other social media channels and trading forums to expand your reach beyond the platform.

Pros & Cons

There are several advantages to becoming a strategy provider on eToro:

- Earnings potential: As a Popular Investor you earn both from trading profits and through a monthly eToro commission payment based on your number of copiers and assets under management (AUM). As your follower base grows, your potential earnings increase, providing a unique opportunity to monetize your trading skills beyond personal profits.

- Social influence and recognition: You can gain a significant level of social influence and recognition within the eToro community. Your trading decisions and strategies are visible to thousands of users who may choose to replicate your trades, thereby elevating your reputation as a knowledgeable and successful trader.

- Networking opportunities: Doors are opened to networking opportunities with other successful traders, potential investors, and industry professionals. This can lead to collaborations, partnerships, and exposure within the financial industry, potentially expanding your reach beyond the eToro platform and enhancing your overall trading career.

There are also several drawbacks to consider:

- Performance pressure: You are under constant scrutiny from your followers, which can create performance pressure. Consistently delivering profitable trades can be stressful and may lead to making riskier decisions to maintain a positive track record, potentially compromising long-term trading strategies.

- Market volatility impact: You may face challenges during periods of high market volatility. Sudden market shifts can lead to increased pressure and rapid changes in followers’ sentiments. Handling these situations effectively requires not only sound trading strategies but also the ability to manage and communicate effectively with followers to avoid panic reactions or mass exodus from copying your trades.

- Level requirements: To achieve and maintain higher Popular Investor levels, you need to commit substantial time and effort to trading, monitoring the markets, and engaging with followers. The pressure to meet the stringent level requirements (including personal financial commitment) might also lead to neglecting proper research and due diligence, ultimately undermining the quality of your trading decisions and potentially harming your own finances and the financial well-being of your copiers.

Bottom Line

The unique blend of social interaction, diverse investment opportunities, and ease of use has contributed to eToro’s widespread appeal and popularity in the realm of copy trading.

If you’re an experienced trader, there is definitely a lot of opportunity on the platform to earn additional income beyond your trading gains.

But remember, building a following on eToro takes time and dedication. It is important to focus on providing value, fostering trust, and maintaining a commitment to responsible trading practices.

By consistently demonstrating your expertise and engaging with your followers, you can increase your visibility and attract copiers to your eToro profile.

FAQ

Is eToro The Best Platform For Strategy Providers?

eToro stands out as the premier platform for strategy providers due to its unique combination of a user-friendly interface, comprehensive social trading features, and a vast global user base.

eToro makes it easy for strategy providers to showcase their trading expertise and attract followers who can replicate their trades automatically.

The platform’s transparent performance data, real-time tracking, and seamless integration of social networking elements foster a dynamic community of traders, making eToro the optimal choice for strategy providers seeking a powerful and engaging platform to share and monetize their trading strategies.

What Are The Drawbacks To Being An eToro Strategy Provider?

The main criticisms of being an eToro Popular Investor include concerns about transparency in disclosing trading strategies, potential conflicts of interest due to receiving compensation from eToro, and the pressure to maintain consistent performance to retain followers, which might lead to risky trading behaviors.

Additionally, there is criticism that centers around the potential for inexperienced traders to become Popular Investors solely based on short-term gains, without demonstrating a comprehensive understanding of market dynamics or risk management.

Differentiating your strategy and aptitude for risk management will be critical for long-term success on the platform.

eToro is a multi-asset platform which offers both investing in stocks and

cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high

risk of losing money rapidly due to leverage. 51% of retail investor

accounts lose money when trading CFDs with this provider. You should

consider whether you understand how CFDs work, and whether you can

afford to take the high risk of losing your money.

This communication is intended for information and educational pur-

poses only and should not be considered investment advice or invest-

ment recommendation. Past performance is not an indication of future

results.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This

is a high-risk investment and you should not expect to be protected if

something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and

assumes no liability as to the accuracy or completeness of the content

of this publication, which has been prepared by our partner utilizing

publicly available non-entity specific information about eTo

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com