BDSwiss Review 2025

Awards

- Best Educational Broker 2024 - Pan Finance Awards

- Best Research And Education Provider 2024 - UF Awards

- Best Trade Execution 2024 - UF Awards

- Fastest Growing Multi-Asset Brokerage 2023 - Gazet International Magazine

Pros

- With support for MT4, MT5, and its own app, BDSwiss ensures its platforms offer advanced charting tools, Autochartist and Trading Central integration, and seamless mobile access.

- BDSwiss had made strides to enhance its trading services, notably through its AI-enabled trend analysis tool added in 2021, plus a low spread account and dynamic leverage up to 1:2000 introduced in 2023.

- BDSwiss caters to a wide range of traders by offering Cent, Classic, VIP, and Raw accounts. Beginners can start with lower-risk Cent accounts, while experienced traders can benefit from VIP or Raw accounts that offer lower spreads and tighter spreads and commissions for high-volume trading.

Cons

- After surrendering its CySEC (Cyprus) and FCA (UK) licenses, BDSwiss no longer accepts clients from the EU and UK. This limits its access to traders in highly regulated markets, reducing its appeal in those regions where stringent oversight might be a priority for users.

- While the growing 900+ asset range is solid, specific categories, like cryptocurrencies and stocks, have fewer options than brokers offering thousands of shares or a more diverse crypto portfolio. Advanced traders looking for niche assets might feel constrained.

- The BDSwiss WebTrader lacks customization, with no window resizing and no asset-specific filters for trading ideas, making for a limiting and frustrating user experience during testing.

BDSwiss Review

Regulation & Trust

2.8 / 5Established in 2012, BDSwiss has a solid reputation for its services, but its regulatory oversight is a mixed bag.

- BDSwiss Holding Plc is authorized by the Securities & Commodities Authority (SCA) UAE. A ‘yellow tier’ body in DayTrading.com’s Regulation & Trust Rating.

- BDS Ltd is authorized by the Financial Services Authority (FSA) Seychelles. ‘Red tier’.

- BDS Markets is authorized by the Financial Services Commission (FSC) Mauritius. ‘Red tier’.

- BDSwiss Investments Ltd is authorized by the Mwali International Services Authority (MISA). ‘Red tier’.

All of these bodies are considered less stringent than ‘green-tier’ broker regulators like the UK Financial Conduct Authority (FCA) and Australian Securities & Investments Commission (ASIC).

We’ve also lowered its trust score following BDSwiss’s decision to exit the UK market after relinquishing its FCA license in 2021.

The broker’s history of regulatory breaches with the FCA underscores the challenges it faced in complying with the stricter regulatory requirements of such jurisdictions.

Despite the regulatory environment, BDSwiss claims it prioritizes client protection by segregating client funds. This means client assets are kept separate from the company’s operational funds, minimizing risk in case of insolvency.

Additionally, the broker offers negative balance protection, an added layer of security during periods of market turbulence that means you can’t lose more than your balance.

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FSC, FSA, SCA, MISA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

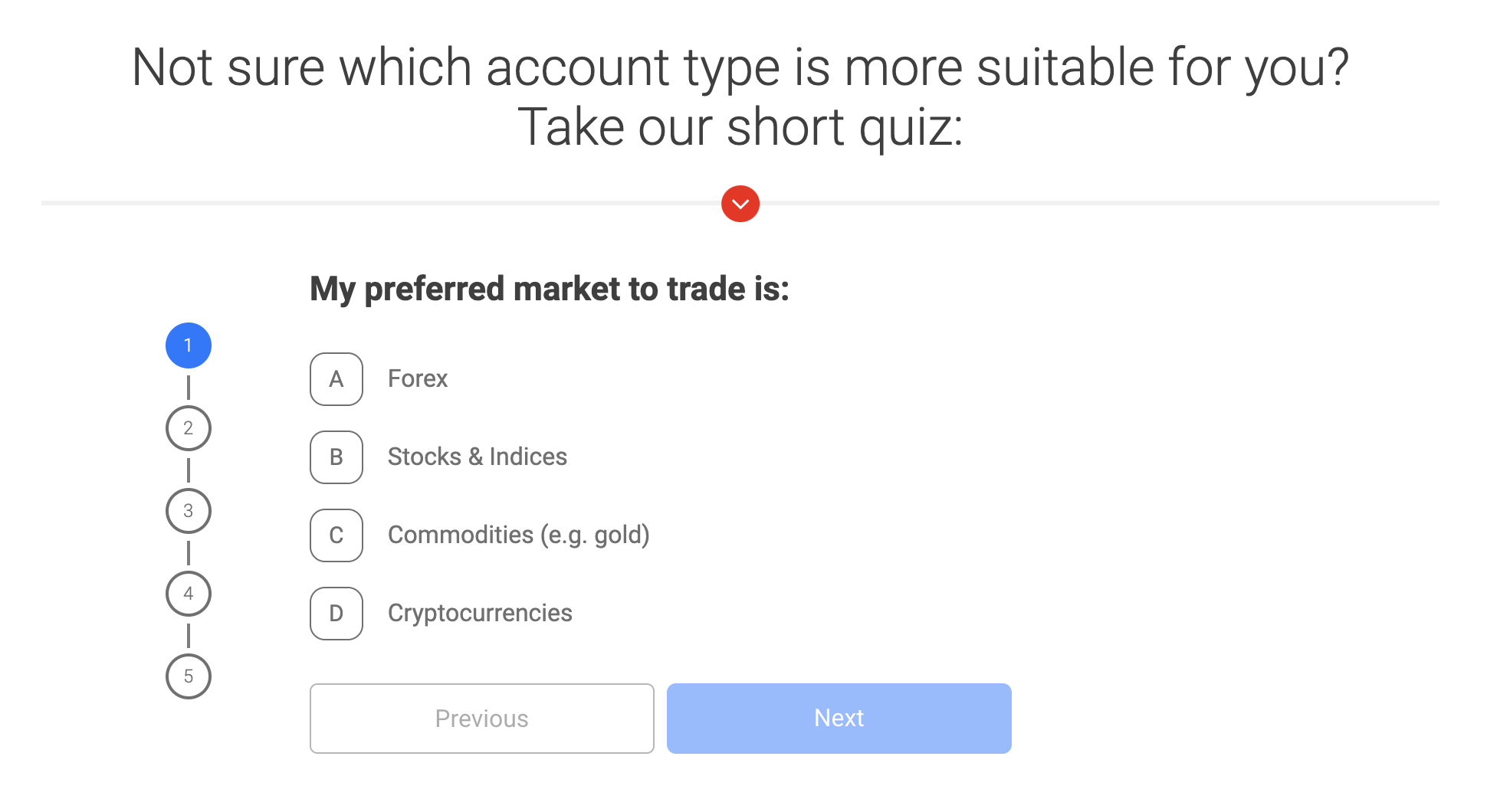

3.5 / 5Live Accounts

BDSwiss offers various account types tailored to different trading levels:

- Cent: This account requires a minimum deposit of $10 and is designed for beginners. It offers micro-lot trading (0.01), spreads starting from 1.6 pips, and leverage up to 1:2000. However, the asset choice is lower at 70+, compared to 250+ with the other accounts. Available in certain countries only.

- Classic: Minimum deposit of $10, standard option with spreads starting from 1.3 pips, no commission, and leverage up to 1:2000.

- VIP: Minimum deposit of $250, spreads starting from 1.0 pips, leverage up to 1:2000, exclusive tools, and priority support.

- Raw: Minimum deposit of $500, spreads from 0.3 pips, $5 per traded lot commission, and leverage up to 1:2000. Introduced in 2023, this raw spread account may appeal to short-term traders seeking low spreads.

I noticed some advanced features like personal account managers or premium analytics are only accessible in higher-tier accounts or with more significant deposits of $1,000+.

Furthermore, MT5 isn’t available with the Cent account, a swap-free account is not available with the Raw account, and some webinars are exclusive to VIP and Raw accounts.

Broadening benefits across all account types would make selecting an account less confusing and make BDSwiss more attractive to traders of all levels.

Demo Accounts

BDSwiss offers a demo account for all its accounts except for the Cent account.

When I opened a VIP demo account, I was given $10,000 in virtual funds to practice on all platforms. Unfortunately, I couldn’t manually alter the balance or the leverage.

The demo account was highly beneficial for testing strategies and risk management techniques in real-time market conditions.

Thankfully, there’s no time limit on demo accounts either, so you can also test longer-term strategies like swing trading.

Deposits & Withdrawals

Depending on your location, BDSwiss offers a wide range of deposit and withdrawal methods, including credit/debit cards (Visa, Mastercard), crypto (eg BTC payments, ETH payments, USDT payments), bank transfer, and e-wallets like Skrill and Neteller.

I like the ability to choose from three account-based currencies (EUR, GBP, and USD), which is helpful for minimizing currency conversion charges.

Deposits are usually instant, which is convenient, but based on my experience, withdrawals can take up to a few days, depending on the method and provider.

Before withdrawing funds, you must verify your account with some ID documents.

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Airtel, AstroPay, Bitcoin Payments, Credit Card, Debit Card, M-Pesa, Mastercard, Neteller, PIX Payment, Skrill, Sofort, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $10 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5BDSwiss covers the bases with a modest but growing range of forex, commodities, indices, stocks, and cryptocurrency CFDs.

However, the total number of assets still feels limited compared to many other brokers, especially as there are no bonds, options, or futures.

Furthermore, BDSwiss does not provide passive investment options such as real stocks, exchange-traded funds (ETFs), or copy trading (except for partners) offered by eToro, FXTM, and Pepperstone.

You can trade:

- Forex: 50+ pairs, including majors like EUR/USD, minors, and exotics like USD/ZAR.

- Commodities: 6+ commodities, including Gold (XAU/USD), Silver (XAG/USD), Brent (CL_BRENT), and Crude oil (USOIL).

- Stocks: 900+ stocks across major US and European stock exchanges (eg Coinbase, Deutsche Bank).

- Indices: 9+ covering the US and Europe (eg S&P 500 and FTSE 100).

- Crypto: 28+ cryptocurrency pairs (eg BTC/USD, ETH/USD).

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:2000 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3 / 5BDSwiss’s fees are reasonable but vary depending on the account type.

For example, the Raw account offers raw spreads starting at 0.0 pips with a $5 commission per lot, while other accounts like Classic have no commission but wider spreads starting at 1.3 pips.

It’s worth noting that BDSwiss does not charge commissions on forex, crypto, and commodity pairs. A fixed commission fee will apply depending on your account type and trading account currency for all other CFDs, including indices and stocks.

Additional fees may apply, including currency conversations (if your base account differs from your funding currency), overnight swap rates, and a highly uncompetitive monthly inactivity fee of $30 (or equivalent in base trading currency) for accounts that remain inactive for 90 consecutive days, until the account balance reaches zero.

Compared to low-cost brokers like Fusion Markets, FP Markets, and IC Markets, BDSwiss’s fee structure is less competitive.

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.3 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.0 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.8 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.1 | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

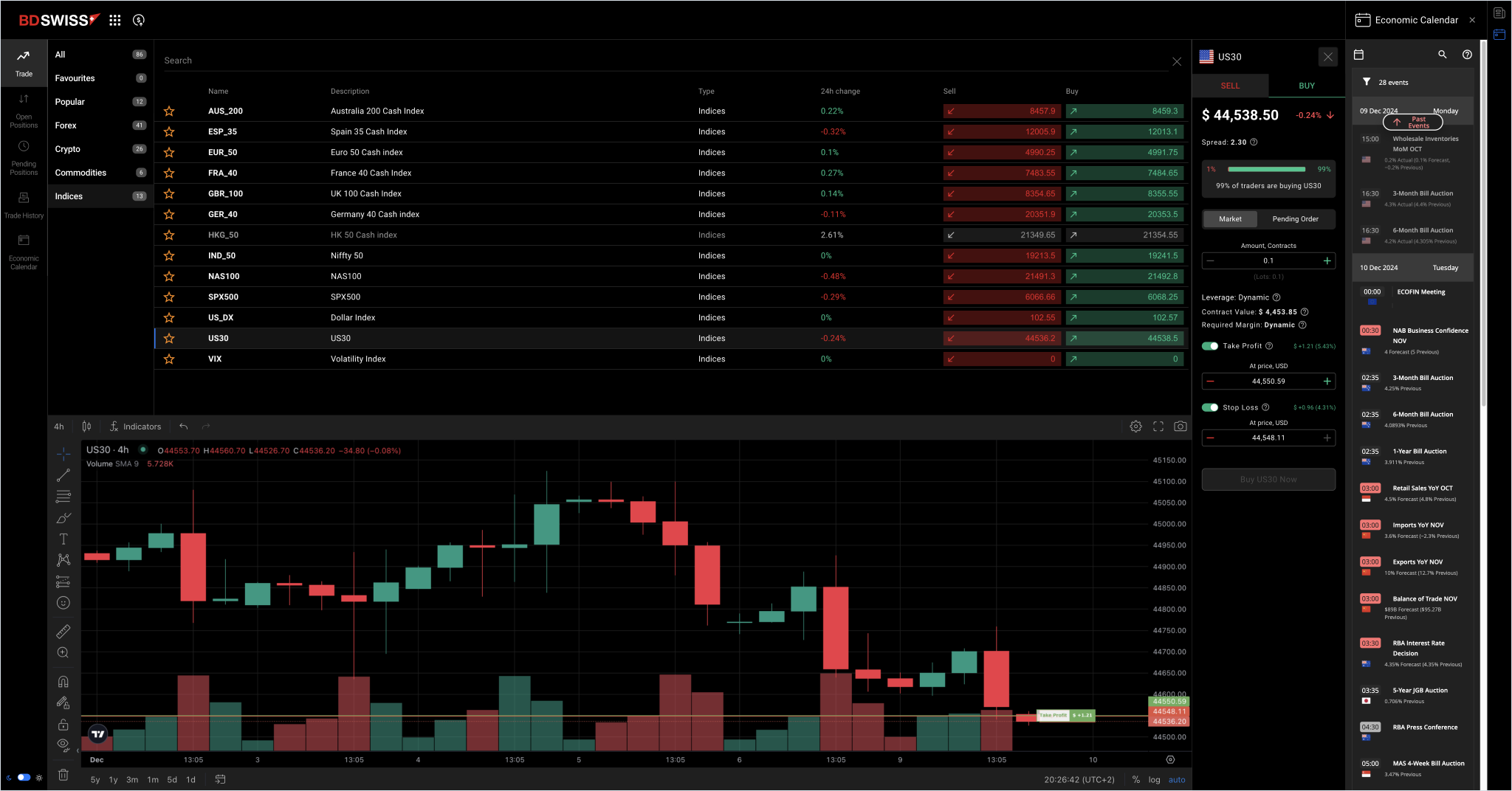

3.8 / 5BDSwiss offers a range of trading platforms to suit different trader preferences.

I find MT4 exceptionally reliable for forex trading, thanks to its robust charting and technical analysis tools, which were easy to customize.

MT5 is an upgrade that offers additional features, such as depth of market and a broader range of tradable assets, which helps streamline multi-asset trading.

The proprietary BDSwiss WebTrader is straightforward, but I’ve had difficulty re-sizing windows to make the workspace more personal. I’d also like to filter the trading ideas by asset, such as indices or commodities, like I can with Signal Centre at FXTM.

I appreciate its clean TradingView-based interface and the ability to trade directly from my browser without downloading anything. However, it lacks some advanced features found on MT5, such as automation and copy trading.

BDSwiss was also an early adopter of artificial intelligence (AI) in the brokerage space, launching an AI-powered trend analysis tool on its WebTrader platform in 2021, automating technical analysis to identify optimal trading opportunities, forecast price movements, and aid risk management in real-time.

All three platforms are also available as mobile apps, which allow me to monitor trades and react to market shifts on the go with real-time data and push notifications.

While all the platforms are versatile, I’d still like to see support for cTrader (and its excellent copy-trading feature) and a standalone TradingView, as I find these two platforms much easier to use.

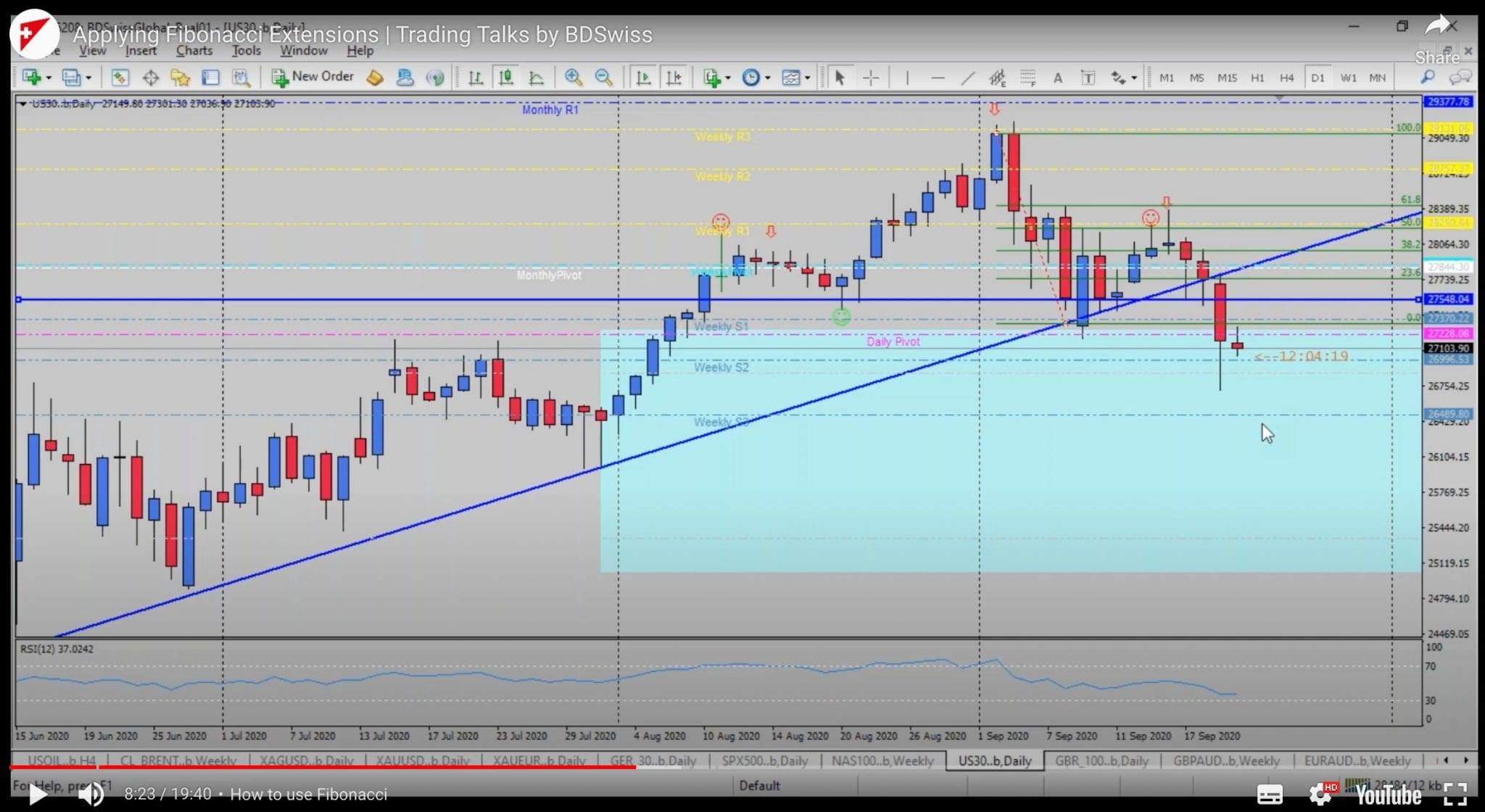

Check out my video tour of the BDSwiss platform to get a feel for the layout and trading features:

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | BDSwiss WebTrader, MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

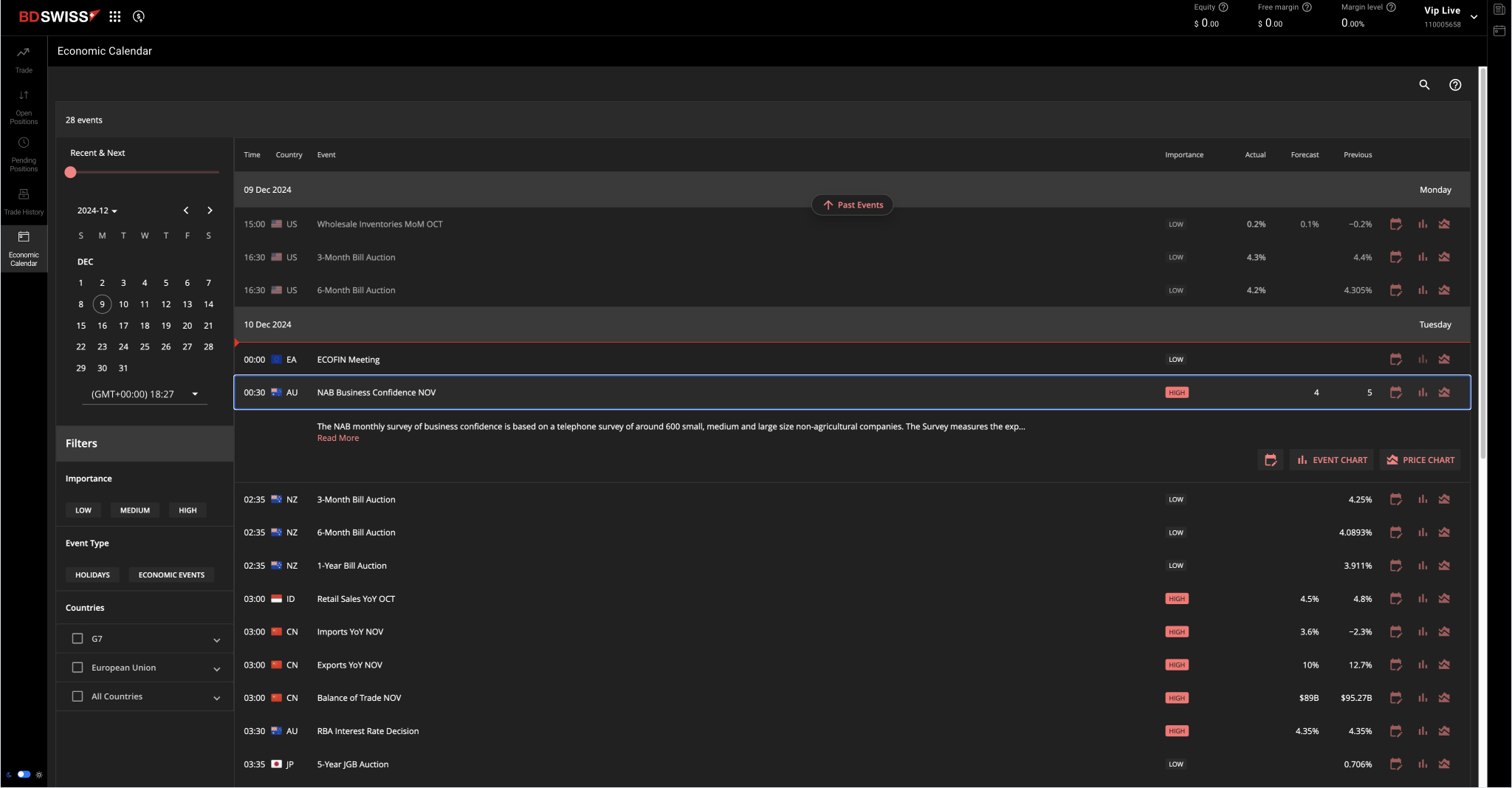

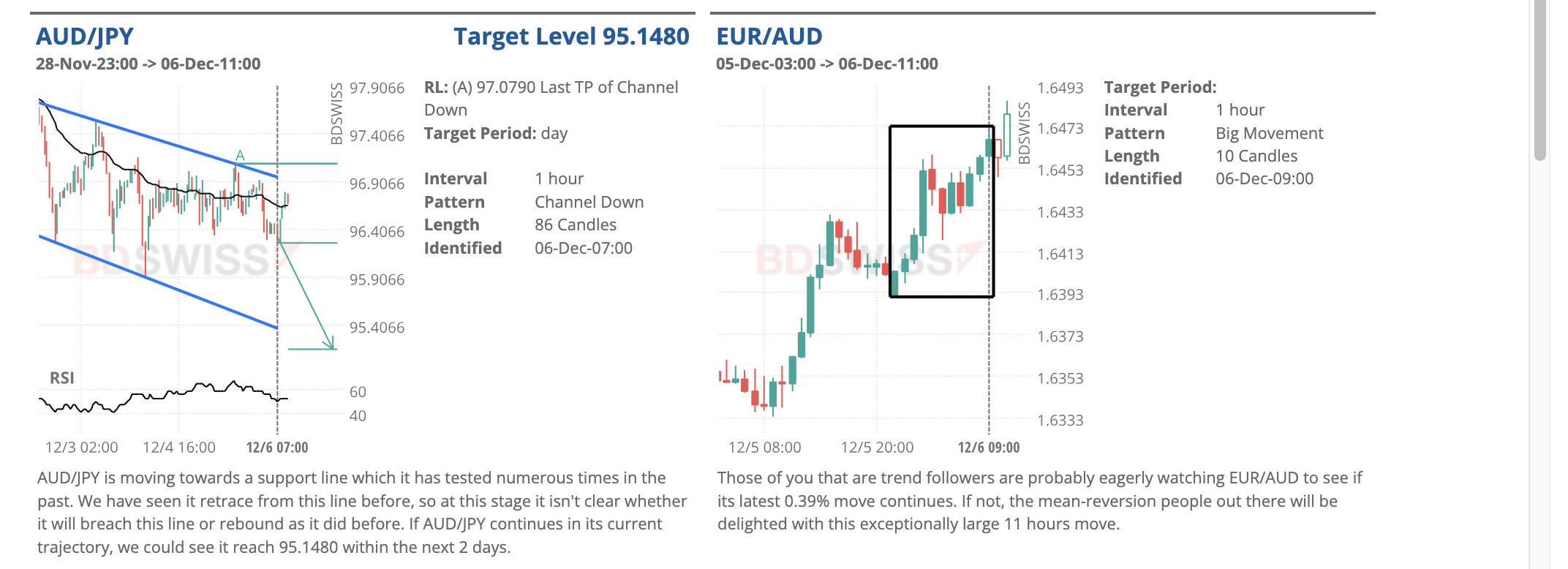

3.8 / 5BDSwiss provides essential research tools, such as daily market updates, economic calendars, and trading calculators, which I find helpful for planning trades.

There are no live webinars or podcasts to add value for newer traders, but integration with third-party Autochartist and Trading Central provides trend analysis and trade ideas within MetaTrader.

BDSwiss offers in-house real-time trading alerts via Telegram exclusively for live account holders in a somewhat unique step. However, this is suspicious, as the track record doesn’t look updated, and there are no meaningful statistics like pips won or lost.

Frustratingly, some research tools need regular updates, such as the ‘Daily Videos,’ whose content was at least three months old at the time of my latest tests. Furthermore, the ‘Technical Analysis’ section replicates the ‘Daily Market Analysis’ section and provides no fresh content.

I also noticed that the ‘Live Webinars’ page needs to be updated to allow re-watching past webinars.

To compete with leading brokers in this category like IG, BDSwiss could provide more frequent and in-depth expert insights, potential trade setups, and trading tutorials. These enhancements would make the research tools significantly more helpful for beginner traders.

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.8 / 5BDSwiss offers a basic range of educational resources, including a glossary of terms, three e-books, 19+ written lessons to introduce you to the basics of trading forex and CFDs, and 18+ video tutorials.

The materials are a good starting point but lack multimedia, advanced topics, and interactive learning options.

Expanding the range of tutorials and training webinars could make BDSwiss’s educational tools more robust and a step towards the top brokers for education like XTB.

I’d appreciate a wider range of structured courses tailored to various experience levels and more detailed, step-by-step tutorials to accommodate diverse learning styles.

To cater to the needs of intermediate and advanced traders, broadening the resource offerings to include in-depth discussions of advanced trading strategies and sophisticated market analysis techniques would significantly enhance their value.

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.9 / 5BDSwiss offers 24/5 customer support via live chat, email, and phone in multiple languages, which is convenient but could be improved compared to brokers like Exness, which offers 24/7 support.

In addition to traditional communication channels, the broker interacts with its clients on popular social media platforms such as Facebook, X, LinkedIn, Instagram, and YouTube.

I find the FAQ section helpful for addressing common queries, though it lacks depth in certain areas. There are also a few video tutorials to assist beginners, but these are very limited compared to more comprehensive and practical libraries from other brokers such as Axi.

| BDSwiss | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With BDSwiss?

BDSwiss can be an appealing choice for active traders due to its robust trading platforms, diverse account options, and wide range of tradable assets.

However, its regulatory status under the Mauritius FSC and Seychelles FSA, which are known for less rigorous oversight than top-tier regulators, may be a significant factor for some.

Before deciding, it’s essential to weigh the potential benefits against the regulatory considerations and assess your specific risk tolerance and trading goals.

FAQ

Is BDSwiss Legit Or A Scam?

BDSwiss is a legitimate broker that claims over 1.7M+ registered client accounts from 180+ countries.

It offers regulated services under entities like the Mauritius FSC and Seychelles FSA. However, it is no longer regulated by top-tier authorities like the FCA or CySEC, which might concern some traders.

Its credibility is supported by years in operation and a strong market presence, but short-term traders should always exercise caution and assess the level of regulatory protection provided.

Is BDSwiss Suitable For Beginners?

BDSwiss can be suitable for beginners due to its range of well-supported platforms, educational resources, and demo accounts.

However, it’s important to note that the broker operates under less stringent regulatory bodies, which may offer less investor protection.

Beginners should carefully consider the risks and start with small investments while learning trading fundamentals.

Top 3 Alternatives to BDSwiss

Compare BDSwiss with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

BDSwiss Comparison Table

| BDSwiss | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.6 | 4.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FSC, FSA, SCA, MISA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | BDSwiss WebTrader, MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:2000 | 1:50 | 1:200 | 1:50 |

| Payment Methods | 13 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by BDSwiss and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| BDSwiss | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

BDSwiss vs Other Brokers

Compare BDSwiss with any other broker by selecting the other broker below.

The most popular BDSwiss comparisons:

Article Sources

- BDSwiss

- BDSwiss Telegram Alerts

- BDSwiss Holding Plc - Securities & Commodities Authority (SCA) UAE

- BDS Ltd - Financial Services Authority (FSA) Seychelles

- BDS Markets - Financial Services Commission (FSC) Mauritius

- BDSwiss Investments Ltd - Mwali International Services Authority (MISA)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of BDSwiss yet, will you be the first to help fellow traders decide if they should trade with BDSwiss or not?