Day Trading in Bangladesh

Rapid economic growth, combined with improving digital infrastructure, means that day trading in Bangladesh is taking off. However, interest is expanding from a low base, and financial market trading is not as large or well developed – and by extension, not as closely regulated – as in other countries.

This guide will explain how day trading in Bangladesh works. It will provide key details on the country’s stock market, tax regime and regulatory landscape, and provide an example of how a short-term trade might look.

Quick Introduction

- Day traders can deal in a wide variety of financial assets, including trading company shares on the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE).

- Financial markets are regulated by the Bangladesh Securities and Exchange Commission (BSEC) and Bangladesh Bank. The BSEC is categorized as an ‘orange tier’ regulator under DayTrading.com’s Regulation & Trust Rating.

- Active traders pay income tax at a progressive rate to the National Board of Revenue (NBR), up to a maximum of 25% of their profits.

Top 4 Brokers in Bangladesh

Our exhaustive testing reveals these 4 platforms are in a league of their own for active traders in Bangladesh:

More Day Trading Platforms in Bangladesh

What Is Day Trading?

Day trading involves buying and selling securities within the same day to profit from short-term fluctuations in prices.

Retail investors in Bangladesh can trade stocks, forex and bonds, though dealing in commodities and derivatives is far more restrictive. Meanwhile, trading in cryptocurrencies like Bitcoin has been illegal in the country since 2017.

Economic growth has slowed in Bangladesh, but the rate of expansion continues to surpass that of major Western countries. If the government meets its long-term objectives, the South Asian nation will become an upper-middle-income country by the early 2030s.

This steady improvement, combined with upgrades to the territory’s technological infrastructure, means that day trading activity is also on the rise. That said, further progress is needed in terms of economic policy and solving financial sector vulnerabilities for the market to flourish.

Equities trading takes place on two separate exchanges: the Dhaka Stock Exchange (DSE), which has been in operation since 1956, and the Chittagong Stock Exchange (CSE), created in the 1990s.

The DSE accounts for the lion’s share of daily transactions, and in recent years has launched trading boards for small-to-medium-sized companies. It has also invested heavily in technology to boost investor interest in the stock market.

Bangladesh’s largest-listed companies are quoted on the DSE 30 Index.Prominent names here include drugs manufacturer Square Pharmaceuticals, telecoms provider Robi Axiata, and building materials supplier Heidelberg Cement.

Is Day Trading Legal In Bangladesh?

Yes. The Bangladesh Securities and Exchange Commission (BSEC), which was set up in 1993, oversees all financial market activity in the country.

In its own words, its role “is to protect the interest of investors in securities, develop the securities market and make rules for matters connected therewith or ancillary thereto.”

The BSEC establishes rules to ensure fair, transparent, and efficient functioning of Bangladesh’s markets, and supervises financial institutions to ensure regulatory compliance. Its role includes issuing licences to organizations, and administering enforcement action if regulations are not adhered to.

The Bangladesh Bank also plays a significant role in regulating and monitoring financial businesses in Bangladesh, such as banks. Additionally, it has sole responsibility for currency trading in the country, overseeing the forex market and regulating transactions to ensure stability and proper foreign currency reserve management.

Forex traders should inspect DayTrading.com’s list of Bangladesh’s best forex brokers when choosing a provider.

How Is Day Trading Taxed In Bangladesh?

Traders typically pay income tax on their profits to the country’s National Board of Revenue (NBR). The tax year runs from 1 July to 30 June, and individuals must typically complete and send their tax returns in by 30 November the following year.

The amount of income tax an individual pays depends on certain factors including sex, age, and whether or not they have certain physical conditions. Most male traders in Bangladesh will pay tax at the following rates:

- 0% on the first 300,000 Bangladeshi taka (BDT);

- 5% on the next 100,000 BDT;

- 10% on the next 300,000 BDT;

- 15% on the next 400,000 BDT;

- 20% on the next 500,000 BDT;

- 25% on the remainder of their earnings.

Getting Started

There are three steps that any day trader must complete to set up shop in Bangladesh. These are:

- Selecting a day broker that accepts Bangladesh traders. The first thing investors must check is that the brokerage they choose is licenced by the local regulator, or by a highly respected body in another territory (like the UK’s Financial Conduct Authority (FCA), or the US Securities and Exchange Commission (SEC)). Once you’ve done this, other important things to look at include trading fees and other charges, the quality of a company’s trading platform, and the range of tradeable financial instruments. For example, CFD trading in Bangladesh is popular with active traders.

- Setting up an account. After selecting a broker, you’ll need to provide certain information to open your trading account. This will include proof of identity and address, as well as details about your employment status, income, social security number (or equivalent), and your investing goals and experience.

- Depositing some cash. You’ll need to put some Bangladeshi Taka in your account once it’s up and running. This can be done via a debit card, wire transfer, or perhaps even through the services of an online payment provider (such as Bangladesh-based iPay).

A Day Trade In Action

With these actions completed, you’ll now be ready to begin trading on Bangladesh’s financial markets. Here I’ll show you what a short-term stock trade on the DSE might look like…

The Background

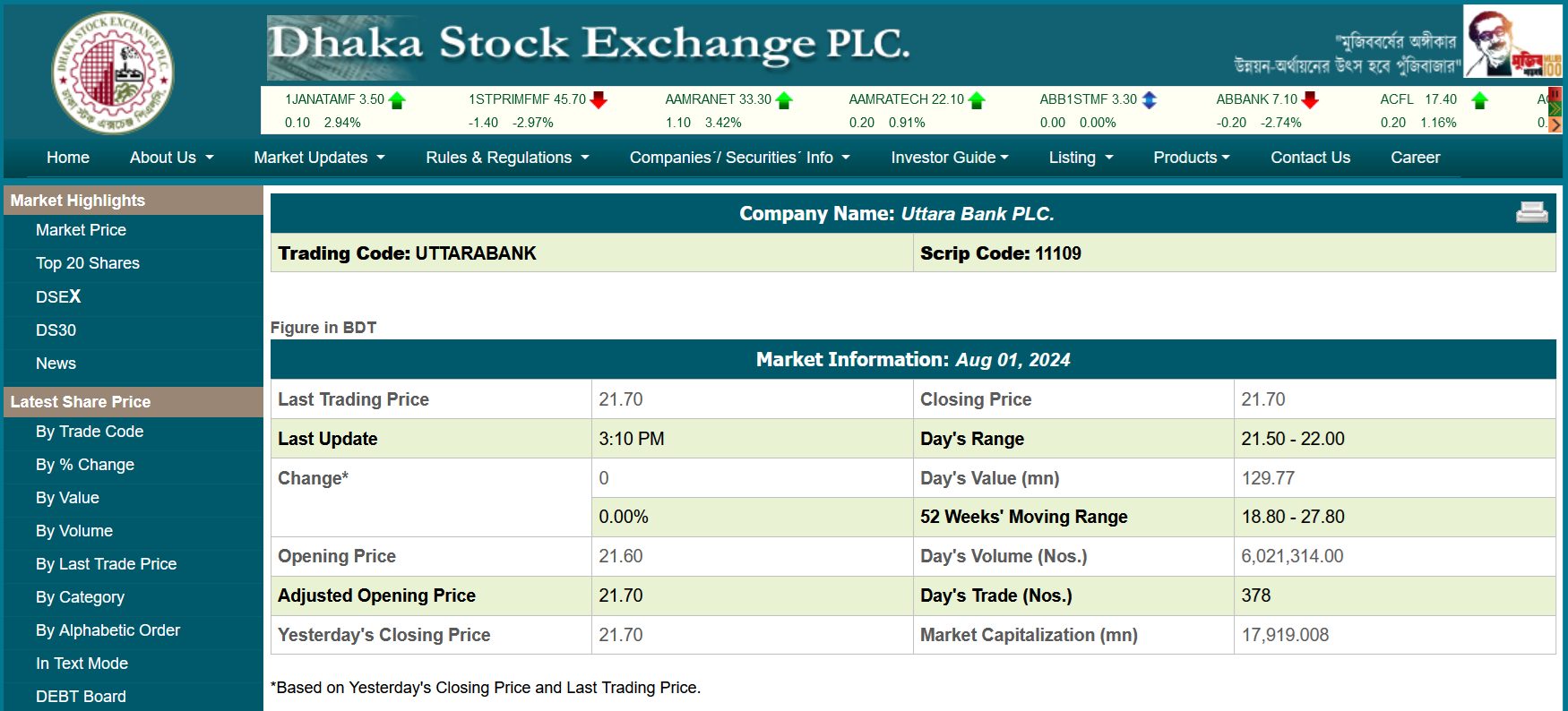

My plan is to turn a profit by trading shares in Uttara Bank, one of the country’s largest financial institutions.

I intend to open a position before the release of Chinese GDP data and to close it shortly afterwards.

My expectation is that growth for the last quarter will be higher than the market is currently pricing in. After analyzing economic data and analyst reports, I conclude that GDP will have risen 4.9% in the period, above the widely expected 4.7%.

China is Bangladesh’s largest trading partner and a major investor in the South Asian nation. So strong data from Beijing can provide a boost to its stock markets.

If my growth projection is correct, investor demand for cyclical stocks like banks could pick up, driving share prices higher. Before placing the trade, I’ll also conduct technical analysis to better understand where Uttara Bank’s share price could head to after the update.

The Trade

Growth figures are due to be published by the National Bureau of Statistics of China (NBS) at 08:00 Bangladesh Standard Time (BST). So I open my trading platform 15 minutes beforehand and prepare to place the trade.

My decision to take a long position in the company will involve two steps:

- I’ll set a ‘take profit’ order at 27.9 BDT per share, which will lock in any gains I make if Uttara Bank shares rise from current levels of 27.7 BDT.

- I’ll set a ‘stop loss’ instruction at 27.6 BDT, a tool that will reduce my losses if the bank drops in price. Like the ‘take profit’ order, my broker will automatically close my position if either of these thresholds are breached. They therefore provide me with a way to effectively manage risk.

A few minutes after I place my trade, the NBS releases GDP data showing growth of 4.8% in the last quarter. While lower than I was expecting, the number was still ahead of analyst forecasts. As a result, stocks move higher across the DSE 30 index.

Uttara Bank is one of these gainers. Within 30 minutes, my ‘take profit’ order of 27.9 BDT is triggered. This gives me a profit of 20 poishas for every share I purchased.

Bottom Line

Bangladesh’s day trading community is growing, but major economic, structural, and regulatory reforms are needed for this trend to continue. Financial market supervision is less robust than in many other countries, so investors should be vigilant to avoid being scammed.

To get started, use DayTrading.com’s selection of the top day trading brokers in Bangladesh.

Recommended Reading

Article Sources

- The World Bank In Bangladesh – World Bank

- Dhaka Stock Exchange (DSE)

- Chittagong Stock Exchange (CSE)

- Dhaka Stock Exchange Extends Technology Partnership with Nasdaq - Nasdaq

- Crypto is fully banned in China and 8 other countries - Fortune

- Bangladesh Securities and Exchange Commission (BSEC)

- Bangladesh Bank

- National Board of Revenue (NBR)

- A Guide to Submission of Income Tax Return - The Institute of Chartered Accountants of Bangladesh

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com