Baxia Markets Review 2025

Pros

- Baxia New York and London data centres for deep liquidity and low latency

- Copy trading services via ZuluTrade & Myfxbook

- MetaTrader 4 and MetaTrader 5 integration

Cons

- No direct stock trading

- Clients from the USA not accepted

- Offshore regulation with limited customer protection

Baxia Markets Review

Baxia Markets is a relatively new CFD and forex broker, with two registered entities providing global trading services. The online brokerage offers 75+ instruments on the industry-established MT4 and MT5 platforms. This 2025 review will cover Baxia Markets corporation details, trading technology, account types, live price quotes, and more. Find out whether our experts recommend opening an account with Baxia Markets.

Company Details

Baxia Markets was founded in 2020 by forex industry professionals. The trading group offers a range of instruments, spanning currencies, indices, cryptos, energy, and metals, alongside localized customer support, competitive trading fees, low latency (~30 ms), and various international payment methods.

The trading broker operates via two entities:

- Baxia Markets Limited (Ltd) – registered in the Bahamas and regulated by The Securities Commission of The Bahamas

- Baxia Markets Global Limited – registered in the Seychelles and regulated by The Financial Services Authority of The Seychelles

Trading Platforms

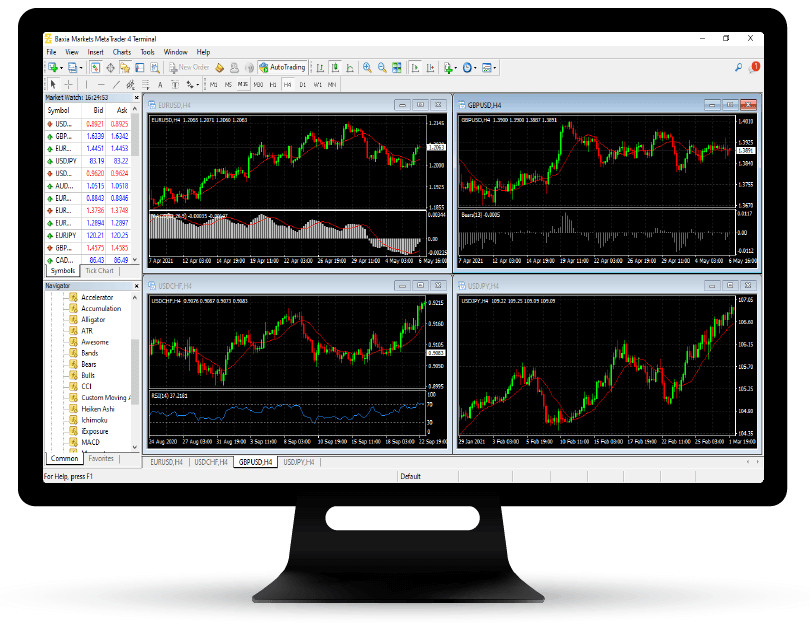

Baxia Markets offers two trading platforms; MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

The industry-renowned platforms are available for free download to Windows and Mac devices or can be used via a web-based profile. MT4 is best suited to beginners while MT5 offers more advanced trading tools and analysis features for experienced traders.

The key features of each terminal are outlined below:

MetaTrader 4

- Nine timeframes

- Four pending order types

- One-click order execution

- Fully customizable charts

- Three order execution types

- 30+ built-in technical indicators

- Access to Expert Advisors (EAs)

- MT4 MultiTerminal to manage multiple accounts simultaneously

MetaTrader 5

- 21 timeframes

- Partial order filling

- Six pending order types

- Fully customizable charts

- Market depth functionality

- Multi-thread strategy tester

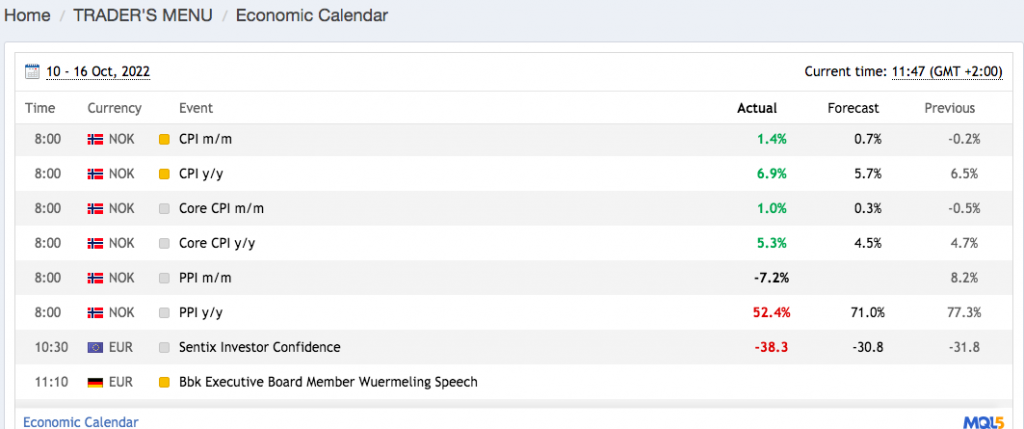

- Integrated economic calendar

- 38 built-in technical indicators

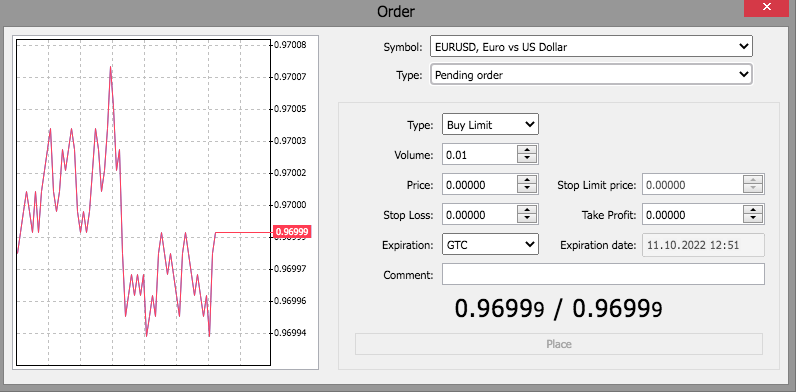

How To Place A Trade

Once Baxia Markets has verified your identity documents, you can begin trading. You will need to fund your profile with a minimum deposit of $50 or equivalent currency.

To make a trade:

- Download the platform or login via the web terminal

- Choose the asset/market you wish to speculate on using the drop-down list or search menu

- Click on ‘new order’ which is located second from the left in the top navigation bar. A ’new order’ screen will then pop out

- Enter the order details, including trading symbol, order type (pending or instant), volume, and risk management parameters (take profit or stop loss)

- Select buy or sell

- Confirm the order

Note, the broker’s FAQ section covers some useful tips and error message support.

Baxia Markets Assets

Baxia Markets offers close to 100 trading instruments:

- Invest in energies and metals such as Crude Oil, Brent Oil, Gold and Silver

- Speculate on 56 major and minor currency pairs including EUR/USD, USD/JPY and GBP/USD

- Trade on 14 of the world’s largest stock index CFDs including the FTSE 100, S&P 500 and Dax 30

- Take positions on several leading cryptos paired with the USD, including Bitcoin, Ethereum & Litecoin

Spreads, Commissions & Fees

Fees vary depending on account type and instrument. Baxia Markets offers industry-leading spreads with its ECN connectivity. Pricing quotes consist of 20+ superior banks and liquidity sources.

The Bx Standard account offers zero commissions. Instead, variable spreads apply. When we used Baxia Markets, we were offered average spreads of 1.4 pips on the EUR/GBP currency pair and 1.2 pips on the USD/JPY pair.

The Bx Zero profile offers raw spreads and applies a commission-based fee structure. This is charged at an average of $7 per round-turn lot. Day traders can expect spreads as low as 0.0 pips during periods of high liquidity.

Spreads can be viewed directly within the platform, as seen below.

Swap fees apply for positions held overnight.

There are no inactivity charges for dormant accounts.

Leverage Review

Baxia Markets offers substantial margin trading opportunities, with leverage up to 1:500. This means if you deposit $100 in your live account, you can access $50,000 in buying power.

Of course, this sounds great from a potential profit perspective, but leveraged trading can significantly increase losses. With this in mind, make sure you take a sensible approach to risk and money management.

The margin call / stop out level is 90% / 20%.

Mobile App

Both the MT4 and MT5 platforms can be used on mobile devices. These are available for free download to iOS, Android, and Huwaei phones and tablets.

You can access the full suite of features and functions found on the web trader and desktop terminals. This includes real-time interactive charts with zoom and scroll, an extended version for iPads, plus access to complete trading history. You can also set live push notifications and SMS alerts for the latest price movements.

Note, Baxia Markets does not currently offer a proprietary mobile app.

Payment Methods

Deposits

Baxia Markets enables clients to open trading accounts and deposit funds in USD, EUR, GBP and AUD. The minimum deposit requirement is $50 or equivalent currency. The broker does not charge fees for any deposit methods, though third-party charges may apply.

- Sticpay – 30 to 60 minute processing time

- Astropay – 30 to 60 minute processing time

- Bank Wire Transfer – 2 to 5 working days processing time

- Credit/Debit Cards (Visa & MasterCard) – 30 to 60 minute processing time

Withdrawals

Withdrawal requests are processed within one to two business days, though the time taken for the funds to clear varies by payment method. Weekend dates and public holidays may cause delays.

Our experts found withdrawal fees do apply at Baxia Markets, which is a drawback versus some competitors. Processing times vary by method:

- Sticpay – $1 fee, 24 to 72 hour processing time

- Astropay – $1 fee, 24 to 72 hour processing time

- Credit/Debit Cards (Visa & MasterCard) – No fee, up to five working days processing time

- Bank Wire Transfer – $20 plus an intermediary bank fee of $20. Three to five working days processing time

Baxia Markets Demo Account

A free demo profile is available to prospective Baxia Markets clients. Only the MetaTrader 5 (MT5) platform is available with the paper trading account. Nonetheless, we were able to access unlimited virtual funds with flexible leverage up to 1:500.

Demo accounts are a great way to practice trading risk-free, with all the features and functionality of a live profile. They are also an effective way to test-drive a potential broker before depositing funds.

When signing up, you will need to complete the standard online registration form, with the option to open a paper trading profile once registered.

Deals & Promotions

Baxia Markets offers a $30 joining bonus for new users. The free trading capital is available without making a deposit.

While using Baxia Markets, we were also offered a refer-a-friend bonus. The referral scheme offers a $50 bonus for every successful recommendation to the broker, though terms and conditions apply.

A demo contest is also occasionally offered, with rewards based on trading performance within the simulated environment.

Regulation & Licensing

The Baxia Markets group operates through two entities; Baxia Limited, regulated by the Securities Commission of the Bahamas (SCB) and Baxia Global Ltd, licensed by the Financial Services Authority of Seychelles (FSA).

These are both offshore regulators which do not offer the same degree of client protection and support as brokers licensed with the UK’s Financial Conduct Authority (FCA) or the Cyprus Securities & Exchange Commission (CySEC), for example.

Baxia Markets also provides limited information about segregated client accounts, consumer protection schemes, or negative balance protection.

Additional Features

Education & Tools

While using Baxia Markets, we were pleased with the trading research available to day traders. Worldwide news articles, PDF newsletter posts and market watchlists are available to account holders. Clients can filter articles by asset, market and technology. This includes energies, ETFs, equity funds, stock and futures.

Baxia Markets also hosts an education center on its official site. This includes an introduction to financial markets, trading basics, and information on how to manage risk. This is a good resource for beginner trades.

An economic calendar and useful forex calculators are also available. There is a YouTube channel too, but this has limited content.

Copy Trading

Baxia Markets has partnered with third-party copy trading providers; ZuluTrade and Myfxbook.

Over 100,000 traders can be copied on ZuluTrade and clients can diversify portfolios by following multiple traders. Clients can also protect their accounts by stepping in to make changes whenever needed. Baxia Markets traders simply need to connect their account to ZuluTrade after they have signed up.

Myfxbook is home to an active social trading community. Traders can interact with other investors, swapping trade ideas, market insights, and more. Myfxbook is also home to interactive charts and graphs with extensive historical data.

Account Types

Baxia Markets offers two accounts; Bx Standard and Bx Zero. Both profiles offer low latency, non-dealing desk execution, a minimum lot size of 0.01 and permit the use of EAs. Profiles can be opened in USD, GBP, AUD or EUR account denominations.

Bx Standard

The most popular profile with all-inclusive spread pricing from 1 pip. An ideal account for beginners.

- EA back-testing

- No commission fees

- MT4 & MT5 platforms

- Floating spreads (1.0 – 1.2 pips average on EUR/USD)

Bx Zero

Offers raw pricing, ideal for experienced investors and scalpers. Spreads start from 0.0 pips with pricing direct from top-tier liquidity providers.

- MT4 & MT5 platforms

- $7 round-turn commission fee

- Suitable for professionals, scalpers and EA users

- Tight raw spreads (0.0 – 0.2 pips average on EUR/USD)

MAM/PAMM accounts are also available at the sign-up stage.

How To Register

It was easy to open a new account with Baxia Markets.

To get started, visit the ‘Create Account’ link at the top right of each web page. Next, complete the online application form. Verification documents such as a passport or utility bill need to be submitted to the broker’s email address (backoffice@baxiamarkets.com).

It can take up to 24 hours for documents to be verified.

Trading Hours

Baxia Market’s live trading hours vary by instrument. Typically, forex trading is available from 00:01 server time to 23:59, Monday to Friday. Note, the broker’s platforms operate on a GMT +2 or GMT +3 (US daylight saving) offset.

There is a published session timetable available on the broker’s website, with trading hours split by asset class. This can also be used to stay up to date with upcoming market closures such as public holidays.

Customer Support

3 / 5Baxia Markets offers several contact options, though these are only available 24/5 (no Saturday or Sunday support). When we tested the live chat service, we received an initial response within three minutes.

A complete self-help FAQ section can also be found on the broker’s website via the ‘resources’ section. The page is cataloged into four categories; account information, questions about trading, forex trading online and understanding MetaTrader problems.

Contact details:

- Email – support@baxiamarkets.com

- Live Chat – accessible bottom right of each webpage

- Telephone – UK +441392 580012, Australia +61 73040 6007, Hong Kong +852 81700166, Mexico +52 29690 3332

Safety & Security

Baxia Markets’ legal documents are not particularly clear but there is no evidence of consumer protection, personal data safeguarding and segregated client funds. This is a potential red flag and may steer prospective traders towards competitor brokers.

Baxia Markets Verdict

With a responsive customer service team, MT4 and MT5 platforms, plus two account types, Baxia Markets seems like a good choice. However, our experts did have concerns about the safety of client funds and withdrawal fees with some methods. The lack of stock trading may also deter some investors from signing up today.

FAQs

What Assets Can I Trade With Baxia Markets?

Baxia Markets offers trading opportunities on forex, commodities, cryptos, and global indices. This includes major, minor and exotic currency pairs, gold, silver and oil, plus access to US, UK, European, Asian and Australian stock exchanges.

Does Baxia Markets Offer A Demo Account Service?

Yes, day traders can utilize a free demo profile. Access unlimited virtual funds and leverage opportunity up to 1:500. Sign up using the ‘create account’ logo on the top-right of each webpage.

What Trading Platform Does Baxia Markets Offer?

Retail traders can use the MT4 and MT5 terminals when investing with Baxia Markets. The online broker also offers copy trading via ZuluTrade and Myfxbook.

Does Baxia Markets Offer Global Trading Services?

Baxia Markets provides trading services on a global scale. This includes the UK, Vietnam, Taiwan, Qatar, Singapore, Kenya, Zimbabwe, Jakarta, Japan, Hong Kong, and Dubai. Note, residents in North America including New York, Boston, Chicago, and Los Angeles are not permitted to trade because of regulatory restrictions. Keep an eye on the latest publications for accepted investors.

Is It Safe To Trade With Baxia Markets?

Our review of Baxia Markets did highlight concerns around the limited regulatory oversight across the registered business entities. Be cautious investing funds with this broker as your capital may be at risk.

Top 3 Alternatives to Baxia Markets

Compare Baxia Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Baxia Markets Comparison Table

| Baxia Markets | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 4 | 3.6 |

| Markets | CFDs on Forex, Commodities, Cryptos & Indices | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $1 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SCB, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | $30 Welcome Bonus | – | 100% Deposit Bonus | 10% Equity Bonus |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:1000 | 1:200 |

| Payment Methods | 7 | 6 | 10 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Baxia Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Baxia Markets | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Baxia Markets vs Other Brokers

Compare Baxia Markets with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Baxia Markets yet, will you be the first to help fellow traders decide if they should trade with Baxia Markets or not?