Day Trading in Australia

Australia is home to a thriving day trading community, which reflects the country’s well-established capital markets and large economy, which is the 13th biggest according to the World Bank.

This guide is your stepping stone to start day trading in Australia. You’ll discover popular financial securities, learn about the regulatory environment, understand trading taxes, and explore a trade on an Australian stock.

Quick Introduction

- Stock trading occurs on the Australian Securities Exchange (ASX), home to around 2,000 firms. Forex trading in Australia is also huge, with high-volume pairs including AUD/USD.

- Short-term trading is supervised by the Australian Securities and Investments Commission (ASIC), which is a ‘green tier’ regulator under DayTrading.com’s Regulation & Trust Rating.

- Resident day traders pay tax at a rate of between 0% and 45% on their profits, plus a 2% Medicare levy to fund Australia’s healthcare system, payable to the Australian Tax Office.

Top 4 Brokers in Australia

After our hands-on tests, these 4 ASIC-regulated platforms came out on top for day traders in Australia:

-

1

PepperstoneRegulated by: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB81.8% of retail investor accounts lose money when trading CFDs

PepperstoneRegulated by: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB81.8% of retail investor accounts lose money when trading CFDs -

2

Fusion MarketsRegulated by: ASIC, VFSC, FSA

Fusion MarketsRegulated by: ASIC, VFSC, FSA -

3

AvaTradeRegulated by: ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM

AvaTradeRegulated by: ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM -

4

XMRegulated by: ASIC, CySEC, DFSA, IFSC

XMRegulated by: ASIC, CySEC, DFSA, IFSC

Day Trading Platforms in Australia

What Is Day Trading?

Day trading involves executing financial market trades throughout the day, with positions held from anything from just seconds to several hours. The aim is to make a small profit on each trade which add up over the course of the day.

To enhance potential profits from these minor price movements, traders often use funds borrowed from their broker to control larger positions. This is known as trading with leverage, and while it can amplify an individual’s earnings, it can also result in whopping losses if the market moves in the ‘wrong’ direction.

Day trading usually happens when market liquidity is high, and positions can be opened and closed simply and cheaply. Price volatility is also more common at these times, leading to better trading opportunities.

What Securities Can I Trade?

Day traders in Australia can buy and sell a wide array of financial assets, from domestic to global, including:

- Stock dealing typically takes place on the Australian Securities Exchange (ASX). Stock traders usually operate between 10:00 and 16:00 Australian Eastern Standard Time (AEST) or Australian Eastern Daylight Time (AEDT) on weekdays.

- Indices with the S&P/ASX 200 flagship stock index consisting of 200 of Australia’s largest listings by market capitalization. It includes financial services giant Commonwealth Bank of Australia, mining business BHP Group and biotechnology specialist CSL.

- Forex traders in Australia may focus on currency pairs containing the Australian Dollar (AUD), such as AUD/USD, AUD/JPY and AUD/NZD, which exhibit significant volume and volatility.

- Commodities like iron ore, given that Australia is the world’s largest exporter, and gold, with Australia the world’s second-largest exporter.

- Derivatives, such as futures and options. CFD trading in Australia is also permitted, though ASIC has stepped up restrictions in recent years.

- Cryptocurrency trading on digital tokens like Bitcoin, Ethereum and Litecoin, however it remains very high risk due to wild price swings.

Australia’s abundance of natural resources means that mining and energy companies feature heavily on the ASX.There are more than 800 such businesses listed, representing just under 40% of all stocks on the exchange, presenting diverse short-term trading opportunities.

Is Day Trading Legal In Australia?

Yes. Capital markets and day trading activities are regulated by the Australian Securities and Investments Commission (ASIC).

Among the most active and respected regulators globally, the ASIC works to maintain and improve trader confidence by ensuring that the country’s markets are fair, transparent and efficient.

It does this by (in its own words):

- “Conducting surveillance of Australia’s markets.”

- “Making market integrity rules.”

- “Authorizing and assessing the operation of market infrastructure providers,” and

- “Taking action where misconduct threatens market integrity and investor confidence.”

CFD trading in Australia, a popular financial product with active traders, is subject to increasing restrictions. In 2021, ASIC introduced a number of new requirements for these products, one of which was the negative balance protection. This limits your losses to the funds you have in your dealing account.

Another major change involved limiting the leverage allowed on CFD trades to:

- 1:30 on major forex pairs.

- 1:20 on minor forex pairs, major stock market indices, and gold.

- 1:10 on commodities other than gold, and minor stock market indices.

- 1:2 on crypto assets.

- 1:5 on shares or other assets (like government bonds).

How Is Day Trading Taxed In Australia?

Active traders must declare their profits to the Australian Tax Office (ATO), the body responsible for administering the country’s tax system and collecting taxes.

The ATO differentiates between ‘traders’ and ‘investors’ to determine the applicable taxes, with day traders typically being the former. When deciding which bracket you fall under, you should consider four things:

- The nature and purpose of your activities.

- The volume and frequency of your trades.

- Whether your trading activities are organized in a business-like way.

- The amount of capital that’s been invested.

Resident day traders will pay tax in Australian dollars ($) at the following rates:

| Taxable Income | Tax Rate |

|---|---|

| $0 to $18,200 | 0% |

| $18,200.01 to $45,000 | 16% |

| $45,000.01 to $135,000 | $4,288 plus 30% on income over $45,000 |

| $135,000.01 to $190,000 | $31,288 plus 37% on income over $135,000 |

| $190,000.01 plus | $51,638 plus 45% on income over $190,000 |

On top of this, residents will typically pay a Medicare levy, which is charged at a rate of 2% on taxable income. Those who earn a higher income without having private health insurance may also be liable for an additional Medicare levy surcharge.

I recommend checking out DayTrading.com’s guide to Trading Taxes in Australia, which provides more details.What’s more, it gives important information on how to prepare your tax return for the ATO.

Getting Started

To begin your journey to day trading in Australia, you need to complete three steps:

- Select a top day trading brokerage in Australia. Check that the provider you’re considering is on ASIC’s list of approved companies. Then look at how user-friendly the firm’s charting platform is, evaluate trading costs, investigate execution speeds, and explore the range of tradeable instruments, such as Aussie stocks. Demo accounts and trading education are also key for beginners.

- Open an account. You’ll need to open a trading account by supplying some personal details and more generic information on your investing experience and style, with day trading falling under the higher-risk types of online investing. You’ll also be required to provide proof of identity and address. Check whether the brokerage offers a platform that uses the Aussie dollar. These types of accounts can make trading simpler and cheaper for Australian residents.

- Deposit some cash. The most common ways to do this are through a debit card or a wire transfer. Some brokers may also allow you to use an online payment provider to transfer money over. BPAY is an Australian solution that’s popular with some active traders.

A Day Trade In Action

You’ll be ready to start trading Down Under with these tasks ticked off. But what might a short-term trade look like on Australia’s financial markets? Here’s a hypothetical example.

The Background

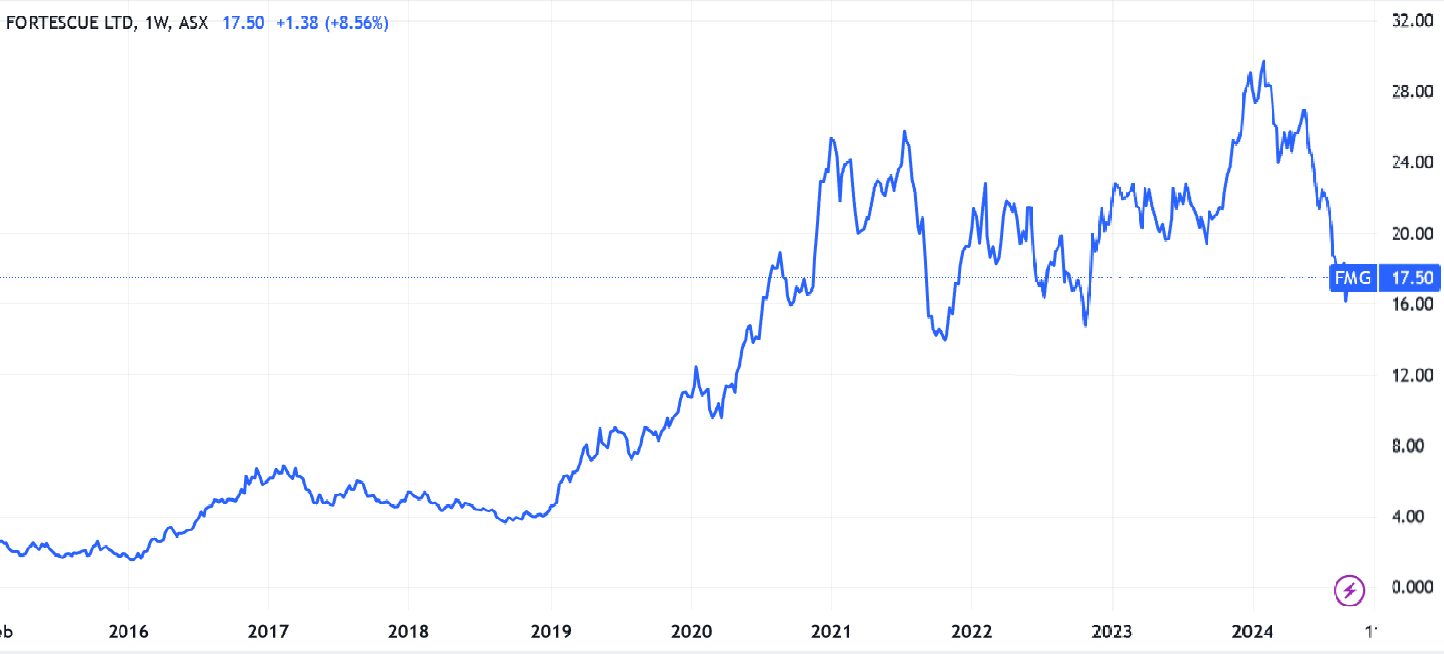

My plan is to trade shares in one of the country’s many mining stocks. More specifically, I intend to buy shares in Fortescue Metals Group after Chinese home price data, and sell them for a profit shortly afterwards.

As a major iron ore producer, Fortescue – which digs for the steelmaking ingredient in Australia’s Pilbara region – is highly sensitive to conditions in China’s real estate sector. Property construction accounts for around a third of the Asian powerhouse’s total steel demand.

After looking at economic news, I conclude that home prices are likely to have risen 0.07% last month at the time of writing. By contrast, the broader market is expected sales to have declined by 0.02%. If I’m correct, prices of iron ore, along with the share prices of industrial metal producers like Fortescue, might appreciate sharply.

Before punching in my trade, I carry out technical analysis on Fortescue’s share price. Day trading is highly influenced by what’s on the charts, so identifying patterns, trends and indicators based on past price and volume data can be critical for success.

The Trade

With my plan drawn up, I open my trading platform at 11:20 Sydney time. This is around two hours before the National Bureau of Statistics of China (NBS) is due to release those upcoming home sales numbers at 09:30 China Standard Time (CST).

At this time, Fortescue shares are trading at $17.50 per share. So I place a ‘take profit’ instruction at $17.67 and a ‘stop loss’ order at $17.41. These tools allow me to manage risk by automatically closing my position if the asset price either rises or closes to these pre-set levels.

A few minutes after this, the NBS releases its much-awaited home price data. As I expected, they show that conditions in the residential real estate sector are healthier than the market had expected. Home prices rose 0.08%, which was also just above what I had forecast.

As a consequence, Fortescue’s share price rises, and within half an hour triggers my ‘take profit’ instruction at 17.67. My position is closed, giving me a profit of 17 cents for each share I bought, excluding trading costs.

Bottom Line

Day traders in Australia can deal across many financial asset classes, and can do so confidently thanks to robust protection from ASIC.

However, as in other regions, Aussie traders should remain aware of the presence of scammers. You should always check that the brokerage you’ve selected is licensed to do business by the ASIC.

Also be aware of the high risks – you could lose any Aussie dollars you invest.

To get started, check out DayTrading.com’s selection of the top day trading platforms in Australia.

Recommended Reading

Article Sources

- GDP (Current US$) – World Bank

- Australian Securities Exchange (ASX)

- Stock market sectors of Australia - TradingView

- Australian Securities and Investments Commission (ASIC)

- Read This Before Trading CFDs - ASIC

- Australian Tax Office (ATO)

- Share Investing Versus Share Trading - ATO

- Tax Rates – Australian resident - ATO

- Medicare and Tax – Services Australia

- China Steel Output Set to Rise Despite Property Woes - Reuters

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com