Asia Pacific Opportunities: BlackBull Introduces HK50 & CHINAA50

BlackBull Markets has bolstered its suite of 20+ indices with the Hang Seng Index (HK50) and China A50 Index (CHINAA50), providing opportunities to capitalize on an increasingly economically dominant region.

Key Takeaways

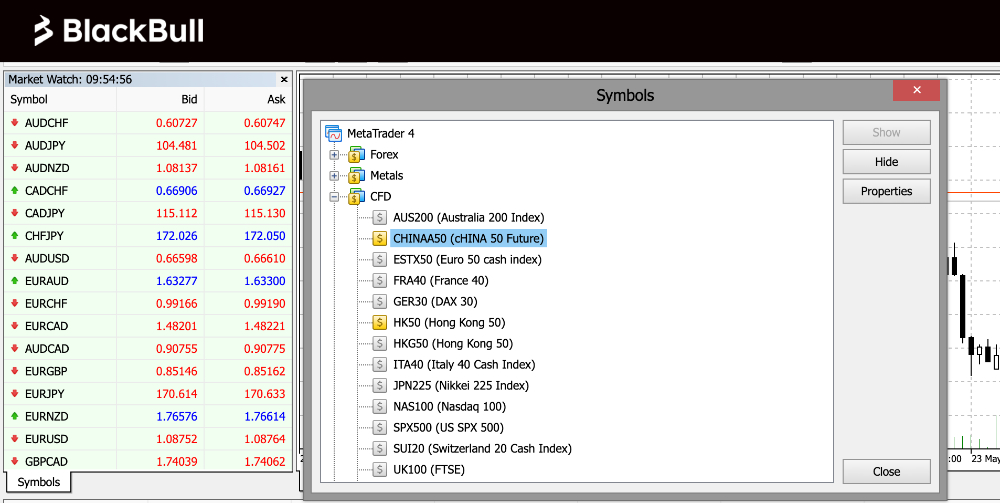

- The HK50 and CHINAA50 are available on the MetaTrader 4 and MetaTrader 5 platforms.

- Floating spreads are charged on both indices with minimum volumes of 0.01 and maximums of 10.

- The latest indices enable traders to diversify portfolios and speculate on movements in East Asia.

What Is The Hang Seng?

The Hang Seng Index is comprised of the 50 largest companies listed on the stock exchanges of Hong Kong. It’s used to gauge the financial performance of Hong Kong.

Constituents are part of several key sectors: financial services, property, utilities, plus commerce and industry.

It’s home to major companies, notably Tencent, HSBC and China Construction Bank Corporation.

What Is The CHINAA50?

The China A50 Index was designed to allow investors to participate in China’s domestic stock markets.

The ‘A’ means it factors in A-type shares from the 50 biggest companies listed on the Shenzhen and Shanghai stock exchanges. A-shares were formerly only available to Chinese investors.

The A50 Index is dominated by several sectors; financial services, industrials and consumer goods.

It’s home to major corporations, notably Kweichow Moutai, PetroChina and China Mobile.

About BlackBull Markets

BlackBull Markets is a New Zealand-based and regulated brokerage with a decade in the online trading industry.

It stands out with its extensive selection of over 26,000 instruments covering forex, stocks, indices, commodities, cryptos and futures.

BlackBull also supports a comprehensive suite of tools, having invested in its own BlackBull Invest and BlackBull Copy Trader, alongside four leading third-party solutions; MT4, MT5, cTrader and TradingView.

With no minimum deposit, around-the-clock support and a growing range of instruments, BlackBull is popular with online traders.