Forex Trading in Argentina

Foreign exchange (FX) trading, the global marketplace for buying and selling currencies like the Peso, has gained significant popularity in Argentina.

As the Argentine Peso (ARS) frequently experiences value shifts, traders discover opportunities to navigate these changes. Yet understanding the market’s dynamics in Argentina is not just important; it’s crucial for anyone looking to engage in this potentially lucrative but risky endeavour.

Our guide to forex trading in Argentina will equip you with the essentials.

Quick Introduction

- Argentina’s economy features high inflation, currency devaluations, social unrest, political uncertainty, and restrictive exchange rate controls, making forex trading appealing for hedging against inflation or profiting from market changes.

- The Comisión Nacional de Valores (CNV) is the primary body responsible for regulating forex trading in the country. However, the Banco Central de la República Argentina (BCRA) also plays a role by overseeing foreign exchange policies and controlling currency reserves.

- Forex trading in Argentina is normally subject to income tax, with rates ranging from 5% to 35%, and payments due to the Administración Federal de Ingresos Públicos (AFIP).

Top 4 Forex Brokers in Argentina

Following our latest set of tests, these 4 platforms are best-in-class for Argentinian forex traders:

How Does Forex Trading Work?

Forex trading involves buying and selling currency pairs, like those containing the Argentine Peso, in an effort to profit from market fluctuations.

To get started, Argentinas generally need to follow these steps:

- Choose a forex broker. You can choose between local brokers regulated by the CNV or international firms which may offer a wider range of currency pairs. You normally need to verify your identity and address, which you can do by providing a copy of your DNI (Documento Nacional de Identidad).

- Fund your account. You will need to load your account via your firm’s supported payment methods, for example, debit cards, wire transfers or electronic wallets such as the popular regional solution, Mercado Pago. Note if you deposit Argentine pesos, funds may need to be converted to the desired trading currency as ARS is not a widely supported account currency. Also, due to strict currency controls in Argentina, funding in foreign currencies might be subject to government regulations.

- Trade currencies. You can place trades through your broker’s desktop software, web platform, or increasingly forex apps. Orders can be placed for various currency pairs such as USD/ARS, EUR/ARS and BRL/ARS (if supported), with instant execution for market orders and conditional execution for limit and stop orders.

Is Forex Trading Legal In Argentina?

Yes, forex trading is legal in Argentina. The Comisión Nacional de Valores (CNV) regulates the activity, ensuring that participants’ trading practices are fair, transparent, and secure.

For example, forex brokers in Argentina should be licensed and comply with CNV regulations, undergoing regular audits and compliance checks.

The Argentine government also imposes specific exchange controls to manage the flow of foreign currencies and stabilize the economy. These controls can affect the availability of foreign currencies and the conditions under which FX trading is conducted.

Is Forex Trading Taxed In Argentina?

Profits from forex trading are generally considered part of an individual’s taxable income and should be declared in the annual income tax return.

The progressive income tax rates for individuals in Argentina range from 5% to 35%, depending on the total taxable income.

Traders must keep accurate records of all currency trading activities, including profits, losses, and expenses. These records should be reported in the annual tax return filed with the Administración Federal de Ingresos Públicos (AFIP), the Argentine tax authority.

I recommend maintaining detailed records of all transactions, including dates, amounts, currency pairs traded, profits, losses, and associated costs. Use trading software or tools that help generate accurate reports for tax purposes.Also consider consulting a tax professional with experience in forex trading in Argentina to ensure compliance with all tax obligations and to optimise tax efficiency. And stay updated on any changes in tax laws that may affect your trading activities.

When Is The Best Time To Trade Forex In Argentina?

The optimal times to trade forex in Argentina depend on a combination of global market hours, the overlap of major trading sessions, and specific economic events. Here’s a detailed guide:

- Sydney Session: Time: 3:00 PM – 12:00 AM (ART). Activity: Typically quieter, with lower volatility and volume. Best for: Traders focusing on AUD pairs.

- Tokyo Session: Time: 8:00 PM – 5:00 AM (ART). Activity: More activity than Sydney, with movements in JPY pairs. Best for: Traders interested in Asian currencies and news.

- London Session: Time: 4:00 AM – 1:00 PM (ART). Activity: High liquidity and volatility, covering EUR, GBP, and CHF pairs. Best for: Major pairs and European news impact.

- New York Session: Time: 9:00 AM – 6:00 PM (ART). Activity: High liquidity and overlap with the London session, affecting USD pairs. Best for: Major pairs, economic news, and market-moving events.

The best time to trade forex in Argentina is during the most active and volatile global trading sessions, particularly when London and New York overlap. Focusing on these peak periods can allow Argentine traders to leverage higher liquidity and potential trading opportunities.

Example Trade

To help you understand how forex trading in Argentina works in practice, let’s consider an example trade…

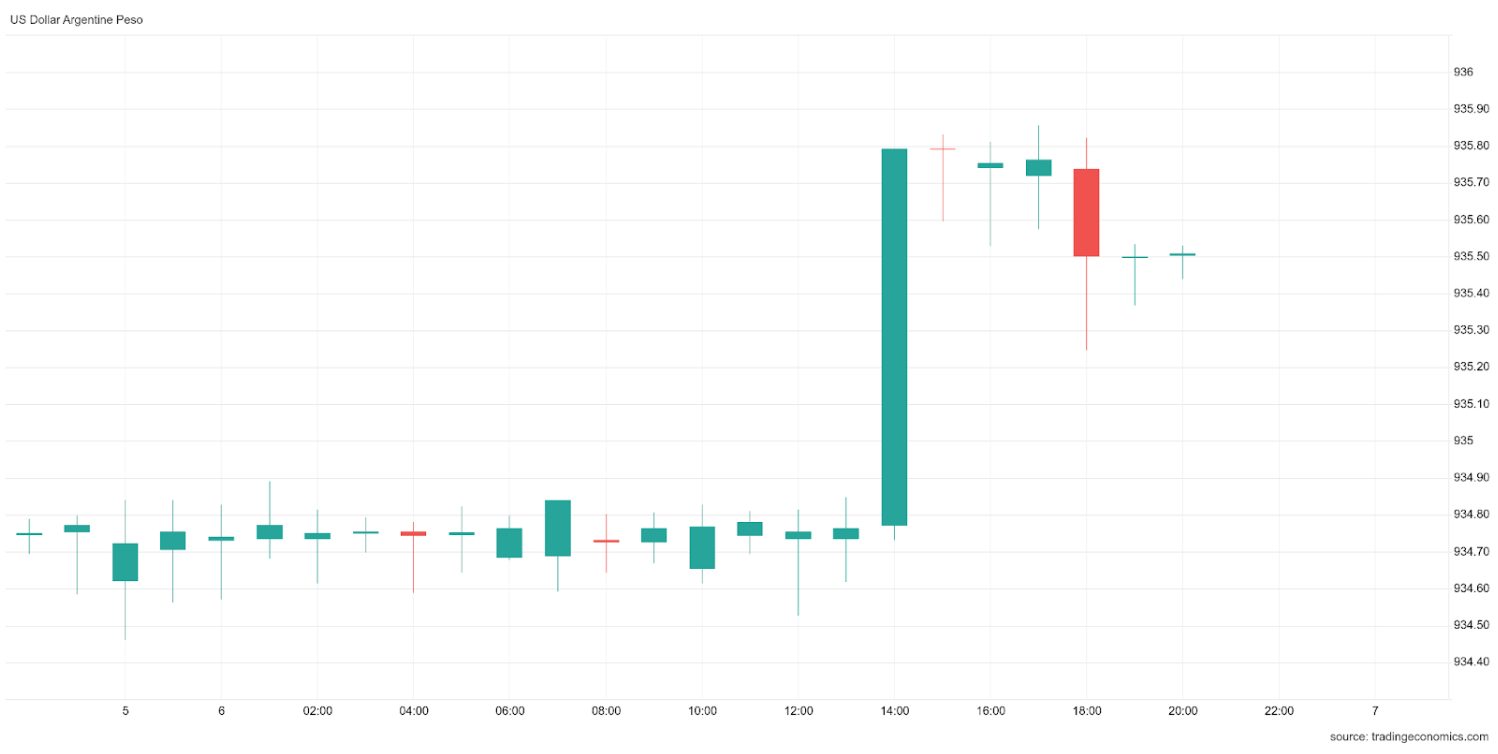

As can be clearly seen in the accompanying USD/ARS chart, the Argentinian Peso (ARS) can be subject to considerable volatile swings versus its major currency peers, such as the US Dollar (USD) and Euro (EUR).

Political and economic instability, combined with the country often conversing with the International Monetary Fund (IMF) for what seems like perpetual financial support, can suddenly cause the currency to lose value compared to its main peers.

In this instance, I could see the spike upward in USD/ARS, and I decided to employ what many of us forex day traders refer to as a “fade”. This contrarian day trading strategy involves trading against the prevailing FX pair’s trend.

Fading the market is considered a high-risk strategy. It’s usually deployed by accomplished traders aware of the inherent risk involved in an approach that goes against the trend and conventional wisdom.

I never get greedy when I identify a potential fade. I’m looking for a 10-15 pip gain, and then I close, whether short or long. I also employ strict 1:1 money management discipline; if I’m shooting for 15 pips, I use stop-loss orders and take profit-limit orders every time.

So, once the 14:00 h candle closed, I could see the next candle formed a classic doji, which suggested that the bullish momentum was now exhausted.

Therefore, having had sufficient time to prepare and place my order (including the spot and limit order element), I entered and exited later in the session, banking the 15 pips.

Bottom Line

Trading forex in Argentina can be profitable but requires careful consideration of the local economic landscape and regulatory environment, especially given the highly volatile nature of the Argentinian Peso.

By educating yourself, implementing robust risk management, and staying informed about market developments, you can navigate the complexities of FX trading and potentially achieve favorable outcomes.

Recommended Reading

Article Sources

- Restrictive Exchange Controls Characterize Argentina's Economy - EY

- Comisión Nacional de Valores (CNV)

- Administración Federal de Ingresos Públicos (AFIP)

- Argentina and the IMF - International Monetary Fund (IMF)

- USD/ARS Chart - Trading Economics

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com