Day Trading in Argentina

Argentina boasts a diverse economy with agriculture, manufacturing, and services as critical pillars. However, it faces significant challenges, including high interest rates and a volatile exchange rate.

The Central Bank of Argentina (BCRA) tightly controls the banking system, imposing strict regulations on foreign currency transactions and capital flows.

Stocks listed on the Bolsa y Mercados Argentinos (BYMA) offer short-term trading opportunities in a volatile market influenced by domestic policies and global trends.

This guide is your key to unlocking success in Argentina’s dynamic day trading environment.

Quick Introduction

- Argentinian day traders can explore local markets, including currency pairs featuring the Argentine peso (ARS) and stocks listed on the BYMA, such as YPF Sociedad Anónima.

- The Comisión Nacional de Valores (CNV) and Central Bank of Argentina (BCRA) regulate Argentina’s financial markets, though their oversight is considered less stringent than ‘green-tier‘ authorities such as ASIC (Australia) or FCA (UK).

- While many brokers serving Argentine traders are regulated internationally, local tax obligations remain, with traders typically paying income tax of 5% to 35% while capital gains are taxed at a flat rate of 15%.

Top 4 Brokers In Argentina

According to our findings, these 4 platforms are superior for active Argentinian traders:

All Day Trading Platforms in Argentina

What Is Day Trading?

Day trading involves buying and selling financial instruments like stocks, forex, bonds, or derivatives within the same day, capitalizing on short-term price movements.

Short-term trading in Argentina presents a wealth of opportunities for profit, including BYMA-listed stocks, currency pairs featuring the Argentine Peso (e.g., USD/ARS), and prominent commodities such as soybeans or corn.

Is Day Trading Legal In Argentina?

Yes, day trading is legal in Argentina. However, it’s subject to specific regulations, as in many countries.

The Comisión Nacional de Valores (CNV) primarily oversees financial activities like online trading to ensure practices are fair and investors are protected.

It’s also worth noting that Argentina has strict foreign exchange controls, implemented by the Central Bank of Argentina (BCRA), which can impact the ability to trade international stocks and currencies. These controls are part of the government’s efforts to stabilize the national currency and control inflation.

How Is Day Trading Taxed In Argentina?

In Argentina, day trading profits are subject to taxation under the country’s tax laws, which range from 5% to 35% depending on your income.

The Federal Administration of Public Revenue implements the tax policy, which is subordinate to the Ministry of Economy of Argentina. See more detailed information on tax brackets in Argentina.

The tax year in Argentina follows the standard calendar year, with returns due at varying times depending on the type of taxpayer. Individual income returns, for instance, are typically due mid-June though dates may vary from year-to-year.

Due to the complexity of Argentine tax laws, I recommend consulting with a local tax advisor for tailored guidance.For example, alongside income tax considerations, you may need to pay capital gains tax on the sale of stocks, bonds or other instruments at a flat rate of 15%.

How To Start Day Trading In Argentina

To thrive in Argentina’s dynamic day trading landscape, follow these basic steps:

- While trading is possible through Argentinean brokers, their oversight is often less stringent. For a secure trading foundation, you may want to opt for a top trading platform regulated by reputable authorities like the UK’s FCA or Australia’s ASIC, in line with DayTrading.com’s Regulation & Trust Rating.

- Account verification usually involves your Argentinean National Identity Document (Documento Nacional de Identidad, or DNI) and a recent utility bill. Once approved, you can conveniently fund your account through wire transfers, debit cards, or potentially local e-wallets like MercadoPago.

- Stock traders can speculate on various Argentinean companies, including Mirgor and Banco Macro. Currency traders can capitalize on fluctuations in Argentina’s official currency with popular forex pairs, including USD/ARS and EUR/ARS. Commodities, indices, cryptocurrencies and other instruments are also supported by some platforms.

A Trade In Action

Let’s consider a scenario with Grupo Financiero Galicia, an Argentinean financial services holding company, to understand how short-term trading operates in Argentina.

Event Background

Grupo Financiero Galicia (GGAL) released its earnings report. The report revealed a significant increase in net income compared to the previous quarter, primarily driven by growth in the lending portfolio and improved asset quality.

This positive earnings surprise was expected to have a bullish impact on the stock price.

Trade Entry & Exit

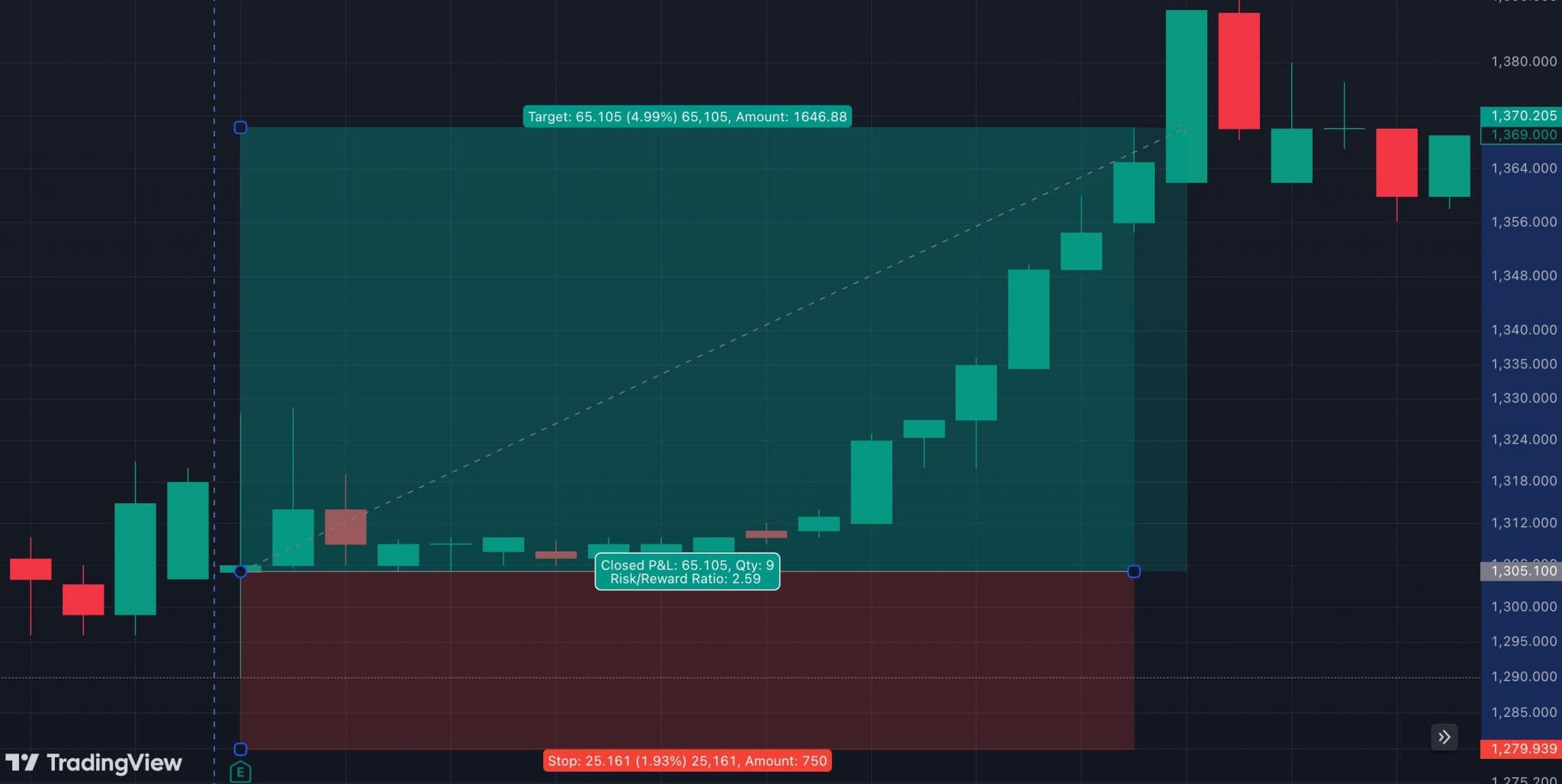

Based on this analysis, I concluded that a price breakout to the upside following the earnings release was highly probable.

In the morning, GGAL opened at ARS 1305, which was about 1% below the previous day’s closing price. I placed a buy order at market open with a stop-loss at ARS 1,279 to protect against a sudden price reversal and limit my loss to -1.93 ROI. The order was filled seconds after the market opened.

Throughout the day, GGAL’s price continued to rise, surpassing the previous resistance level of ARS 1,355. The stock’s momentum was strong, as indicated by increasing trading volume.

To secure profits, I set my take-profit order at ARS 1,370, hoping for a 4.99% ROI. The take-profit order was triggered around 4 hours later, resulting in a profitable exit from the trade.

Bottom Line

Day trading in Argentina is a regulated activity. You access the Buenos Aires Stock Exchange mainly through licensed brokers, with online platforms expanding access.

While Argentina offers short-term trading opportunities, its economic climate, marked by high inflation and currency fluctuations, presents challenges.

Despite these hurdles, fintech advancements equip you with tools to navigate the dynamic market.

To get started, use our selection of the best brokers for day traders in Argentina.

Recommended Reading

Article Sources

- Bolsa y Mercados Argentinos (BYMA)

- Comisión Nacional de Valores (CNV)

- Central Bank of Argentina (BCRA)

- Ministry of Economy of Argentina

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com