Brokers With APIs

Brokers with APIs are gaining popularity thanks to the rise of automated trading, advancement of technology and increase in the size of the trading markets. The application programming interfaces are not trivial tools but they provide an opportunity for advanced software integration and strategy implementation.

This 2025 guide to brokers with APIs will explore the main facets of API trading, including how they work and what to look for in API trading brokers.

Best Brokers With API Access

Our experts recommend these brokers if you want the top application programming interfaces for trading:

Here is a summary of why we recommend these brokers in April 2025:

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- CEX.IO - CEX.IO is one-stop-shop for crypto investors where you can buy and sell popular digital tokens, speculate on prices with margin trading and earn rewards through staking. Since it launched in 2013, more than five million traders have deposited over $7.5 billion. CEX.IO is registered with the FinCEN in the US and the GFSC in the EU.

- Gemini - Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- Coinbase - Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

Cons

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

CEX.IO

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | GFSC |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP |

Pros

- CEX.IO has remained a trusted crypto exchange since its launch, with 5+ million users

- The proprietary terminal features an advanced charting package from TradingView, including 50+ technical indicators

- The broker offers 24/7 support with fast response times during tests

Cons

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

- Deposit and withdrawal fees are relatively high, including 0.3% + $25 for SWIFT withdrawals

- It's a shame that there's no demo account for traders looking to practice strategies

Gemini

"Gemini’s ActiveTrader platform and TradingView integration make it a good choice for serious crypto traders seeking a reliable charting environment, though we were disappointed by some unnecessary fees and previous security breaches."

Michael MacKenzie, Reviewer

Gemini Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | NYDFS, MAS, FCA |

| Platforms | ActiveTrader, AlgoTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, HKD, SGD |

Pros

- The TradingView integration delivers top-quality tools, including backtesting and algo trading capabilities

- The exchange ensures high security standards with 2FA a requirement for all crypto investors

- Crypto perpetual futures are available in many jurisdictions with up to 1:100 leverage

Cons

- Some larger coins by market cap are not available to buy through Gemini

- There are high fees for some funding methods including a 3.49% fee for card transactions

- There is no practice profile or demo account for prospective traders

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Demo account

- Customizable proprietary trading platform and mobile app

- Comprehensive research and data

Cons

- No forex, commodities or futures trading

- No MT4 or MT5 platform integration

- Shortcomings regarding platform loading times and technical glitches

Coinbase

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Crypto |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT |

| Minimum Deposit | $0 |

| Minimum Trade | $2 |

| Account Currencies | USD, EUR |

Pros

- As a Nasdaq-listed company, Coinbase follows strict financial regulations, with licensing across the US, UK, and Europe. Security includes FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

- There are platforms for all levels: beginners can use the simple Coinbase app, while Advanced Trade provides lower fees and pro-level tools.

- Coinbase Advanced bolstered its leveraged trading offering with two new futures products ion 2025: Natural Gas (NGS) - 1,000 MMBtu per contract with up to 11x leverage, and Cardano (ADA) futures - 1,000 ADA per contract with up to 5x leverage.

Cons

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

How APIs work

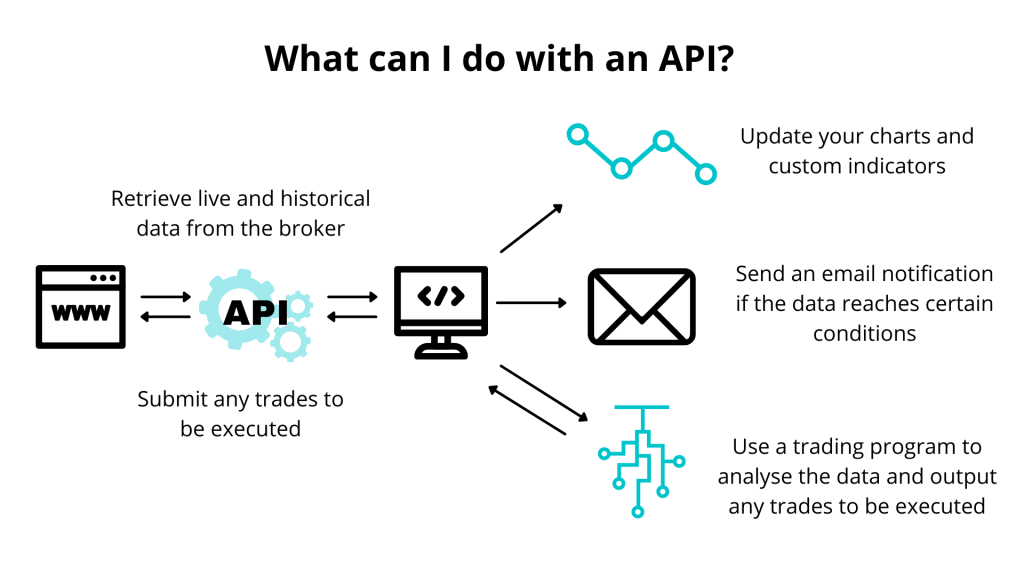

An application programming interface (API) is a set of programming code that requests data and sends instructions between software platforms. APIs are becoming more and more widespread in a range of industries and the number of brokers with APIs is steadily growing.

APIs act as a communication bridge for information between a broker’s servers and custom software applications employed by the user. APIs have several useful applications including sending orders from third-party software or receiving live or historical data. For example, an API can be used to connect a set of automated trading algorithms with your preferred broker’s trading platform.

APIs are essential to any automated trading strategy. In the past, traders would have had to filter through trading opportunities on one platform and place trades on another. Now that brokers with APIs are becoming more common, this process has been simplified. Algorithmic trading via APIs allows users to exploit useful trading opportunities by placing instant, accurate trades, removing the need for manual supervision. Using programming languages such as Python, traders can develop their own applications or complex strategies and automatically execute trades using their broker’s API.

There are two main uses for APIs in trading:

Third-Party Applications – Traders using third-party applications, such as MetaTrader 4, may need access to the broker’s API for pricing data and the ability to place trades.

Developer Applications – Using programming languages like Python, Java or C++, many traders are now beginning to develop their own automated trading applications. APIs allow them to access a broker’s pricing data and place trades.

If you want to find more broker-specific information about a particular API, you should be able to find the API documentation on the firm’s main site. This will give you information on how to authenticate the API, what data is available, how to place orders through the API and other technical details.

Some brokers with APIs will also provide a library of pre-written code to make interaction easier. This will usually be in the broker’s native coding language. This library will usually contain a set of functions for placing a trade, allowing you to avoid writing your own and speeding up the development process.

Pros Of Trading Using Brokers With APIs

Here are some benefits of trading using brokers with APIs:

Automate Trading – APIs are essential for connecting your automation algorithms with your broker’s servers. This goes for fully and semi-automated trading strategies. Algorithmic trading is very useful to implement strategies that would be very difficult and time-consuming to do manually, like high-frequency trading.

Historical Data – Automated trading systems require historical data. With an API, you can seamlessly obtain this information and store, analyse and use it to your liking. Traders often use historical data for backtesting strategies.

Custom Indicators – APIs allow traders to automate their own trading signals and indicators. There are many libraries within various coding languages in which custom indicator solutions can be found.

Create Custom Alerts – If you are looking for customised notifications sent to your email, you can use an API to retrieve stock prices, spreads or even the value of your portfolio and notify you when these fulfil certain conditions.

Create Your Own Trading Terminal – If your broker’s trading terminal is not exactly what you are looking for, you can build your own custom terminal and use your broker’s API to populate it with data and implement trading functionalities.

Cons Of Trading Using Brokers With APIs

Steep Learning Curve – If you are new to coding, APIs can seem quite daunting. It is recommended you practise first with an API for a demo account before placing real trades. There are many tutorials online and brokers with APIs will offer examples on their documentation to help you get started.

Limits & Quotas – Brokers will often limit the frequency with which you can use the API to avoid overloading their bandwidth. For example, they may limit how many trades you can do per minute or hour, how often you can fetch information or which historical data you can access. Ensure that your broker’s limits are enough for your trading needs and implement limits in your code so you do not exceed the allowed quota.

Fees – Most brokers with API support offer them for free but, if you want to go over their established limits, you might need to pay a fee and some brokers might charge a commission on your profit only for using the API.

Security – To access your broker’s API you will need a key, which acts as a password. However, there are different protocols for APIs and they all offer different characteristics, often with a trade-off between speed and security. Research the protocol used by your broker and the security measures they implement for a secure experience.

How To Get Started Using Brokers With APIs

- Carefully Consider Your Strategy: decide which strategy you will be using and write a simple version in your programming language of choice. Make sure you understand the requirements of your strategy – for example, consider how much historical data you will need, which will be your trading frequency, any third-party applications you’d like to use and which assets are you looking to trade.

- Choose One Of The Best Brokers With APIs For Your Needs: you will need to evaluate brokers according to their general features, as well as their API features. Some of the broker characteristics to consider are countries where they accept clients, market access, security, fees and customer service. Furthermore, some of the API features you need to think about are:

- API Demo: Do they offer a demo account and can you access it via the API? This will allow you to test your code and strategies with low risk and ensure that a paid account will be a good fit for your needs.

- Coding Language & Data Formatting: Ensure the API works with a language that you are comfortable with and that the format of the outputted data can be well understood by your program. JSON is a well-known data format that can be read by different coding languages.

- Documentation: A well-explained API is a must, especially for beginners. Choose a broker that offers complete documentation with examples and code snippets to make the learning curve easier.

- Support: The broker’s customer support should also cover their API, so they can help with more technical questions or issues.

- Quotas & Fees: If a broker has a limit on API trading, ensure your trading needs are well within this limit or that you are happy to pay the corresponding fees.

- API Type: Do you prefer REST, WebSocket or SOAP APIs? They each have specific characteristics, though the differences may not be huge if you are just getting started.

- Open An Account & Register For The API: Open an account with your selected broker, ideally a demo account, and register for API access. You will then get a key that you can use to log in.

- Set Up The API & Test Your Strategy: Check that you can access the API with no trouble, try out the code examples provided and connect your strategy to the API. Also, link your API to any third-party software you would like to use. When you are comfortable, test your strategy. It is recommended you do so for a few weeks to fully de-bug any technical issues that come up and tweak your strategy if needed.

- Use The Trading API With A Live Account: Once you are happy with your broker and their API and your strategy has been tested, you are ready to go live. Always ensure you monitor your strategy and the API and do not hesitate to contact the broker’s help desk or trading community if you have any issues.

Final Word

Brokers with APIs and their use are becoming increasingly ubiquitous. They allow users to create custom terminals and implement advanced trading strategies through automation. Having a good grasp of coding languages such a Python, Java and C++ will give you the edge when trading using brokers with APIs. There are numerous free online tutorials about coding and APIs and any good broker will provide comprehensive documentation to help get you started.

FAQs

What Are Brokers With APIs?

Brokers with APIs allow users to trade via an application programming interface, which lets you receive information from the broker’s server, like historical data, and send back information, like trades you would like to place. You can also use APIs to place trades with the broker from third-party software, like MetaTrader 5.

What Advantages Do Brokers With APIs Have?

Using brokers with APIs can allow you to implement advanced trading strategies. For example, APIs can give you the ability to automate trading, populate your custom terminal with live data and create custom alerts and indicators.

What Should I Compare When Looking For Brokers With APIs?

When starting with APIs, make sure you can test your code on a free demo account. Find out which coding language and format are used by the broker and ensure you are comfortable with them. Make sure the broker has comprehensive API documentation, as well as reasonable fees and limitations.

Do Brokers With APIs Charge Fees?

Alongside regular brokerage fees, some brokers may place limitations on the information you can receive using their API. For example, you may only be able to update your live data once every 5 minutes. Brokers may also charge additional fees if you wish to increase the amount of information you can receive.

Should I Start Using My Broker’s API?

Trading using brokers with APIs has many advantages for traders that specialise in algorithmic trading and want to develop more complex strategies. However, make sure you are aware that you will need to have at least basic to intermediate programming knowledge to start trading via an API.

n