Airtel Brokers 2026

Airtel Money is a mobile wallet service, popular in Africa and South Asia, that facilitates straightforward deposits to trading accounts from phones – eliminating the need for wire transfers or credit cards.

Users benefit from near-instant processing times, low transaction fees, plus robust security measures like encryption and PIN verification while using Airtel Money for day trading.

Jump into DayTrading.com’s pick of the best brokers that accept Airtel Money, tested and rated by experts.

Best Airtel Brokers

Following our hands-on evaluations, these are the 3 highest-rated trading platforms accepting Airtel deposits:

Here is a short overview of each broker's pros and cons

- Axi - Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

- BDSwiss - Established in 2012, BDSwiss is an award-winning forex and CFD broker, offering over 900 instruments to clients in over 180 countries. With fresh account options, dynamic leverage and AI-powered tools added, BDSwiss offers a well-rounded day trading package.

- FreshForex - FreshForex, operated by Riston Capital Ltd, was established in 2004 and provides forex and CFD trading access to clients in over 200 countries. The company positions itself as a convenient option for new traders, with low starting deposits and a focus on affordability and frequent bonus promotions.

Compare The Best Airtel Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage | Regulators |

|---|---|---|---|---|---|

| Axi | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Axi Copy Trading, MT4, AutoChartist | 1:500 | FCA, ASIC, FMA, DFSA, SVGFSA |

| BDSwiss | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | BDSwiss WebTrader, MT4, MT5, AutoChartist, TradingCentral | 1:2000 | FSC, FSA, SCA, MISA |

| FreshForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | MT4, MT5 | 1:2000 | SVGFSA |

Axi

"Axi is a stand-out option if you want to day trade forex on the MetaTrader 4 platform thanks to the broker’s growing selection of 70+ currency pairs, the MT4 NextGen upgrade, and tight spreads from just 0.2 pips if you opt for the Pro account."

Christian Harris, Reviewer

Axi Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, ASIC, FMA, DFSA, SVGFSA |

| Platforms | Axi Copy Trading, MT4, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CHF, PLN |

Pros

- Axi's latest copy trading app is really intuitive based on our tests with useful filtering options to match strategies with individual risk preferences.

- Advanced traders can now sign up for the Axi Select funded trader program through the broker’s offshore entity, providing funding up to $1 million with a 90% profit share.

- Axi offers a terrific MT4 experience, enhanced with the NextGen plug-in for advanced order management and analytics, and complete with low execution latency of approximately 30ms.

Cons

- Despite bolstering its stock CFDs in US, UK and EU markets, it’s still nowhere near as extensive as firms like BlackBull which offer thousands of equities for diverse opportunities.

- Despite performing well whenever we use it, Axi's support is unavailable 24/7, which can be inconvenient for traders in different time zones or those needing assistance outside standard trading hours.

- Axi is falling behind by only offering MT4 when many rivals now support MT5, cTrader, TradingView and proprietary software for a slicker experience with more advanced tools.

BDSwiss

"BDSwiss will suit day traders in search of fast execution, with 68.3ms median execution speeds, dynamic leverage up to 1:2000, and powerful charting tools. The catch is the dwindling regulatory oversight in recent years. "

Christian Harris, Reviewer

BDSwiss Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FSC, FSA, SCA, MISA |

| Platforms | BDSwiss WebTrader, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, GBP |

Pros

- BDSwiss caters to a wide range of traders by offering Cent, Classic, VIP, and Raw accounts. Beginners can start with lower-risk Cent accounts, while experienced traders can benefit from VIP or Raw accounts that offer lower spreads and tighter spreads and commissions for high-volume trading.

- BDSwiss had made strides to enhance its trading services, notably through its AI-enabled trend analysis tool added in 2021, plus a low spread account and dynamic leverage up to 1:2000 introduced in 2023.

- With support for MT4, MT5, and its own app, BDSwiss ensures its platforms offer advanced charting tools, Autochartist and Trading Central integration, and seamless mobile access.

Cons

- While the growing 900+ asset range is solid, specific categories, like cryptocurrencies and stocks, have fewer options than brokers offering thousands of shares or a more diverse crypto portfolio. Advanced traders looking for niche assets might feel constrained.

- The BDSwiss WebTrader lacks customization, with no window resizing and no asset-specific filters for trading ideas, making for a limiting and frustrating user experience during testing.

- After surrendering its CySEC (Cyprus) and FCA (UK) licenses, BDSwiss no longer accepts clients from the EU and UK. This limits its access to traders in highly regulated markets, reducing its appeal in those regions where stringent oversight might be a priority for users.

FreshForex

"FreshForex is an obvious fit for experienced day traders looking for very high leverage of 1:1000+, especially paired with the ECN account where spreads start from 0.0 and commissions at $1.90. "

Christian Harris, Reviewer

FreshForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs |

| Regulator | SVGFSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, ZAR, MYR, NGN |

Pros

- Active traders benefit from access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which offer advanced charting capabilities, technical indicators, and algorithmic trading features.

- The broker offers a broad selection of over 270 instruments, spanning major and exotic forex pairs, a particularly extensive suite of cryptocurrencies, various commodities, global indices, individual stocks, and ETFs. This variety supports diverse trading strategies and portfolio diversification, catering to different market interests and risk appetites.

- FreshForex has invested in its research tools to inform clients' trading decisions, with forex calculators, market forecasts and analytics, plus a VPS for serious day traders looking to run hands-off strategies.

Cons

- While ECN accounts offer competitive, tight spreads, the spreads on Classic and Market Pro accounts tend to be higher than those provided by the cheapest brokers we've used, increasing costs for high-frequency traders or scalpers.

- FreshForex's customer support performed below-average during testing, with particularly hard to reach agents on live chat during market hours, posing challenges for day traders needing urgent support.

- FreshForex relies solely on the MT4 and MT5 platforms and does not offer proprietary trading software or support for popular alternatives, such as cTrader and TradingView, that we're increasingly seeing other brokers integrate. This limits options for day traders who prefer more modern, user-friendly interfaces or enhanced charting and social trading features.

How Did We Choose The Best Airtel Brokers?

To identify the top Airtel brokers, we:

- Took our database of around 500 online brokers and identified all those that claim to support Airtel

- Confirmed that the platforms accept Airtel deposits in their client area or by speaking to customer support

- Sorted them by their overall rating, which blends over 100 data points and findings from our direct tests

Comparing Airtel Brokers

Choosing a broker with Airtel deposits is a personal choice, but we suggest weighing these key factors:

- Trust: We recommend brokers that we trust, determined by the firm’s regulatory credentials, history, and the observations of our experts. Airtel itself is a trusted payment method and telecoms provider, based in India and is also active in other nations across Africa and the Middle East. The firm’s banking services are overseen by the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI). The company has also been operational for over 25 years while its Airtel Money product has attracted over 34 million users, including active traders.

- Markets: We prefer brokers that offer a wide range of markets that allow day traders to explore diverse trading opportunities. Our evaluations have found that the top Airtel platforms typically offer key asset classes like forex, stocks, commodities, indices and cryptocurrencies. Importantly, this may include African and Indian securities given the payment method’s popularity in these regions. Assets are often tradable via contracts for difference (CFDs), which allows for short-term speculation without requiring any ownership of the underlying asset, while leverage enables you to multiply your trading results.

- Fees: We prioritize platforms with low fees, which is important for active traders who need to protect their profits. We assess important trading costs, notably spreads and commissions, focusing on popular markets like EUR/USD and oil, then weighing these against transaction costs such as deposit and withdrawal fees. Conveniently, users are not typically charged when making a payment to a broker from their Airtel Wallet.

- Tools: We prioritize brokers who offer powerful and reliable charting platforms for short-term trading strategies. MT4 and MT5 have led the industry for years, but we’re seeing alternatives like TradingView and cTrader increasingly rival MetaTrader’s position. Day trading apps are also on the rise, aligning with Airtel Money’s mobile-centric users.

What Is Airtel?

Bharti Airtel Limited was founded in India in 1995 by Sunil Mittal.

The Airtel Payments Bank was later founded in 2016, which introduced the Airtel Money digital wallet, where traders can make trading deposits via the Airtel Thanks app.

The firm operates in 18 countries, mainly across South Asia and Africa.

Airtel is a relatively secure payment method, with various data protection and cyber security measures in place including 2-factor authentication (2FA) and one-time passwords (OTP).

Fees

Airtel doesn’t charge fees for depositing to a broker via a virtual card, although a wallet payment to a broker’s bank account may incur a 3% charge.

Casual traders should also note that a Rs 20 maintenance fee can be charged on wallets if you have not transacted for six calendar months. This fee is deducted from the wallet balance.

There’s also a Rs25 + GST annual maintenance charge for virtual prepaid cards, though a virtual debit card is free.

However, fees for using Airtel may vary depending on your location.

Speed

Airtel wallet transactions are usually near-instant, which will appeal to active traders looking to make frequent payments to and from their trading accounts.

That said, some brokers may have their own processing times depending on their internal processes. For example, we’ve seen that withdrawals can take up to five working days if know your customer (KYC) and anti-money laundering (AML) checks need to be completed.

How To Deposit Using Airtel

To begin making payments using Airtel, you’ll need to first register for a wallet account via the provider’s website.

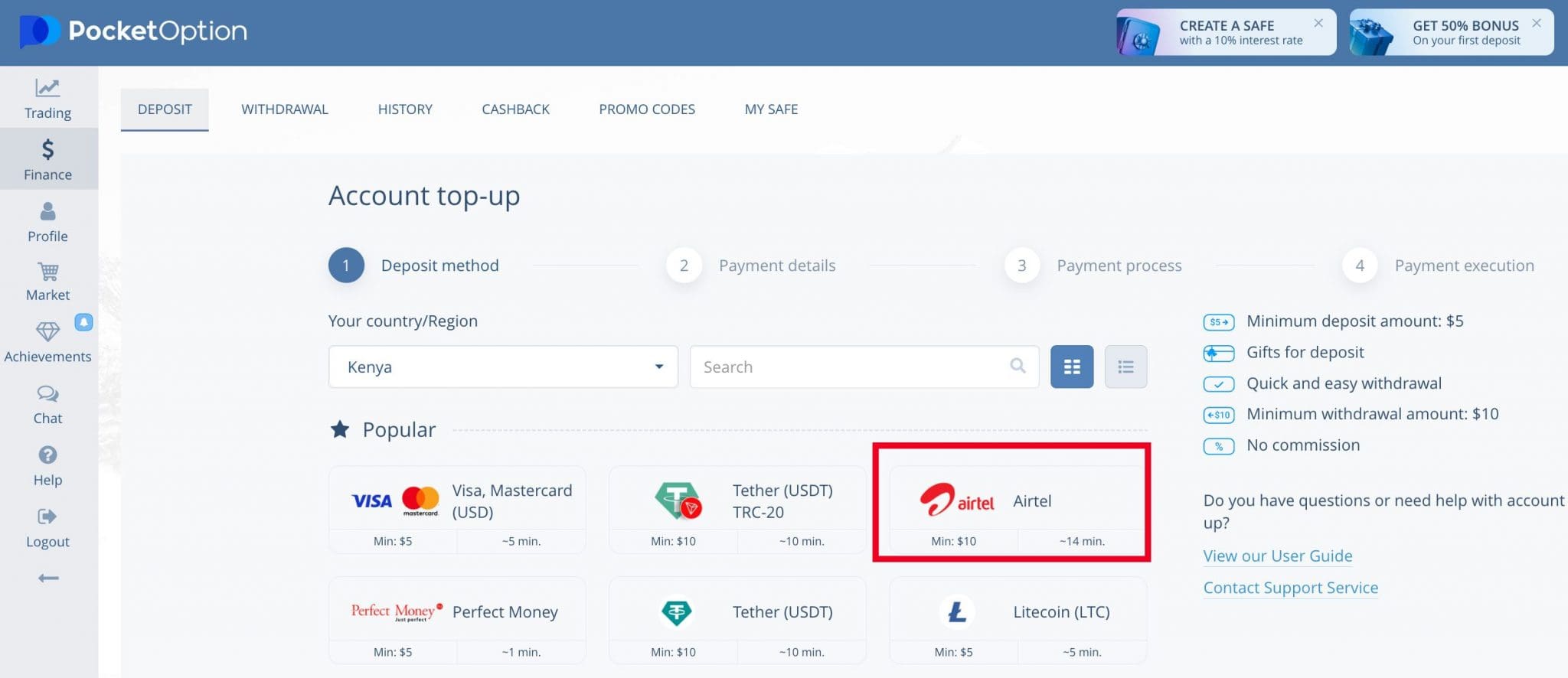

You should then be able to fund your trading account quickly, though the process may differ depending on the broker. At Pocket Option, for example:

- Sign into your platform and select ‘Top Up’ in the top right-hand corner

- Select ‘Airtel’ from the list of payment methods

- Enter the amount you wish to deposit, followed by your Airtel payment details

- Confirm the transfer

Pros & Cons of Funding Your Trading Account With Airtel

Pros

- Airtel Money transfers are usually processed immediately to trading accounts

- Deposits and withdrawals via Airtel are generally low-cost based on our investigations

- Airtel offers virtual cards, physical cards, plus a range of rewards for flexibility

- Airtel has a long 25+ year history and is a secure payment service for day trading

Cons

- Airtel is not widely offered based on our evaluations, so traders may need to consider alternative mobile money brokers

- It relies on mobile connectivity so any technical disruptions could affect your trading payments

- Airtel Money is geared towards African and Indian traders so it won’t suit all global traders

Is Airtel Good For Day Trading?

Airtel is an excellent choice for African and Indian day traders looking for fast and convenient trading payments from their mobile phones. The payment app offers seamless account management for those who trade on the go.

To get started, see DayTrading.com’s selection of the top Airtel brokers.

FAQ

Is Airtel Safe To Use For Day Trading?

Founded in 1995, Airtel has been providing payments and banking solutions since 2016 and is overseen by the Reserve Bank of India. The provider is also trusted by millions of customers in Africa, South Asia and beyond.

However, security will also depend on the broker you choose to register with. That’s why we recommend a regulated Airtel broker that has been tested by our experts.

How Much Does It Cost To Fund A Trading Account With Airtel?

There are no fees for making payments via Airtel Money, although there may be a 3% for transferring to another bank account. There’s also a Rs20 charge if you haven’t made a payment in 6 months.

Brokers may also have their own transaction fees so check terms and conditions before sending any money.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com