Day Trading in the UAE

Day trading in the United Arab Emirates has gained significant traction, buoyed by the country’s robust economy and supportive financial infrastructure. The UAE boasts one of the most diversified and resilient economies in the Middle East, with a GDP surpassing $500 billion.

The Emirates’ tax-free environment, advanced trading platforms, and access to global markets make it an attractive hub for beginners and experienced day traders seeking opportunities in a rapidly growing landscape.

Are you ready to start day trading in the UAE? This guide will get you started.

Quick Introduction

- The UAE has its stock exchanges, with the Abu Dhabi Securities Exchange (ADX) and the Dubai Financial Market (DFM) being the primary venues. Abu Dhabi’s ADX lists companies from various sectors, such as banking, telecommunications, and energy. Dubai’s DFM is a public joint-stock company that lists many stocks, including banks and real estate firms.

- The Securities and Commodities Authority (SCA) is the primary regulator of the Emirates’ financial markets. It oversees the stock exchanges, ensures investor protection and also regulates forex trading in the UAE.

- The UAE’s tax-friendly environment, overseen by the Federal Tax Authority, exempts trading profits from personal income tax. This includes gains from day trading stocks or other financial instruments.

Top 4 Brokers in the UAE

After in-depth tests, these 4 platforms stood out from the pack for day traders in the UAE:

Day Trading Platforms in the UAE

What Is Day Trading?

Day trading involves buying and selling financial instruments within a single day to profit from short-term price fluctuations. Unlike long-term investors, day traders close all positions before the market closes.

Short-term traders in the Emirates can deal a wide range of securities both local and global, such as stocks listed on the ADX, commodities like oil given its pivotal role in the region’s economy, indices like the MSCI UAE Index, and currency pairs containing the dirham (AED).

Is Day Trading Legal In The UAE?

Day trading is legal in the UAE, and the country’s well-regulated financial market environment supports various trading forms.

The SCA is the key regulator ensuring that trading activities, including day trading, adhere to strict guidelines and regulations.

The SCA oversees the stock exchanges and ensures transparency, investor protection, and adherence to market rules. At the same time, the CBUAE regulates the banking sector and has some oversight of financial activities, including money markets.

While day trading is legal in the Emirates, you must know the rules and regulations these authorities set, including trading account requirements, leverage use, and reporting obligations.You must also use licensed brokers and trading platforms approved by the relevant regulatory bodies in the UAE.

How Is Day Trading Taxed In The UAE?

The UAE is known for its tax-friendly environment. Trading is not subject to personal income tax, so profits from trading activities, such as day trading Emirate stocks or other assets, are not taxed.

There are also no capital gains or dividend taxes in the UAE, which makes it an attractive destination for traders and investors.

However, businesses that engage in day trading may be subject to a corporate tax introduced in 2023. The corporate tax is set at a standard rate of 9% on profits exceeding AED 375,000.

The lack of taxes on personal trading profits is a significant advantage for individual traders in the UAE, contributing to its reputation as a global financial hub.

I still recommend keeping detailed records of all transactions to ensure accurate tax reporting and compliance with UAE tax regulations.Also consult with a local tax professional who can provide guidance on specific obligations and help you accurately determine your tax liabilities from short-term trading activities.

Getting Started

Here’s a simple three-step guide to get you started day trading in the United Arab Emirates:

- Choose a top day trading broker in the UAE. Prioritize factors such as low trading fees, a reliable charting platform, fast order execution, compliance with financial regulations in the UAE, a halal account if you aim to comply with Islamic Finance principles, excellent support potentially in Arabic, and competitive margin requirements if you plan to trade with leverage.

- Set up your trading account. Like in most countries, you’ll need to complete an online application and provide personal and financial details. You’ll also need to verify your identity with suitable documents, such as a copy of your Emirates ID and proof of address. In our experience, this typically takes anywhere from 15 minutes to 48 hours.

- Deposit dirhams. After your trading account is approved, fund it using your preferred payment method, such as a debit card, bank wire transfer, digital wallet, or increasingly mobile money. Consider using a broker with an AED account to slash conversion fees while providing a smooth day trading experience for residents.

A Day Trade In Action

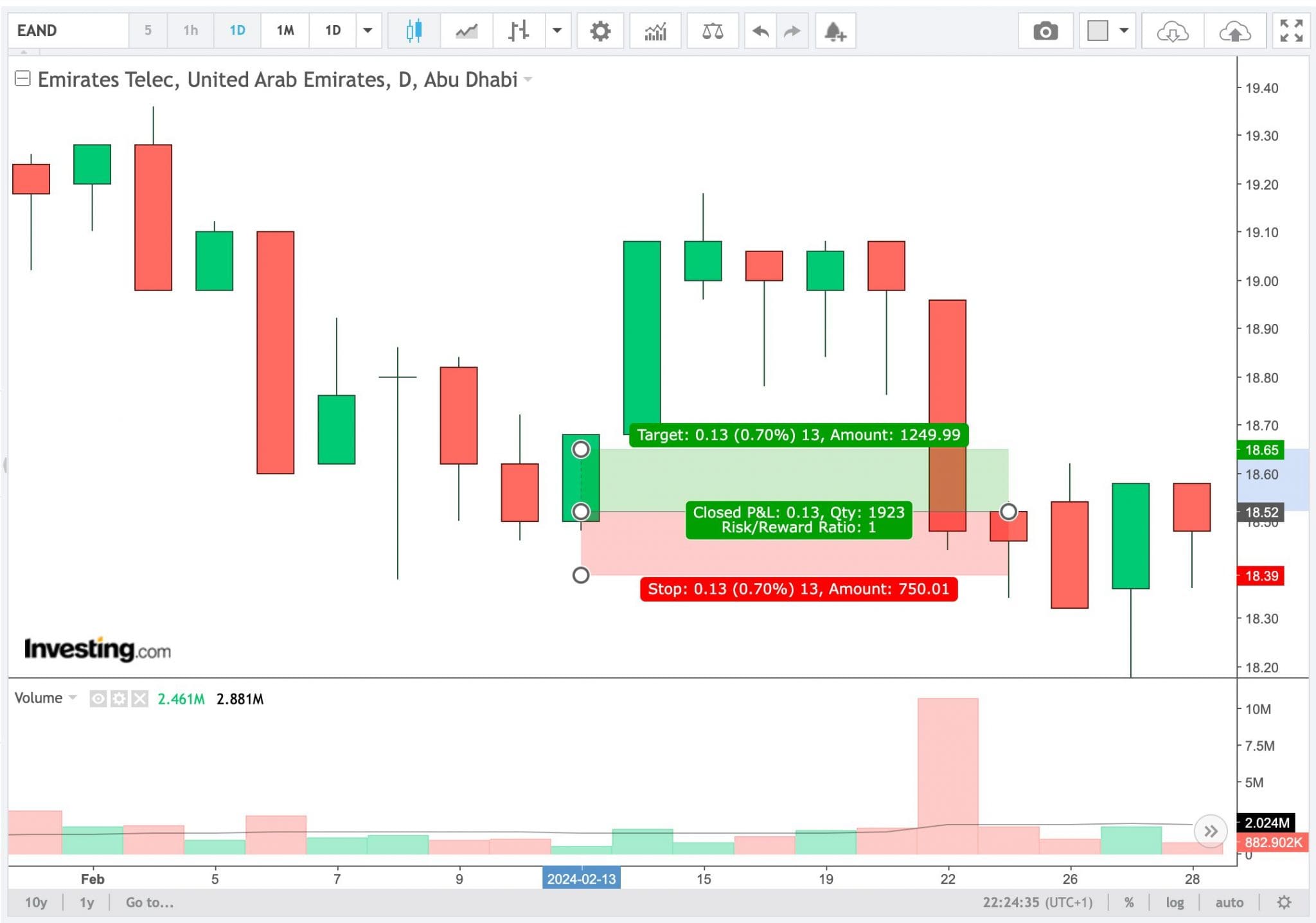

Let’s consider a scenario where I day trade Emirates Telecom, an ADX-listed telecommunications service provider whose principal activities include providing telecommunications services, media, and related equipment.

Event Background

I closely followed Emirates Telecom ahead of its quarterly earnings release. I expected strong results based on market sentiment, past earnings, and the growing demand for digital services in the UAE.

Analysts agreed, and institutional investors were accumulating shares. A rising RSI signaled positive momentum. I believed a strong earnings report would boost the stock price, at least temporarily.

Trade Entry & Exit

When the earnings report was released, the company exceeded expectations with increased revenue and subscriber growth.

As the market opened, heavy buying confirmed my bullish prediction. I entered the trade when a strong bullish candlestick formed on the 15-minute chart, placing a market order to buy Emirates Telecom at AED 18.52 per share.

I also set a stop-loss order at AED 18.39 to manage risk, risking 0.70%.

The price suddenly pulled back for a couple of candles, but then continued to rise, driven by increased trading volume. I monitored the price, aiming to exit at AED 18.65 for a 0.70% gain (1:1 risk-to-reward ratio).

After three hours, the stock reached my target, and I sold my shares, capitalizing on the positive earnings and market enthusiasm.

Bottom Line

Day trading in the UAE is a thriving activity driven by the country’s advanced financial infrastructure and supportive regulatory environment.

Regulation plays a crucial role in ensuring the safety and integrity of day trading in the UAE. This regulatory framework, combined with the UAE’s tax-free environment on personal trading profits, makes the country an attractive destination for day traders.

To get started, see DayTrading.com’s pick of the best brokers for day trading in the United Arab Emirates.

Recommended Reading

Article Sources

- Abu Dhabi Securities Exchange (ADX)

- Central Bank of the UAE (CBUAE)

- Dubai Financial Market (DFM)

- UAE corporate tax - UAE Government

- UAE GDP - International Monetary Fund

- Securities and Commodities Authority (SCA)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com