Best Trading Accounts

Trading accounts can vary immensely between brokers. From cash and margin accounts to retail or professional accounts, the ‘right’ choice is not always clear. We’re also seeing growing diversity in the types of trading accounts available, with more specialized accounts to meet specific trading needs, such as day trading.

Ultimately, the best trading account will depend on your circumstances, such as starting capital, preferred pricing model, leverage needs, trading strategy, favored execution options, and desired trading tools.

Discover the best trading accounts in 2025 to find the right solution for you. We also compare the various account options available side-by-side.

Top 6 Trading Accounts

After tests, these accounts came out on top, combining low entry requirements with excellent trading conditions:

| Broker | Demo Account | ECN Account | STP Account | DMA Account | Islamic Account | Professional Account | Custodial Account | Managed Account | Minimum Deposit |

|---|---|---|---|---|---|---|---|---|---|

| Coinbase | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | $0 |

| FOREX.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | $100 |

| Capitalcore | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ | $10 |

| Firstrade | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✔ | ✘ | $0 |

| Binarium | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | $5 |

| xChief | ✔ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ | $10 |

Brokers for Different Trading Account Types

How Did We Choose The Best Trading Accounts?

To identify the top trading accounts for 2025, we:

- Took data from our directory of 227 brokers, where we record the availability of 10+ account types.

- Assigned each firm a rating from 1 to 5, factoring in the choice and quality of their online trading accounts.

- Sorted brokers by this ‘Accounts & Banking Rating’, revealing the best accounts for various types of traders.

What Should I Consider When Selecting A Trading Account?

Drawing on our years in the industry and personal experience opening and using a variety of trading accounts, there are several factors we, and you, should consider:

Regulation

The first question every trader should ask, and that we always answer when evaluating trading accounts, is whether the broker providing the account is regulated.

This is because regulated trading accounts often come with various protections. In the US, for example, cash and securities in regulated accounts receive up to $500,000 insurance through the Securities Investor Protection Corporation (SIPC) in the event your brokerage faces financial difficulties.

Another important safeguard provided with regulated trading accounts in the European Union, Australia, the UK, and other countries though not the US, is negative balance protection. This means your account cannot fall below zero – an important safeguard for day traders dealing in fast-moving markets.

However, it’s important to understand that not all regulators provide the same protections or exercise the same oversight of trading account providers. Therefore, we strongly recommend using an account authorized by a ‘green tier’ regulator – these provide the strongest safeguards for traders in their respective jurisdictions.

- IG knocks every alternative out of the park when it comes to regulatory credentials, earning it a 4.9/5 score for ‘Regulation & Trust’. It’s authorized by 7 ‘green-tier’ regulators and provides GBP 85K account insurance in the UK, EUR 20K in the EU and CHF 100K in Switzerland.

Markets

Choose a trading account that provides access to the financial markets you want to do business in.

Most accounts we see provide access to a variety of assets, but some brokers offer accounts that focus on specific instruments, for example:

- Forex accounts: A forex account is tailored for trading currencies. You can buy or sell one currency against another, such as the Euro and US Dollar (EUR/USD), aiming to profit from fluctuations in exchange rates.

- Stock accounts: A stock trading account allows you to engage in the buying and selling of shares, often granting you access to various stock exchanges, such as the New York Stock Exchange (NYSE). These accounts may also enable you to receive dividends from your stock investments.

- Crypto accounts: A crypto trading account enables you to buy, sell, and trade various cryptocurrencies, such as Bitcoin, Ethereum, and Ripple. These accounts are provided by crypto brokers or crypto exchanges. Prioritize security and opt for crypto accounts with robust encryption, two-factor authentication, and a track record of safeguarding user funds.

- Options accounts: An options trading account is a financial account designed specifically for engaging in options trading. The account serves as the platform through which you can execute various options strategies, including buying and selling call or put options, engaging in complex spreads, and hedging.

You may want to open multiple trading accounts depending on what you want to trade and your strategy.For example, I use IC Markets for day trading forex, IG for day trading stocks, eToro for investing in stocks, and TopFX for trading indices.

- AvaTrade is one of the few brokers to keep things extremely simple, catering to newer traders. Its single account offers access to all its 1,250+ markets with no restrictions – scalping, hedging and algo trading are all permitted. The account opening process is also a breeze – taking less than 5 minutes to sign up.

Cash or Margin

Decide whether you need a cash or margin account, a large distinction that’s particularly important for US investors where there are strict rules on margin trading.

A cash account allows you to trade only with the available cash you’ve deposited into your trading account. A margin account allows you to borrow funds from your broker to increase your buying power.

Let’s say I have $5,000 in my trading account and want to buy shares in Apple.The maximum value of the shares I can buy with my cash account is $5,000 (minus any fees).

However, a margin account could allow me to trade 5x my balance, so $25K worth of Apple stocks, multiplying my trading results (profits and losses).

As a result, cash accounts are more limiting, though they can be very useful for beginner traders as they will prevent any loss of unaffordable capital.

- IG is a superb option regardless of whether you want a cash or margin account. There are zero account minimums or inactivity fees with its cash account while its margin trading solution offers tiered margin rates from 3.33% to 50% for retail investors and as low as 0.45% for professional investors.

Pricing Structure

Choose a broker with a pricing structure that firstly, you understand, and secondly, will help maximize your returns, which may depend on your trading strategy.

In general, trading accounts can be split into two pricing models:

- Commission-free: This type of trading account charges no commission on trades – just the spread (the difference between the bid and ask price of an asset). As a result, commission-free accounts are particularly popular with beginners looking for simple pricing.

- Raw spread: This type of trading account charges a lower spread in return for a fixed commission, often charged per lot if you’re trading currencies and metals. This type of trading account is particularly popular with active traders and those looking to keep spreads to a minimum, such as day traders.

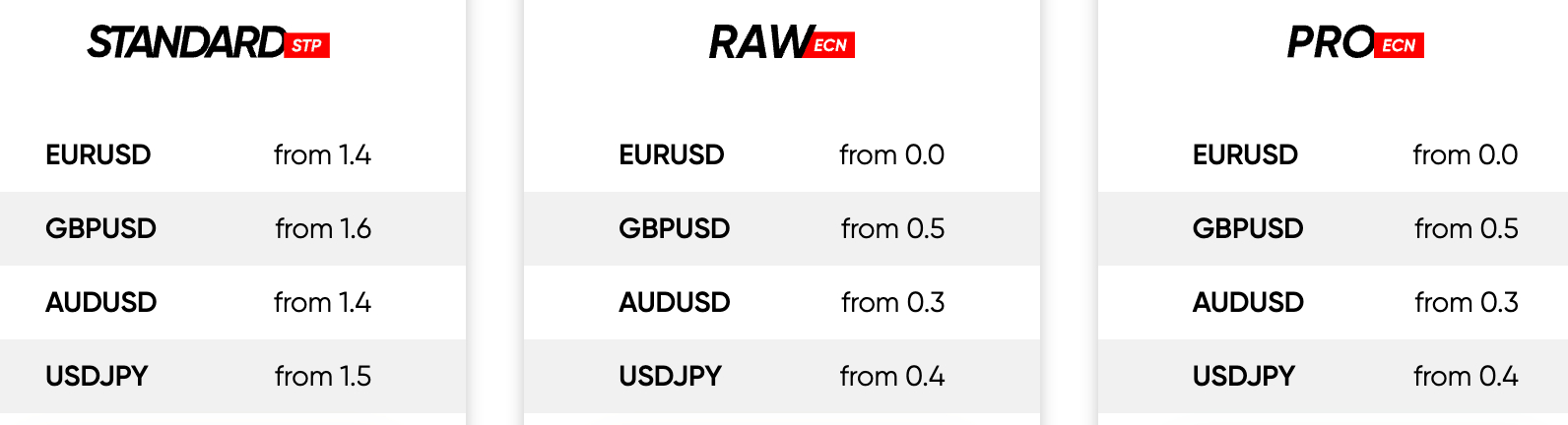

- Vantage continues to stand out with a choice of pricing structures in its accounts that tick the box for traders at every level. Its Standard account is the perfect entry point for beginners with zero commission, the Raw account is terrific for active traders seeking tight spreads with a low commission of $3/lot, while the Pro account is tailor-made for pro investors with a commission of just $1.50/lot.

Minimum Deposit

Choose a trading account with a minimum investment that aligns with your budget.

We’ve evaluated hundreds of trading accounts over many years and you can normally expect to deposit up to $250, with several big names, notably Interactive Brokers, dropping their minimum investment ($10,000 to $0) in recent years, lowering the entry barrier for aspiring traders.

Experienced traders and those with larger budgets may want to consider a trading account with a higher minimum investment. This is because VIP or premium accounts typically come with a range of exclusive features, personalized services, and enhanced trading conditions, notably lower fees, priority support, and dedicated account managers.

- Fusion Markets stands out with a $0 minimum deposit and an excellent choice of 10 account currencies (USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD), catering to an array of international traders.

Order Execution

An important aspect of choosing a trading account is considering the type of order execution that will best suit your strategy and preferences.

Among the most widely used execution options are:

- Straight Through Processing (STP) accounts: These streamline the trading process by allowing orders to be transmitted directly from the trader to external liquidity providers, such as banks. Brokers with STP accounts often make their profit through a markup on the spread or by charging a fixed commission per trade.

- Electronic Communication Network (ECN) accounts: These operate on a more decentralized electronic network. The system aggregates buy and sell orders from various participants, including banks and retail traders. While ECN brokers may charge a commission on trades, the pricing is often more competitive, and traders benefit from potentially tighter spreads.

- Direct Market Access (DMA) accounts: These allow traders to place orders directly on the exchange order book, providing direct interaction with the market for enhanced control over trades. Brokers with DMA accounts help reduce conflicts of interest between the trader and brokerage, though fees can be higher and include costs for market data.

- Pepperstone offers flexible trading accounts depending on your preferences, with a particularly attractive Razor account that uses ECN capabilities to deliver superb pricing averaging 0.12 pips on the EUR/USD, helping it earn our ‘Best Forex Broker 2024’ award.

Trading Platforms and Tools

Pick a trading account with access to your preferred platform if you’re an experienced trader, or one with a user-friendly, intuitive solution if you’re a new trader.

Whilst many accounts provide access to all the platforms available at a brokerage, whether in-house or proprietary, some accounts only permit use of certain software, such as MetaTrader 4 (MT4) – the most widely available platform, though modern alternatives like TradingView and cTrader are gaining ground.

We’re also observing the rising use of smartphones for online investing, with the best trading apps sporting increasingly sophisticated charting tools, real-time data and even algorithmic trading capabilities – all popular with active traders.

I strongly recommend making use of a demo account to test-drive a platform you’ve not used before.I have opened dozens of demo trading accounts over the years and they remain the best way to get a feel for trading software, pricing models and brokers more generally, before depositing real money.

- IC Markets offers a superior selection of dependable and advanced platforms, especially since introducing TradingView to accompany MT4, MT5, cTrader, Trading Central and AutoChartist. IC also added its Raw Trader Plus account in 2023, delivering rebates, VPS hosting and priority support for high-volume traders.

Specialized Trading Solutions

With more brokers today offering accounts that cater to specific strategies, religious beliefs and other needs than we’ve ever seen, it’s worth asking whether you would benefit from a specialist type of trading account:

- Islamic accounts: Also known as a swap-free account, these accounts cater to individuals adhering to Islamic finance principles, which prohibit the payment or receipt of interest (Riba). In traditional trading accounts, overnight interest payments, known as swaps or rollover fees, are common when positions are held overnight. However, Islamic trading accounts eliminate these interest-based transactions, ensuring that trading complies with Sharia law by offering traders a swap-free alternative.

- High-Frequency Trading (HFT) accounts: These are designed for traders engaging in high-frequency trading – executing a large number of orders at extremely high speeds. HFT accounts leverage advanced algorithms and technology to capitalize on small price fluctuations in financial markets, aiming to profit from rapid and short-term market movements. They cater to experienced traders seeking to exploit market inefficiencies and capitalize on fleeting arbitrage opportunities.

- Multi-Account Manager (MAM) / Percentage Allocation Management Module (PAMM) accounts: These allow professional traders or money managers to manage multiple trading accounts simultaneously. The manager can execute trades on behalf of multiple investors, and the profits or losses are allocated among the participating accounts based on their proportional investments. The MAM/PAMM model is particularly popular with investors seeking a hands-off approach to trading.

- Professional trading accounts: This type of trading account is designed for highly experienced traders who meet specific criteria. These criteria may include a minimum level of trading activity, financial assets, or professional experience in the financial industry. They often offer enhanced features, lower fees, and higher leverage compared to retail accounts.

- HYCM stands out by catering to a wide range of specialist trading needs. Unlike the majority of brokers we’ve evaluated, it supports an ECN account (terrific for day trading), a halal account (great for Islamic traders) and a pro account (designed for seasoned, high-volume traders).

How Do I Open A Trading Account?

Opening a trading account is straightforward and usually entails three key steps:

- Fill out the sign-up form with your personal details such as name, country and contact details

- Choose your account type and settings, such as ECN account and USD base currency

- Verify your identity and address by supplying copies of requested documents

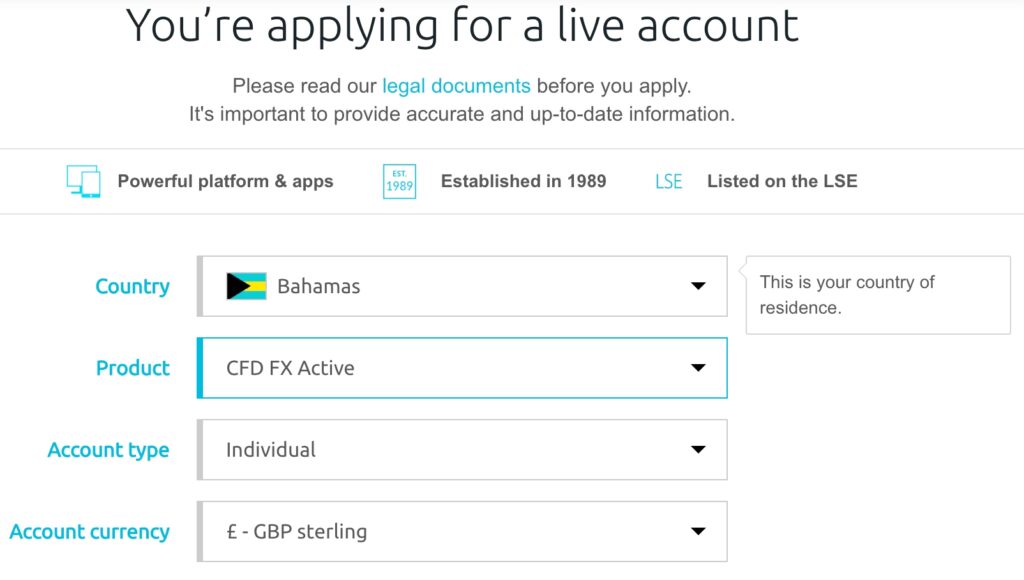

I have opened multiple live trading accounts over the years and it normally takes around 10-15 minutes to complete sign-up forms and a few working days to get your account activated.To show you how it works in practice, below is the account opening form that I filled in at CMC Markets.

Bottom Line

Different types of brokerage accounts cater to the diverse needs of traders and investors. This variety allows you to choose the best trading account that aligns with your goals, risk tolerance, and regulatory jurisdiction.