Commodities Trading

Commodities hold immense significance within the financial market due to their fundamental role in production and manufacturing processes. At their core, commodities represent essential raw materials used in the production of goods and services that permeate our daily lives, from oil and natural gas to coffee and soybeans.

Trading commodities serves as a strategic means to enhance your portfolio diversification, particularly in periods of heightened market turbulence and uncertainty.

This guide for beginners will explain what commodity trading involves, alongside our tips for getting started and an example trading strategy.

Quick Introduction

- Tradable commodities are classified as energies, metals, livestock, and agriculture.

- The most traded commodity is oil, which is used in many products from petrochemicals to petroleum, to lubricants to diesel.

- Traders generally don’t buy and sell physical commodities – they trade in derivatives like futures and options.

- Supply and demand exert a significant influence on the price dynamics of commodities. When the supply dwindles while demand surges, it results in elevated prices. Conversely, prices fall when the scenario is reversed.

- Commodities can be considered risky to trade due to their susceptibility to unpredictable factors, including unusual weather phenomena, epidemics, and both natural and human-induced disasters.

Best Commodities Trading Brokers

We have evaluated more than 100 commodity trading brokers and these 4 offer the best market access, platforms and fees in 2025:

-

1

Plus500 USWelcome Deposit Bonus up to $200Trading with leverage involves risk.

Plus500 USWelcome Deposit Bonus up to $200Trading with leverage involves risk.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$1000.0 LotsCFTC, NFAFutures on Forex, Commodities, Cryptos, Indices, Interest RatesWebTrader, AppACH Transfer, Wire Transfer, Debit Card, Mastercard, VisaUSD -

2

NinjaTrader

NinjaTrader

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Stocks, Options, Commodities, Futures, CryptoNinjaTrader Desktop, Web & Mobile, eSignalACH Transfer, Debit Card, Wire Transfer, ChequeUSD -

3

Interactive Brokers

Interactive Brokers

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$0$1001:50FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFMStocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, CryptocurrenciesTrader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, QuantowerCheque, ACH Transfer, Wire Transfer, Automated Customer Account Transfer Service, TransferWise, Debit CardUSD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF -

4

FOREX.comActive Trader Program With A 15% Reduction In Costs

FOREX.comActive Trader Program With A 15% Reduction In Costs

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$1000.01 Lots1:50NFA, CFTCForex, Stocks, Futures, Futures OptionsMT4, MT5, TradingView, eSignal, AutoChartist, TradingCentralWire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, PLN

Full List of Commodities Brokers

What Is Commodities Trading?

Trading commodities is similar to trading stocks but involves speculating on the price of raw materials or primary goods like oil, gold, agricultural products, or even things like natural gas.

Instead of owning shares of a company, you’re essentially betting on the future price movements of these physical goods. Just like in stock trading, you can speculate on whether the prices will go up (long position) or down (short position) and profit from those price changes.

However, trading commodities is often more influenced by factors like supply and demand, weather conditions, and geopolitical events rather than the performance of a specific company. It can be a way to diversify a portfolio and take advantage of different market dynamics.

Globally, commodities find themselves traded on prominent commodity exchanges such as the London Metals Exchange (LME), the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Intercontinental Exchange (ICE).

What Affects Commodity Prices?

Supply & Demand

Commodity prices are influenced by a complex interplay of factors, with supply and demand dynamics serving as the primary drivers. When demand for a particular commodity outstrips its supply, prices tend to rise, and conversely, an oversupply often leads to price declines.

Geopolitical Events

Geopolitical events can significantly impact commodity markets, with conflicts, trade disputes, and political instability in major producing regions disrupting supply chains and affecting prices.

Additionally, economic conditions play a pivotal role, as robust economic growth typically spurs increased commodity consumption, while economic downturns can lead to reduced demand.

Currency Exchange Rates

Currency exchange rates can also exert a substantial influence on commodity prices, especially when commodities are priced in a particular currency, like the US dollar.

Fluctuations in exchange rates can affect the affordability and attractiveness of commodities for international buyers and sellers.

Weather Events and Natural Disasters

Weather events and natural disasters, such as droughts, floods, or hurricanes, can disrupt the supply of agricultural commodities, causing significant price fluctuations.

Moreover, government policies, including tariffs, subsidies, and regulations, can alter market dynamics by restricting exports, imposing import duties, or introducing new regulations that impact production and trade.

Speculative Trading

Lastly, speculative trading in commodity markets by traders looking to profit from short-term price movements can contribute to heightened price volatility, as market sentiment and perceptions can drive price swings.

As an illustration, when the supply of oil experiences an uptick, it leads to a reduction in the price of a single barrel. Conversely, when there is an escalation in the demand for oil, which frequently occurs during the summer months, it results in a price upswing.

Spot vs Futures Price

Spot price and futures price are two key concepts in commodities trading, and they represent different aspects of the commodity market:

- The spot price, also known as the cash price or current market price, is the current market value of a commodity for immediate delivery and settlement. It reflects the price at which the commodity can be bought or sold for now. Spot prices are determined by the real-time supply and demand conditions in the physical marketplace and are used by producers, consumers, and traders involved in the immediate buying or selling of the actual commodity.

- Futures prices, on the other hand, can be more or less than the spot price at any given moment because prices are determined on exchanges. Traders typically do not engage in the direct trading of physical commodities due to the impracticality of buying actual barrels of crude oil or bushels of wheat. Instead, you need to analyze market activities and chart patterns to forecast future fluctuations in supply and demand dynamics. Subsequently, you take long or short positions in futures contracts based on the expected direction in which supply and demand forces will influence prices.

Pros & Cons of Trading Commodities

Pros

- Market Conditions: Commodity markets can be highly volatile, offering the potential for substantial profits in a short time. Leverage can amplify returns, allowing you to control larger positions with a smaller capital investment.

- Diversification: Adding commodities to a portfolio can enhance diversification, potentially reducing overall risk. They often have a low correlation with traditional stocks and bonds, reducing overall portfolio risk.

- Leverage: Trading commodities often allows for higher leverage, which can amplify profits but also magnify losses. Stock trading typically involves lower leverage, reducing the potential for extreme gains or losses.

- Inflation Hedge: Certain commodities, such as precious metals like gold and silver, have historically acted as a hedge against inflation. When the value of fiat currencies erodes due to inflationary pressures, the prices of these commodities tend to rise, preserving purchasing power for investors.

- Long-Term Investment Opportunities: Some commodities, such as agricultural products or rare minerals, offer long-term investment potential. Traders can benefit from the growing global population and resource scarcity by holding positions in commodities expected to appreciate over time.

Cons

- Volatility: Commodity markets are known for their price volatility, which can lead to significant price swings in a short period. This volatility can result in both quick gains and substantial losses. High volatility can be challenging for inexperienced traders and increases the risk of substantial losses.

- Lack Of Inherent Value: Unlike stocks, which represent ownership in a company with intrinsic value, commodities are physical goods with no inherent value beyond what the market assigns. This lack of underlying value can make trading commodities riskier because predicting price movements is more challenging.

- External Factors: Commodity prices can be heavily influenced by external factors such as weather conditions, geopolitical events, and government policies. These factors can be challenging for inexperienced traders to predict and can introduce additional risks.

- Expertise Required: Successful commodity trading often requires specialized knowledge of the specific commodity market, supply and demand dynamics, and global factors that impact prices. Without this expertise, you may struggle to navigate these complexities.

- Liquidity And Costs: Some commodity markets may have lower liquidity than stock markets, which can result in wider bid-ask spreads and higher trading costs. Illiquid markets can also make it challenging to enter and exit positions quickly.

How To Trade Commodities

There are several different ways to trade commodities, each with its own characteristics and strategies:

- Futures: You can buy and sell standardized futures contracts, which obligate you to purchase or deliver the underlying commodity at a specified future date and price. Futures contracts are commonly used for hedging and speculation in commodities markets.

- Options: Options provide the right, but not the obligation, to buy (call option) or sell (put option) a commodity at a predetermined price within a specified time frame. Options offer flexibility and can also be used for hedging or speculative purposes.

- Exchange-Traded Funds (ETFs): ETFs allow you to gain exposure to commodities without directly trading futures contracts. They track the performance of commodity indexes.

- Contracts For Difference (CFDs): CFDs are derivative instruments that allow you to speculate on the price movements of commodities without owning the underlying asset. They provide leverage and flexibility but also involve risk.

- Mutual Funds: You can participate in commodities through mutual funds or commodity pools, where a fund manager handles the trading and diversification of commodity investments.

- Spread Betting: In spread betting, you speculate on whether commodity prices will rise or fall. It’s a tax-efficient method used primarily in the UK and Ireland, where profits are exempt from capital gains tax.

- Binary Options: Binary options involve betting on whether the price of a commodity will be above or below a specified level at a predetermined time. They offer fixed payouts but are considered high-risk and speculative.

Each of these methods has its advantages and risks, so you should carefully consider your objectives, risk tolerance, and familiarity with the commodities market before choosing a specific approach.

Additionally, regulatory requirements and tax implications may vary depending on the method chosen and your location.

An Example of a Commodity Trade

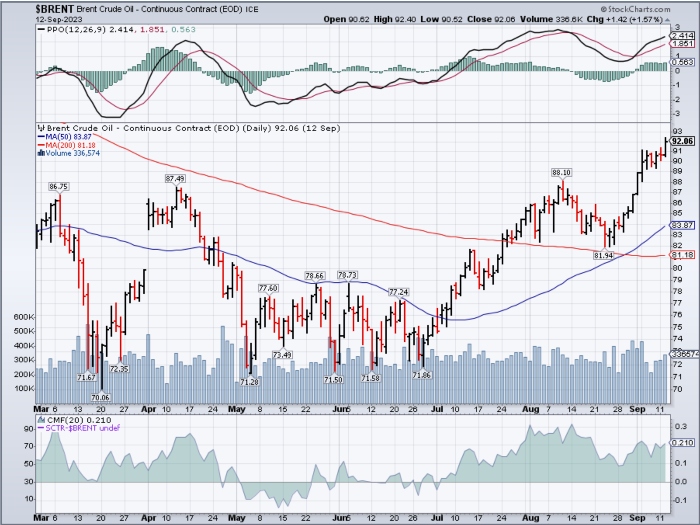

Let’s take a popular commodity like crude oil and provide an example of how to trade it.

Scenario: You believe that the price of crude oil will increase in the coming months due to increasing global demand and potential supply disruptions in oil-producing regions.

1. Research And Analysis

Begin by conducting thorough research on the oil market. Analyze factors such as geopolitical events, OPEC decisions, production levels, and global economic conditions that may impact oil prices.

2. Select A Broker

Choose a reputable broker that offers access to crude oil futures or contracts for difference (CFD) on oil prices. Deposit the desired amount of capital into your trading account, ensuring that you have enough funds to cover potential losses, as oil markets can be volatile.

3. Choose Your Trading Strategy

Decide on your trading strategy. Are you planning to hold a long-term position or make short-term trades based on technical analysis? Set your risk tolerance and profit targets accordingly.

4. Place Your Order

Using your trading platform, place an order to buy crude oil contracts. You can choose between buying actual futures contracts (which may require higher capital and involve physical delivery) or CFDs (which allow for more flexible trading without physical delivery).

5. Monitor The Market

Keep a close eye on the oil market. Stay updated on news and events that could affect oil prices. Use technical analysis tools and indicators to identify potential entry and exit points.

6. Implement Risk Management

Set stop-loss orders to limit potential losses and take-profit orders to lock in profits when oil reaches your desired price levels.

7. Review And Adjust

Regularly review your trading position and adjust your strategy as needed. If your analysis changes or market conditions shift, be prepared to adapt your approach.

8. Close Your Position

When your target price is reached or if market conditions change unfavorably, close your position by selling your crude oil contracts. Make sure to record your trades for tax and record-keeping purposes.

9. Evaluate Your Performance

After your trade is closed, assess your performance. Analyze what went well and what could be improved. Learning from each trade can help you refine your trading skills for future opportunities.

Consider starting with a demo account if you’re new to trading commodities to practice your strategies without risking real capital.

Bottom Line

Trading commodities can be both more profitable and riskier than stock or forex trading, depending on your skill, risk tolerance, and the specific commodities being traded.

It is essential to thoroughly research and understand the market, develop a well-defined trading strategy, and carefully manage risk when considering commodities trading.

Additionally, diversifying a portfolio with a mix of asset classes, including both stocks and commodities, can help balance risk and potential rewards.

FAQ

Why Trade Commodities?

Commodities offer exposure to a distinct asset class with the potential for uncorrelated returns compared to traditional stocks and bonds, reducing overall portfolio risk.

Their inherent volatility allows you to profit from short-term price fluctuations, and the use of leverage can amplify returns, making it appealing for those seeking rapid gains.

What Are The Most Popular Commodities To Trade?

The most popular commodities to trade include crude oil, gold, silver, natural gas, and agricultural products such as wheat, corn, and soybeans.

Crude oil, being a critical energy source, attracts significant attention due to its global demand and price sensitivity to geopolitical events. Precious metals like gold and silver are favored for their role as inflation hedges and safe-haven assets. Natural gas is essential for heating and electricity generation.

Agricultural commodities are influenced by factors like weather conditions and global food demand, making them attractive if you want to try to capitalize on supply and demand dynamics. These commodities are widely traded due to their liquidity, volatility, and economic significance.

Can You Trade Commodities 24/7?

No, commodities trading is not available 24/7. Markets operate within specific trading hours set by the exchanges where commodities are traded. These trading hours can vary depending on the type of commodity and the exchange itself.

While some commodities, particularly energy products, may offer extended trading hours that include overnight sessions, they are still bound by the exchange’s schedule, and trading occurs during defined market hours rather than around the clock.

You need to be aware of the specific trading hours for each commodity you wish to trade and the exchange where it is listed.

What Is The Role Of Forwards And Futures In Commodities Trading?

Forwards and futures contracts are very similar, though futures tend to have standardized terms, whereas the exact terms of a forward contract can be varied. Both can be used when trading commodities, either for the purpose of speculating or to achieve certainty on price.

Do All Brokers Support Trading Commodities?

No, not all brokers support trading commodities. While many brokerage firms offer a wide range of trading options, including stocks, bonds, and commodities, there are also specialized commodity brokers and futures commission merchants (FCMs) that focus exclusively on commodities and futures trading. The availability of commodities trading depends on the broker’s offerings and the type of instruments they provide.

If you are interested in commodities you should carefully select a broker that specifically supports trading commodities and provides access to the markets you wish to participate in, as different brokerages may offer different commodities and trading tools.

Guides on Specific Commodities

- Aluminium Brokers 2025

- Cannabis Brokers 2025

- Cattle Brokers 2025

- Cocoa Brokers 2025

- Coffee Brokers 2025

- Copper Brokers 2025

- Corn Brokers 2025

- Cotton Brokers 2025

- Gasoline Brokers 2025

- Gold Brokers 2025

- Iron Brokers 2025

- Lead Brokers 2025

- Lean Hogs Brokers 2025

- Lithium Brokers 2025

- Livestock Brokers 2025

- Natural Gas Brokers 2025

- Nickel Brokers 2025

- Oil Brokers 2025

- Orange Juice Brokers 2025

- Palladium Brokers 2025

- Platinum Brokers 2025

- Precious Metals Brokers 2025

- Silver Brokers 2025

- Soybeans Brokers 2025

- Steel Brokers 2025

- Sugar Brokers 2025

- Wheat Brokers 2025

- Zinc Brokers 2025

Recommended Reading

Article Sources

- Commodity Fundamentals: How To Trade The Precious Metals, Energy, Grain and Tropical Commodity Markets - Ronald C. Spurga, 2016

- Basics of Futures Trading - Commodity Futures Trading Commission

- A Beginner’s Guide To Commodity Trading - eToro

- What Are Commodities and How Do You Trade Them? - IG Index

- Major Global Trading Hubs - World Gold Council

- Energy - The Intercontinental Exchange

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com