5paisa Review 2025

Pros

- Huge investment offering including stocks, mutual funds, IPOs, ETFs, commodities and forex

- Free educational content with blog posts, online courses and articles suitable for all experience levels

- Two powerful platforms with stock screeners, financial calculators and daily news streams

Cons

- A minimum account balance of Rs 450 must be maintained in the brokerage account

- 5paisa’s mobile trading charges are expensive, at INR 100 per call

- Server downing issues have been reported

5paisa Review

5paisa is an Indian discount broker that supports trading in a range of financial instruments, from delivery and intraday stocks to currency futures and commodity options. The broker offers a decent trading platform, well-reviewed mobile application and competitive leverage rates. Read on to discover the advantages and disadvantages of trading with 5paisa.

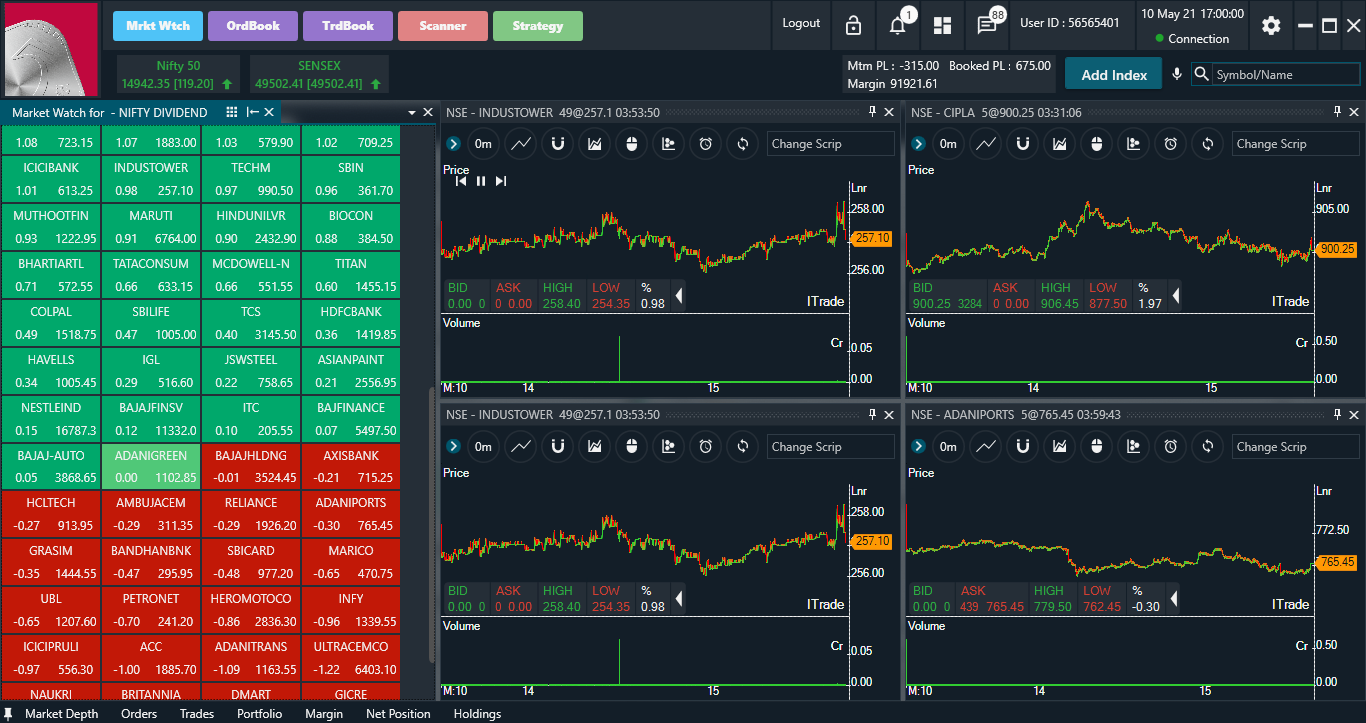

Platform

5paisa’s platform is available on any web browser, making it accessible from any device type. 5paisa’s trading website allows you to execute trades on all assets offered by the broker, as well as draw together your positions, view your portfolio and keep updated with the latest trading news.

For more frequent traders, 5paisa offers its Trade Station platform,which is an downloadable client with charting and advanced trading analysis tools. The advanced application offers features for comparing stock prices and maximising profit potential.

Markets

5paisa offers a handful of markets, including stocks, currency, futures, options, mutual funds and insurance products. The range of equities and derivatives is competitive, though some traders looking for more diverse portfolio options may be better served by brokers with cryptocurrencies and commodity CFDs.

Additional Features

Smart Investor

5paisa users can access ‘Smart Investor’ for INR 4,99. This platform is perfect for the trader that wants consistent advice and trusted tips. The model portfolio, idea list, market outlook and stock evaluation features all combine to create a platform for clients to stay updated on new trends and stocks to watch, as well as a good place to evaluate all the key information available. The algorithms suggest the best stocks for you to trade based on fundamentals and performance patterns.

Smallcase

5paisa users can also use ‘Smallcase’, which highlights a stock portfolio that has large earning potential and is estimated to perform well in current market conditions. This comprehensive feature helps to minimise risk as users invest in a portfolio rather than a singular stock. The Smallcase platform is user friendly, allowing you to buy, sell and alter trades at any time.

Swing Trader Tool

This tool can be accessed through 5paisa and is great for traders with short term goals. The swing trader site provides trading tips alongside critical analysis to help make profits.

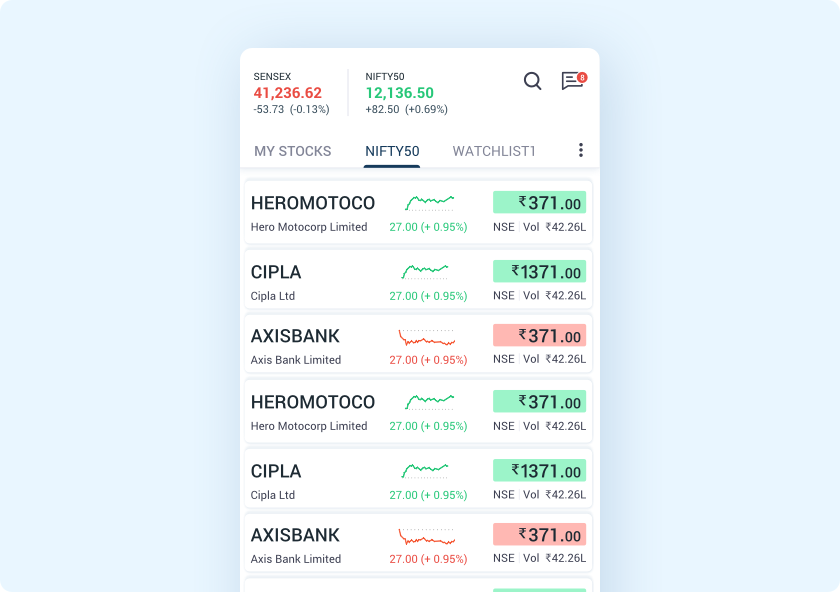

Mobile Apps

5paisa’s mobile app is one of few mobile trading platforms available from Indian brokers. With reviews averaging over four stars, the app seems to be easy to navigate but mostly useful for small traders who like to make quick trades on the go. The mobile app uses advisory features to provide a great user experience but has a lack of customisation and analysis tools.

Account Types & Fees

5paisa has flat rate charges per order that differ between account types. The more you pay for your account type, the less you pay per order. It is important to note that your 5paisa account must have at least INR 450 in it at any time.

Account charges:

- Optimum – No monthly plan charges and INR 20 per order.

- Platinum – INR 499 per month and INR 10 per order.

- Titanium – INR 999 per month and INR 10 per order (no charges on stock orders).

Leverage

Leverage trading allows you to take larger positions for the possibility to magnify your profits, or your losses. Below is a list of the leverage rates 5paisa offers:

- Currency Futures – 1:1

- Equity Intraday Trading –Up to 1:4

- F&O Exposure Intraday – Up to 1:5

- Option Writing Exposure –Up to 1:4 on normal days and 1:6 on expiry days

Opening Hours

As 5paisa is an Indian broker, its opening hours are in IST (GMT + 05:30).

- Pre-Opening Session: 09:00 – 09:15 IST (04:30 – 04:45 GMT)

- Trading Session: 09:15 – 15:30 IST (04:45 – 11:00 GMT)

- Closing Session: 15:40 – 16:00 IST (11:10 – 11:30 GMT)

Customer Support

5paisa’s contact details are:

- Email Address: support@5paisa.com

- Telephone: +91 89766 89766

5paisa Verdict

5paisa is a competitive Indian stockbroker with a range of equities and derivatives, a sleek mobile app and a good selection of account payment plans. The discount broker is an accessible option for newer traders with less capital, experience and time on their hands, though investors with more capital may prefer the more advanced features and improved asset ranges of larger brokers.

FAQs

How Can I Reach 5paisa’s Customer Support?

You can email the support team at support@5paisa.com or you can use the brokerage’s contact number +91 89766 89766.

How Do I Login To 5paisa?

You can login to your 5paisa account on the broker’s website or through its mobile application.

Is 5paisa A Discount Broker?

Yes. 5paisa is an Indian discount broker that charges a flat fee of INR 20 per trade, or zero on stock deliveries for the titanium plan (INR 999 per month).

How Do I Use 5paisa To Trade?

To get started with 5paisa you must first set up an account. If you already have a Demat account, you can just open a trading account, otherwise you can use the broker’s ‘all-in-one’ account. Once registered, simply log in and get trading.

What Are 5paisa’s Fees?

5paisa clients are subjected to commission charges on every order, which can be reduced by signing up to (and paying for) improved monthly plans. Without upgrading, the commissions are INR 20 per order. For INR 499 a month, charges are dropped to INR 10 per order. For another INR 500 (999 total), stock delivery charges are wiped out completely, though other assets are still charged.

Top 3 Alternatives to 5paisa

Compare 5paisa with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

5paisa Comparison Table

| 5paisa | Interactive Brokers | FOREX.com | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.3 | 4.5 | 4 |

| Markets | Forex, Stocks, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | INR 450 | $0 | $100 | $1 |

| Minimum Trade | $0 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SEBI | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | SVGFSA |

| Bonus | – | – | Active Trader Program With A 15% Reduction In Costs | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | MT4, MT5 |

| Leverage | – | 1:50 | 1:50 | 1:1000 |

| Payment Methods | 1 | 6 | 8 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by 5paisa and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| 5paisa | Interactive Brokers | FOREX.com | World Forex | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | No | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

5paisa vs Other Brokers

Compare 5paisa with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of 5paisa yet, will you be the first to help fellow traders decide if they should trade with 5paisa or not?