Best Forex Brokers In Zimbabwe 2026

To trade forex in Zimbabwe you will need to open an account with a broker. Although the Reserve Bank of Zimbabwe (RBZ) oversees forex trading domestically and is responsible for currency reforms that are combating the high inflation impacting the Zimbabwean Dollar, many residents turn to international brokers for their excellent platforms, fees and range of currency pairs.

Explore our pick of the best forex brokers in Zimbabwe. Every forex platform accepts traders from Zimbabwe and supports convenient deposit options like PayPal.

6 Top Forex Brokers In Zimbabwe

We have tested and analyzed hundreds of forex trading platforms and these 6 emerged as the best for traders in Zimbabwe:

-

1

XM

XM -

2

Vantage

Vantage -

3

PrimeXBT

PrimeXBT -

4

FXCC

FXCC -

5

XTB69-83% of accounts lose money when trading CFDs with this provider.

XTB69-83% of accounts lose money when trading CFDs with this provider. -

6

IG

IG

Here is a short overview of each broker's pros and cons

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- PrimeXBT - PrimeXBT offers forex trading on over 50 majors, minors and exotics with margin opportunities and zero commissions. The forex platform is fast, reliable and feature-rich based on our latest tests with 3 charts, 10 timeframes, and 91 technical studies - ideal for active trading strategies.

- FXCC - FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

- XTB - XTB provides access to 60+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

- IG - IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

Best Forex Brokers In Zimbabwe 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| PrimeXBT | 45+ | 0.1 | / 5 | $0 | - |

| FXCC | 70+ | 0.2 | / 5 | $0 | CySEC |

| XTB | 70+ | 1.0 | / 5 | $0 | FCA, CySEC, KNF, DFSA, FSC |

| IG | 80+ | 0.8 | / 5 | $0 | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

- There are no short-term strategy restrictions with hedging and scalping permitted

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- Unfortunately, cryptos are only available for Australian clients

PrimeXBT

"PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader."

William Berg, Reviewer

PrimeXBT Quick Facts

| GBPUSD Spread | Variable |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | Variable |

| Total Assets | 45+ |

| Leverage | 1:1000 |

| Platforms | Own |

| Account Currencies | USD, EUR, GBP |

Pros

- The web platform and app were built for technical traders with advanced charting features, a customizable layout and multiple order types including one-cancels-the-other (OCO).

- Maker and taker fees of at 0.01% and 0.02%, respectively, for crypto futures contracts are highly competitive within the industry.

- Ultra-fast execution speeds, averaging 7.12ms, make PrimeXBT an excellent option for day traders looking to secure the best prices in volatile markets.

Cons

- While common in the crypto industry, PrimeXBT lacks authorization from a trusted regulator, seriously elevating the risk for retail traders.

- The lack of integration with established platforms like MT4 will be limiting for traders familiar with the world’s most popular forex trading software.

- Despite improvements, the selection of around 100+ instruments still seriously trails competitors, notably OKX with its 400+ assets.

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| GBPUSD Spread | 1.0 |

|---|---|

| EURUSD Spread | 0.2 |

| EURGBP Spread | 0.5 |

| Total Assets | 70+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR, GBP |

Pros

- FXCC is trusted and licensed by the CySEC, a top-tier European regulator offering high standards of safeguarding

- The free education section, including the 'Traders Corner' blog, offers a large selection of materials that will serve all experience levels

- There are no deposit fees except industry-standard mining charges on cryptos, which is advantageous for active traders

Cons

- High withdrawal fees may catch out unsuspecting traders, including a significant $45 charge for bank wire payments

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

- While the range of currency pairs exceeds most alternatives, the selection of additional assets is narrow, and notably, there are no stocks

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| GBPUSD Spread | 1.4 |

|---|---|

| EURUSD Spread | 1.0 |

| EURGBP Spread | 1.4 |

| Total Assets | 70+ |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Platforms | xStation |

| Account Currencies | USD, EUR, GBP |

Pros

- XTB has boosted its interest rate on uninvested balances and added zero-fee ISAs (On ETFs and real shares, or 0.2% with transactions over €100k) for UK clients with a huge range of markets available.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

- With a vast range of instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

Cons

- XTB does not offer a raw spread account, which is becoming increasingly common among competitors like Pepperstone, and may disappoint day traders looking for the tightest spreads.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

IG

"IG continues to provide a comprehensive package with an intuitive web platform, best-in-class education for beginners, advanced charting tools bolstered by its recent TradingView integration, real-time data, and robust trade execution for experienced day traders."

Christian Harris, Reviewer

IG Quick Facts

| GBPUSD Spread | 0.9 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 0.9 |

| Total Assets | 80+ |

| Leverage | 1:30 (Retail), 1:250 (Pro) |

| Platforms | Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD |

Pros

- The proprietary web-based platform continues to caters to traders of all levels, with advanced charting tools and real-time market data useful for day trading, while IG has also added TradingView integration.

- IG obtained a crypto asset license from the FCA, allowing it to re-enter the UK market to provide buying, selling and storing opportunities on 55+ digital tokens with fees from 1.49%, and all within an FCA-licensed environment.

- The IG app offers a superb mobile trading experience with a clean design that helped it secure Runner Up at our 'Best Trading App' award.

Cons

- Beginners might find IG’s fee structure complex, with various fees for different types of trades or services, potentially leading to confusion or unexpected charges.

- IG applies an inactivity fee of $12 per month after 2 years, deterring casual investors.

- IG has discontinued its swap-free account, reducing its appeal to Islamic traders.

How We Choose Forex Brokers In Zimbabwe

To find the best forex trading platforms in Zimbabwe, there are several factors we, and you, should consider:

Trust

When you trade currencies through an online broker you need to be confident your money is secure.

This is especially important given Zimbabwean news reports of forex Ponzi schemes and managed account fraud. The country’s Reserve Bank has also warned that criminals are conducting illegal forex exchange operations via social media.

That’s why we only recommend forex brokers we trust – a judgement we make by weighing the strength of their regulatory credentials, years in the industry, reputation, and the observations of our hands-on testers.

- Pepperstone continues to demonstrate it’s a highly trusted broker with licenses from top-tier watchdogs, including the FCA in the UK, the CySEC in Europe, and the ASIC in Australia. Also reassuring is its global client base of over 400,000 traders and long track record since 2010.

Currency Pairs

Having access to a wide range of forex assets can help you discover opportunities.

Our analysis shows that not many brokerages offer trading on the Zimbabwean Dollar, which has faced hyperinflation and even been taken out of circulation for periods. However, our top picks offer a wide choice of majors, minors and exotics, providing investors with diverse trading opportunities.

- FOREX.com shines with its above-average selection of 80+ forex assets, including the ZAR paired with the USD, GBP, EUR and JPY.

Forex Platforms

If you’re making short-term forex trades, access to a fast, stable and intuitive charting platform is important.

MetaTrader 4 (MT4) continues to dominate the forex scene and is the most widely supported third-party platform by online brokers in Zimbabwe. It’s best for intermediate to advanced traders looking for rich technical analysis features and algo trading.

However, our years in the industry have shown us that the proprietary software provided by some brokers is increasingly strong, often sporting a more modern interface that makes for an attractive entry point for newer traders.

That’s why we favor forex brokers with platforms and apps that will serve forex traders of all levels and strategies, an assessment we make by personally testing software where practical.

Vantage – ProTrader

Vantage – ProTrader

We also look for tools that offer frequent updates on the most significant global market movements as well as specialized data on regions like Southern Africa.

- Vantage provides Zimbabwean forex traders with a first-rate toolkit that includes a slick bespoke platform and mobile app, plus MT4, MT5, and powerful third-party tools like ZuluTrade’s copy trader and Myfxbook’s automated solution.

Deposit Options

If you plan to make frequent deposits and withdrawals, choosing a forex broker with straightforward and low-cost payment methods is important.

This is especially important for traders in Zimbabwe where cash shortages have been reported and where mobile money and e-wallets are quickly becoming many people’s favored payment methods.

Our highest-rated forex trading platforms support classic card and wire transfers as well as fast and convenient alternatives, such as PayPal and EcoCash via PayNow, allowing you to fund your account with ease from Zimbabwe.

- Pepperstone remains one of the best forex brokers that accepts traders from Zimbabwe with no minimum deposit and convenient funding options like PayPal.

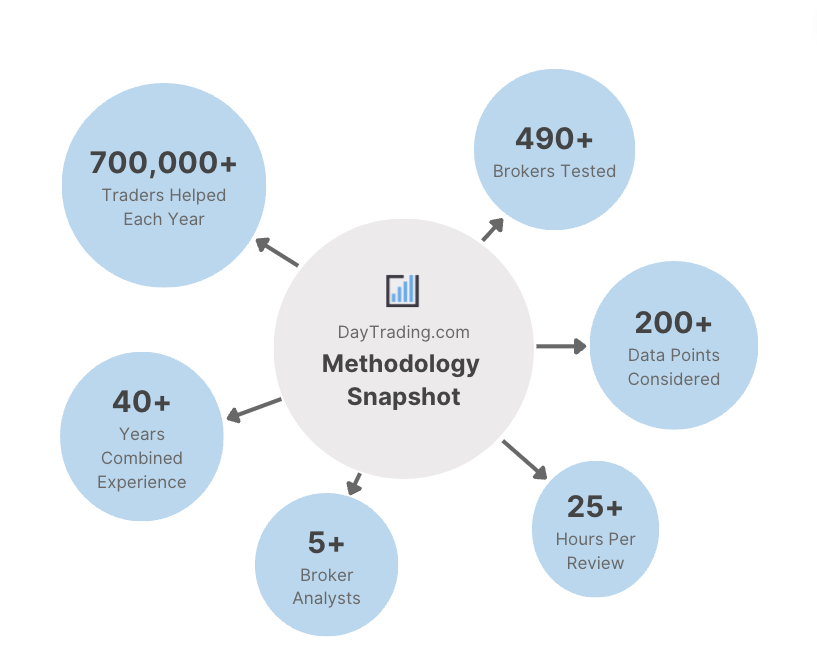

Methodology

We leveraged our extensive database of forex brokers to focus on those accommodating traders in Zimbabwe, ranking them based on an aggregate score derived from critical factors, including:

- Regulation by trusted authorities, if not Zimbabwe’s RBZ then respected watchdogs elsewhere.

- A wide selection of currency pairs, featuring currencies of interest to traders in Zimbabwe, such as ZAR/USD.

- An easy-to-use process for funding accounts, considering popular local methods such as PayPal and EcoCash.

- Advanced yet user-friendly charting tools for capitalizing on forex market opportunities.

FAQ

Is Forex Trading Legal In Zimbabwe?

Forex trading is legal in Zimbabwe. Day traders can sign up with online brokers, either onshore or offshore, to speculate on the price of currency pairs. Make sure to check the latest regulations and tax obligations in Zimbabwe.

Who Regulates Forex Trading In Zimbabwe?

Zimbabwe’s financial regulator is the Reserve Bank of Zimbabwe (RBZ), which oversees all foreign exchange activities in the country.

Because of the Zimbabwean Dollar’s instability in recent years, it’s a good idea to follow the RBZ’s latest announcements to stay updated about any changes to rules and regulations. For example, capital controls have been imposed in efforts to prevent the Zimbabwean Dollar’s slide.

How Much Money Do I Need To Start Forex Trading In Zimbabwe?

The amount of capital you need to begin forex trading in Zimbabwe depends on the broker’s minimum deposit. Although some require US$250 – around Z$80,000 – or more for an initial deposit, others like Pepperstone don’t have any minimum deposit, appealing to beginners.

Recommended Reading

Article Sources

- Reserve Bank of Zimbabwe (RBZ)

- Quartz - Zimbabwe Cracks Down On Currency Dealers

- PaymentsJournal - Cash Is Scarce in Zimbabwe, As Inflation Spirals

- The Evolution of Mobile Money in Zimbabwe

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com