Best CFD Brokers And Trading Platforms In South Africa 2026

The number of CFD brokers in South Africa has risen in recent years, driven in part by tougher restrictions from the European Securities and Markets Authority (ESMA), which prompted many trading platforms to expand into developing markets.

Explore the best CFD brokers in South Africa following firsthand tests and exhaustive analysis. We’ve pinpointed the CFD trading platforms that are regulated by the South African Financial Sector Conduct Authority (FSCA) and excel in catering to short-term traders in South Africa.

Top 6 CFD Trading Platforms in South Africa

Our findings show these are the 6 top brokers for South African CFD traders:

Here is a short overview of each broker's pros and cons

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- Vantage - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- Plus500 - Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

Best CFD Brokers And Trading Platforms In South Africa 2026 Comparison

| Broker | CFD Trading | FSCA Regulated | ZAR Account | Minimum Deposit | Leverage | Markets |

|---|---|---|---|---|---|---|

| XM | ✔ | ✔ | - | $5 | 1:1000 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Exness | ✔ | ✔ | ✔ | Varies based on the payment system | 1:Unlimited | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| AvaTrade | ✔ | ✔ | - | $100 | 1:30 (Retail) 1:400 (Pro) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Trade Nation | ✔ | ✔ | ✔ | $0 | 1:500 (entity dependent) | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Vantage | ✔ | ✔ | - | $50 | 1:500 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Plus500 | ✔ | ✔ | ✔ | $100 | ✔ | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Multiple account currencies are accepted for global traders

- There is a low minimum deposit for beginners

- Full range of investments via leveraged CFDs for long and short opportunities

Cons

- Fewer legal protections with offshore entity

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- The ECN accounts are very competitive with spreads from 0.0 pips and a $1.50 commission per side

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- The customer support team continue to provide reliable 24/7 support via email, live chat and WhatsApp

- Plus500 provides a specialized WebTrader platform designed explicitly for CFD trading, offering a clean and uncluttered interface

Cons

- Educational resources are limited compared to best-in-class brokers like eToro, impacting the learning curve for beginners

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

- Plus500’s lack of support for MetaTrader or cTrader charting tools might be a deal breaker for advanced day traders looking for familiarity

What To Look For In A South African CFD Broker

Our years testing CFD providers have taught us there are key factors to look at when picking a platform:

Trust

Choosing a broker you can trust to safeguard your funds is key when CFD trading, especially when South Africa has had its fair share of scams.

For example, South African-based CFD broker, Banxso, was unknowingly involved in the ‘Immediate Matrix’ scam that used a deep fake of tech Billionaire, Elon Musk, to encourage traders to part with millions of Rand. The reputation of this popular South African broker was exploited by scammers.

All our recommended brokers are licensed by the FSCA or another trusted regulator. Our experts check each licence claim against the relevant register, for example, the FSCA’s Authorized Financial Services Providers. Then we factor in our direct observations during the testing process, looking for dependable platforms for day trading CFDs.

- Plus500 stands out as a highly trusted CFD broker for South Africans with a license from the FSCA, a superb track record dating back to 2008, over 25 million users, and a listing on the London Stock Exchange, demonstrating a high degree of transparency. Our experts have also traded at Plus500 using real money and praise its secure trading environment.

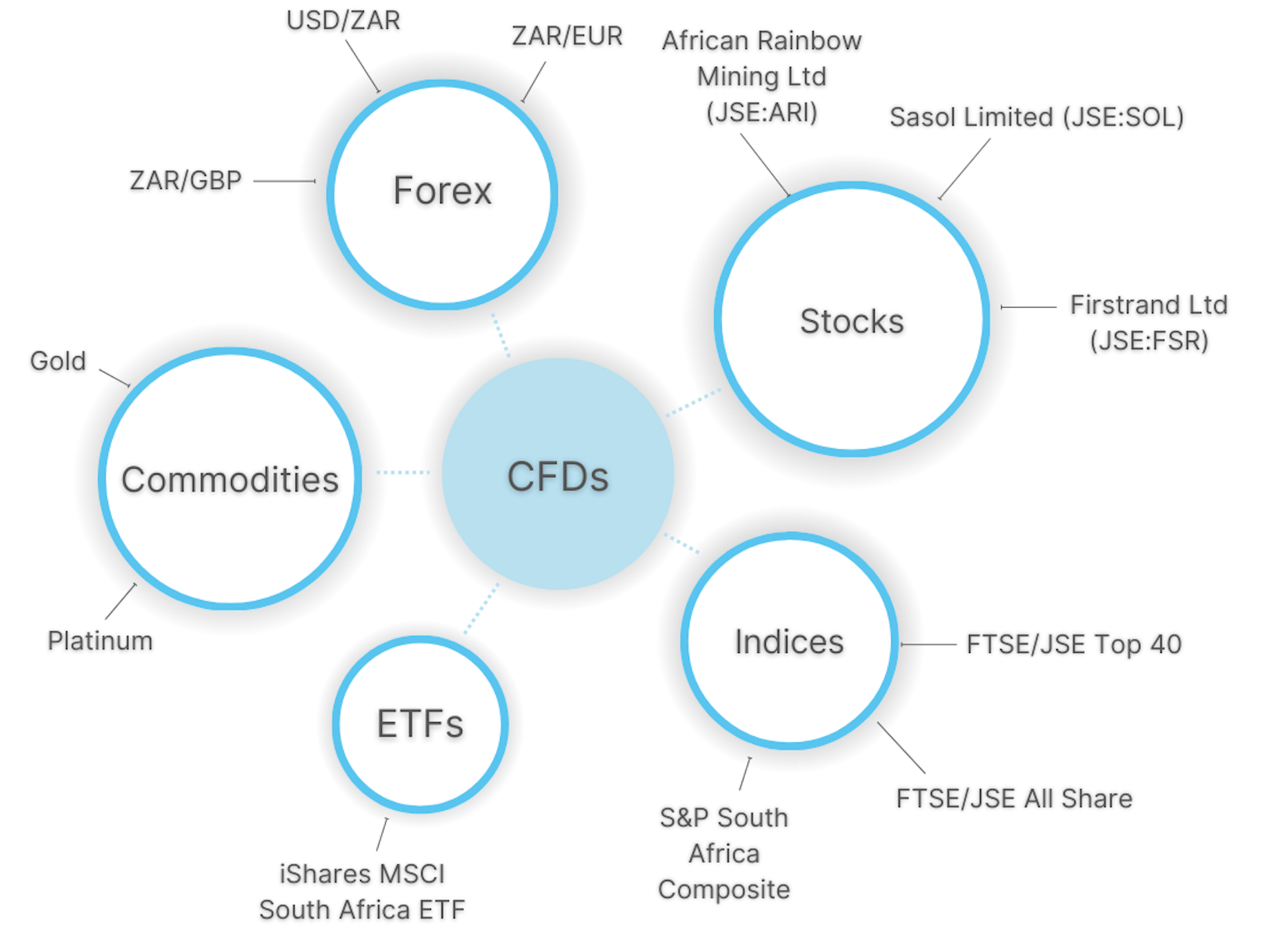

Underlying Assets

The top CFD brokers in South Africa offer opportunities to speculate on short-term price movements spanning popular financial markets. That’s why we explore the platforms of each CFD provider we test, investigating the range of underlying assets, from stocks and indices to forex, commodities and cryptos.

For example, forex CFDs can be used to speculate on currency pairs with a ZAR element, such as USD/ZAR, GBP/ZAR, and EUR/ZAR. The South African Rand is a relatively unstable currency compared to more commonly traded denominations. This is in part due to South Africa’s developing economy and heavy reliance upon trading partners, such as the US, for its wealth.

In 2023, the ZAR experienced a mass sell-off when reports that South Africa had provided weapons to Russia emerged. Investors feared it could spell Western sanctions given the war in Ukraine. ZAR hit a new low of 19.8 to the dollar.

South Africa also has its own stock exchange, the Johannesburg Stock Exchange (JSE). The 16th largest by market capitalization in the world, although not many brokers offer CFDs on South African stocks.

- IG offers an extensive suite of 17,000+ CFDs, including 80+ currency pairs with 4 having a ZAR component, as well as commodities like platinum, palladium, gold and iron ore, which South Africa is a major exporter of. Interactive Brokers also stands out with 50+ CFDs on JSE-listed stocks, including Firstrand Ltd (FSR), Impala Platinum (IMP) and Vodacom Group (VOD).

Leverage

Leverage trading is one of the main draws of CFDs, but it also increases the risk of large losses. Therefore we look for brokers who are transparent in their margin trading requirements (the amount of money you must put down to amplify your buying power).

Let’s say I want to use a CFD to take a short position on African Rainbow Minerals (JSE: ARI) following rumours of staff strikes at key locations.I put down 2,000 Rand and my CFD broker offers me 1:10 leverage, amplifying my position and potential results (profits and losses) to 20,000 Rand (10 x 2,000).

However, leverage is not capped, unlike with CFD providers regulated in Europe or Australia for example, where leverage is typically limited to 1:30 for retail investors. This makes the CFD trading environment in South Africa high-risk, so risk management is essential.

- XM offers high leverage up to 1:1000 on CFDs, alongside transparent margin requirements and a helpful calculator where you can set ZAR to the base currency. XM will issue a margin call if your account value drops below 50%, and will stop out positions when the account value is 20% of the required margin.

Pricing

Choosing a CFD trading platform with excellent pricing is key, especially for fast-paced strategies like day trading where profit margins can be slim.

That’s why we evaluate CFD fees on the most popular financial markets where possible, covering stocks, indices and commodities. We also consider additional charges, such as inactivity fees and conversion costs if depositing Rand to a trading account denominated in another currency.

Importantly, you should expect higher spreads when trading CFDs on South African assets due to relatively low trading volumes. For example, while we commonly see spreads of <1 pip on the EUR/USD, spreads on the USD/ZAR can reach 120+ pips from our analysis.

- Vantage excels in its competitive pricing models that cater to a range of CFD traders. Its Standard account offers commission-free trading with floating spreads from 1 pip with straightforward pricing for newer traders, while the Raw ECN and Pro ECN solutions are designed for experienced traders looking for the tightest spreads from 0.0 pips and commissions as low as $1.50.

Account Funding

Convenient, secure and low-cost deposits and withdrawals can make or break the CFD trading experience. That’s why we open accounts at CFD brokers we test and navigate the cashier portal to investigate the range of payment methods available.

For South Africans, we know that 60% of online transactions are completed using credit/debit cards or bank transfers. But e-wallets are becoming increasingly popular, for example, PayPal and Skrill.

- We love Trade Nation for these reasons: it’s affordable with no minimum deposit, CFD traders can open a ZAR-based account, and there is a great selection of e-wallets, including PayPal and Skrill, alongside Visa, Mastercard and bank transfers.

FAQ

Which Is The Best CFD Broker In South Africa?

We’ve listed, rated and evaluated the best CFD brokers in South Africa. Use our rankings to find the right platform for your needs.

Who Regulates CFD Trading Platforms And Brokers In South Africa?

The Financial Sector Conduct Authority (FSCA) regulates CFD trading platforms and brokers in South Africa.

It replaced South Africa’s Financial Services Board (FSB) in 2018 and is a trusted regulator, though not as respected as bodies like the FCA in the UK or ASIC in Australia.

How Much Money Do I Need To Open A CFD Trading Account In South Africa?

Our analysis shows you often need between 0 and 250 USD, or around 0 to 4,600 ZAR, to open a CFD trading account in South Africa.

That said, IG and Trade Nation have no minimum, making them stand-out options if you want an affordable, FSCA-regulated CFD trading platform.