Best Day Trading Platforms and Brokers in the US 2026

The best day trading platforms in the US cater to active short-term traders, offering trading on key markets like the Nasdaq and EUR/USD. The top brokers are also regulated by the CFTC, NFA or FINRA, provide accounts in US Dollars for convenient deposits, and offer reliable execution.

Explore the best day trading platforms in the US, chosen after hands-on testing and in-depth analysis. All recommended brokers welcome US day traders and have our experts’ confidence.

Top 6 Platforms For Day Trading In The US

After exhaustively evaluating 140 online brokers, these 6 platforms continue to stand out as the best for day traders in the United States:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

5

FOREX.com

FOREX.com -

6

Optimus Futures

Optimus Futures

This is why we think these brokers are the best in this category in 2026:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

Best Day Trading Platforms and Brokers in the US 2026 Comparison

| Broker | US Regulated | USD Account | Minimum Deposit | Markets | Platforms |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| NinjaTrader | ✔ | ✔ | $0 | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) | NinjaTrader Desktop, Web & Mobile, eSignal |

| Plus500US | ✔ | ✔ | $100 | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App |

| OANDA US | ✔ | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist |

| FOREX.com | ✔ | ✔ | $100 | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | WebTrader, Mobile, MT4, MT5, TradingView |

| Optimus Futures | ✔ | ✔ | $500 | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts | Optimus Flow, Optimus Web, MT5, TradingView |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Day traders can enjoy fast and reliable order execution

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

Cons

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

Choosing A Day Trading Platform In The US

There are several key factors to consider when deciding which platform to use for day trading:

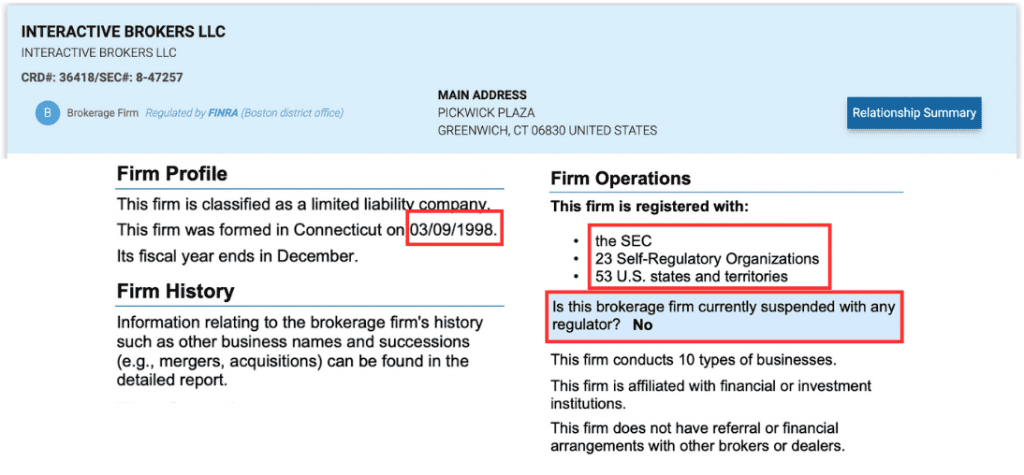

Choose A Trusted Broker

We only recommend US day trading brokers we’ve personally tested after weighing their regulatory credentials with their industry standing.

Several ‘Green-Tier’ regulators oversee day trading activities in the US:

- Securities and Exchange Commission (SEC): Responsible for regulating the securities industry, notably stocks and options exchanges.

- Commodity Futures Trading Commission (CFTC): Responsible for regulating derivatives and commodities trading.

- National Futures Association (NFA): Responsible for regulating derivatives trading, working alongside the CFTC as a self-regulatory organization.

- Financial Industry Regulatory Authority (FINRA): Responsible for overseeing brokerage firms, working under the SEC as a non-governmental organization. Its Pattern Day Trader (PDT) rule mandates traders with 4+ day trades in 5 days to keep a minimum of $25,000 in their accounts, and it limits day traders to borrowing up to 50% of the purchase price of securities. That said, US regulators have introduced plans to scrap the $25K minimum for pattern day traders. This move could open day trading up to smaller investors and spell good news for US brokers.

Regulators also enforce strict rules to help combat trading scams, which have targeted US traders in recent years. In 2022 for example, Finance Magnets reported that two American nationals, Patrick Gallagher and Michael Dion, used a fake investment firm, Global Forex Management, to swindle $30 million in investor deposits.

I recommend checking any broker you plan on day trading with is regulated in the US. You can do this by using FINRA’s BrokerCheck, which provides details on a company’s history and any disputes.

- IG scooped our vote as the most trusted broker. It’s authorized by 13 regulators including the CFTC in the US, boasts a 50+ year industry, and our experts have traded at IG with real money and reported a reliable day trading environment with no withdrawal issues.

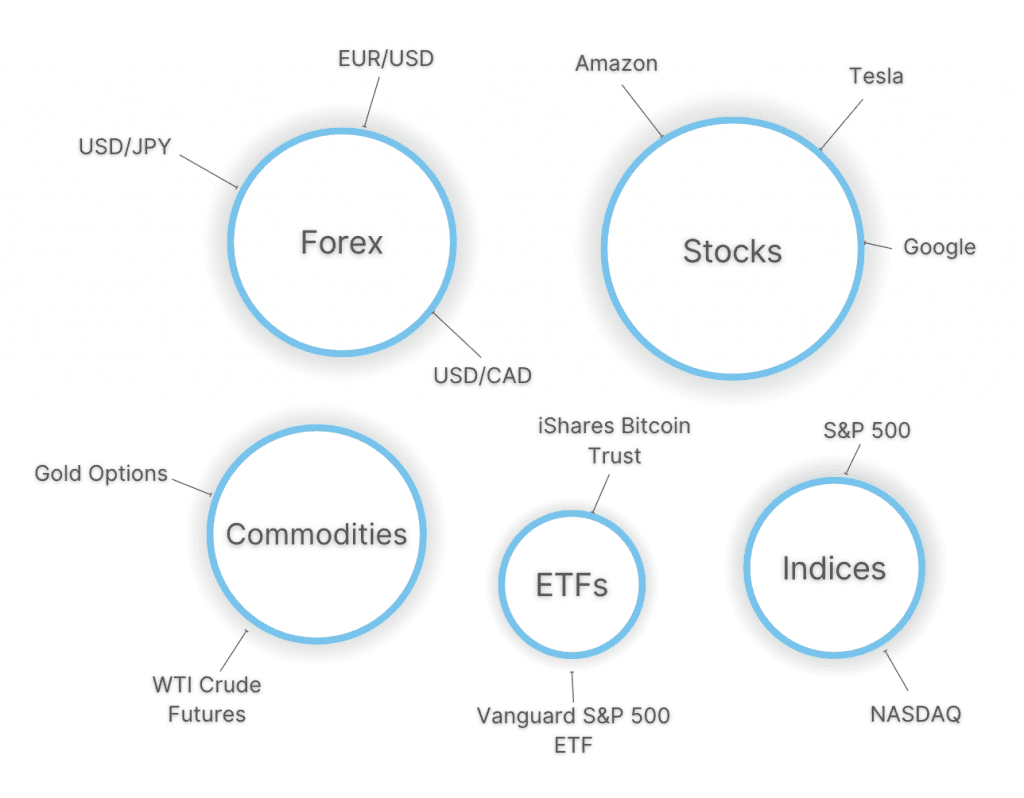

Choose A Broker With Wide Market Coverage

The best platforms provide access to a wide range of financial markets, catering to diverse day trading strategies.

We’ve used the platforms of every broker we’ve recommended and countless more, to make sure they offer trading on popular markets in the US, as well as opportunities in global financial markets.

American traders can speculate on forex with many currency pairs containing a US Dollar component, as well as stocks listed on key stock exchanges like the New York Stock Exchange and Nasdaq.

Additionally, many top platforms offer short-term trading on popular commodities like oil and natural gas through futures and options.

In January 2024, the SEC also approved the launch of new spot Bitcoin ETFs for US traders, including the iShares Bitcoin Trust, enabling investors to speculate on current prices without having to buy BTC.

Unlike many countries, CFD day trading is not permitted in the US. These popular short-term trading vehicles are over-the-counter products that are restricted under US securities laws.

- Interactive Brokers has spent years adding to its suite of instruments, now offering a fantastic selection of products for active traders spanning 15 markets, 24 countries and 27 currencies, including stocks, ETFs, futures, futures options, fixed income, mutual funds, cryptocurrencies, indices and warrants.

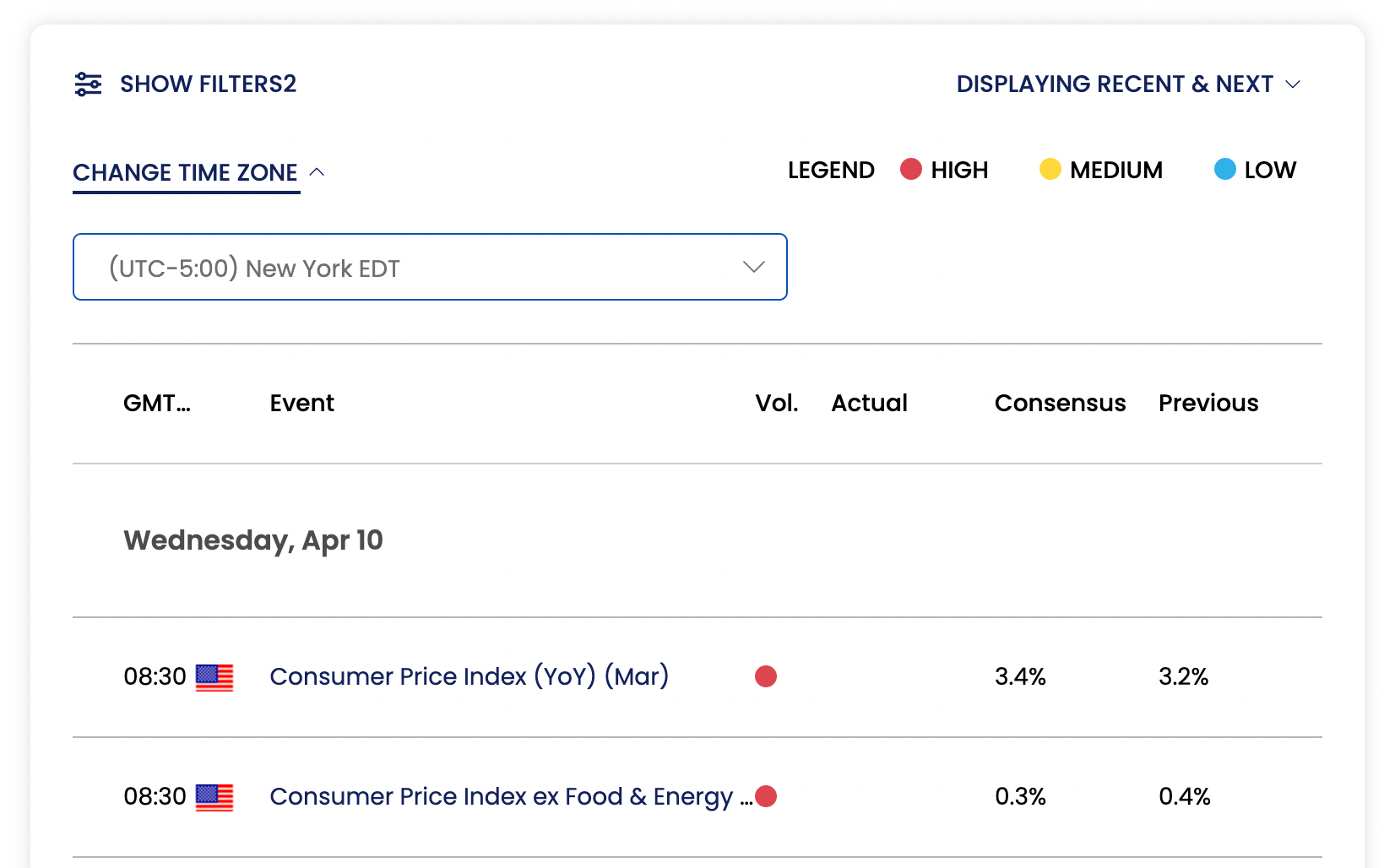

Choose A Broker With Low Fees

We only recommend brokers with competitive pricing for active day traders, for whom a large volume of trades can lead to mounting fees.

To identify low-cost day trading brokers in the US, we evaluate fees on popular assets, for example, USD currency pairs like the EUR/USD and GBP/USD, and major indices.

We then balance the trading fees with the quality of the overall day trading environment. For example, it may be worth paying more for tools that provide insights into events that could impact US financial markets such as interest rate decisions from the Federal Reserve Board and yields on bills auctioned by the Department of Treasury.

- FOREX.com offers a cost-effective RAW account for serious day traders, with spreads from 0.0 and a $7 commission per $100K on forex and zero commissions on stocks, options and mutual funds. Its Active Trader program can further cut costs by 15%. The platform also provides excellent tools, including a user-friendly financial calendar that you can filter by the US, event type, and volatility, helping to identify short-term trading opportunities.

Choose A Broker With Terrific Charting Tools

The top US brokers stand out by providing intuitive platforms with excellent charting tools that are often employed by short-term traders.

Our experts have spent hundreds of hours testing dozens of charting platforms and day trading apps, balancing ease of use with the range of charting styles, timeframes, indicators and algo trading features.

MetaTrader 4 and MetaTrader 5 remain the most popular third-party day trading platforms, especially among seasoned traders. However, they face increasing competition from the likes of TradingView, which sports a more intuitive interface in our view, lending it to beginners.

Since many US brokerages are focused on securities, specialized terminals are also often available, notably Charles Schwab’s thinkorswim.

Alternatively, brokers like Plus500 have invested heavily in building their own software in recent years, though it still lacks the customization capabilities and account analytics available on leading third-party solutions, despite a slick design that we really enjoy.

- IG’s almost unmatched selection of platforms and apps cater to all types of day traders and strategies. Alongside the broker’s proprietary platform and MT4, active traders can use the advanced ProRealTime, which delivers over 100 technical indicators for short-term analysis.

Choose A Broker With Reliable Order Execution

Efficient order execution is crucial, especially for day traders speculating on volatile US stocks like Beneficient (NASDAQ: BENF) and Etao International Co., Ltd (NASDAQ: ETAO), where minor price discrepancies can affect profits.

Let’s say I plan to buy 500 shares of ETAO at $5.00, targeting a quick profit by selling at $5.10. However, slow execution resulted in a buy price of $5.05, and I ended up selling at $5.10.Instead of the $50 profit I anticipated, I only made $25 in profit.

That’s why we analyze order execution policies and data where available, with our experts deeming <100 milliseconds ‘fast’ for day traders. This will help ensure low latency – the least possible downtime between order placement and fulfilment.

- OANDA continues to stand out with excellent execution speeds as low as 12 milliseconds on popular markets like EUR/USD. US clients can also request regular trade execution reports, as per the NFA’s transparency requirements.

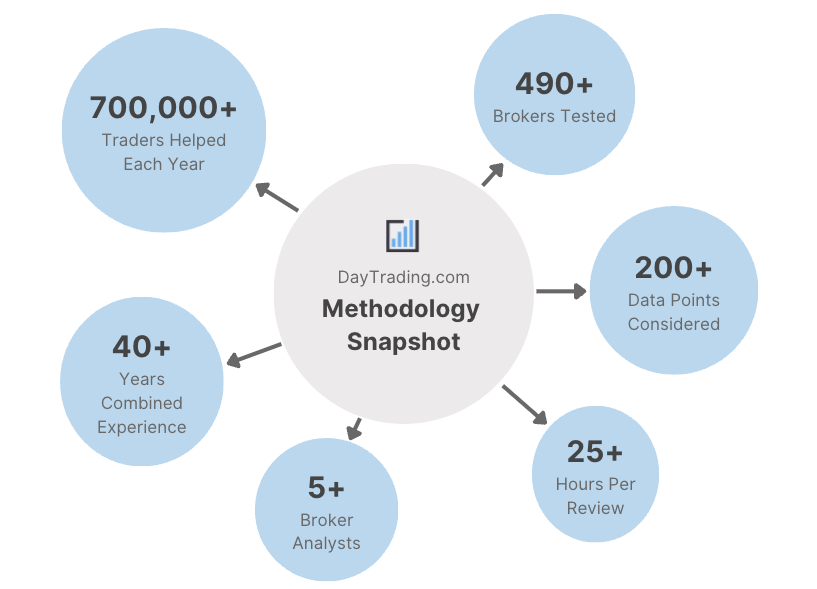

Methodology

To find the best day trading platforms in the US, we took our vast database of brokers and filtered them on those accepting investors from the United States. We then ranked them on their overall rating which draws on over 200 data points and criteria, notably:

- Whether they are trusted and regulated by the SEC, CFTC, FINRA or another reputable agency.

- Whether they offer short-term trading on a range of markets, such as US equities and currencies.

- Whether they offer low day trading fees, focusing on key markets like EUR/USD and US stocks.

- Whether they deliver intuitive charting platforms and day trading apps following tests.

- Whether they offer fast and reliable order execution for active trading strategies.

I do not recommend day trading for inexperienced investors. Regardless of the broker you choose, there is a high risk you could incur substantial losses in a short period. Consult with a financial advisor if you are unsure whether day trading aligns with your goals.

FAQ

Which Is The Best Day Trading Platform In The US?

Use our list of the top day trading brokers in the US to find a suitable platform for your requirements.

All our recommended brokers have been tested by our industry experts, though the choice of day trading platform is ultimately a personal decision.

Who Regulates Day Trading Brokers And Platforms In The US?

Several regulators oversee day trading platforms and activities in the US, including the SEC, CFTC, NFA and FINRA. These authorities often coordinate efforts to combat scams, penalize misconduct, and provide investor protection for day traders.

That said, day trading is inherently risky with many active investors losing money. You can also lose more than your deposit as negative balance protection is not provided as standard in the US, despite it being a requirement in other heavily regulated jurisdictions, notably the UK and Australia.

How Much Money Do I Need To Start Day Trading In The US?

Based on our database of 140 day trading brokers, US investors will often need between $0 and $250 to open an account.

That said, some day trading platforms stand out with no minimum, catering to budget investors. The highest-rated are Interactive Brokers and OANDA.

Most US day trading platforms support deposits in debit card, wire transfer and ACH transfer.

Recommended Reading

Article Sources

- Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Financial Industry Regulatory Authority (FINRA)

- Pattern Day Trading Rule - FINRA

- BrokerCheck - FINRA

- Nasdaq Stock Exchange

- Beneficient (NASDAQ: BENF)

- Etao International Co., Ltd (NASDAQ: ETAO)

- New York Stock Exchange

- SIPC Investor Protection

- US Trading Scam - Finance Magnates

- Federal Reserve Board

- Department of Treasury

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com