Forex Trading in Taiwan

One of the most technologically advanced countries, the Taiwanese economy is ranked 22nd in the world in terms of GDP, with around $570 billion in foreign exchange reserves and a developed regulatory landscape.

Looking to start forex trading in Taiwan? This guide for beginners unpacks the Taiwanese forex market and goes over taxes and regulations. We also walk through a trade on the USD/TWD.

Quick Introduction

- The New Taiwan dollar (currency code TWD) is Taiwan’s official currency with approximately $24 billion in Taiwanese dollars going through the foreign exchange market daily.

- The Financial Supervisory Commission (FSC) supervises forex trading in Taiwan, protecting retail investors, while the Central Bank of the Republic of China (Taiwan) manages foreign exchange policies and the stability of the TWD.

- For traders in Taiwan focused on TWD currency pairs like USD/TWD, the Asian session (8:00 AM to 6:00 PM Taiwan Time (TST)) is an optimal time to trade, while the London-New York overlap (9:00 PM to 1:00 AM TST) offers opportunities for global forex pairs like USD/JPY.

Top 4 Forex Brokers in Taiwan

After our latest hands-on tests, these 4 platforms are the frontrunners for Taiwanese forex traders:

How Does Forex Trading Work?

Forex trading involves the conversion of one currency into another, with around $6.6 trillion worth of transactions every single day.

The Taiwanese dollar (TWD) is commonly traded against other key currencies, with some of the most popular pairs including the TWD/USD and TWD/JPY, mirroring Taiwan’s strong trade links with the US and Japan.

Let’s say you believe the TWD will strengthen against the USD due to upcoming economic data indicating a trade surplus (more exports than imports). You could sell the USD/TWD pair at an exchange rate of 32.00, employing leverage of 1:30, meaning you control a position worth $6,000 with $200 in margin.

If, when the economic data comes out, the exchange rate falls to 31.50, the TWD has strengthened. You could then close your trade at this rate, profiting from the 0.50 difference (less any fees).

Is Forex Trading Legal In Taiwan?

Forex trading is legal, provided you use a licensed broker and adhere to the rules laid down by the Financial Supervisory Commission (FSC) and the Central Bank of the Republic of China (Taiwan).

- The FSC requires that providers of forex trading services in Taiwan, both local and global, must obtain a license. The FSC then supervises firms to ensure they meet requirements surrounding capital adequacy, risk management and operational transparency.

- The CBC is focused on managing foreign exchange policies and the stability of the Taiwan dollar. Traders may want to stay abreast of announcements surrounding interest rate decisions, future monetary policy decisions, and currency interventions in the case of substantial volatility, which could all impact the TWD.

Taiwan’s strict regulations provide a high degree of protection for forex traders, with many credible and reputable brokers working in the Taiwanese market.

Is Forex Trading Taxed In Taiwan?

Gains from forex trading in Taiwan are taxed anywhere between 5-40% as part of income tax bands, with payments due to the National Taxation Bureau of Taipei.

The Taiwanese tax year ends on 31 December, with deadlines for filing individual income tax returns by 31 May of the following year.

Given Taiwan’s evolving tax requirements, I recommend consulting a local tax professional to ensure you correctly report your forex trading activities and optimize for any deductions or allowances that may be available.

When Is The Best Time To Trade Forex In Taiwan?

The best time to trade currencies is generally when the market is liquid and volatile, providing more trading opportunities alongside lower costs and favorable execution.

However, it depends on the currency pairs you want to trade:

- Asian trading session (8:00 AM to 6:00 PM TST). Alongside Taiwan, this includes key financial hubs like China, Japan and Singapore, making it suitable for trading currency pairs like USD/TWD and JPY/TWD.

- London-Asia overlap (4:00 PM to 7:00 PM TST). While less active for TWD pairs, this overlap brings heightened market activity for global currency pairs like the EUR/USD and GBP/USD.

- London-New York overlap (9:00 PM to 1:00 AM TST). Although outside of standard working hours in Taiwan, this is the most active period in the foreign exchange market globally, bringing enhanced volatility and liquidity for majors like the USD/JPY and EUR/USD.

A USD/TWD Trade

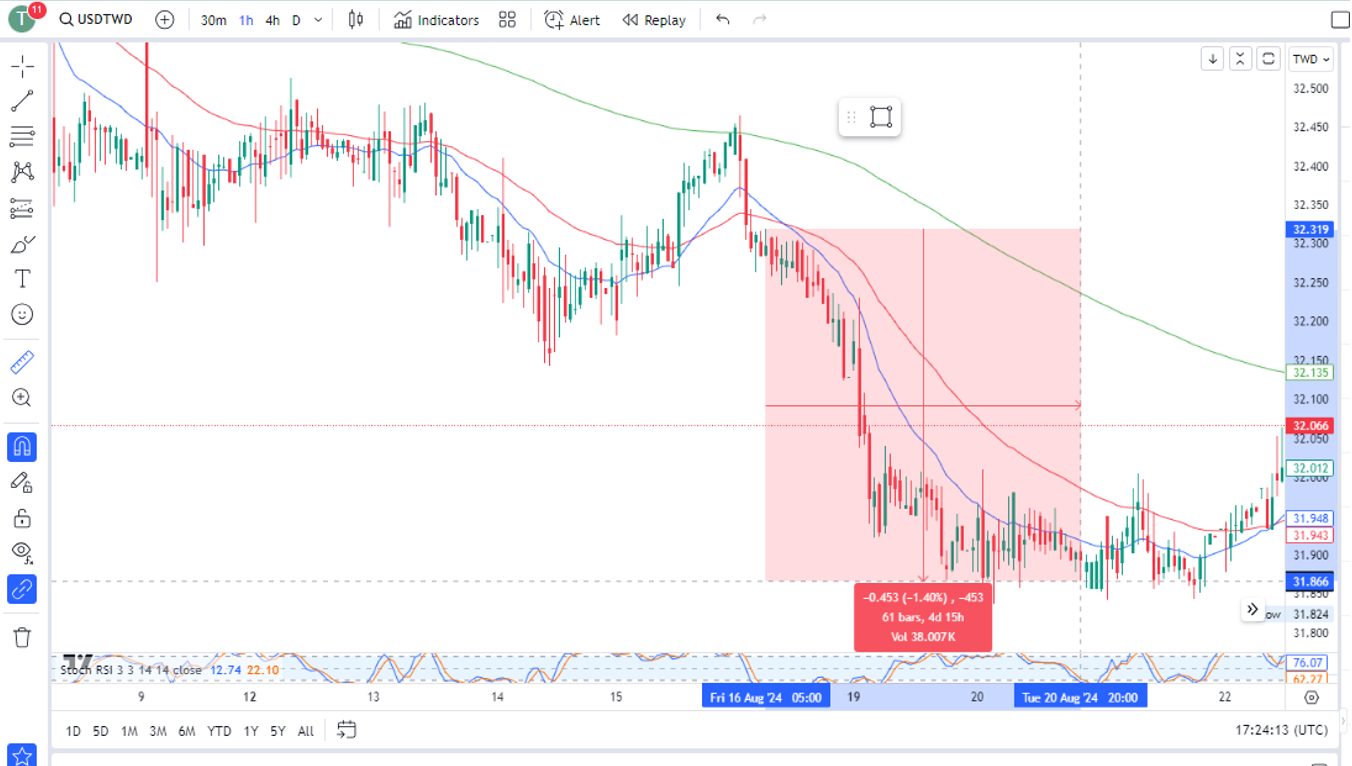

Here is an example of a USD/TWD currency trade I executed on the 1-hour chart.

With clear signs of a bearish engulfing candle on the daily timeframe, I checked the 4-hour and 1-hour charts for confluence and waited for price action to break through the 200, 50 and 20-day moving averages on the 1-hour and 4-hour charts.

With all three timeframes now pointing to bearish price action, I entered the trade on the 1-hour chart.

Trade Entry & Exit

With price action breaking through the 20, 50, and 200-day moving averages on all three timeframes and stochastic indicators pointing to bearish price action, I executed a short trade at 32.03, setting a stop loss order to minimize any potential losses.

Having set both stop loss and take profit orders before entering the trade, I monitored events closely and paid attention to established levels on the 1-hour, 4-hour, and daily timeframes.

I allowed my trade to play out as planned and exited the trade at 31.900 (an established level tested many times before).

Bottom Line

You can make money trading forex in Taiwan, provided you know what you are doing and manage your risk. And with strict regulations overseen by the FSC, you can trade with peace of mind, knowing your Taiwanese dollars are protected.

However, the risks remain high so only risk what you can afford to lose. Also, to avoid forex trading scams, use DayTrading.com’s pick of the top forex day trading platforms.

Once you’ve chosen a provider, deposit Taiwanese dollars in your trading account by either bank transfer, debit card, or if supported, local payment providers such as Taiwan Pay or Ezpay.

Recommended Reading

Article Sources

- Taiwan Foreign Exchange Reserves - CEIC

- Taiwan Data Sets - IMF

- Financial Supervisory Commission (FSC)

- Central Bank of the Republic of China (Taiwan)

- National Taxation Bureau of Taipei

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com