Best Forex Brokers In The Netherlands 2026

Searching for the best forex broker in the Netherlands to trade currencies online? Explore our expert-tested and rated selection of top forex trading platforms, tailored for Dutch traders.

Many of our recommendations are authorized by top-tier EU regulators like the Authority for the Financial Markets (AFM), providing a secure trading experience. They also offer EUR accounts for convenient deposits.

Top Forex Brokers In The Netherlands

We've tested dozens of forex brokers that operate in the Netherlands to identify these 6 exceptional options:

-

1

XTB75% of accounts lose money when trading CFDs with this provider.

XTB75% of accounts lose money when trading CFDs with this provider. -

2

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

3

XM

XM -

4

Vantage

Vantage -

5

AvaTrade

AvaTrade -

6

FOREX.com74-76% of retail accounts lose money with this provider.

FOREX.com74-76% of retail accounts lose money with this provider.

This is why we think these brokers are the best in this category in 2026:

- XTB - XTB provides access to 60+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

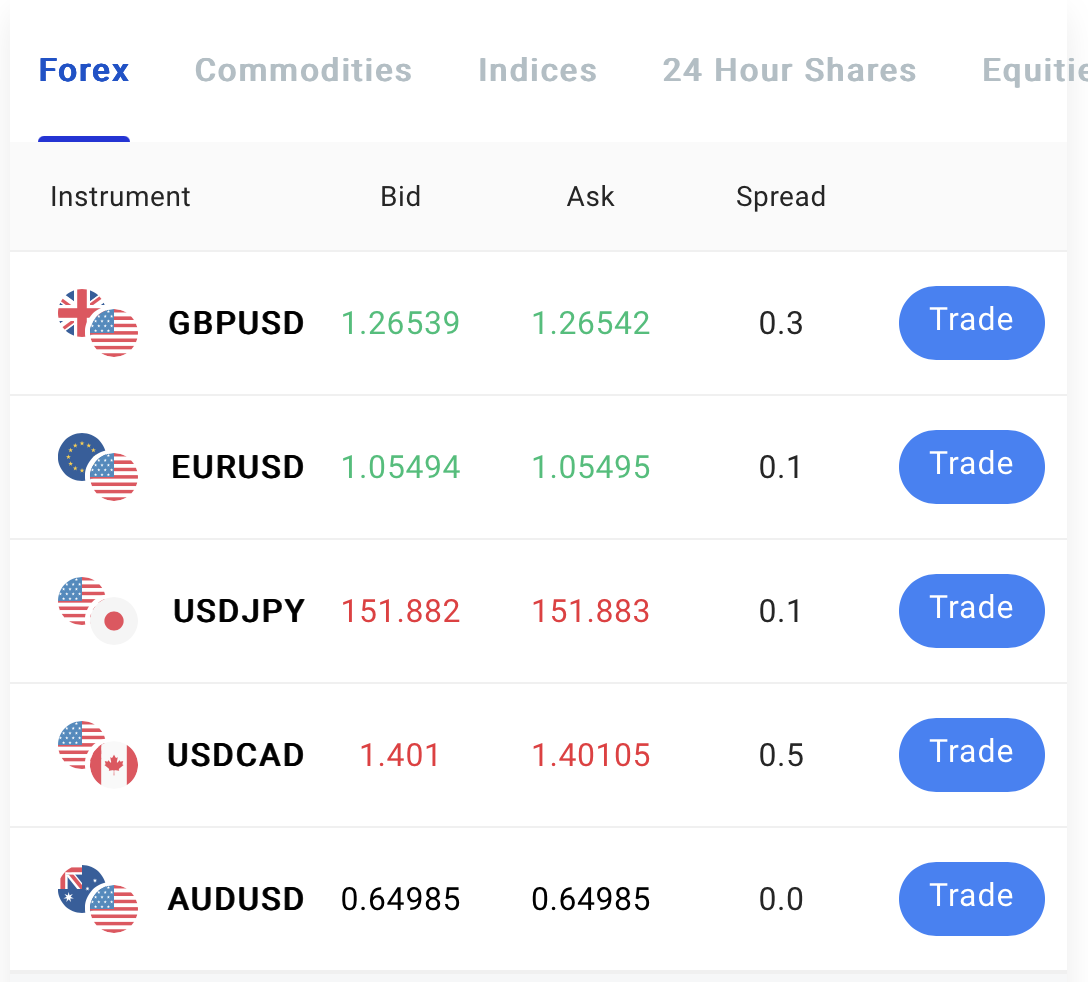

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

Best Forex Brokers In The Netherlands 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | EUR Account | Regulator |

|---|---|---|---|---|---|---|

| XTB | 70+ | 1.0 | / 5 | $0 | ✔ | FCA, CySEC, KNF, DFSA, FSC |

| Eightcap | 50+ | 0.0 | / 5 | $100 | ✔ | ASIC, FCA, CySEC, SCB |

| XM | 55+ | 0.8 | / 5 | $5 | ✔ | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Vantage | 55+ | 0.0 | / 5 | $50 | ✔ | FCA, ASIC, FSCA, VFSC |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ✔ | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| FOREX.com | 84 | 1.2 | / 5 | $100 | ✔ | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| GBPUSD Spread | 1.4 |

|---|---|

| EURUSD Spread | 1.0 |

| EURGBP Spread | 1.4 |

| Total Assets | 70+ |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Platforms | xStation |

| Account Currencies | USD, EUR, GBP |

Pros

- The xStation platform continues to impress with its user-friendly interface and intuitive features, including customizable news feeds, sentiment heatmaps, and trader calculator, reducing the learning curve for newer traders.

- With a vast range of instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

Cons

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:30 |

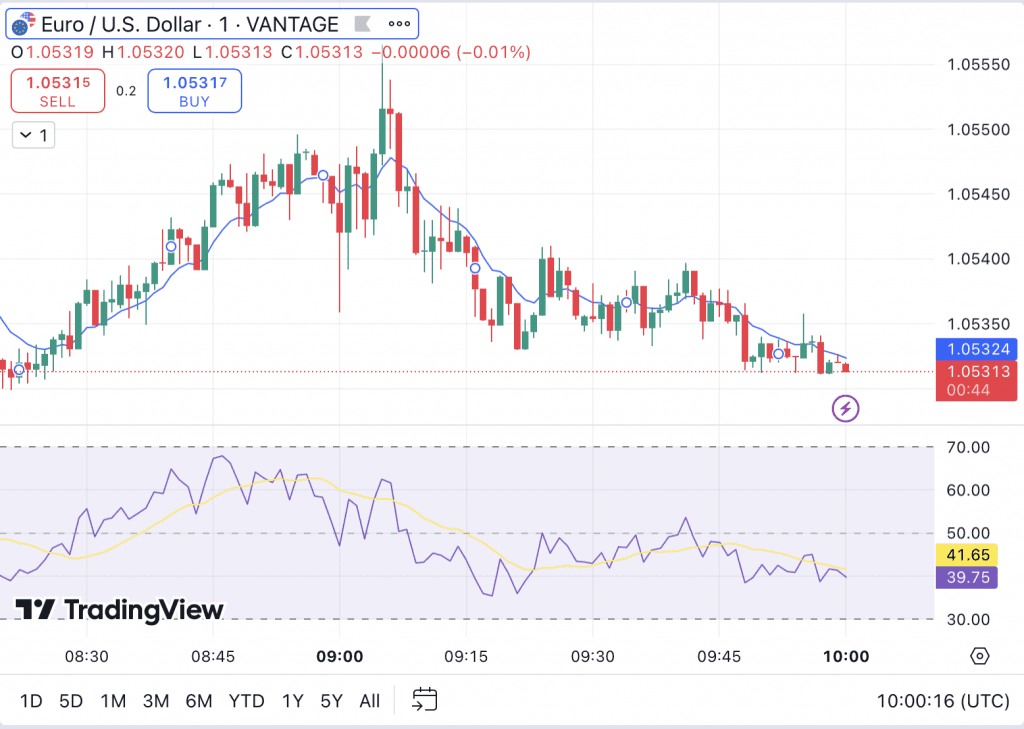

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

Cons

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:30 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

Cons

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- Unfortunately, cryptos are only available for Australian clients

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:30 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

How We Chose The Best Forex Brokers In The Netherlands

To pinpoint the top forex trading platforms in The Netherlands, we started by narrowing down our database of 140 brokers to include only those that welcome Dutch residents and support forex trading.

Next, we ranked these platforms based on overall scores from our in-depth evaluations. Our team of traders and industry professionals combined insights from 200+ data points with hands-on tests to assess their performance.

Our top 10 forex brokers earned their place by delivering in these five crucial areas:

Trust

You should never invest your euros with a broker you can’t rely on. The risks are too high. For example, two Dutch individuals were handed prison sentences for their role in a large-scale forex scam which led to the clients’ “Enormous losses”.

That’s why we consider our Regulation & Trust Rating the starting point of every review – carefully evaluating the credibility of providers.

Traders in the Netherlands have the advantage of a ‘green-tier’ regulator in the AFM, which plays an active role in licensing and monitoring forex providers to ensure fair play.

Another advantage is the access to firms that are licensed by other reliable EU regulators like Germany’s BaFin or Cyprus’ CySEC, thanks to EU passporting rules.

As well as strong regulatory oversight, we look for brokers with proven credentials, demonstrated through a long and clean record in the industry.

Beware of scam brokers, some of which attempt to deceive traders by imitating or ‘cloning’ reputable firms. Always carefully check the URL and credentials before registering with a new forex provider.I also recommend checking its license with the Dutch regulator, for example, by searching the AFM’s Registers.

- FOREX.com has long been one of our most trusted brokers in the Netherlands with a near-perfect Regulation & Trust score of 4.9/5, thanks to authorization by top EU bodies like CySEC. This, together with a fantastic forex offering, has earned FOREX.com DayTrading.com’s runner-up ‘Best Forex Broker’ in previous years.

Currency Pairs

You will want a broker that supports a large range of currency pairs to maximize your access to trading opportunities.

Or at the very least, for traders in the Netherlands, you may want to trade currency pairs containing the euro (EUR).

Since this is the second most traded currency in the world according to the Bank For International Settlements (BIS), you’ll have no difficulty accessing common EUR pairs like EUR/USD, EUR/GBP and EUR/JPY.

- Pepperstone remains near the top of our charts for forex market access in the Netherlands with its offering of 100+ major, minor and exotic currency pairs. But it isn’t just this exceptionally wide range that caught our attention: Pepperstone’s fees are also among the best around, with our testers accessing spreads around 0.1 pips on EUR/USD and EUR/GBP in the Razor account.

Pricing

We look for forex brokers with tight spreads and low or no commission fees, since trading fees quickly add up when you’re day trading currencies.

Fortunately, EUR pairs are among the most popular, which tends to make for tight spreads. For instance, the EUR/USD pair is traded more than any other, and that can often translate to razor-thin spreads that can touch 0.0 pips.

To access such a tight spread will usually mean paying a commission fee, but nowadays ultra-competitive brokers have brought this charge down to a few euros per lot.

- We consistently rank IC Markets as one of the best budget brokers, but there’s nothing cheap about what it offers traders in the Netherlands. Despite the market-beating fees, which average 0.1 pips on the EUR/USD, IC Markets has cut no corners, providing top-rate charting options with the MetaTrader, cTrader and TradingView, as well as analysis providers Autochartist and Trading Central and even free VPS hosting.

Charting Platforms

Day trading forex is a fast-paced and often highly technical style that requires a quick and powerful charting platform.

You’ll need flexible time frames, charting options, and a good range of tools and indicators to read the charts and plan trades. Some platforms also directly integrate research tools such as news feeds and economic calendars into the chart interface.

Some advanced day traders also look for algo trading tools, using these to set up automated forex strategies.

MetaTrader 4 has long been the most popular choice among forex traders, and it performs all of these functions well.

However, it is starting to show its age after decades, and we increasingly look for brokers that support newer platforms with more a contemporary design and features.

My personal favorite platform is TradingView – for me, it’s the one that has it all. The platform interface is slick, modern and packed with features for forex traders.Most importantly, it allows me to conduct all my research on one platform as it has an integrated news feed, calendars and social trading functions.

- Vantage continues to provide flexible charting options for every stripe of forex trader, with MT4 and MT5 for traditionalists, TradingView for a more contemporary platform, and the proprietary ProTrader catering to seasoned traders. It also covers bases for analysis and copy trading through tools like DupliTrade.

Account Funding

We made sure forex platforms have convenient account options for traders in the Netherlands – especially those that accept euros as a base currency and have accessible funding methods.

One such attractive option for Dutch traders is iDEAL, as this is a fast and secure digital method that’s accepted by many banks in the Netherlands.

We also looked for brokers that allow people to sign up without breaking the bank. While from our analysis most forex providers will take on new clients with an initial deposit of around EUR 200, we have found options that are significantly cheaper at EUR 20 or even lower, catering to beginners.

- XM‘s range of account payment options are still some of the most convenient for traders in the Netherlands, with popular digital solutions including Apple Pay and Google Wallet, as well as traditional card and wire transfers. It’s also one of the most accessible brokers, with an ultra-low $5 initial deposit requirement.

FAQ

Who Regulates Forex Brokers in the Netherlands?

In the Netherlands, online brokers providing forex trading services must be registered with the Autoriteit Financiële Markten (Authority for Financial Markets; AFM). This is the country’s financial markets authority responsible for ensuring transparent and fair trading practices.

Thanks to the European Union’s passporting framework, forex brokers licensed by other EU regulators, such as CySEC in Cyprus, can also operate legally in the Netherlands. However, they must comply with EU-wide standards set by the European Securities and Markets Authority (ESMA).

What Is The Best Forex Trading Platform In The Netherlands?

The ideal forex trading platform for Dutch traders depends on their trading experience, goals, and budget.

For example, new traders might find Vantage‘s ProTrader platform the easiest to get started on, while experienced forex day traders will enjoy IC Markets‘ ultra-tight spreads and fast execution.

DayTrading.com provides a comprehensive list of top forex brokers catering to traders in the Netherlands, suitable for all types of active forex traders, so check our recommendations to get started.

Recommended Reading

Article Sources

- Autoriteit Financiële Markten (Authority for Financial Markets; AFM)

- AFM’s Registers

- OTC Foreign Exchange Turnover - Bank For International Settlements

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com