Forex Trading in Namibia

Namibia’s economy, with a GDP of approximately $12 billion and a relatively small population of 2.5 million, offers unique opportunities for forex traders to profit from currency fluctuations.

Forex trading is gaining traction in the country, driven by Namibia’s growing internet penetration, estimated at 51% (roughly 1.37 million Internet users).

This guide is a valuable resource if you’re new to forex trading in Namibia. It provides practical tips and emphasizes the importance of a strong foundation for making informed trading decisions.

Quick Introduction

- The Namibian dollar (NAD) is pegged to the South African rand (ZAR) at a 1:1 ratio. However, unlike the frequently traded ZAR, the NAD has trading limitations due to its lower liquidity.

- The New York session (15:00 to 23:00 CAT) overlaps with the London session between 15:00 and 19:00 CAT, and exhibits significant market activity, offering excellent opportunities for trading pairs like ZAR/USD and ZAR/EUR.

- In Namibia, both the Bank of Namibia (BoN) and the Namibia Financial Institutions Supervisory Authority (NAMFISA) regulate forex trading. The BoN oversees foreign exchange flows and currency policy, while NAMFISA regulates the entities that facilitate forex trading, focusing on consumer protection.

Top 4 Forex Brokers in Namibia

Following our in-depth tests, these 4 platforms are a cut above the rest for Namibian forex traders:

How Does Forex Trading Work?

Forex trading involves speculating on the price movements between different currency pairs, such as the Namibian Dollar (NAD) against the US Dollar (USD).

Let’s say you believe the NAD will strengthen against the USD, then you may buy the USD/NAD pair. If the exchange rate moves from 17.50 to 17.00, meaning the Namibian Dollar strengthens, you could sell your position at a profit (less any fees). However, if the NAD weakens and the rate moves to 18.00, you would incur a loss.

Our investigations show that the NAD is not as frequently traded or easily accessible at online brokers in large quantities.In contrast, the ZAR is widely available on top forex platforms, offering alternative trading opportunities for Namibian traders.

Is Forex Trading Legal In Namibia?

Forex trading is legal in Namibia. The BoN and NAMFISA regulate the activity.

These regulatory bodies ensure that forex trading is conducted in compliance with the country’s financial laws and regulations, protecting traders and maintaining the integrity of the financial market.

While the BoN focuses on the overall monetary policy and banking sector, NAMFISA focuses on ensuring the stability, transparency, and integrity of non-banking financial institutions, particularly in their interactions with consumers in the forex market.

Is Forex Trading Taxed In Namibia?

In Namibia, profits generated from online forex trading may be subject to taxation. You must report these earnings to the Namibia Revenue Agency (NamRA).

For individual traders, forex profits are considered part of personal income and are taxed according to Namibia’s progressive income tax rates.

These rates range from 18% for annual income exceeding NAD 50,000 to 37% for income over NAD 1.5 million. As your FX trading income increases, so does your tax liability, reflecting Namibia’s progressive tax structure.

Accurate and detailed records of your currency trading activities, including profits and losses, are crucial for ensuring compliance with Namibian tax laws.

I recommend consulting with a local tax professional who can provide guidance on reporting forex trading income correctly and applying any deductions or allowances.

When Is The Best Time To Trade Forex In Namibia?

The best time to trade forex in Namibia depends on when the major global forex markets overlap, providing higher liquidity and more trading opportunities.

Namibia operates in the Central Africa Time (CAT) zone, UTC+2.

- The London session (10:00 to 19:00 CAT) is one of the most active forex trading sessions. It’s particularly important for trading currency pairs involving the euro (EUR), British pound (GBP), and Swiss franc (CHF). The London session offers high liquidity and volatility, making it an ideal time for trading.

- The New York session (15:00 to 23:00 CAT) overlaps with the London session between 15:00 and 19:00 CAT, increasing market activity. This overlap is the most active trading period globally, offering excellent opportunities for trading pairs like ZAR/USD and ZAR/EUR.

- While the Asian session (02:00 to 11:00 CAT), particularly the Tokyo market, is less volatile compared to the London and New York sessions, it can still be advantageous for trading currency pairs involving the Japanese yen (ZAR/JPY) and Australian dollar (ZAR/AUD). However, liquidity tends to be lower.

Example Forex Trade

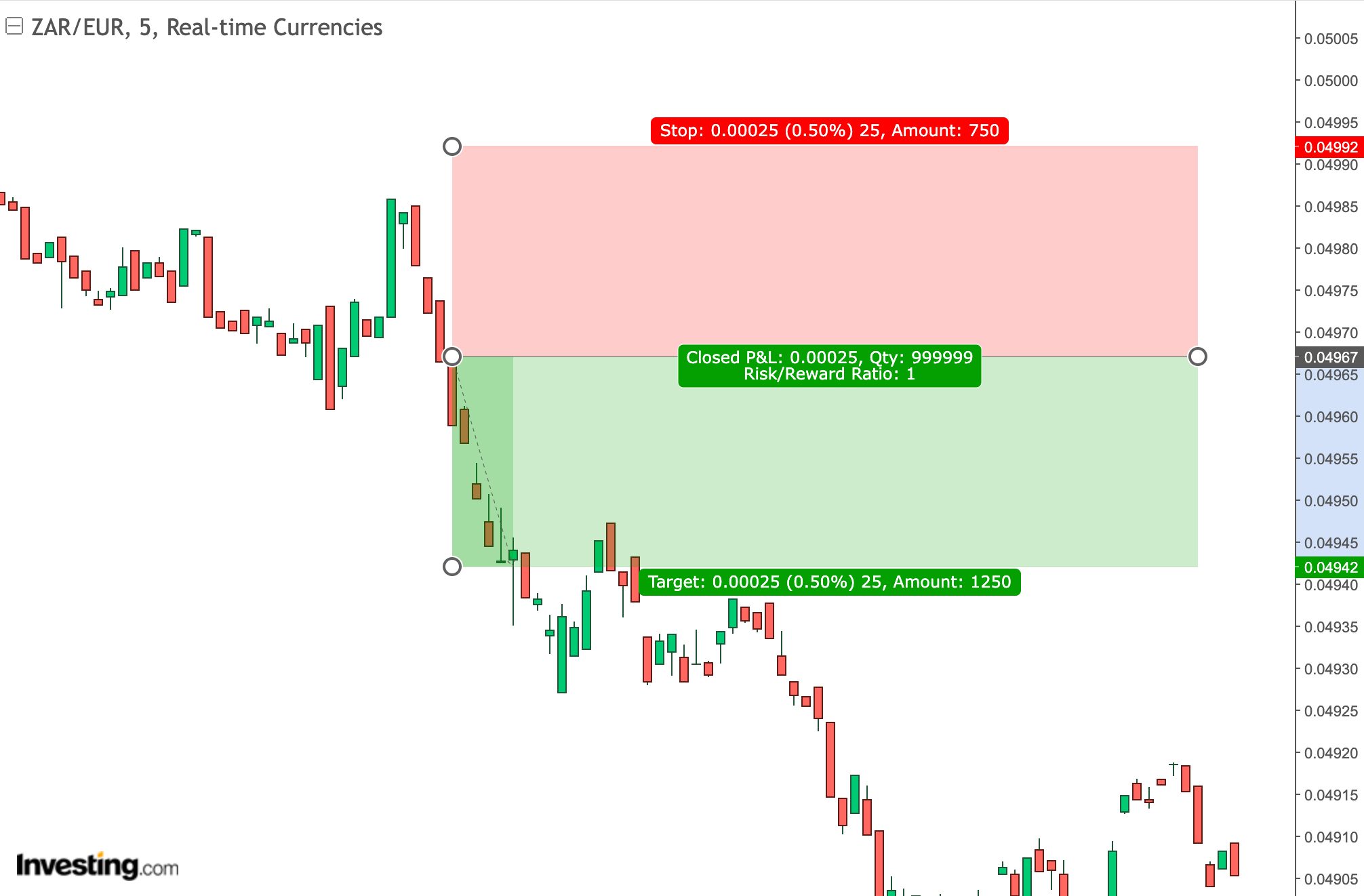

Let’s explore a hypothetical scenario where I engage in a short-term forex trade.

In this scenario, I trade the South African rand (ZAR) against the euro (EUR), given that the NAD may be less suitable for active trading due to its low liquidity which can result in higher trading fees.

Event Background

I followed economic developments in the Eurozone, particularly a highly anticipated announcement regarding the region’s inflation data.

The European Central Bank (ECB) had been under pressure to manage inflation effectively, and the announcement revealed that inflation had moderated more than expected, easing concerns about the Eurozone economy.

This positive news suggested that the ECB might be less aggressive in tightening monetary policy, bolstering confidence in the EUR.

Anticipating that the EUR would strengthen against other currencies, including the ZAR, I prepared to make a trade on the ZAR/EUR currency pair.

Trade Entry & Trade Exit

As soon as the inflation data was released, I observed an immediate reaction in the forex market, with the EUR starting to gain strength against the ZAR.

Analyzing the market conditions, I noticed a clear upward momentum in the EUR, supported by high trading volumes and positive market sentiment.

Recognizing this as an opportune moment, I entered the trade by shorting (selling) the ZAR/EUR pair, effectively betting on the rand’s decline against the euro.

To manage my risk, I placed a stop-loss order above a key resistance level where the pair had previously faced selling pressure. This ensured that any sudden reversal in the market would limit potential losses.

As the trading day unfolded, the euro continued to gain ground, pushing the ZAR/EUR pair lower, as I had anticipated. I watched the trade closely, trailing my stop-loss to protect the profits accruing as the ZAR continued its downward trajectory.

Toward the latter part of the trading session, I noticed that the pair was approaching a significant support level, where the downward momentum began to slow, and the price started consolidating.

Sensing that the market was running out of steam and that a reversal could occur, I decided it was prudent to exit the trade at this point. I closed my position, locking in the gains from the rand’s depreciation against the euro.

Trade Summary

This trade was a successful example of how timely analysis and quick action can lead to profitable results in forex trading.

The positive European inflation data provided a strong catalyst for the euro’s rise, and by entering the trade as the market began reacting, I could capitalize on the movement in the ZAR/EUR pair.

Carefully managing risk with a strategically placed stop-loss and exiting the trade near a key support level allowed me to secure my profits before any potential market reversal.

Overall, this trade reinforced the importance of staying informed about global economic developments and acting decisively when opportunities arise.

Bottom Line

Forex trading in Namibia is regulated by the Bank of Namibia and the Namibia Financial Institutions Supervisory Authority, but regulation is limited.

Forex profits are subject to taxation by the Namibia Revenue Authority, and accurate record-keeping is essential for compliance.

The best time to trade currencies online depends on your preferences and a well-defined trading plan.

To get started, use DayTrading.com’s selection of the best forex trading platforms in Namibia.

Recommended Reading

Article Sources

- Bank of Namibia (BoN)

- Namibia Digital Devices and Services - Kepios

- Namibia Financial Institutions Supervisory Authority (NAMFISA)

- Namibia Revenue Agency (NamRA)

- Namibia GDP - IMF

- Namibia Taxes on Personal Income - PWC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com