Best MetaTrader 4 (MT4) Brokers In 2026

Since launching in 2005, MetaTrader 4 (MT4) has become a favorite with active traders thanks to its excellent charting, customization, automated trading through Expert Advisors (EAs), and widespread support from brokers.

Delve into DayTrading.com’s pick of the best MT4 brokers. Every provider has been tested by our expert team, which includes experienced traders who have spent countless hours developing their own MetaTrader algorithms.

Top 6 MetaTrader 4 Brokers

As of our latest tests in February 2026, we've evaluated 140 brokers and found these 6 best for trading on MT4:

-

1

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

2

FOREX.com

FOREX.com -

3

xChief

xChief -

4

InstaTrade

InstaTrade -

5

Exness

Exness -

6

IC Markets

IC Markets

Why Are These The Brokers With The Best MT4 Integration?

Here is why we think these are the top MT4 brokers:

- OANDA US is the best MT4 broker in 2026 - When we tested OANDA’s MT4, the standout was its proprietary plugin suite - especially for order book data and advanced charting. Micro-lot trading and no minimum deposit make it accessible. Automation ran smoothly and mobile MT4 performed reliably, with fast sync and clean trade execution.

- FOREX.com - During our tests, FOREX.com's MT4 stood out for fast execution and a rich suite of custom indicators. The platform supports micro lots, automation via EAs, and mobile trading. Add-ons like integrated Trading Central and real-time news made strategy testing and analysis seamless.

- xChief - When we tested XChief’s MT4, it delivered tight spreads from 0.3 pips with $2.50 per lot commission on ECN accounts. The platform supported fast execution, seamless EA automation, and mobile trading. A solid bonus for active traders was the rebate program and VPS hosting, which kept latency low during strategy testing.

- InstaTrade - During our hands-on tests, InstaTrade’s MT4 offered reliable execution, a wide range of CFDs and support for micro accounts. Automation via EAs ran without issue. The platform includes built-in analytics tools but lacks advanced plugin extras.

- Exness - When we tested Exness’s MT4, execution was near-instant while automation via EAs ran flawlessly, and the platform supported nano lots with flexible leverage. The mobile MT4 was stable, and Exness’s real-time analytics widgets added useful trade transparency.

- IC Markets - When we tested IC Markets’ MT4, execution was consistently among the fastest we've seen - ideal for high-frequency strategies. Spreads averaged 0.1 pips on EUR/USD with a $7 per lot commission. EA automation, VPS integration, and advanced tools like Depth of Market made the platform a standout for serious algo traders.

Compare The Best MT4 Brokers On Key Attributes

Find the right MT4 broker for you with our comparison of key features:

| Broker | MT4 Integration | Instruments | Regulators |

|---|---|---|---|

| OANDA US | ✔ | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | NFA, CFTC |

| FOREX.com | ✔ | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | NFA, CFTC |

| xChief | ✔ | CFDs, Forex, Metals, Commodities, Stocks, Indices | ASIC |

| InstaTrade | ✔ | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures | BVI FSC |

| Exness | ✔ | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| IC Markets | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, CMA, FSA |

How Safe Are These MT4 Brokers?

How reliable are the top MT4 brokers and do they have features that help protect your funds?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| Exness | ✘ | ✔ | ✔ | |

| IC Markets | ✘ | ✔ | ✔ |

Mobile MT4 Trading Comparison

Are these brokers good for trading on MT4 from mobile?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ | ||

| Exness | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ |

Are The Top MT4 Brokers Suitable For Beginners?

Traders new to MT4 should use brokers that allow trading with virtual money (a demo account) alongside other features that beginners will benefit from.

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| Exness | ✔ | Varies based on the payment system | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots |

Compare Advanced Trader Features

Are these brokers with MT4 integration suitable for advanced traders?

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✔ | ✘ | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ |

Compare The Ratings Of Top MT4 Brokers

Discover how the top MT4 brokers stack up in key areas from our hands-on tests.

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| OANDA US | |||||||||

| FOREX.com | |||||||||

| xChief | |||||||||

| InstaTrade | |||||||||

| Exness | |||||||||

| IC Markets |

Compare Fees For Trading On MT4

The cost of trading on MT4 with a broker will add up over time.

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| OANDA US | ✘ | $0 | |

| FOREX.com | ✘ | $15 | |

| xChief | ✘ | - | |

| InstaTrade | ✘ | - | |

| Exness | ✘ | $0 | |

| IC Markets | ✘ | $0 |

How Popular Are These MT4 Brokers?

Some traders prefer the most popular MT4 brokers, i.e those with the most clients.

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Exness | |

| xChief | |

| FOREX.com | |

| IC Markets |

Why Trade On MT4 With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- The broker offers a transparent pricing structure with no hidden charges

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

Why Trade On MT4 With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

Why Trade On MT4 With xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- Traders can access a copy trading solution via the MetaQuotes Signals service

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

Why Trade On MT4 With InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

Cons

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

Why Trade On MT4 With Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Why Trade On MT4 With IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

How Did We Pick The Top MT4 Brokers?

To compile a list of the best brokers that support MT4, we:

- Leveraged our evolving database that currently stands at 140 online brokers;

- Identified the approximately 75+, or around 30%, that support MT4 on desktop, web or mobile;

- Ranked those firms by their rating, blending 200+ data points with the hands-on observations of our testers to identify the 10 absolute best.

How To Choose A MetaTrader 4 Broker

There are six key questions to ask yourself when choosing a broker with access to MetaTrader 4:

1. Does the broker support MT4 on your preferred device?

Almost every brokerage we’ve assessed supports the downloadable desktop client, web-accessible terminal, or iOS and Android-friendly mobile app. However, consider your needs:

- Desktop: Ideal for advanced traders needing full features, customization and offline access to historical data. It also has superior speeds because it directly connects to the broker’s servers.

- Web: Suitable for beginners, but lacks custom indicators and automated trading. It may also have slower speeds that could impact fast-paced strategies like day trading.

- Mobile: Great for the growing class of on-the-go traders. The app has been downloaded over 10 million times, although the Android version gets slightly higher user ratings than its Apple counterpart.

2. Does the broker support your desired instruments on MT4?

While all MT4 brokers offer forex trading, some increasingly provide additional asset classes like stocks, indices, commodities, and crypto.

Check available instruments before funding an account, as some brokers (eg AvaTrade) may not offer specific products like options trading on MT4.

3. Does the broker offer low trading fees?

Look for brokers with tight spreads and low or zero commissions, especially if you’re a day trader dealing in high volumes. However, be aware that some brokers may offer wider spreads on MT4 than on their proprietary platforms.

ECN MT4 brokers like Pepperstone are great for low fees, with spreads starting at 0.0 and 25%+ rebate programs for active traders.

4. Does the broker provide an MT4 demo account?

Most brokers offer MT4 demo accounts, letting you test strategies risk-free. These typically last 14-30 days and come with $10,000-$100,000 in virtual funds.

If you need ongoing access to MT4 demo mode, brokers like IC Markets offer unlimited paper trading as long as you’re active.

5. Is the broker trustworthy?

Not all MT4 brokers are regulated by reputable authorities, which increases the risk of you falling victim to trading scams and can limit access to safeguards like negative balance protection.

6. Does the broker offer unique MT4 add-ons?

Some brokers provide a superior MT4 trading experience with extra features to inform trading decisions.

For example, Pepperstone offers 28 indicators and EAs through its MT4 Smart Trader Tools.

Getting Started With MT4

Download our free MetaTrader 4 Tutorial PDF.

I’ve spent a lot of time over the years trading on MT4. My verdict? MT4 is a solid platform for traders at all levels. Its balance of power and simplicity is one reason it’s stood the test of time. From advanced charting and analysis to automated trading, it offers everything you need to be successful in today’s fast-paced markets.

Drawing on my direct experience with MT4, I’ll walk you through its key features, how you can customize it to fit your style, and share tips to help you get up and running smoothly.

Downloading And Installing

Getting MT4 up and running is pretty straightforward:

- Go to the official MetaTrader 4 website or your broker’s site to download the platform.

- Run the installer and follow the instructions.

- Once installed, open MT4 and log in with your trading account details.

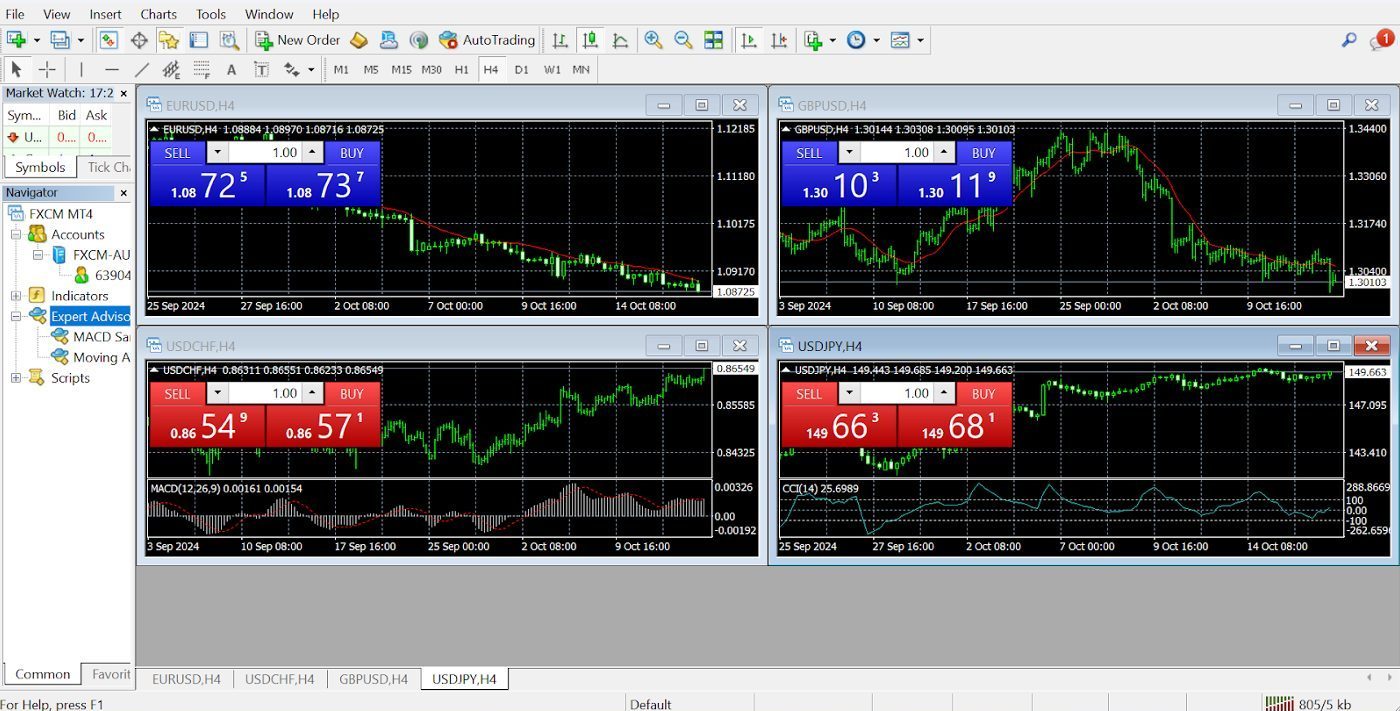

You’ll then be presented with your platform in default form, which will look something like the one below. The standard settings can vary slightly depending on the broker you use to open your MT4 account.

Navigating The Platform

- Market Watch: This is where you’ll see live prices for all the instruments you can trade – right-click on an asset to open a chart or place an order.

- Navigator: This window gives you quick access to your accounts, indicators, Expert Advisors, and scripts.

- Terminal: This is your command centre for monitoring trades, account history, and alerts.

The Terminal option below is your go-to place to start when your account is opened and when you log in to your MT4 platform. Here, you can pick up mail, see messages from your broker, check out relevant articles, read news, click on strategy ideas, and see all your trading activity.

Get familiar with the icons at the top of the platform navigation. They serve as shortcuts to many features and options.

At first, MT4’s layout can feel a little overwhelming, but after exploring each section, it all starts to make sense. Soon, it becomes second nature.

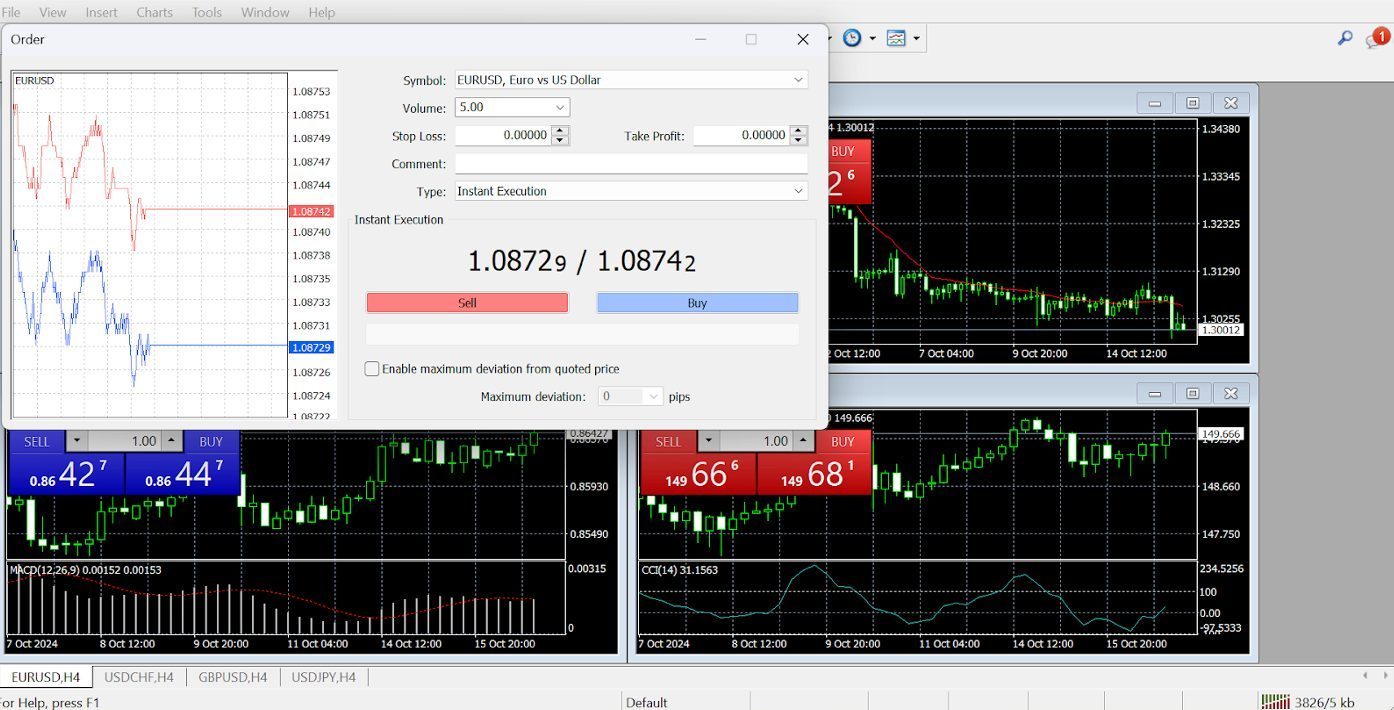

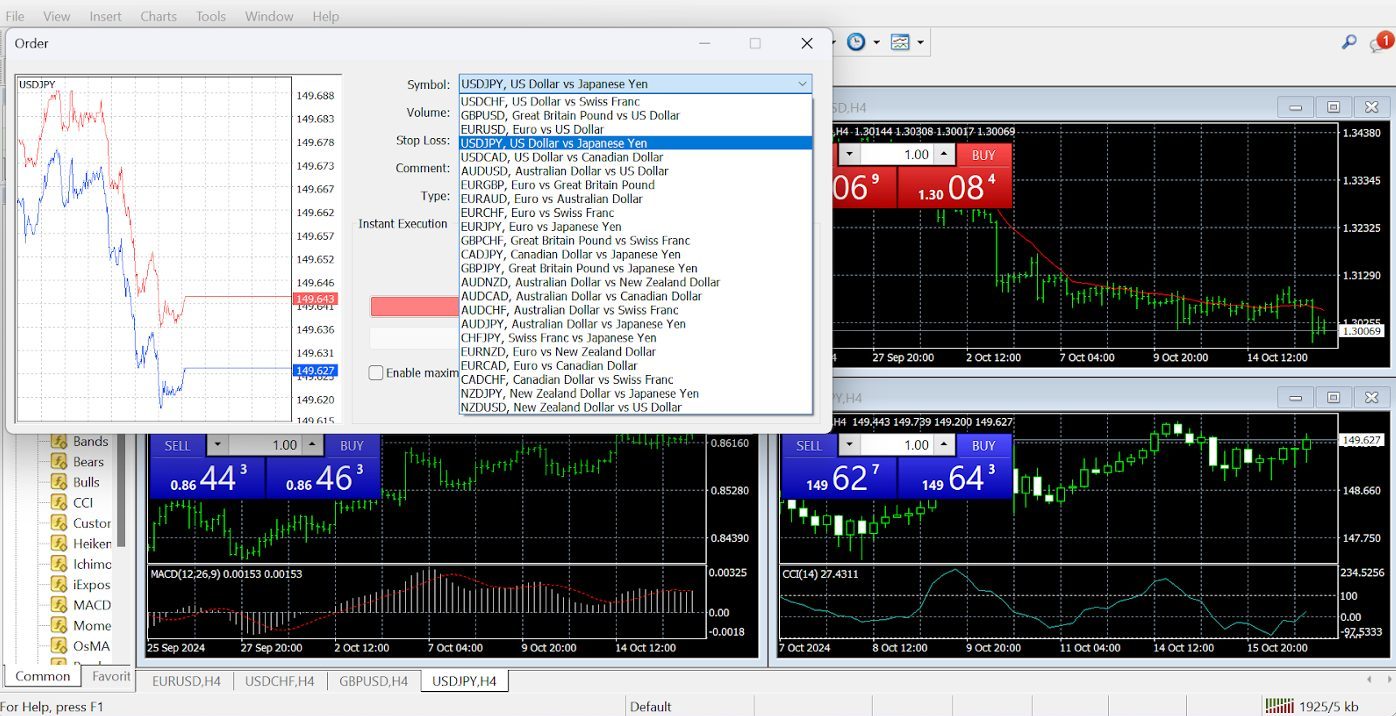

Placing Your First Trade

Ready to make a day trade? Here’s how you do it:

- Open a chart by right-clicking on an instrument in the Market Watch window.

- Press F9 or click “New Order” to bring up the trading window.

- Set your order type, stop loss, take profit and lot size, then hit “Buy” or “Sell.”

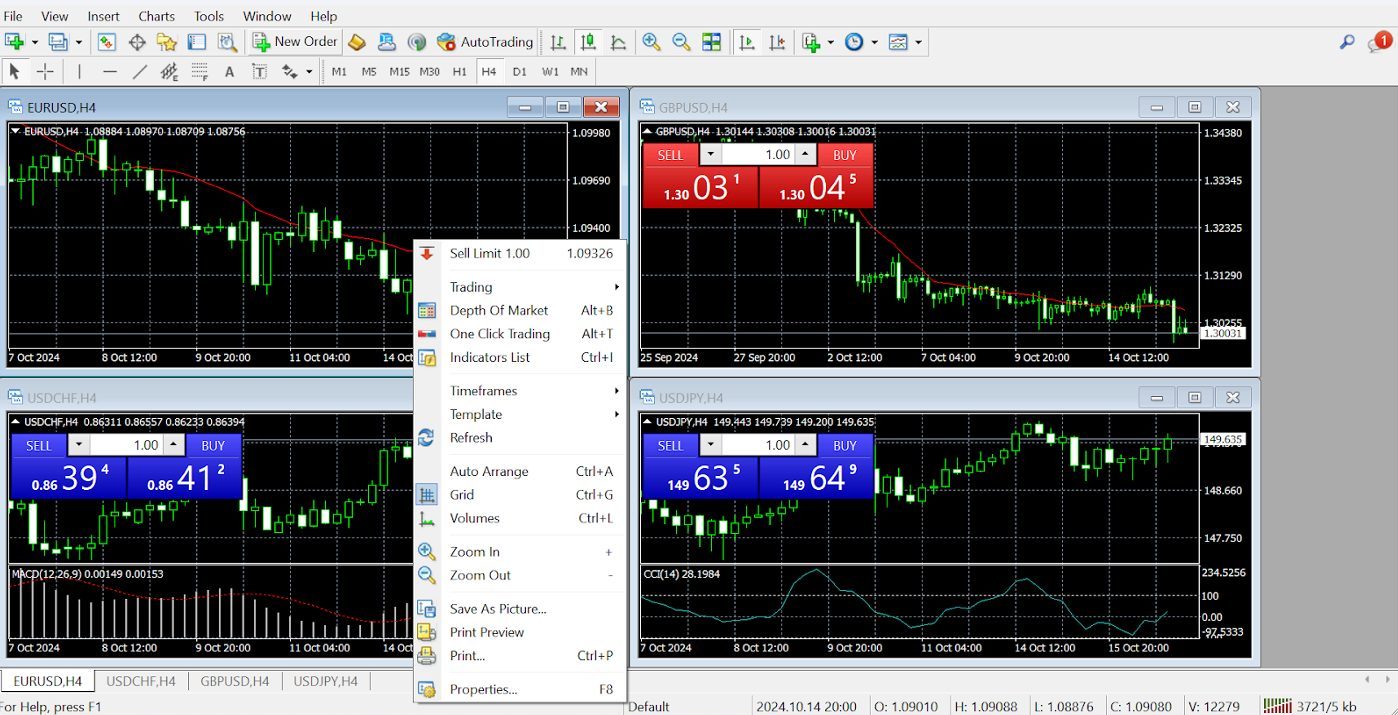

Once you get more confident with your trading plan, strategies, and platform, you can use one-click trading after you’ve set up your trading parameters. Just right-click a chart, and the menu below appears.

Customizing The Platform

Once you familiarize yourself with the basics, you can dive deeper into customization. Set up hotkeys, adjust chart settings, or add indicators that match your trading style.

MT4 gives you the freedom to make the platform truly yours.

Spend time learning the platform, setting up your workspace, and testing strategies. Once you’ve got a handle on MT4, it becomes a powerful tool that can significantly improve your trading experience.Trust me, after a few sessions you’ll be navigating MT4 like a pro.

Key Features For Active Traders

Market Watch And Charting

When you first open MT4, you’ll notice the “Market Watch” window on the left side.

This is where you can keep track of live prices for various instruments, whether you’re into forex, commodities, or CFDs. But that’s just a start on how personalized you can make it happen with the charts.

MT4 gives you several chart types, including candlesticks, bars, and lines, so you can visualize price movements however you prefer.

You can also break down the charts by timeframes, ranging from one minute to one month, which helps you spot trends whether you’re scalping or holding for longer.

When I first started using MT4, I set up multiple charts for different timeframes and strategies. Having all those visual insights open at once gave me a better feel for where the market was headed.

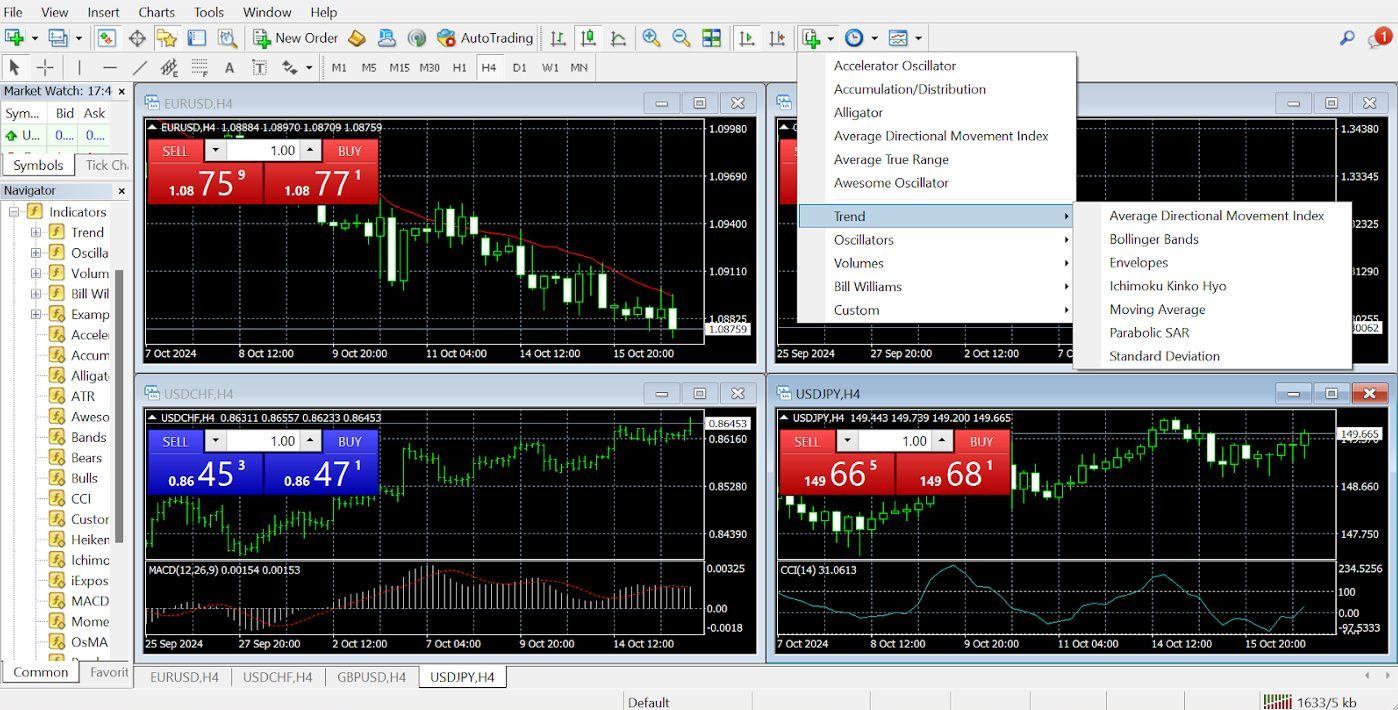

Technical Indicators And Analysis Tools

MT4 comes loaded with 30 built-in indicators, such as Moving Averages, RSI, MACD, and Bollinger Bands.

If you want to get deep into the technicals, you can add custom indicators; thousands are free, or you can even code your own if you know MQL4.

These tools help with analyzing the market and making decisions. For example, combining the RSI with a Moving Average can help you spot potential reversal points or confirm trends.

The indicators are listed on the right-hand side of the platform under an icon with a green plus sign. Click it, and the various indicator groupings, such as trend indicators, will appear in a drop-down menu.

I usually stick with a few key indicators like the MACD for momentum and Fibonacci retracements for potential support and resistance levels.But be careful not to overload your MT4 chart with too many indicators – it can get messy and confusing.

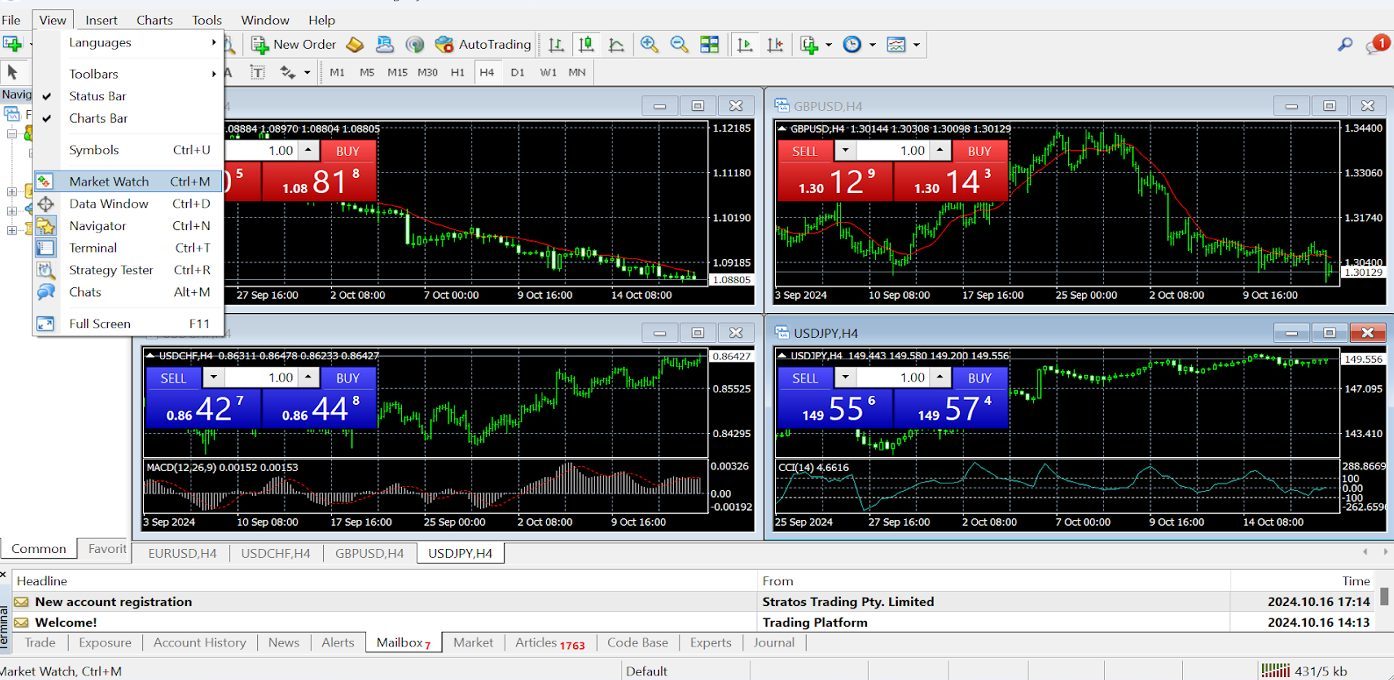

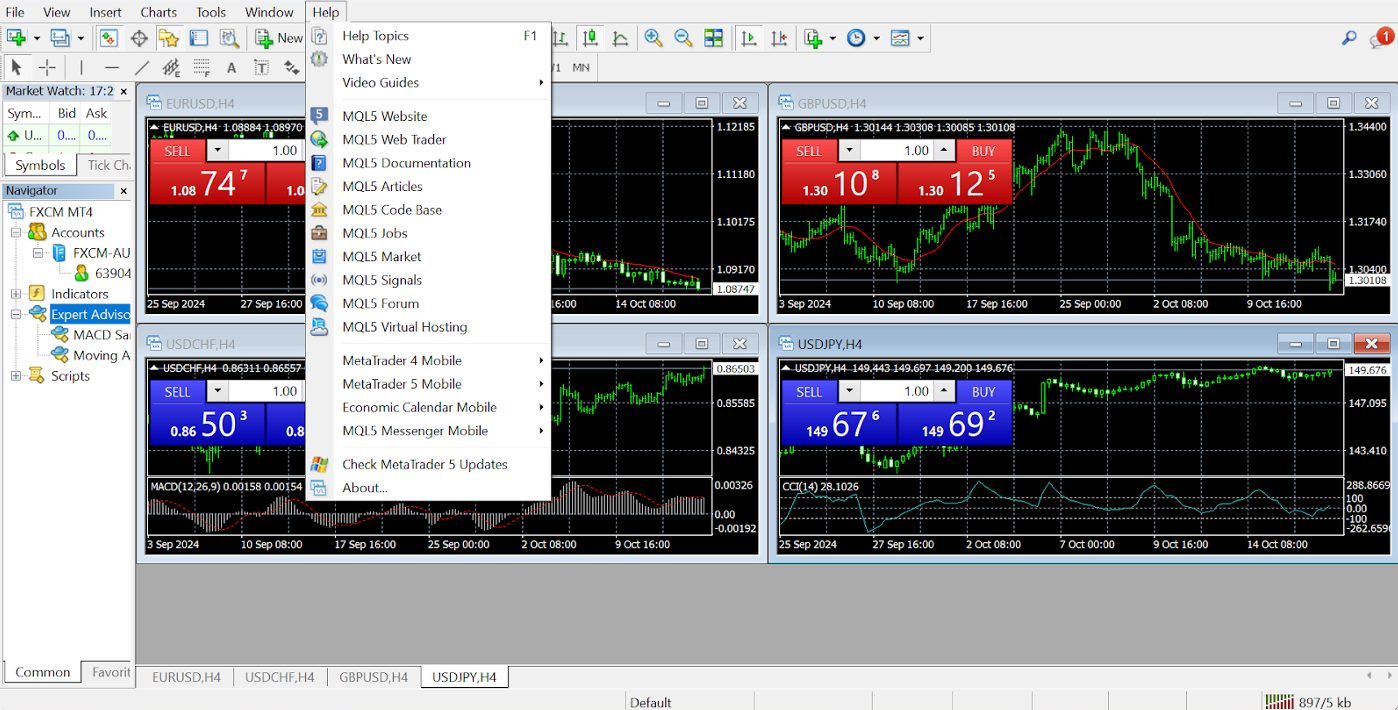

Automated Trading With Expert Advisors (EAs)

One of MT4’s standout features is automated trading using Expert Advisors (EAs). These are essentially bots that can execute trades based on your strategy without needing you to monitor the market 24/7.

You can either write your own EAs, download free ones, or purchase more advanced options from the MT4 marketplace. This is a huge benefit for traders who want to diversify their strategies or run multiple systems simultaneously.

To find examples of scripts (EAs) you can experiment with, simply roll over the view button, select navigator and the menu will appear.

Before using any EA on your live account, make sure you backtest it thoroughly. I’ve seen strategies that looked great on paper but didn’t hold up in real market conditions. Backtesting is your safety net.

Order Types And Execution

MT4 offers different order types, making it flexible for all kinds of traders. Whether you want to jump into a trade right now or set up an order for later, you have options:

- Market Orders let you trade instantly at the current price.

- Pending Orders let you set up future trades at your desired price (like buy limits or sell stops).

- Stop Orders automatically close your position if it hits a certain level.

- Trailing Stops move your stop loss as the price moves in your favour, helping lock in profits without manual adjustments.

Click the new order icon at the top of the navigation to place an order. You’ll then be able to select from a list of all the currency pairs your broker offers.

I love using trailing stops when I’m trading momentum. It helps secure profits while the market is still moving in my favour, without me having to keep a constant eye on it.

Trading Signals And Copy Trading

MT4 also has a built-in “Trading Signals” feature that allows you to follow and copy trades from experienced traders. This feature is super helpful if you’re just starting out or don’t have the time to stay glued to your screen.

You can access this service by clicking the help button in the nav. You then see a drop-down menu that lists several MQL5 topics. Market and signals are listed there.

You can choose from thousands of signals, and expert advisors in a marketplace in which experienced traders will share their code; some charge, and some don’t.

In my early days using MT4, I followed a couple of top traders and learned a lot just by watching their moves. It’s a good way to get a feel for how pros trade, but choose wisely – you don’t want to follow anyone blindly.

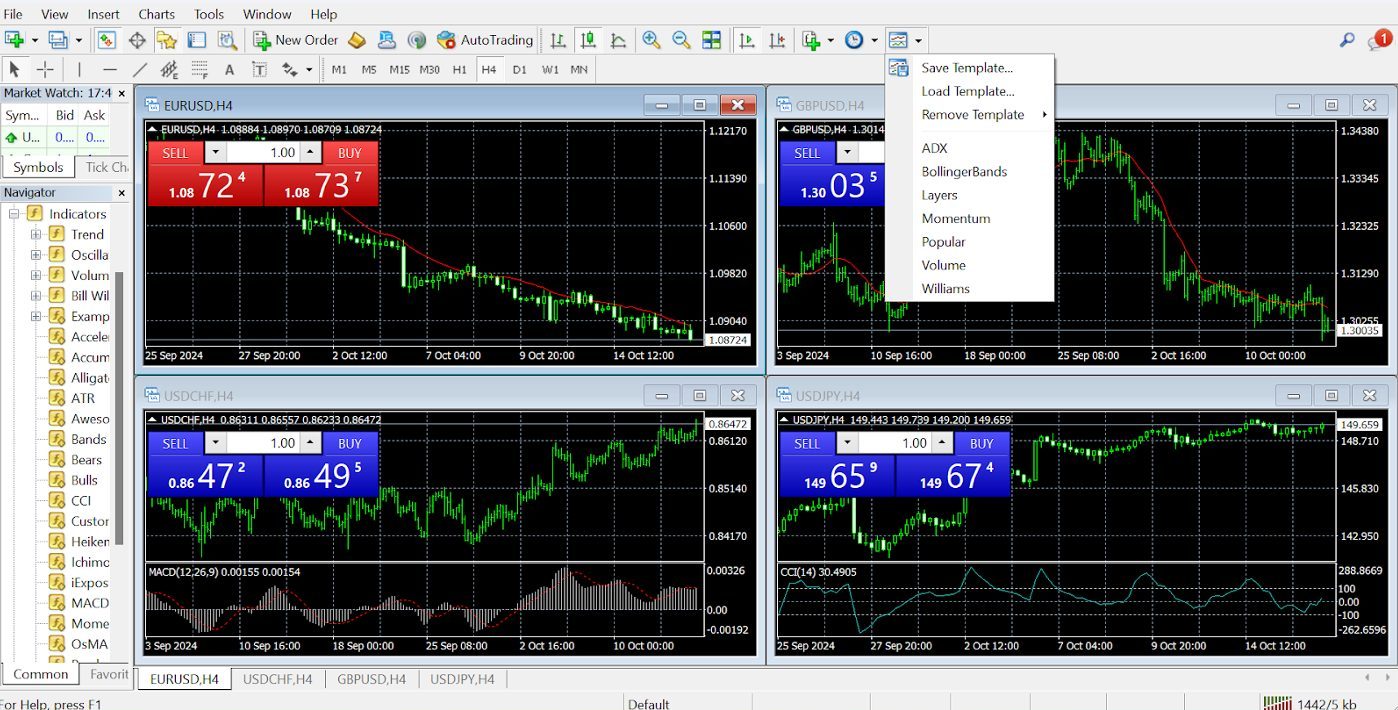

Customization Options

Custom Indicators And Scripts

One of the coolest things about MT4 is how customizable it is. You can add custom indicators and scripts to fit your specific trading style.

Once I felt comfortable with the basics, I started adding custom indicators that aligned more with my strategies. It’s easy to find tons of them online, but make sure you’re downloading from trusted sources.

Workspace Layouts

MT4 allows you to create and save different workspace layouts. You can set up multiple chart layouts for various strategies and easily switch between them.

If you want the four most traded currency pairs horizontally on your chart, you can save your layouts; simply click file and click profiles. Or click the chart icon at the end of the top nav bar and choose save template.

I have a simple, clutter-free workspace on MT4 for my everyday trading and a more detailed setup when I want to dive deep into analysis. Being able to switch between them quickly makes life much easier.

Custom Timeframes

While MT4 has nine default timeframes, you can add custom ones if you need even more precision. There are ways to tweak the settings or use custom scripts to achieve this.

Chart Themes And Templates

MT4’s charts are fully customizable. You can change colours and themes and even save templates for future use.

I keep my charts clean and easy on the eyes. Choose colours that don’t strain your vision, especially for those long trading sessions that many day traders will be familiar with.

Should I Use MT4 Or MT5?

For beginners or those primarily interested in forex trading, MetaTrader 4 is the obvious choice. If you’re an advanced trader wanting additional, sophisticated tools, you may prefer MetaTrader 5 (MT5).

Here’s a side-by-side comparison of MT4 and MT5 so you can see where they differ:

| Order Types | Technical Indicators | Chart Types | Chart Timeframes | Automated Trading | Economic Calendar | Mobile Compatible | Web Terminal | Desktop Download | Demo Mode | |

|---|---|---|---|---|---|---|---|---|---|---|

| MT4 | 4 | 30 | 3 | 9 | MQL4 | N | Y | Y | Y | Y |

| MT5 | 6 | 38 | 3 | 21 | MQL5 | Y | Y | Y | Y | Y |

Bottom Line

MetaTrader 4’s enduring popularity comes from its blend of power, flexibility, and ease of use. Whether you’re a beginner or an experienced trader, MT4 offers advanced charting tools, technical indicators, and automated trading via Expert Advisors (EAs) and copy trading, making it versatile for different strategies.

One of the biggest reasons MT4 remains a top choice is its approachability. It offers a comprehensive range of features without overwhelming users, and its clean, user-friendly interface means that traders can start placing trades right out of the gate.

Plus, the platform’s customizability ensures that as active traders grow and refine their strategies, MT4 can grow with them.

Add in the large, active community that continuously develops custom indicators, scripts, and strategies, and you’ve got a platform that stays relevant year after year.

So despite increasing competition from the newer and more advanced MetaTrader 5, plus competitors like cTrader and TradingView, MT4’s ability to offer professional-grade tools while remaining accessible to active traders of all levels makes it a front-runner in the day trading world.

To find the right provider for your needs, turn to our rankings of the best MT4 brokers for day trading.

FAQ

Is MetaTrader 4 A Broker?

MetaTrader 4 is not a broker. It is an electronic trading platform licensed to online brokers. The brokerages then offer the platform to their traders.

How Does MetaTrader 4 Work?

MetaTrader 4 facilitates access to financial markets through its online trading platform. The platform is split between a client and a server module. The server component is licensed to MT4 brokers while the client portal is used by the broker’s clients.

Is MetaTrader 4 Free At Online Brokers?

MetaTrader 4 is free to download and use. However, you’ll pay the usual fees when you place trades, such as spreads, commissions and overnight fees (you can avoid these if you day trade).

We’ve observed some brokers offering wider spreads on MT4 than on their proprietary platforms, so investigate the cost structure before signing up.

Is MetaTrader 4 Safe To Use?

MetaTrader 4 is a relatively secure platform that uses 128-bit SSL encryption, two-factor authentication (2FA) and data segregation. However, online trading itself is risky.

Only risk what you can afford to lose and pick an MT4 broker regulated by a trusted body according to DayTrading.com’s Regulation & Trust Rating.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com