Forex Trading in Lesotho

Lesotho is a landlocked nation surrounded by South Africa. Its modest economy is reliant on agriculture, remittances from migrant workers, and textile exports, while the Lesotho loti is fixed to the South African rand.

Its GDP of approximately $2.4 billion reflects its limited economic scale. The country’s banking sector must also be developed, hindering its financial integration with global markets, including foreign exchange.

Despite these challenges, currency trading is gaining popularity among Lesotho traders, drawn to the potential for substantial returns and the convenience of online trading platforms, though the risks remain high.

If you’re a beginner considering forex trading in Lesotho, this guide is a must-read. It’s packed with practical tips and emphasizes the importance of mastering the basics to make sound trading decisions.

Quick Introduction

- The Lesotho loti (LSL) is pegged at par (1:1) to the South African rand (ZAR), and both currencies are legal tender in Lesotho. Yet while the LSL can be traded, its trading volume is typically low, and it’s often traded alongside the ZAR due to its fixed exchange rate.

- The Central Bank of Lesotho (CBL) regulates forex trading activities. However, the country’s forex trading regulatory framework is still evolving, potentially affecting the level of oversight and protection for traders.

- Forex trading profits in Lesotho may be subject to income tax. Two marginal tax rates apply – 20% and 30% – collected by the Revenue Services Lesotho (RSL).

Top 4 Forex Brokers in Lesotho

After in-depth testing and analysis, these 4 platforms are the obvious choices for forex traders in Lesotho:

How Does Forex Trading?

Forex trading in Lesotho involves buying and selling currency pairs to profit from price changes. This can be done at an online broker who will typically provide a desktop platform, web terminal or forex trading app.

The Lesotho loti is primarily traded against other key currencies like LSL/ZAR and LSL/USD, reflecting Lesotho’s economic ties with South Africa and the broader global markets.

Let’s say you believe the LSL will strengthen against the USD because you anticipate a rise in remittances from expatriate workers, you could sell the USD/LSL pair, and if the exchange rate falls, the LSL strengthens and you could potentially make a profit (less any trading fees).

Our investigations show that the LSL isn’t widely traded or readily available at online brokers.However, the ZAR is commonly featured on top forex platforms, providing opportunities for traders in Lesotho.

Is Forex Trading Legal In Lesotho?

Yes, forex trading is legal in Lesotho. The Central Bank of Lesotho (CBL) oversees the country’s financial sector and ensures all financial activities, including forex trading, adhere to legal frameworks.

The CBL plays a pivotal role in maintaining monetary stability and regulating currency flow, indirectly impacting the foreign exchange market.

However, our research shows the CBL does not license online brokers and has warned against forex investment scams, urging Lesotho traders to be cautious and conduct thorough research before investing.

Although the market infrastructure may not be as developed as in larger economies, technological advancements and online trading platforms have made it easier for you to participate in forex trading in Lesotho.

Is Forex Trading Taxed In Lesotho?

Forex trading is subject to taxation by the Revenue Services Lesotho (RSL).

Profits earned from trading currencies online may be considered part of your individual taxable income and are subject to income tax.

Two marginal tax rates apply when calculating personal income tax (PIT) in Lesotho: 20% and 30%.

You are generally required to report your forex trading profits when filing your tax returns. However, due to the relatively underdeveloped regulatory framework in Lesotho, enforcing and reporting taxes on FX trading activities might be challenging.

I recommend consulting a local tax professional to ensure compliance with the tax regulations in Lesotho.This is especially important if you make frequent forex trades as tax authorities often approach short-term trading and long-term investing differently.

When Is The Best Time To Trade Forex In Lesotho?

The best time to trade forex in Lesotho depends on the overlap of global forex market sessions and the liquidity in the currency pairs you are trading.

- The London Session (10:00 to 19:00 SAST) is one of the most active forex trading sessions, particularly for European currency pairs like ZAR/EUR and ZAR/GBP.

- The New York Session (15:00 to 23:00 SAST) is another highly active period, especially for USD-based pairs like ZAR/USD.

- The overlap between the London and New York sessions (15:00 to 19:00 SAST) is particularly favorable for high liquidity and potential price movements.

- The Asian session (midnight to 09:00 SAST), which includes the Tokyo and Sydney markets, is less volatile than the London and New York sessions. However, if you prefer less volatile markets, it can be a good time to trade currencies like ZAR/JPY and ZAR/AUD.

Ultimately, the best time to trade in Lesotho is when it aligns with your trading style and preferences.

An Example Forex Trade

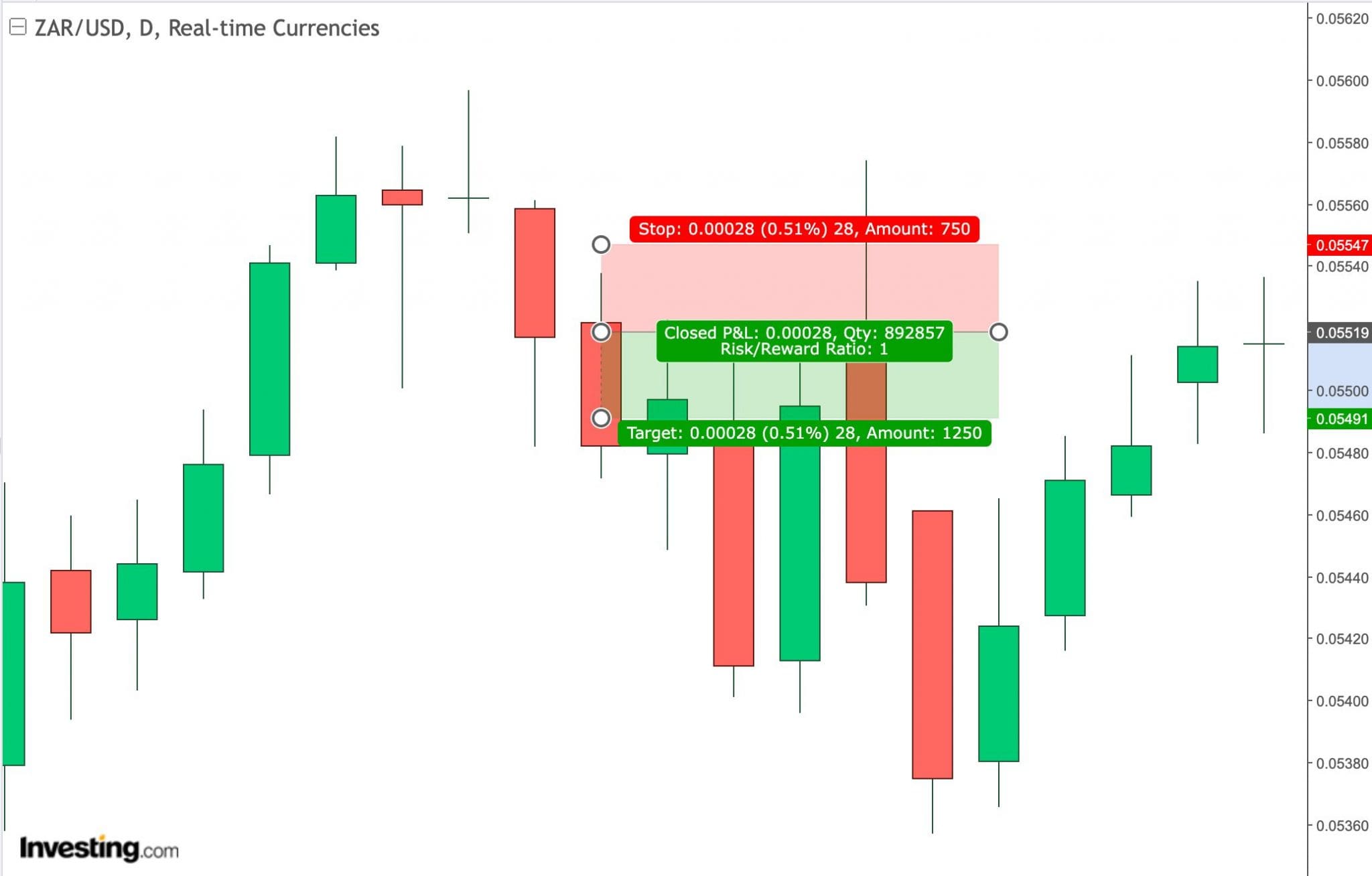

Let’s explore a hypothetical scenario where I day trade the South African rand (ZAR) against the US dollar (USD).

Event Background

I was watching the economic calendar, anticipating a significant US economic announcement expected to influence the markets.

The US Federal Reserve released a report revealing stronger-than-expected job growth, signaling a robust economy.

As expected, this positive news boosted the US dollar against several currencies, including the South African rand.

Seeing the potential for a significant price movement, I took advantage of the opportunity by making a short-term trade on the ZAR/USD currency pair.

Trade Entry & Exit

As soon as the news broke, I immediately saw the ZAR’s price falling (USD gaining strength).

I entered the trade by shorting (selling) the ZAR against the USD, expecting the ZAR to continue falling throughout the day.

I set my stop loss at 0.05547 (-0.51%), slightly above the recent high, to limit potential losses if the market reversed unexpectedly. Based on my analysis of support levels and the expected range of movement, I aimed for 0.05491 (0.51%) for my take profit level.

I closely monitored the market throughout the day, watching as the ZAR fell against the USD.

The price moved steadily in my favor, and a few hours later, the ZAR/USD pair hit my take profit level. I exited the trade, locking in a profitable gain from the sharp movement caused by the positive US economic data.

Trade Analysis

Reflecting on this trade, the combination of timely analysis and quick execution enabled me to capitalize on the USD’s strength following the positive US economic announcement.

By carefully setting my entry, stop loss, and take profit levels, I was able to manage risk effectively and secure a profit as the market reacted to the news.

This experience emphasized the importance of staying informed about key economic events and being prepared to act swiftly when opportunities arise in the forex market.

Bottom Line

Forex trading in Lesotho, though gaining popularity, operates within a modest economic context where the Lesotho loti, pegged to the South African rand, can be traded on global markets, albeit with limited volume.

The Central Bank of Lesotho oversees forex regulation, but the regulatory environment is still evolving.

FX trading profits are taxable, and you are encouraged to trade during the London and New York sessions for optimal liquidity and trading opportunities.

However, the nascent market presents challenges in regulatory oversight and tax compliance.

To get going, see DayTrading.com’s pick of the best forex trading platforms in Lesotho.

Recommended Reading

Article Sources

- Revenue Services Lesotho (RSL)

- Central Bank of Lesotho (CBL)

- Lesotho GDP - IMF

- Lesotho Taxes on Personal Income - RSL

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com