Best Forex Brokers In Kenya 2026

Interest in forex trading is rising in Kenya, fuelled by the adoption of smartphones, an increasingly financially literate demographic, and a volatile Kenyan shilling (KES). The country’s Capital Markets Authority (CMA) is also one of the most prominent regulators on the African continent and has stepped up its oversight of forex trading activities in recent years.

Discover the best forex brokers in Kenya. We’re seeing a growing number of brokers cater to forex traders in Kenya, supporting convenient deposit options like M-Pesa and KES-based trading accounts. Every forex platform recommended has been personally tested by our experts.

6 Top Forex Brokers in Kenya

After reviewing 140 brokers, these 6 stand out as the best for forex traders in Kenya:

Here is a summary of why we recommend these brokers in February 2026:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- RoboForex - RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

- Exness - Exness offers an impressive selection of around 100 forex pairs - more than most brokers we've evaluated - along with competitive spreads on major pairs starting as low as 0.1 pips. Additionally, traders benefit from a robust suite of forex analysis tools, including market news powered by FXStreet.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

Best Forex Brokers In Kenya 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| RoboForex | 30+ | 0.1 | / 5 | $10 | IFSC |

| Exness | 100+ | 0.0 | / 5 | Varies based on the payment system | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 30+ |

| Leverage | 1:2000 |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| GBPUSD Spread | 0.0 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.0 |

| Total Assets | 100+ |

| Leverage | 1:Unlimited |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- It’s quick and easy to open a live account – taking less than 5 minutes

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- Unfortunately, cryptos are only available for Australian clients

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

How We Rate Best Forex Brokers In Kenya

These are the key areas we assess forex brokers in and recommend you do too:

Trust

Choose a trustworthy broker to safeguard your funds from forex trading scams.

This is especially important given the number of fraudsters targeting Kenyan forex traders. In one notable example, reported by Bizna Kenya, Limuru-based VIP Portal tricked “unsuspecting investors” out of a staggering Sh. 1 billion.

The Capital Markets Authority (CMA) is providing tighter oversight of forex trading activities, for example cracking down on 40 unlicensed forex trading firms, however there remains a high risk to your funds.

If you don’t choose a locally registered forex broker, our recommendation is to select a well-established trading platform tightly regulated by ‘Green Tier’ bodies like the FCA in the UK or the ASIC in Australia. Make sure you also stay up to date with Kenyan tax rules.

- Pepperstone is one of the most trusted forex brokers in the industry, thanks to its 10+ year history and multiple licenses from top-tier bodies, including the FCA, ASIC, CySEC and DFSA. Crucially, Pepperstone is also authorized by Kenya’s CMA and has an office in Nairobi.

Currency Pairs

Choose a broker that offers the currency pairs you wish to trade.

For local traders this might mean those containing the Kenya shilling (KES), such as the USD/KES, however we’ve evaluated hundreds of brokers and these are not usually available.

With this in mind, consider a broker with a wide range of majors, minors and exotics, offering diverse opportunities, including those in prominent currencies on the African continent, such as the South African Rand (ZAR).

- IG stands out with its fantastic selection of 80+ currency pairs, including the USD/ZAR, EUR/ZAR, GBP/ZAR, and JPY/ZAR. Combined with its advanced ProRealTime charting software, IG is an excellent choice for active forex traders.

Pricing

Select a low-cost broker, especially if you’re day trading forex. This will help protect slim profit margins from frequent transaction costs.

Our experts regularly evaluate trading fees on currency pairs, from minimum to average spreads where practical. We also consider non-trading fees such as conversion costs for transferring Kenyan shillings to a trading account based in another currency.

- Vantage’s flexible pricing model with no hidden fees caters to a broad spectrum of forex traders. The broker offers three accounts: Standard (commission-free pricing that will appeal to newer traders), Raw (low spreads with $3 commissions that will appeal to active day traders), and Pro (even more competitive commissions from $1.50 for high-volume traders).

Forex Platforms

Find a forex platform you enjoy using with the tools you need, for example, day traders may need a strong charting package for technical analysis.

Kenyans, like many retail investors, are also increasingly turning to forex trading apps, the reliability and features of which we’ve seen significantly improve in recent years.

You’ll normally have two options when it comes to forex software:

- Third-party: MetaTrader 4 and MetaTrader 5 have dominated the industry for years with advanced charting tools, various order types and support for algorithmic trading, though alternatives like TradingView and cTrader are making up ground with more intuitive workspaces.

- In-house: Many forex brokers have poured money into proprietary platforms, now sporting more user-friendly interfaces for beginners, often with tutorials and straightforward accessibility through web browsers.

- FOREX.com excels in this category thanks to its superior range of charting platforms, including MT4, MT5, TradingView and a WebTrader with one of the slickest designs I’ve seen. Its SMART Signals also provide valuable insights into price patterns across various currencies, potentially helping identify opportunities.

Account Funding

Choose a forex broker that makes account deposits and withdrawals in Kenyan Shillings low-cost and hassle-free.

Since very few online brokers support accounts based in Kenyan Shillings based on our findings, consider platforms with convenient local solutions. M-Pesa, for example, remains one of the most popular payment methods in Kenya, according to Akurateco.

- XM is a great choice for Kenyan forex traders looking for fast and affordable payment methods, from bank transfers and credit cards to digital solutions like M-Pesa. Additionally, the 5 USD, around 660 KES, minimum deposit is among the lowest in the industry.

Methodology

We leveraged our extensive database of forex brokers to focus on those accepting Kenyan traders, ranking them based on their rating derived from key factors, including:

- Regulation by reputable authorities, if not Kenya’s CMA then other trusted bodies.

- A wide selection of currency pairs to provide ample short-term trading opportunities.

- Competitive pricing for day traders with no hidden fees.

- User-friendly and reliable platforms following hands-on tests.

- Smooth account funding, considering the availability of local solutions like M-Pesa.

FAQ

Is Forex Trading Legal In Kenya?

Yes, residents of Kenya are permitted to trade currencies online.

However, we recommend keeping up with the latest regulations from the Capital Markets Authority (CMA) and tax rules from the Kenya Revenue Authority (KRA).

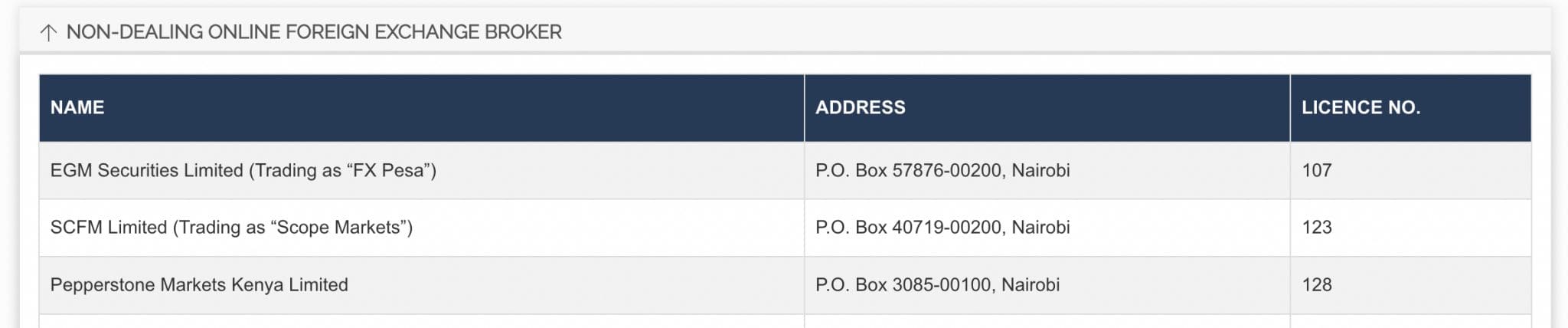

Who Regulates Forex Trading In Kenya?

The Capital Markets Authority (CMA) regulates forex trading in Kenya.

It’s a respected regulator that’s ramped up its oversight of forex brokers in recent years. Licensed firms must meet capital requirements of 50 million Kenyan Shillings, have a Director with experience in financial services, and maintain an office in Kenya.

Forex traders in Kenya can also open accounts with forex brokers based overseas though you may not be protected under domestic laws. As such, only trade currencies with established, tightly regulated international firms.

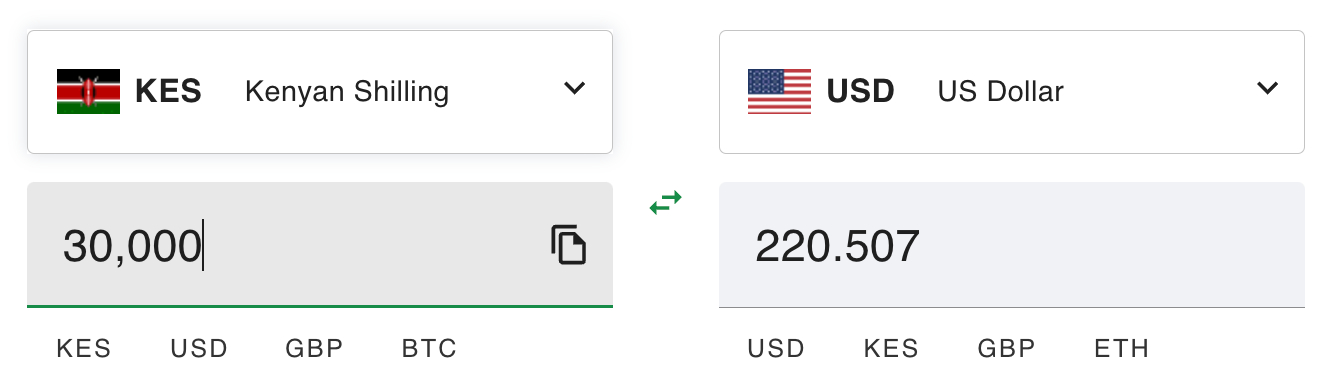

How Much Money Do I Need To Start Trading Currencies In Kenya?

Based on our vast directory of forex brokers accepting Kenyan traders, a deposit of up to 250 USD is normally required, equivalent to approximately 35,000 shillings.

That said, several leading forex brokers have no minimum deposit catering to budget traders, notably Pepperstone, which is also authorized by the CMA.

Is Forex Trading Safe In Kenya?

No, forex trading in Kenya, like all countries, is not safe. There is the risk of losing your money if the markets do not move in your favor, alongside scams which we’ve seen target Kenyan traders in recent years.

Recommended Reading

Article Sources

- Kenya Capital Markets Authority (CMA)

- CMA Cracks Down On Unlicensed Firms - Business Daily Africa

- VIP Portal Forex Scam - Bizna Kenya

- Payment Gateways In Kenya - Akurateco

- Kenya Revenue Authority (KRA)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com