Best Day Trading Platforms and Brokers in Japan 2026

To day trade key markets like stocks listed on the Tokyo Stock Exchange (TSE) or currency pairs involving the Japanese yen (JPY), such as USD/JPY, you will need to register with an online broker.

The Japanese Financial Services Agency (FSA) regulates local brokers, though residents can also sign up with trusted international day trading platforms (though Japanese tax rules still apply).

We’ve listed the best day trading brokers in Japan following exhaustive tests. Many of these platforms tailor their services to active Japanese traders, offering domestic assets, JPY accounts, and convenient payment methods like the Tokyo-based JCB Card.

Top 6 Platforms For Day Trading In Japan

Following our hands-on assessments, these 6 platforms are the standout options for Japanese day traders:

This is why we think these brokers are the best in this category in 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

Best Day Trading Platforms and Brokers in Japan 2026 Comparison

| Broker | Minimum Deposit | JPY Account | Markets | Platforms | Leverage |

|---|---|---|---|---|---|

| Exness | Varies based on the payment system | ✔ | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| IC Markets | $200 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| XM | $5 | ✔ | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| AvaTrade | $100 | - | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| IC Trading | $200 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 |

| Trade Nation | $0 | - | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | MT4 | 1:500 (entity dependent) |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Multiple account currencies are accepted for global traders

- Full range of investments via leveraged CFDs for long and short opportunities

- The trading firm offers tight spreads and a transparent pricing schedule

Cons

- Fewer legal protections with offshore entity

Methodology

To find the best day trading platforms in Japan, we scoured our directory of 140 online brokers and extracted all those that accept Japanese traders.

We then ranked them by their overall rating, drawing on 100+ data points and findings from our hands-on tests.

- We made sure each platform accepts Japanese day traders.

- We assigned each broker a trust score taking into account their regulations.

- We focused on brokers with competitive day trading fees.

- We prioritized platforms with a diverse range of markets.

- We favored brokers with reliable charting platforms.

- We checked each broker’s leverage and margin requirements.

- We examined each platform’s execution quality.

How To Choose A Day Trading Broker In Japan

There are several factors to consider when choosing a day trading broker:

Trust & Regulation

The most trustworthy brokers are regulated by ‘green tier’ authorities which mandate transparent pricing, fair market practices and safeguarding measures.

This helps to protect active traders from misconduct and fraud, like the massive $105 million investment scam uncovered by Japanese regulators, as reported by Finance Magnates.

Day traders should feel reassured that the Japanese Financial Services Agency (FSA) is a proactive green tier regulator. Additionally, regulators like Australia’s ASIC may also license brokers that accept Japanese traders, providing stringent provisions like negative balance protection.

- AvaTrade maintains a podium position for Japanese traders, with local regulation by the FSA, among other respected agencies and a long history since 2006. It also offers negative balance protection and a bespoke risk management tool, AvaProtect.

Day Trading Fees

Active traders make frequent transactions throughout the day, which can impact profitability if costs are high.

During our routine tests, we evaluate spreads and commissions on notable assets like USD/JPY, with the best brokers offering narrow spreads from 0.0 pips.

We also consider non-trading fees, which can mount up if making multiple deposits, especially if you’re transferring Japanese yen to an account based in another currency.

I also recommend considering whether you get access to premium research tools which might justify higher costs.For example, day traders may benefit from daily forex analysis on JPY currency pairs, or economic updates from the Bank of Japan.

- IC Markets consistently delivers superior pricing for active traders, with raw spreads averaging 0.14 on USD/JPY and 8.585 on the JP225 Index. Impressively, you also get free access to terrific research tools, including Trading Central‘s Market Buzz feature where you can view market sentiment and gauge price trends on Japanese assets.

Range of Markets

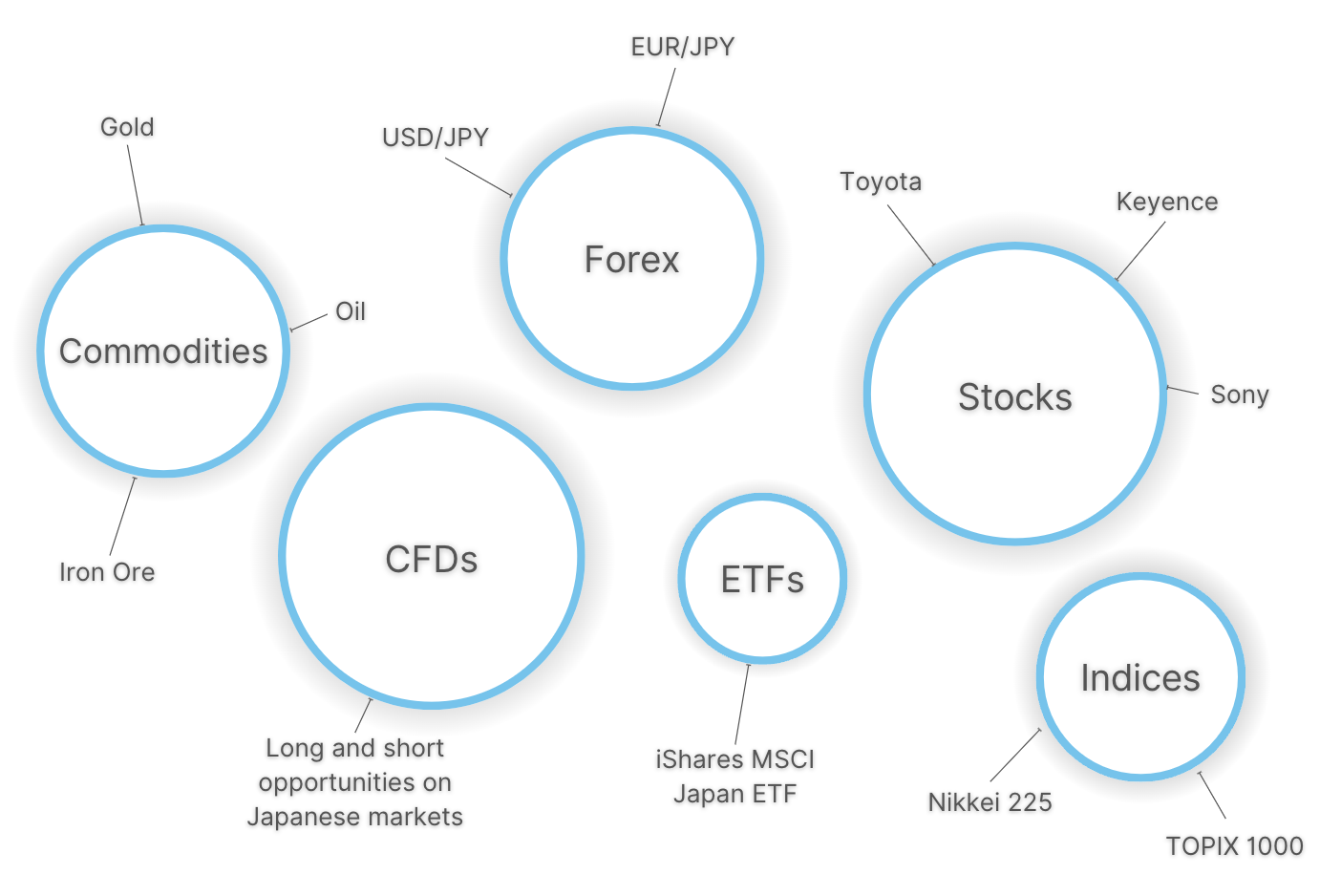

Having access to a wide range of markets is crucial for building a diversified portfolio and spreading risk across multiple asset classes.

Traders may want a platform with a range of currency pairs involving the JPY given that forex trading in Japan is huge, as well as equities and indices listed on the Tokyo Stock Exchange (TSE), such as Toyota and the Nikkei 225.

- IG offers thousands of day trading opportunities, notably four JPY pairs, TSE-listed stocks, as well as a range of Japanese ETFs, including the iShares MSCI Japan ETF.

Platforms & Tools

Day traders rely on a powerful and stable charting environment to analyze their chosen markets and build trading strategies.

The best brokers will offer a range of platforms and analysis tools, with MetaTrader 4, MetaTrader 5 and cTrader being some of the most common solutions. These platforms offer a superb range of technical indicators, chart types and timeframes, catering to various short-term trading strategies.

That said, I personally enjoy using TradingView, thanks to its sleeker design and super easy navigation.It’s also been integrated by a growing number of brokers in recent years, notably VT Markets, which accepts Japanese traders.

- FOREX.com is great for beginners and experts alike, offering a range of first-rate platforms including MT5 and a user-friendly bespoke solution powered by TradingView. The SMART Signals tool also delivers statistics-driven trade ideas, making the broker a top pick for aspiring traders.

Leverage & Margin

Transparent leverage and margin requirements are important for day traders who need to understand potential gains and risks upfront.

Leverage effectively allows you to boost your potential profits using only a small deposit.

For example, if I set up a trade on Toyota shares with 1:10 leverage, my outlay of 40,000 yen would be increased to 400,000 yen.

Conversely, this also means my losses could be magnified 10x, which highlights the importance of employing solid risk management.

- XM offers very high leverage up to 1:1000 (only recommended for professional traders). The broker also has a 50% margin call (where you will be required to top up your margin level) and a stop-out level set to 20% (where your positions will start automatically closing if you do not meet the margin requirement).

Execution Quality

Fast-paced trading strategies have a greater chance of success if orders are filled quickly and efficiently.

The best brokers will ensure that time delays (latency) are minimized and that orders are executed at the requested price or better (slippage).

During our routine tests, we investigate whether brokers meet our preferred benchmark execution speeds of <100 milliseconds.

- FxPro offers superior execution compared to many alternatives, with speeds as low as 13 milliseconds with 71.4% of orders completed at the requested price. It also offers a competitive range of JPY currency pairs, including minors like SGD/JPY.

Minimum Deposit

Typically, you’ll need up to 250 USD (approximately 38,920 JPY) to open a live trading account.

Based on our tests, though, many day trading platforms go much lower with some even requiring no minimum deposit – great for newer traders.

Leading brokers also offer low-cost, fast and hassle-free funding options. While Japan remains a largely cash-based economy, card payments such as JCB cards, are one of the more popular online methods according to findings by Adyen.

- Exness is a convenient choice for Japanese traders, with its JPY-based accounts, easy funding via JCB card, and just a $10 minimum deposit to get started. It’s one of the most accessible day trading brokers we’ve tested.

FAQ

Who Regulates Day Trading Platforms In Japan?

The Japanese Financial Services Agency (FSA) is responsible for overseeing online brokers in Japan.

That said, traders can also register with trusted overseas firms which are regulated by other reputable authorities, for example, the ASIC (Australia) or FCA (UK). That said, it’s important to continue adhering to the FSA’s regulations and tax rules in Japan.

Which Is The Best Broker That Accepts Day Traders From Japan?

Use our list of the best day trading platforms in Japan to find the perfect broker for your needs.

For example, if you’re looking for a fantastic selection of Japanese markets, IG offers JPY currencies, TSE-listed stocks, and an excellent range of ETFs. It also boasts some of the best research and education tools that I’ve seen.

Recommended Reading

Article Sources

- Japan Financial Services Agency (FSA)

- Tokyo Stock Exchange (TSE) - Japan Exchange Group

- Bank of Japan

- Toyota Motor Corporation - TSE

- Nikkei 225 Index Futures - TSE

- Payment Methods In Japan - Adyen

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com