Best Day Trading Apps In India 2026

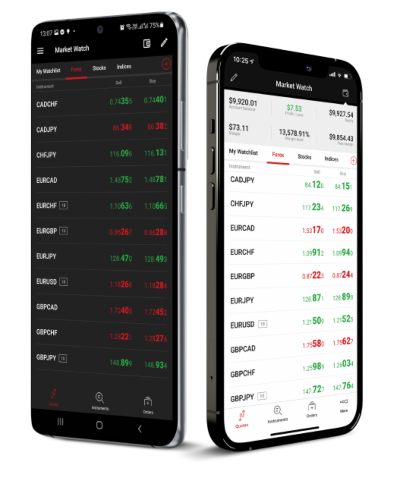

Online trading apps in India are becoming increasingly popular, allowing retail investors to trade stocks, forex and cryptos directly from mobile and tablet devices. But which are the best trading and investment apps?

In our 2026 updated test of top day trading apps in India we have compared the mobile apps on all important features – from market access and commission-free investing to safety ratings and iOS and Android compatibility. Our experts have compiled a list of the top online trading apps in India along with a larger comparison of all the alternatives.

Top 6 Day Trading Apps In India

After our tests we have found that these are the 6 best trading apps in India:

-

1

XMApps for iOS, Android & Windows

XMApps for iOS, Android & Windows -

2

RoboForexApps for iOS & Android, R StocksTrader

RoboForexApps for iOS & Android, R StocksTrader -

3

IC MarketsApps for iOS & Android

IC MarketsApps for iOS & Android -

4

AvaTradeApps for iOS & Android

AvaTradeApps for iOS & Android -

5

PepperstoneApps for iOS & Android75-95% of retail investor accounts lose money when trading CFDs

PepperstoneApps for iOS & Android75-95% of retail investor accounts lose money when trading CFDs -

6

Fusion MarketsApps for iOS & Android

Fusion MarketsApps for iOS & Android

Here is a summary of why we recommend these brokers in February 2026:

- XM - XM offer a mobile app for both Android and iOS that has been specifically tailored to each platform, maximizing the functionality of both. The app delivers the MT4 and MT5 software on the move, with full access to the broker’s 1,000+ instruments. Where they shine is their dependability with minimal glitches and delays during testing. The built-in news, trading journal and push notifications also ensure you have everything you need to day trade from your hand.

- RoboForex - RoboForex continues to excel with its wide range of iOS and Android-friendly platforms to meet short-term trading needs, including MT4 and MT5. The R StocksTrader app performed particularly well during testing, with a vast selection of stocks and ETFs, portfolio analytics, customizable watchlists, an events tracker, plus a fast and dependable mobile trading environment. The only notable absence in the RoboForex offering is the increasingly popular cTrader app, that's favored by many day traders.

- IC Markets - IC Markets deliver mobile apps for their cTrader, MT4, MT5 and TradingView platforms. They have been developed on Android and iOS separately, taking full advantage of the functionality available on each. With raw pricing, and spreads from 0.0, the apps deliver an excellent trading tool for all levels of trader. Yet what really stands out is how they've managed to maintain the lightning-fast execution speed IC Markets is known for, right within the apps. It's a seamless trading experience that feels both professional and highly responsive.

- AvaTrade - AvaTradeGO consistently impresses with its comprehensive mobile trading experience, boasting an interface that's not just easy to use, but genuinely intuitive. Navigating the app is a breeze, ensuring fast access to hundreds of markets, including forex, stocks, indices, commodities, ETFs, and bonds. However, what sets AvaTradeGO apart is its AvaProtect™ feature, offering an unmatched level of risk protection that's rare to find elsewhere.

- Pepperstone - Pepperstone excels for its excellent integration with the MT4, MT5, cTrader, and TradingView apps, making it a standout option for day traders familiar with these leading third-party trading solutions. These platforms deliver a stable and reliable mobile trading experience, enhanced by Pepperstone's almost unrivalled execution speeds and wide range of asset classes. Recent improvements also helped it secure second place in DayTrading.com's annual 'Best Trading App' award for 2025.

- Fusion Markets - Fusion Markets offers seamless integration with the cTrader, MT4, MT5 and TradingView apps, available on Android or iOS. Although we find the design of the MetaTrader app increasingly outdated, detracting from the user experience, it excels for its premium charting package, integrated news stream and push notifications. The cTrader app performed even better during tests, featuring a superior design and an extensive suite of over 70 indictors and 26 timeframes, making it the obvious choice for advanced day traders.

Best Day Trading Apps In India 2026 Comparison

| Broker | iOS Rating | Android Rating | Minimum Deposit | Trading Markets | Regulators |

|---|---|---|---|---|---|

| XM | / 5 | / 5 | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| RoboForex | / 5 | / 5 | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | IFSC |

| IC Markets | / 5 | / 5 | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, CMA, FSA |

| AvaTrade | / 5 | / 5 | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | / 5 | / 5 | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Fusion Markets | / 5 | / 5 | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | ASIC, VFSC, FSA |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Mobile Apps | iOS, Android & Windows |

|---|---|

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Minimum Deposit | $5 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Mobile Apps | iOS & Android, R StocksTrader |

|---|---|

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Minimum Deposit | $10 |

| Account Currencies | USD, EUR |

Pros

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

Cons

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Mobile Apps | iOS & Android |

|---|---|

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Mobile Apps | iOS & Android |

|---|---|

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Minimum Deposit | $100 |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Mobile Apps | iOS & Android |

|---|---|

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Mobile Apps | iOS & Android |

|---|---|

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

How Trading Apps Work

Trading apps connect individual investors with popular financial markets, such as the NSE (National Stock Exchange of India) or the USD/INR forex pair. From a mobile device, users can buy and sell stocks at the click of a button, track their trading activity in real time, and make deposits and withdrawals.

Alternatively, some day trading apps in India are solely developed to provide market analysis, live signals, financial news, or a demo trading environment. These investment applications essentially support the decision-making process for aspiring traders.

Retail investors can download online trading apps from popular brokers or directly via the Apple App Store and Google Play. Traders simply need a stable internet connection and a compatible mobile or tablet device.

Interestingly, India is one of the most rapidly growing markets for mobile app trading. Mobile investing was only introduced in the country in 2010 but has seen exponential growth in recent years.

The result is that Indians now have a long list of mobile trading applications to choose from. But an increase in choice can make it harder to find the ‘right’ investment app.

How To Compare Online Trading Apps In India

There are several key factors to consider when looking for the best online trading app:

- Assets – The top trading apps in India connect users with a range of financial markets, from stocks listed on the BSE or NSE to currency pairs with Indian Rupees. Also look for a trading app that provides opportunities on popular global markets, including major forex pairs, US shares, plus soft and hard commodities.

- Fees – Although the majority of Indian trading apps are free to download, most firms charge a spread and/or commission on each trade. Interactive Brokers, for example, apply a 0.00345% transaction charge for all cash delivery trades in India. Traders are also liable to a 0.0001% SEBI turnover charge, 0.015% stamp duty fee, and a 0.100% securities transaction tax. In addition, it’s worth checking for other non-trading fees, such as deposit and withdrawal charges, overnight swaps, plus inactivity penalties.

- Regulation – Some of the best online trading apps in India are regulated by the SEBI (Securities and Exchange Board of India). The financial watchdog oversees the country’s financial markets, promoting a safe, fair, and transparent trading environment. Alternatively, leading trading apps that accept Indian traders may hold a license with another trusted regulator, such as the FCA (UK Financial Conduct Authority) CySEC (Cyprus Securities & Exchange Commission (CySEC), or ASIC (Australian Securities & Investments Commission).

- Device Compatibility – Before downloading an online trading app in India, it is worth checking your device is compatible. Most top-rated apps are available on Apple, Android, Samsung and Sony devices. Traders can also check whether the online trading app supports native languages such as Hindi, Bengali, or Gujarati.

- Features & Tools – The best online trading app in India will provide a user-friendly mobile investing experience with one-click trading, technical indicators, news streams, and mobile-optimized charts with pinch and scroll functionality. Also look for useful tools that can support beginners, such as copy trading and forex signals.

- Payment Methods – Does the trading app accept local payment solutions, such as RuPay or PhonePe? This will help ensure straightforward, secure and low-cost deposits and withdrawals. These apps are also more likely to be brokers with INR accounts, helping to reduce or eliminate forex conversion fees. In addition, check for minimum deposits as some of India’s online trading apps allow users to get started without an investment.

- Customer Support – For beginners, in particular, hassle-free access to customer service is important if there are technical issues with the app or general account queries. The best Indian online trading apps will provide 24/5 or 24/7 in-app support via live chat or social media.

Types Of Trading Apps

Alongside traditional trading apps, other types of mobile investment applications can prove useful to Indian traders.

Financial News

News trading apps have become popular in India, providing real-time bulletins to a wide audience base. The best applications for traders provide access to the latest information on business, the economic climate, and political events.

The latest announcements on Gross Domestic Product (GDP) and Consumer Price Index (CPI), for example, can have a significant impact on the volatility of Indian stocks

There are several financial news apps that our experts recommend for Indian traders:

- Daily Hunt – Over one million local news articles available in 14 Indian languages from multiple content providers

- The Times Of India – Coverage of the latest international and national news with analyst reviews and market insights

- Aaj Tak Hindi News Live TV App – The main Indian news channel, the app provides live news streaming and breaking bulletins in Hindi

- Inshorts – Local and global news sources summarized into news bulletin snapshots of sixty words or less

Signals

Sometimes referred to as a trade notification or alert, trading signals can alert investors to potential market opportunities with information on when to potentially enter and exit a position. Traders can essentially access the latest market data, alongside trade suggestions and strategy tips.

Importantly, trading signal apps provide information directly to Indians’ phones, including through push notifications. This could be via WhatsApp, SMS, or email.

Automated Trading

Automated investing apps or algo bots are in demand, particularly for Indian retail investors looking for a hands-off approach to trading.

Automated mobile apps can execute trades on an investor’s behalf, following pre-defined criteria. Users can define a strategy and set limits and let the application do all the analysis work in the background.

After testing various automated online trading apps in India, our experts had several favorites:

- Deriv – The broker’s automated trading software is popular with retail traders. The DBot platform helps traders build an automated trading program in five steps which can be deployed on more than 50 assets. Three pre-programmed strategies are also available to help beginners get started.

- Vantage – Indian traders can program strategies to run around the clock using the Expert Advisor (EA) functionality on the MetaTrader 5 platform. Traders can design and build their own bots or download pre-made systems.

- SpeedBot – This is one of the leading algorithmic trading apps in India. Users can trade a variety of markets by linking the application to one of multiple supported Demat accounts. Traders can review a catalog of bots, classified by investment styles. Clients also benefit from profit heatmap charts and real-time performance analysis.

Demo Trading

Many brokers offer demo accounts via iOS and Android-compatible apps.

Suitable for beginners, the top virtual apps provide Indian traders with access to real-time pricing and market conditions, plus all the features and tools that can be used within a live profile. Also look out for additional in-built education and learning materials to use alongside paper trades.

Bottom Line

Indian trading apps connect aspiring investors with popular financial markets, whether that’s stocks listed on the National Stock Exchange of India or shares in US technology firms and major forex pairs.

To find the best online trading app in India, compare commissions, spreads and fees, market access, device compatibility, additional tools, and support for local deposit and withdrawal methods.

Use our ranking of the top online trading apps in India to get started today.

FAQs

Are Online Trading Apps Legal In India?

Yes, online trading is legal in India, including through mobile devices. With that said, check the regulatory status of the hosting brokerage before downloading the mobile trading application.

Firms will either be registered with the Securities and Exchange Board of India (SEBI) or another trusted regulator, such as the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), or the Cyprus Securities & Exchange Commission (CySEC).

Which Is The Best Online Trading App In India For Beginners?

Beginners may want to sign up with an app that offers demo trading. Alternatively, look for trading firms that offer good educational resources, copy trading tools, plus on-hand customer support.

Use our list of beginner-friendly trading apps in India to find a suitable provider.

What Type Of Online Trading Apps Are Available To Indian Investors?

Traders in India can access several different trading and investment apps. This includes a standard brokerage app which facilitates trading in stocks, forex, commodities and cryptos.

Alternatively, some online trading apps in India specialize in news announcements, market insights, forex signals, copy trading, and automated bots.

Which Online Stock Trading App Is Best In India?

There is no ‘best’ online share trading app in India. Financial goals, risk appetite and user preferences vary between traders. With that said, the top stock trading apps in India offer access to the NSE and BSE, alongside trading on popular global markets, such as US, EU, Asian and Australian stocks. Some leading share trading apps also offer commission-free trading and fractional stocks.

Head to our full guide for the best Indian stock trading apps in 2026.