Short Selling Forex

Short selling forex is a strategy whereby you bet against currencies. In a short sell, you take a position that the value of a particular currency will fall in value. Our guide explains how it works as well as how to get started. We also list the best brokers for forex shorting.

Best Forex Shorting Brokers

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com

Short Selling Forex Explained

Unlike shorting stocks, where you sell borrowed shares and agree to return them in the future, in the forex market, you simply need to place a sell order. This is made slightly more complicated because when trading forex in pairs, you are always buying / going long on one currency while selling / going short on another. Therefore, if you wanted to short the Great British Pound following Brexit, you would need to sell GBP while choosing a counter currency to buy. We explain how this works in more detail below.

Importantly, going short is the opposite of going long. When you go long, you expect the value of the currency to rise and you open a buy position. This usually takes place in a bullish forex market, whereas shorting occurs during a bearish market. As more forex traders enter the market and start shorting the currency, a domino effect can occur as the value continues to decrease.

How Does Short Selling Work In The Forex Market?

As outlined above, there are two options available to someone looking to trade a currency pair, they can either buy or sell. In both options, the trader is buying one currency and selling another. Which currency the trader believes will fall or rise in value determines the currency they sell or buy.

If you are trading the GBP/USD, for example, and choose to go short, you are simultaneously selling the pound while buying the dollar. Equally, if you go long, you buy the pound while selling the dollar. As a result, you not only have to determine the currency you believe will drop in value, but also one that will rise against it.

Example

Short selling forex is best explained through an example…

Let’s say that you believe the value of the Euro is going to fall and therefore you want to short it. You need to pick a currency pair with EUR and believe the US Dollar is a good option.

Let’s also say the EUR/USD forex pair is currently trading at 1.1102. Your forex trading platform gives you the option to go long and buy EUR/USD at 1.11025 or go short and sell at 1.11015. As you believe the Euro will fall, you opt for the latter and open a sell position.

The next thing to determine is your position size. At the current rate, selling a standard lot is the same as trading €100,000 for $111,015. Considering this, you sell two lots of EUR/USD. This means that your total position size is €200,000 or $222,030.

The margin rate determines how much of the total position size you must deposit upfront. Let’s assume your broker has a margin requirement of 2%. Therefore, to open the trade and short the Euro, you must deposit 2% of your total position size, which is €4,000 or $4,440.60.

Two hours have passed, and it becomes clear that your hunch was correct and the value of the Euro has dropped against the US dollar. The EUR/USD forex pair is now trading at 1.10025. To close out the short-selling trade, you buy two lots at the current buy price.

Working out the profit from your trade is easy. All you do is subtract what you have just bought from your original sale. In this case, that is $222,030 – ($110,025 *2), which equates to a profit of $1,980.

Note, some brokers charge a commission on top of the spread, both of which may cut into profits.

Forex Shorting Basics

Before you start shorting the forex market, it is worth understanding some key terminology:

- Currency Pair – When you trade forex, currencies are presented in pairs. Each pair has a base currency and a quote currency, with the base listed first. For example, in the EUR/USD forex pair, the Euro is the base currency, and the US dollar is the quote currency.

- Pip Values – Price changes are measured in pips. For almost all currencies, one pip is 0.0001 of the value of the quote currency. The key exception to this is when the Japanese yen is the quote currency. In this case, one pip is normally 0.01 yen.

- Lot Sizes – Lot sizes determine the number of units of base currency that are traded. In standard transactions, the lot size is 100,000 units of the base currency. Some of the best platforms for day trading forex also offer mini and micro-lots of 10,000 and 1,000 units respectively.

Benefits Of Forex Shorting

We have summarised the main advantages of short selling forex:

- You can trade derivatives rather than owning the currency

- Trading on leverage means less upfront capital is required

- The strategy allows you to bet against currencies

- There is potential to generate profits

- You can trade off news events

Drawbacks Of Forex Shorting

There are also risks to short selling forex:

- The forex market can be volatile

- Trading on margin can amplify losses

How To Start Shorting Forex

If you want to start short selling forex, follow these steps:

1. Research Forex Pairs

The first step is to research different forex pairs that you believe will fall in value. If you want to take on more risk in return for larger profits, opt for more volatile forex pairs. If you want to make quick but small profits, opt for forex pairs with greater liquidity.

2. Analyse The Pair

After you have identified a forex pair that you want to short, carry out the technical and fundamental analysis. This can help confirm whether the trade is likely to yield profits. Use technical indicators like Fibonacci retracements to determine whether the pair is overbought or oversold.

3. Select A Strategy

Before you enter a position, have a clear strategy. Many techniques are available, each with their own advantages and disadvantages. You can find information on different strategies here, as well as videos on YouTube.

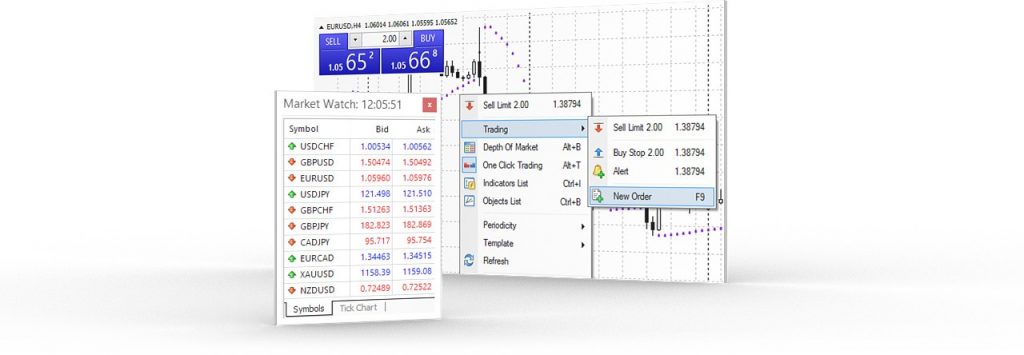

4. Fund Your Trading Account

Once you have identified a forex pair you wish to short, carried out your analysis and selected a strategy, you are almost ready to go. But before you start, you will need to open and fund an account with a forex trading broker. There are plenty available, so choose a provider that meets your needs. Compare minimum deposits, typical spreads, customer service levels and the breadth of forex assets available.

5. Open, Monitor & Close

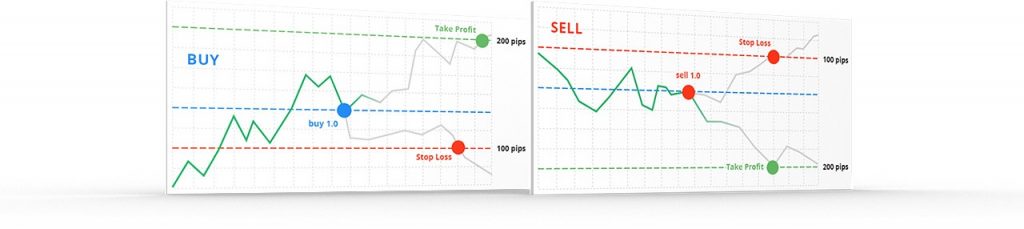

On your broker’s platform, select your chosen currency pair and go short by selecting the sell option. Implement any stop-loss and take-profit orders to protect your investment and then monitor your position. Once you are ready to close, make the opposite trade and open a buy position on the corresponding currency pair.

Risk Management

Short selling forex is arguably riskier than going long. If you go long on a currency pair, there is a limit to how much money you can lose – the value can go no lower than zero. However, when shorting a pair, if the value keeps rising, there is theoretically no limit to how far it could rise and how much money you could lose.

With this in mind, it is important to implement risk management techniques. One method is a stop-loss order. This instructs the broker to close the position if the currency being shorted rises to a certain value, thus protecting you from spiralling losses. Equally, you can also use take-profit orders. These instruct the broker to close the position if the price of the forex pair you are short selling drops to a specific value. This locks in profit and eliminates the risk of the pair rising in value again.

Education, Strategy & Signals

For those looking to enhance their forex trading skills, there is plenty of educational material available online, including strategy guides. There are also courses available on education sites like Udemy. These include the Short Selling Ninja course: The Big Short for Forex & Stocks (10 Hrs). This aims to teach everything there is to know about short selling forex, as well as going over a few different strategies.

For those seeking a more automated investing approach, there are forex trading signals. These notify you of suitable positions, essentially telling you what trades to make and when to close them.

Final Word

Short selling forex provides traders with the option to bet against currencies. It allows investors to factor in current events and profit from a currency’s downturn in value. It is also fairly easy to get started short selling forex. To start trading today, follow our five-step guide above.

FAQs

Is Shorting Forex Haram?

Opinions differ on whether short selling forex is haram or halal. Many councils are of the opinion that going short or long on forex is fine in Islam, however, it is worth conducting your research and looking into Islamic trading accounts before investing funds.

Is Short Selling Forex Risky?

Yes – short selling forex is risky with no theoretical limit to the size of losses. Therefore, it is important to carry out careful market analysis and use risk management techniques when trading.

What Is Going Short In Forex?

Short selling forex, or going short, means you bet against a currency. You are predicting that the value of the currency, for example the USD, will drop against its pair currency, such as the GBP.

What Is The Difference Between Going Long Or Short On Forex?

If you are short selling forex, you are assuming the value of the currency will drop. Conversely, going long assumes that the value of the currency will rise.

What Is The Best Forex Pair To Short?

There is no simple answer as to what the best forex pair to short sell is. This depends on current market sentiment and your view as to which currencies may be about to experience a decline in value. With that said, major forex pairs are often considered a good place to start owing to their high liquidity and competitive trading fees.