Best Forex Demo Accounts

A forex demo account is the safest way to learn forex trading. The best demo accounts will offer an app, as well as an online account. They will also match the live platform and offer full functionality to ensure the experience is comparable. Read on to find the best forex demo account for you.

Top 6 Forex Demo Accounts

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

Focus Markets

Focus Markets

This is why we think these brokers are the best in this category in 2026:

- Interactive Brokers - IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

- NinjaTrader - NinjaTraders supports the trading of popular currencies including the EUR/USD. The software also offers advanced features to streamline the trading experience, including complex order types like market if touched (MIT) and one cancels other (OCO).

- Plus500US - Plus500 US offers futures trading on a small selection of 13 currencies, including popular pairs like the EUR/USD and GBP/USD. Day trading margins are competitive, starting from $40, while the educational resources do an excellent job of breaking down the basics of forex futures for new traders.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- OANDA US - OANDA offers a diverse selection of 68 currency pairs, more than many alternatives. The broker’s in-house platform offers superb day trading capabilities via powerful TradingView charts, including 65+ technical indicators and 11 customizable chart types.

- Focus Markets - Focus Markets offers forex trading on 50+ majors, minors and exotics with competitive conditions, including spreads from 0.0 in the Raw account with a $3.50 commission per lot or spreads from 1.0 pip on majors like USD/CAD in the Standard account.

Best Forex Demo Accounts Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| Interactive Brokers | 100+ | 0.08-0.20 bps x trade value | / 5 | $0 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| NinjaTrader | 50+ | 1.3 | / 5 | $0 | NFA, CFTC |

| Plus500US | 13 | 0.75 | / 5 | $100 | CFTC, NFA |

| FOREX.com | 84 | 1.2 | / 5 | $100 | NFA, CFTC |

| OANDA US | 65+ | 1.6 | / 5 | $0 | NFA, CFTC |

| Focus Markets | 50+ | 0.0 | - | $100 | ASIC, SVGFSA |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| GBPUSD Spread | 0.08-0.20 bps x trade value |

|---|---|

| EURUSD Spread | 0.08-0.20 bps x trade value |

| EURGBP Spread | 0.08-0.20 bps x trade value |

| Total Assets | 100+ |

| Leverage | 1:50 |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| GBPUSD Spread | 1.6 |

|---|---|

| EURUSD Spread | 1.3 |

| EURGBP Spread | 1.6 |

| Total Assets | 50+ |

| Leverage | 1:50 |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| EURUSD Spread | 0.75 |

|---|---|

| Total Assets | 13 |

| Leverage | Variable |

| Platforms | WebTrader, App |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- Plus500 added prediction markets to its 'Plus500 Futures' platform in February 2026, with event-based trades covering 10 categories, from financials to politics, including short-term opportunities with intraday contracts that expire after just 15 minutes.

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:50 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| GBPUSD Spread | 3.4 |

|---|---|

| EURUSD Spread | 1.6 |

| EURGBP Spread | 1.7 |

| Total Assets | 65+ |

| Leverage | 1:50 |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- The broker offers a transparent pricing structure with no hidden charges

Cons

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| GBPUSD Spread | 0.0 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.0 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT5 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

Cons

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

What Is a Forex Demo Account?

A forex demo account is a type of trading account where the customer is given free “play money” to practice trading with. It can be seen as a form of “forex trading simulator” with no financial risk to the trader. It is also a great way to try out a broker’s trading platform before using real money.

These accounts act as a practical and convenient way for traders to practice in a safe environment. Sometimes, platforms will offer a form of tutorial alongside their demo account, while others will offer a sign in where the user can then create and experiment with trading at their leisure.

There are several different versions of demo account available on the market, which we’ll look at in detail further down in this guide.

Other than the functionality and tools included in demo accounts, these specific offerings from companies provide a viable and effective way for beginners to learn how to trade without the risk of losing their own money or the money of others.

For traders starting out, demo accounts can be an incredibly valuable resource, even once they’ve decided which platform they’d like to use in the long-term.

Forex Demo Accounts vs Real Money Accounts

What’s the difference between a forex demo account and a real money account?

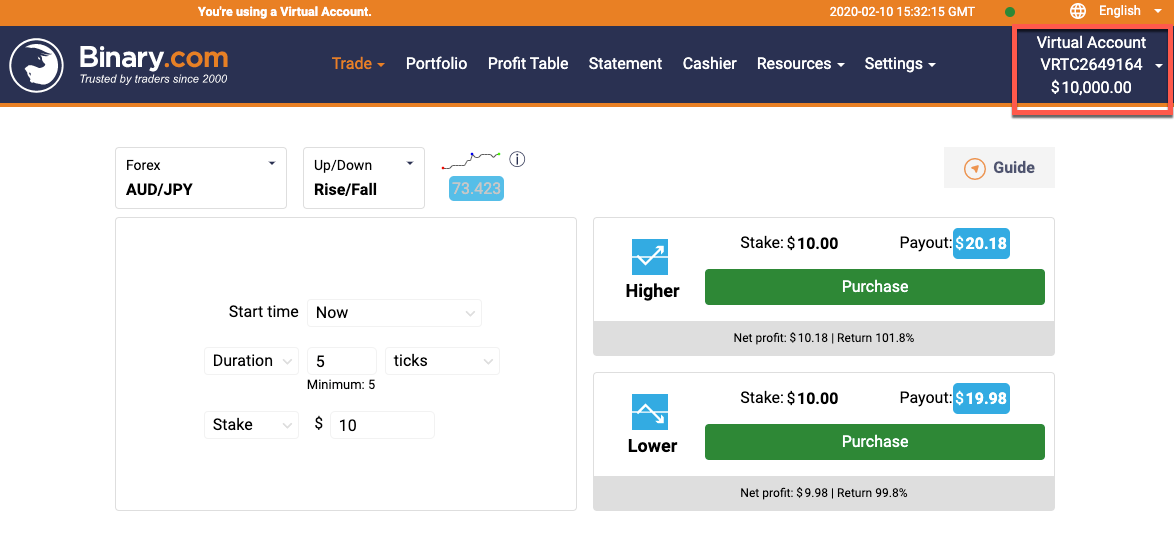

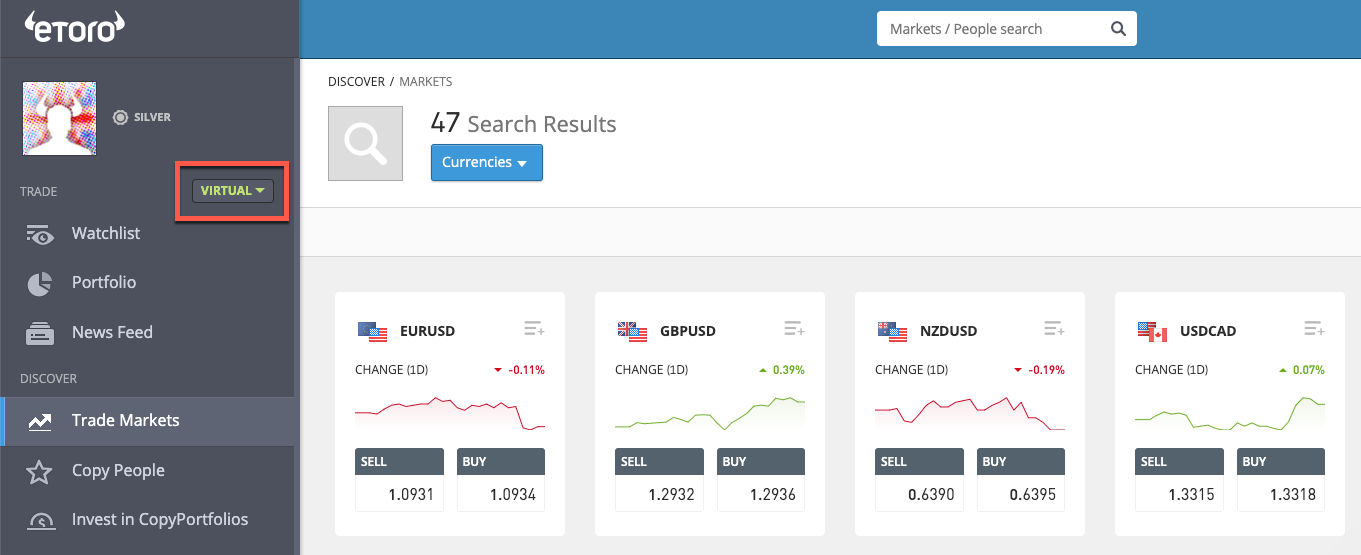

With demo or virtual accounts, the trading balance is a fictional balance. Winning or losing trades will impact the balance, but no ‘real’ money is at stake. If you blow your balance, you can contact the support team and ask for it to be reset.

A real money account requires you to deposit money – and the risks you take with it are real. Especially where leverage or margin is used.

In theory, this should be the one and only difference with Demo and Real accounts. In practise, that single change impacts almost every decision.

The psychological differences between trading with real money, and trading a virtual balance are huge. Pressing ‘buy’ on a trade is much harder when real money is at stake, and snatching at profits is more likely.

Competitions and contests are one way that can help bridge the psychological gap – the tension of trying to win a competition is similar to risking real money – but still not quite the same. So there is no actual answer to resolving this difference – it is just a case of making sure you are aware of it.

A good broker should ensure every other element of a demo account is exactly the same as a genuine account.

How To Compare Forex Demo Accounts

If you’re ready to start looking into the demo accounts that might be available, step one is doing your research.

There are several different types of account available from some of the best online Forex traders, but it’s all about finding what works best for you.

Certain brands may have restrictions in terms of usage for their demo accounts, including time limits, virtual cash limits and more. Carefully reading what your chosen platforms offer is an excellent place to start.

Here are a few of the types of demo accounts you may come across to get you started:

No Time Limit / Unlimited Accounts

As one of the most common demo accounts you’ll come across, many but not all good Forex trading platforms will offer an unlimited demo account to try out.

This means once you log in to your demo account – which, in most cases, will be a different access point to the standard trading platform – you’re free to test out your trading as little and as much as you want. There is no expiration.

Unlimited accounts aren’t just ideal for beginners – they’re perfect for testing out new techniques, back testing, and brushing up on your trading in the long-term too.

No Registration Accounts

No registration demo accounts are accounts you can access without any need to sign up with the platform.

This means no marketing emails, no personal details provided and no communications. For those that want a brief glimpse at what a trading platform can offer, a no registration account is an excellent option.

However, accounts with no registration will be lost the second you leave the page, meaning you can’t come back to continue your existing trades or continue testing a specific practice or idea.

Free Accounts

In most cases, demo accounts are free-of-charge. You’ll rarely come across a platform that’s asking you to pay or put money into what is essentially a testing stage.

No trading costs should apply to those using demo accounts, because none of the money being used is real.

This means you can access demo accounts for multiple different trading platforms at no cost, allowing you to thoroughly and adequately decide which platform is the best for you based on first-hand research.

Forex Demo Account Platforms

When it comes to accessing the demo accounts you like the look of the most, the next step is looking at what is compatible with your current setup. There are multiple different options available out there for demo account platforms – which you pick is up to you:

MetaTrader 4

Also known as MT4, MetaTrader 4 is a very popular platform used for trading and analytics. While a newer MT5 (below) version is available, MT4 continues to be favourite for many traders. This is thanks to its robust design and familiar controls, making it a top pick for many long-time traders. MT4 is used for Windows OS.

MetaTrader 5

MetaTrader 5, or MT5, is the newer version of the MT4 platform, offering a multi-functional platform that has a host of new features not included in the original MT4. For new traders, starting off on this platform provides you with the most up-to-date option on the market from this popular developer.

Mac OS

The MetaTrader platforms mentioned above are exclusively on the Windows operating system, though some individuals do find workarounds to use this popular software within the Mac OS.

For the majority of traders, however, the use of specifically brand-designed platforms is the solution, with many companies offering their own proprietary Mac OS software alongside Windows and Linux options.

cTrader

A UK-designed platform by Spotware that supports trading and charting, cTrader is a pared-back platform option that looks slick and is incredibly user-friendly. For new traders that want something simple and easy, cTrader is an excellent platform of choice.

Mobile App

Alongside desktop applications, there has been a steep increase in the number of forex traders using forex trading apps for trading on-the-go. This could be through entirely mobile systems or integrated apps for existing trading platforms. We go into further detail about mobile applications for Forex trading below.

Forex Demo Account Competitions

One of the most valuable additions that many traders enjoy from specific Forex trading platforms is contests and competitions.

While these are commonplace on real money trading platforms, they are also increasingly common for use with demo accounts.

This brings an extra touch of reality to virtual trading, helping to bridge that gap between testing out trading and doing it for real. It’s well-worth investigation demo accounts that offer addition interaction like this, as it provides a good impression of how actual money trading would look to those who aren’t quite there yet.

Typical contests and competitions for forex demo accounts may include weekly, monthly, and even daily rushes to achieve specific numbers and beat your fellow demo-users. In many cases, these wins can result in real cash prizes – providing the rush of trading without the risk of using your own money.

This makes contests an excellent middle ground between using your own wallet and simply practising for nothing in a demo setting.

Apps

The evolution of mobile forex trading apps has meant great things for Forex traders. Not only can you now trade from anywhere, but all the information is available at your fingertips with just a tap and a swipe.

The best Forex apps are available for both iPhone and Android. There’s plenty of choices out there, especially when it comes to apps that are companions to a more extensive desktop platform.

Where Can I Download Apps?

Downloading apps for Forex trading can be as easy as visiting the iOS App Store or the Google Play Store and finding an app that sounds interesting to you.

Equally, you can search directly for specific apps if they are something you’ve already tested out on desktop, or you can even go straight to a particular broker’s website and download your mobile app from them immediately.

As with any mobile applications, it’s straightforward to install your favourite trading platform onto your phone – and then you can use it from anywhere.

What You Should Know As A Beginner

As a complete beginner to the world of forex trading, what should you know? The most important thing to understand before you begin trading with real money is what exactly you want out of a platform.

Would you like extensive functionality, or would you prefer as many types of analysis as possible? Do you want something you can access from mobile, or is desktop preferable? Do you use Windows or Mac OS?

Finding the best platform for you means doing your research, understanding what you need and working towards it.

The joy of demo accounts is the fact that they are entirely free.

For those entirely new for forex trading, they provide a great space to learn, grow and develop away from costly mistakes and expensive accidents. Feel free to create as many demo accounts as you want to find the best fit for you – it’s not often you’ll fall in love with the first thing you try, so don’t be afraid to get out there and give it all a go.

Once you’ve shopped around a bit, you’ll be in a far better place to find something that works for you.

Comparing Forex Demo Accounts

When you start researching demo accounts, knowing what’s important to you is the best place to start.

Comparison factors can enable you to find platforms that work for you, as opposed to ones that are just ‘the best’ in general. Factors to consider should include what kind of thing you’d like to trade, as some forex day trading brokers have a wider variety of options than others.

You should also consider whether the platform has all the features you want. While some systems are feature-rich with countless add-ons and widgets, some are far more simplistic for a more streamlined experience.

Know what’s important to you can allow you to compare accounts based on your wants – instead of just going for the best-reviewed platform out there right now.

Trader Location

There might be some changes in availability based on your location as a trader. Most brokers will offer the forex demo account to the same regions where they offer the real account. So if a brand accepts traders from Australia, you should be able to open a demo account in Australia too.

It is not always this simple however. While regions such as South Africa and Asia (India, Singapore, Philippines etc) will find things straightforward, regulation can impact things elsewhere. So traders in the US, Canada and the EU, may find that regulators impact what brokers can offer. Certain options may not be available.

But in very general terms, if you can open a real money account, you should be able to open a forex demo account first.

Finding The Best Account For You

Once you’ve got a strong concept of what you’re looking for, it’s time to hunt down that elusive perfect platform.

Forex demo accounts can come in handy here, allowing you to narrow down which platform is best for you. Once you’ve found a platform that looks to be perfect, don’t leap straight into trading. Instead, fully utilise their demo account to ensure you’re adequately familiar with all this particular platform entails.

With more knowledge and experience behind you, you can’t go wrong.

If you’re testing the water of Forex trading for the first time, demo accounts can be your best friend. Used the right way, they can even be profitable for new traders – both in terms of contests and in terms of the knowledge gained through additional learning time and risk-free interaction. Why not give them a go today?