Best Forex Brokers In The UK

The best forex brokers in the UK are regulated by the Financial Conduct Authority (FCA), providing a secure environment for Brits to trade currencies like the Great British Pound (GBP).

Explore our pick of the top forex brokers accepting UK traders. Our British testers have evaluated each platform, verified their FCA regulation, and awarded them a high overall rating after considering 100+ data points.

Top 6 UK Forex Brokers

After reviewing 140 platforms, these 6 brokers stand out as the best for forex trading in the UK:

-

1

Pepperstone72% of retail investor accounts lose money when trading CFDs

Pepperstone72% of retail investor accounts lose money when trading CFDs -

2

XTB70% of accounts lose money when trading CFDs with this provider.

XTB70% of accounts lose money when trading CFDs with this provider. -

3

Interactive Brokers

Interactive Brokers -

4

Vantage

Vantage -

5

FOREX.com

FOREX.com -

6

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs

This is why we think these brokers are the best in this category in 2026:

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

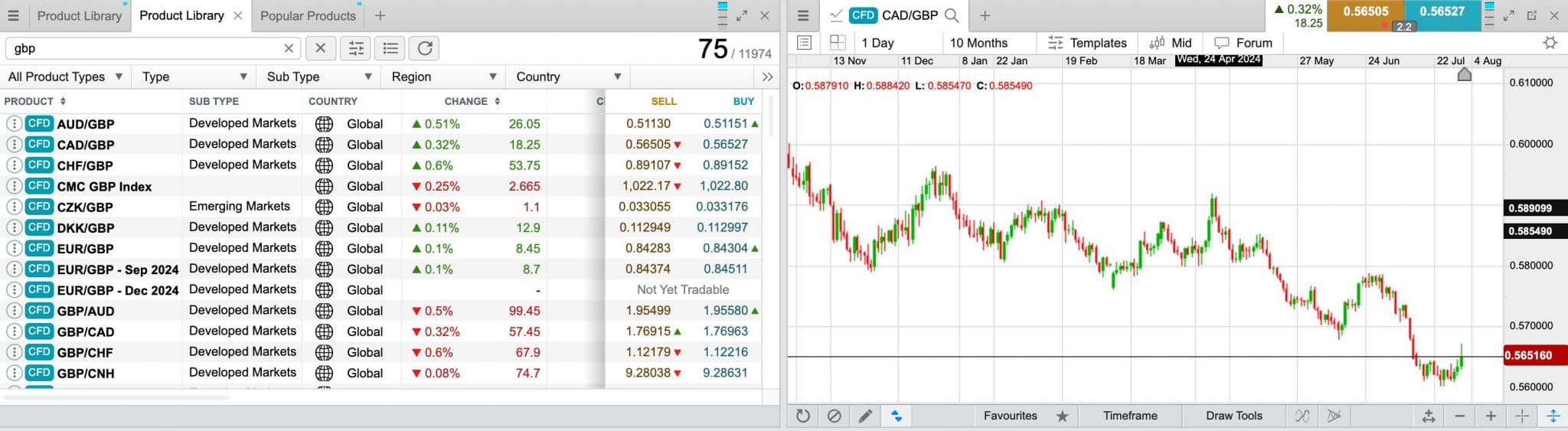

- XTB - XTB provides access to 60+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

- Interactive Brokers - IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

Best Forex Brokers In The UK Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| Pepperstone | 100+ | 0.1 | / 5 | $0 | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| XTB | 70+ | 1.0 | / 5 | $0 | FCA, CySEC, KNF, DFSA, FSC |

| Interactive Brokers | 100+ | 0.08-0.20 bps x trade value | / 5 | $0 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| FOREX.com | 84 | 1.2 | / 5 | $100 | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| Eightcap | 50+ | 0.0 | / 5 | £100 | ASIC, FCA, CySEC, SCB |

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| GBPUSD Spread | 1.4 |

|---|---|

| EURUSD Spread | 1.0 |

| EURGBP Spread | 1.4 |

| Total Assets | 70+ |

| Leverage | 1:30 |

| Platforms | xStation |

| Account Currencies | USD, EUR, GBP |

Pros

- With a vast range of instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

- With an excellent range of educational materials, including training videos and articles integrated into the platform, XTB supports traders at all levels.

Cons

- XTB does not offer a raw spread account, which is becoming increasingly common among competitors like Pepperstone, and may disappoint day traders looking for the tightest spreads.

- XTB discontinued support for MT4, limiting traders to its proprietary platform, xStation, potentially deterring advanced day traders familiar with the MetaTrader suite.

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| GBPUSD Spread | 0.08-0.20 bps x trade value |

|---|---|

| EURUSD Spread | 0.08-0.20 bps x trade value |

| EURGBP Spread | 0.08-0.20 bps x trade value |

| Total Assets | 100+ |

| Leverage | 1:50 |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:30 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

- It’s quick and easy to open a live account – taking less than 5 minutes

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:30 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:30 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

What Is A Forex Broker?

Forex brokers provide British investors with access to the foreign exchange market through platforms for buying and selling currencies, such as the Great British Pound (GBP).

Transactions in the forex market are presented as a pair of two currencies, for example, GBP/USD or EUR/GBP. Both of these pairs allow you to speculate on the value of GBP in relation to other currencies – the USD and EUR, respectively.

Forex’s popularity among UK investors can be attributed to its liquidity and its global availability, which allows trading 24 hours a day, 5 days a week.

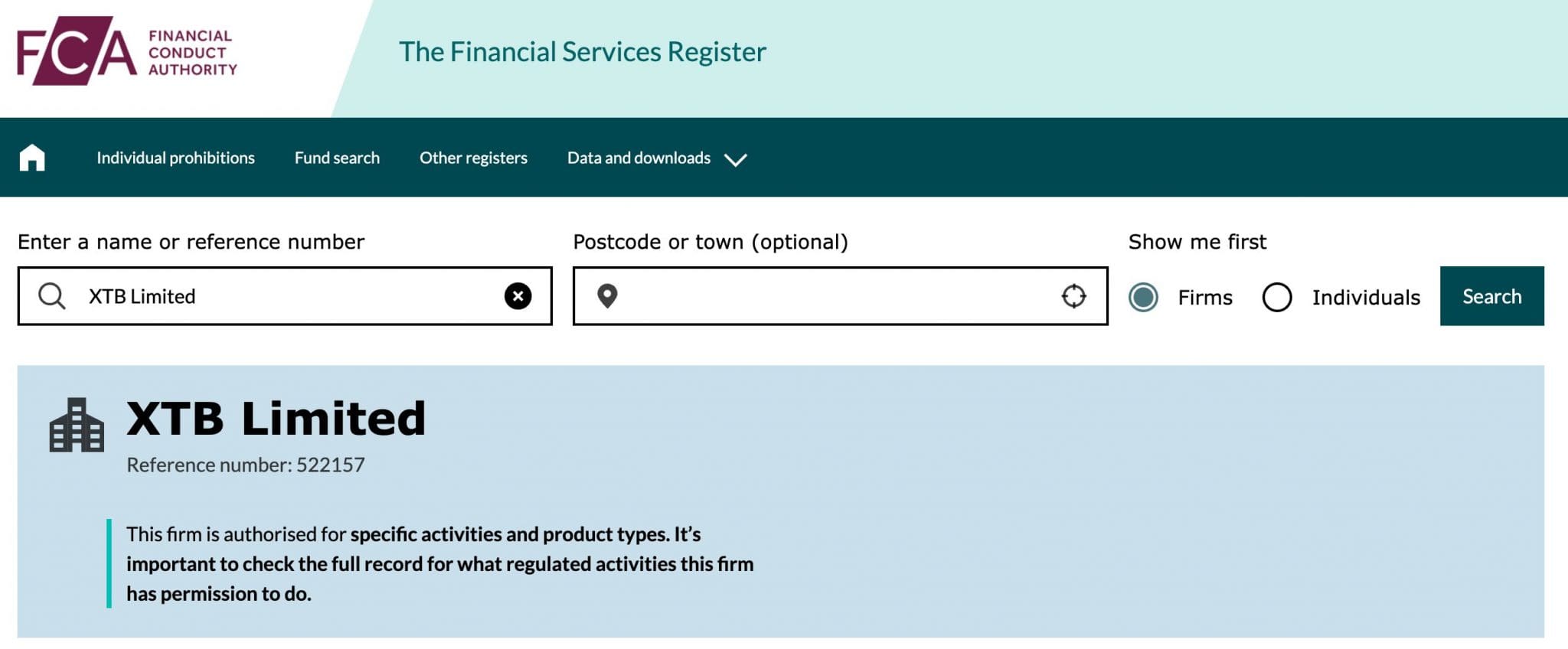

FCA Oversight

The Financial Conduct Authority (FCA) is the UK’s financial regulator and is considered ‘green tier’ in line with DayTrading.com’s Regulation & Trust Rating.

The FCA oversees financial services activities within the United Kingdom, including online forex trading platforms. All firms offering currency trading to Brits must be authorised by the FCA, with the regulator maintaining a Warning List of unauthorised companies.

The organisation aims to maintain competitive and fair financial markets. This includes protecting British investors against firms acting unlawfully or without their customers’ interests in mind.

Regulated forex brokers in the UK must meet several requirements, including limiting leverage to 1:30 for major currency pairs like GBP/USD and 1:20 for non-major currency pairs like GBP/CAD.

Firms must also segregate client funds to prevent misuse, provide negative balance protection so you cannot lose more than your balance, and not offer misleading financial incentives and bonuses.

Choosing an FCA-regulated forex broker is non-negotiable.It will give you access to the Financial Ombudsman Service to resolve disputes and the Financial Services Compensation Scheme (FSCS) which pays out up to £85,000 per client should the company run into solvency issues.

Additionally, it provides peace of mind against forex scams, which continue to plague the industry.

How Forex Brokers In The UK Make Money

There are several ways through which forex brokers in the UK make money:

Spreads

The spread of an instrument is the difference between the bid and ask price, where the bid price is the quoted price for selling a currency pair, while the ask price is the quoted price for buying the currency pair.

For example, if the broker displays the GBP/USD price as 1.1000/1.1001, then the spread would be 0.0001, or 1 pip.

Spreads can be either fixed or variable. Fixed spreads, often popular with aspiring traders looking for increased price certainty, mean that the price displayed on the platform is the price at which your order should be executed. Market makers tend to offer fixed spread trading accounts.

Variable spreads, popular with active, experienced traders, mean that the price will change depending on market conditions. For example, the market liquidity of GBP pairs generally increases when the London session times open, which can facilitate tight spreads.

ECN and STP forex brokers in the UK generally offer variable spreads.

Commissions

Commissions are charges levied when customers open and close orders. These are commonly charged by ECN forex brokers as it is typically their main source of revenue.

Commissions are typically charged as a flat fee (i.e. £2 per round per lot).

Importantly, the best UK brokers should offer low fees on forex pairs with the GBP, including the GBP/USD, EUR/GBP, and GBP/JPY.

How To Compare UK Forex Brokers

Forex trading platforms have their own advantages and disadvantages, each making them more or less competitive for a different set of British investors.

Below are some of the most important factors that should be considered when searching for the best forex broker.

Currency Pairs

Firstly, ensure that the forex brokerage offers the currency pairs you want to trade, such as those containing the British Pound.

While most brokers offer popular forex pairs (like GBP/USD, EUR/GBP and GBP/AUD) exotic pairs (like GBP/SGD, GBP/TRY and GBP/ZAR) are less common.

- CMC Markets is in a league of its own when it comes to the range of currency pairs based on our evaluations. CMC offers 330+ FX pairs and 35+ containing the GBP. It also has 12 currency indices, including a GBP index, providing a holistic view of a currency alongside the currencies of key trading partners.

Spreads & Fees

These conditions are often the most important aspect when looking for a forex broker, as they have a direct and meaningful impact on profits. That said, we don’t recommend choosing a forex trading platform based solely on its fee structure.

Spreads will often differ across each FX pair, though as the GBP is a key currency, you can typically expect tight yet sometimes volatile spreads. Lower spreads or even zero spread brokers can suit high-volume traders, though these brokerages may apply a higher commission rate.

As well as spreads and commissions, forex brokers in the UK may charge transaction fees, inactivity fees and overnight swaps, all of which you should incorporate into your decision and calculations.

The top-rated UK forex trading platforms publish a transparent pricing schedule on their website so you can compare costs before opening an account.

- FOREX.com is a low-cost broker, earning 4.6/5 in DayTrading.com’s Fees & Costs rating. Spreads start from 0.0 on EUR/USD in the RAW Spread account with a $5 commission per $100K, while the Standard account features spreads of 1.0 pips on the EUR/USD during our latest tests.

Payment Options

Another consideration when comparing forex brokers is the available deposit and withdrawal methods.

The best forex brokers in the UK offer a wide range of payment options with low fees. Not only does this demonstrate commitment to user accessibility, but each payment option requires its own set of security checks.

Popular payment methods offered by British FX brokers include Visa & Mastercard debit cards and credit cards, wire transfers, and e-wallets such as Skrill and Neteller.

It is also worth checking that GBP is provided as an account base currency. This will make managing your account and forex trading activity in your local currency easier.

- IG offers free deposits via bank wire transfer, credit/debit cards, plus PayPal with a GBP account for convenience. Two of our team have also used IG for real-money trading and haven’t reported any issues with deposits and withdrawals.

Minimum Deposit

When opening a new profile, you will need to fund your account by at least the broker’s minimum deposit amount.

Beginners may find forex brokers with a low minimum deposit more accessible as they require less capital upfront. However, ensure you can access the full catalogue of tools and services, such as forex signals or copy trading if you’re interested in those.

Some UK forex trading platforms increasingly offer a minimum deposit from just £0, while others ask for as much as £1,000 or more for access to advanced features or the best trading conditions.

- AvaTrade requires a minimum deposit of £100, though it recommends a starting balance of at least £1,000 to enjoy the full range of products offered. AvaTrade has also come a long way in recent years, picking up DayTrading.com’s ‘Best Trading App’ award.

Platforms

The platforms offered by forex brokers can make or break your experience. The most widely available platform for forex traders is MetaTrader 4 (MT4).

Although it sports an outdated design that I don’t enjoy, this platform offers a wide range of useful tools for market analysis and can be customised to suit your needs.

For FX brokers that offer different platforms, try to find out how many chart types, technical indicators, and additional functionalities are supported by the platform.

Accounts

Forex trading platforms in the UK often offer more than one account option. Each account tends to have different conditions and will be geared towards different experience levels or strategies.

For example, some firms adopt an STP pricing model while others offer ECN spreads. Alternatively, some forex brokers offer PAMM accounts while others provide an Islamic-friendly profile.

Importantly, the minimum deposit, the range of tradable currency pairs, the quality of the tools, plus the fee structure tend to be the key variants between forex accounts.

Mobile Apps

For those who want to access their account or execute positions on the go, a forex app is a must.

MT4 automatically comes with supported mobile apps, though UK brokers that offer proprietary terminals increasingly provide their own bespoke applications that better integrate with their systems.

- Interactive Broker’s mobile app provides its desktop counterpart’s full functionality. Access advanced quotes and research, plus powerful trading tools such as the Order Entry Wheel. Following obvious investment in recent years, it now delivers the complete mobile forex trading experience.

Customer Support

The best forex brokers in the UK are responsive and reliable.

Ensure there is a range of options to connect with the customer service team, such as telephone, email and live chat.

If your broker doesn’t provide 24-hour support, make sure their contact hours align with the times you normally trade. In the UK, the forex market is at its most active just after 8 am GMT when the London session opens.

- Pepperstone provides 24/7 customer support that we’ve used countless times over the years. Based on our experience, you won’t be kept waiting for help with account queries or questions about forex trading conditions.

Bottom Line

Choosing the best forex brokers in the UK can be a difficult task. However, breaking it down into the features above can be useful to speed up your search and support easier decision-making.

The top-ranked UK brokers will have FCA authorisation alongside a competitive fee structure, a responsive customer service team and convenient deposit and withdrawal methods.

Use our comparison table to kickstart your search.

Regardless of the forex broker you choose, trading currencies is high-risk. Most retail investors lose money.

FAQ

What Are The Best UK Forex Brokers For Beginners?

Beginners will benefit most from the high levels of regulation provided by FCA-regulated brokers, along with user-friendly platforms, low minimum deposits and responsive customer support. Beginners should also make sure to choose a broker that offers a demo forex account.

Based on our reviews, some first-rate beginner-friendly brokers are eToro, Pepperstone, and CMC Markets.

Where Is There A List Of FCA-Regulated Forex Brokers In The UK?

There is a long list of forex brokers in the UK with FCA licenses, including IG and FOREX.com. You can check a broker’s regulatory status on their website or find a list of registered UK FX brokers on the FCA’s Financial Services Register.

We recommend finding a trusted, regulated forex broker in the UK to ensure a secure and legitimate experience.

How Much Leverage Can I Get With Forex Trading Platforms In The UK?

The leverage limits offered to clients depend on whether the broker is FCA-regulated or not. Unregulated forex trading platforms can offer high leverage of 1:100 or more. However, this comes with amplified risks of losses that can extend beyond the balance of your account.

Given the risky nature of leverage trading, the FCA has capped forex leverage to 1:30.

Which Is The Best Forex Broker In The UK?

It is not possible to say that one brokerage or another is the best forex broker in the UK. Many top brokers can compete for that title. You should not try to find the best broker. Instead, you should try to find the right forex broker for you. The best forex platform for one person’s needs is not necessarily the best broker for another trader.

With this said, Pepperstone is a very good broker that was named our forex broker of the year and the FCA-regulated broker Eightcap was named the best overall broker.

Which Forex Brokers In The UK Have 0 Pip Spreads?

Zero pip spread brokers in the UK are beneficial for high-volume traders like scalpers. These types of providers are typically ECN brokers like Pepperstone and Vantage.

However, it’s important to be aware that costs may then be passed on through higher commission charges.

How Much Capital Do I Need To Trade With Forex Trading Platforms In The UK?

This will depend on the minimum deposit requirement permitted by the forex trading platform. Some FX brokers in the UK allow you to open an account and get started with as little as £1, while others require higher minimum deposits like £1,000.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com