Best Day Trading Platforms and Brokers in South Africa 2026

The best day trading brokers in South Africa provide intuitive platforms with excellent charting features, competitive fees, fast execution speeds, and margin trading.

Many also offer accounts in a convenient currency like the South African Rand (ZAR), are regulated by a credible body like the South African Financial Sector Conduct Authority (FSCA), and facilitate trading on popular markets such as the Johannesburg Stock Exchange (JSE).

Find the top day trading platforms in South Africa. All the online brokers we list below accept clients from South Africa.

Top 6 Platforms For Day Trading In South Africa

After testing, reviewing, and rating 140 brokers, our exhaustive analysis reveals that these are the 6 best day platforms and brokers in South Africa:

Here is a short overview of each broker's pros and cons

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- FXCC - FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

Best Day Trading Platforms and Brokers in South Africa 2026 Comparison

| Broker | ZAR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|

| RoboForex | - | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

| FXCC | - | $0 | CFDs, Forex, Indices, Commodities, Crypto | MT4, MT5 | 1:500 |

| XM | - | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| IC Markets | - | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| AvaTrade | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities, Crypto |

| Regulator | CySEC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP |

Pros

- FXCC is trusted and licensed by the CySEC, a top-tier European regulator offering high standards of safeguarding

- There are no deposit fees except industry-standard mining charges on cryptos, which is advantageous for active traders

- There are no restrictions on short-term trading strategies like day trading and scalping

Cons

- While the range of currency pairs exceeds most alternatives, the selection of additional assets is narrow, and notably, there are no stocks

- Although the MetaTrader suite continue to shine for technical analysis, the subpar design dampens the trading experience, especially compared to modern alternatives like TradingView

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Choosing A Day Trading Broker In South Africa

Our extensive experience in the day trading sector has revealed that there are several crucial elements to take into account when choosing a broker:

Trust and Regulation

It’s essential to select a trusted brokerage.

Doing so safeguards your funds against harmful trading practices, such as price manipulation and even fraud. Opting for a trustworthy broker is especially crucial considering South Africa’s history with trading scams.

One prominent example is Forex International, a company which offered guaranteed returns. Its scammer operators, Peter and Louis Henderson, who have since been jailed following an investigation by the South African Reserve Bank, were found to have stolen R 1.6 million before transferring the money to offshore bank accounts.

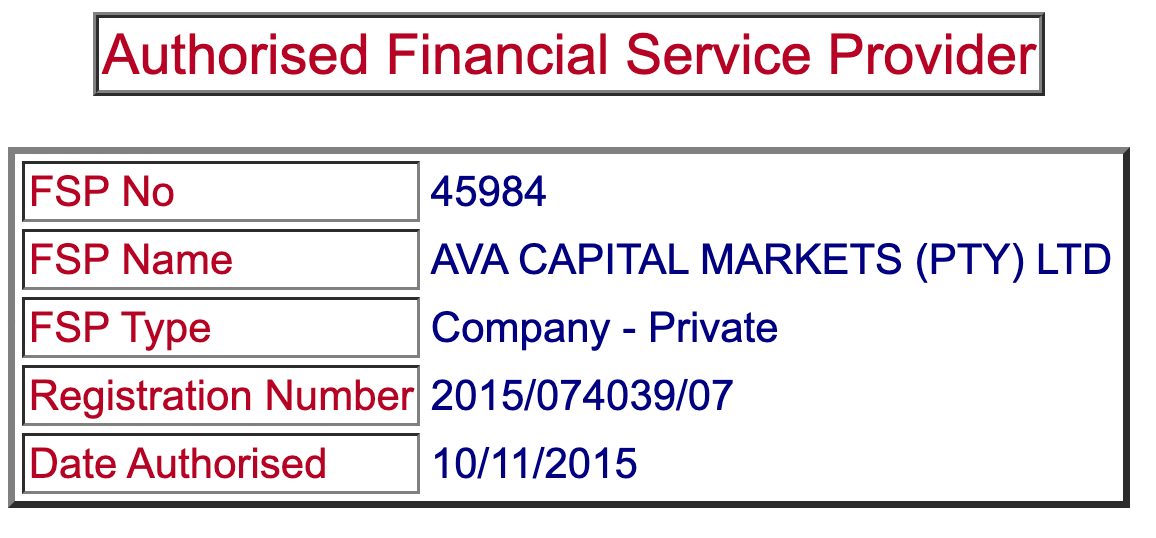

As a result, we routinely verify that day trading brokers are regulated by a credible authority, such as South Africa’s Financial Sector Conduct Authority (FSCA). The FSCA oversees brokers and permits popular short-term trading instruments like contracts for difference (CFDs).

Alternatively, we recommend global brokers regulated elsewhere that we trust, an assessment we make by verifying the number and quality of their regulatory licenses, their track record of treating day traders fairly, and their standing in the industry. It’s important to continue adhering to the FSCA’s regulations and local tax rules if you do opt for an overseas broker.

- AvaTrade earns our trust year after year owing to its regulation in 9 jurisdictions including South Africa. The over 400,000 traders and long row of industry awards also underscore its reliability.

Trading Fees

Choose a trading platform with low fees for both trading and non-trading activities.

For day traders, who typically engage in a high volume of transactions, it’s crucial to minimize transaction costs as they can significantly erode profits.

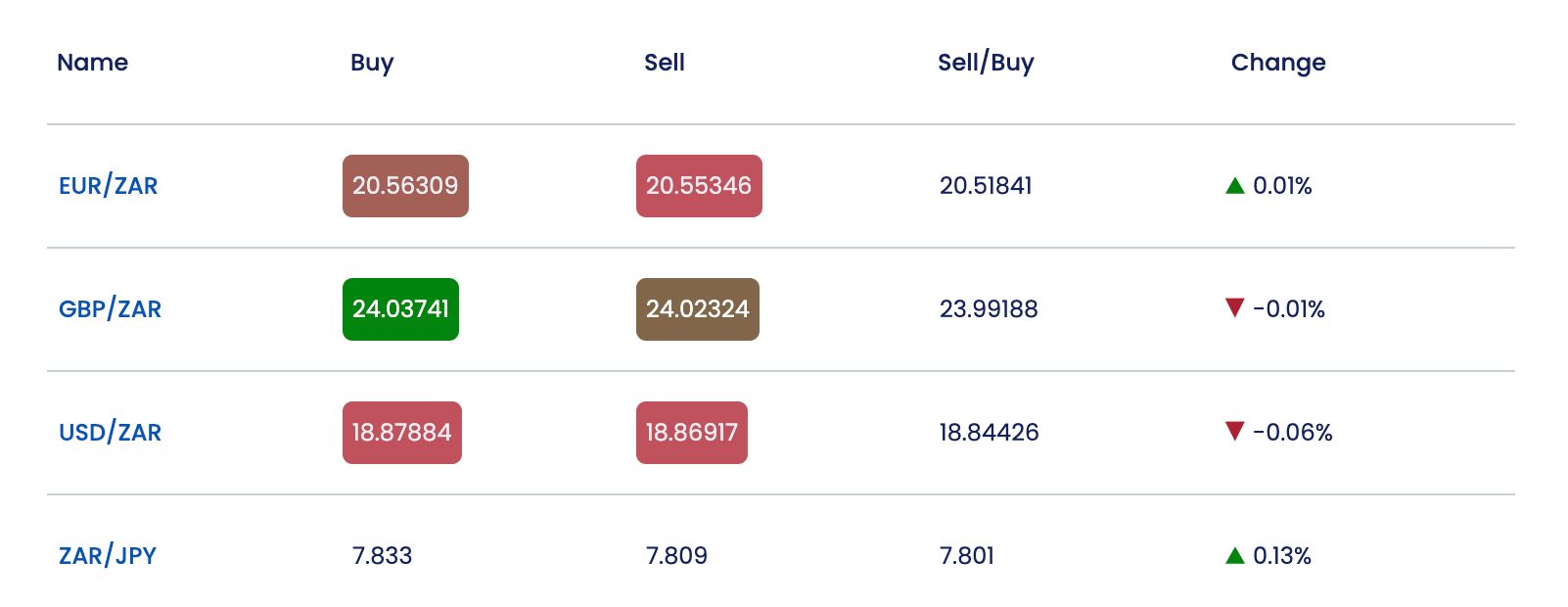

We recommend South African day trading brokers who offer attractive pricing, something we determine by recording and comparing their spreads on popular assets like the ZAR/USD.

We also evaluate any additional fees, such as those for deposits and withdrawals which can impact active traders, plus inactivity penalties which penalize casual investors.

Importantly, we then balance pricing with the quality of the broker’s tools and overall trading environment, as we know from first-hand experience that the cheapest brokers aren’t always the best.

- IC Markets stands out as one of the lowest-cost day trading platforms based on our tests using real money, with 25 liquidity providers helping to ensure ultra-tight spreads from 0.0 pips. There are also no deposit and withdrawal charges or inactivity fees.

Trading Platforms and Tools

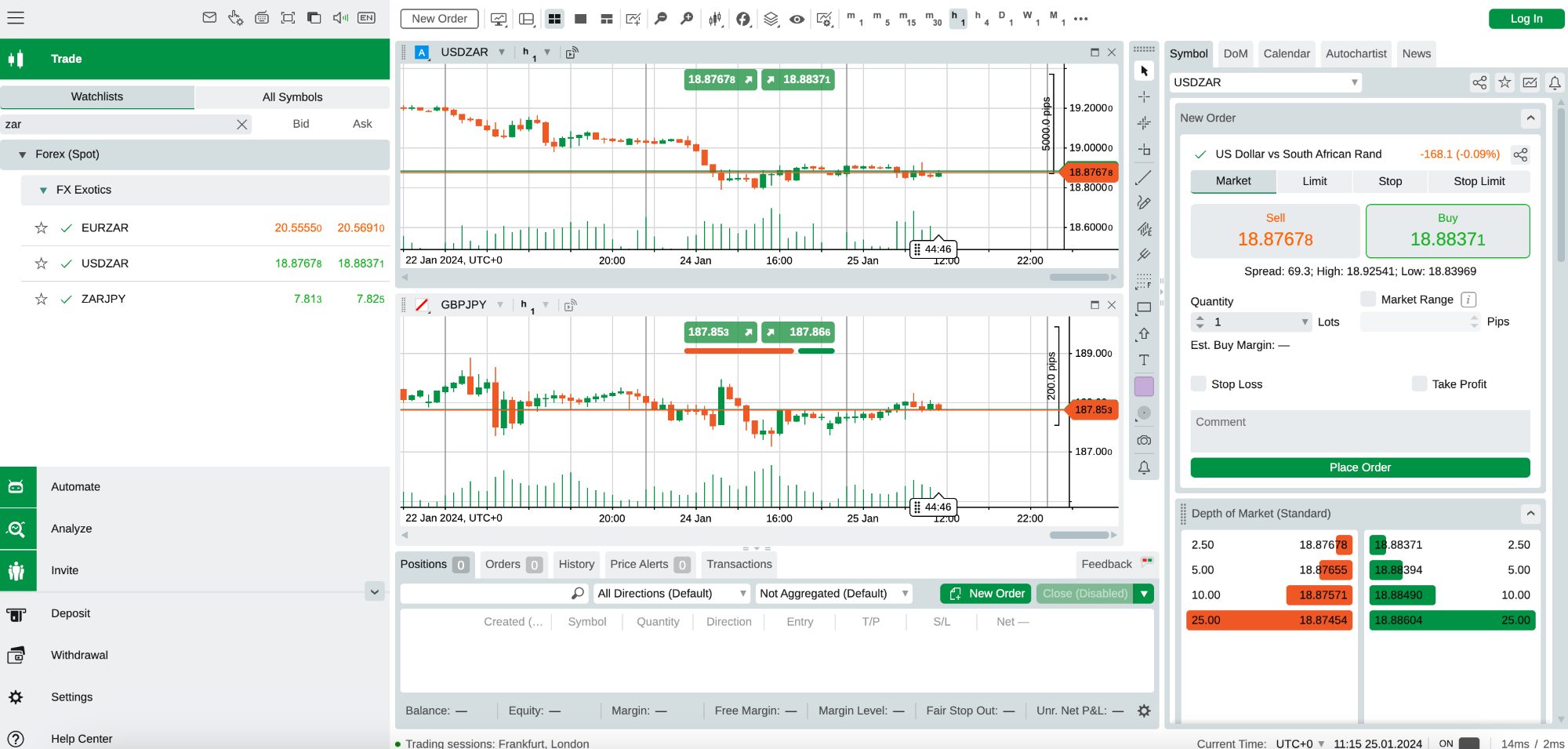

Select a user-friendly platform equipped with a good charting package.

Charting tools are especially crucial for day traders, as many depend on technical analysis for their short-term trading strategies.

Advanced day traders might require a range of sophisticated indicators and drawing tools, available from leading third-party platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. These are also great for automated trading.

On the other end of the scale, beginners will find the essentials they need in most proprietary platforms, including popular day trading indicators like Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI).

Our experts always evaluate the trading platforms, apps, and tools as a part of our review methodology. We conduct hands-on tests of the software to ensure it delivers an excellent user experience, complete with the charting tools necessary for day traders at every experience level.

- Pepperstone continues to stand out for its charting platforms with MT4, MT5, cTrader and TradingView. It’s also one of the few day trading brokers in South Africa to support Autochartist, which identifies actionable trading opportunities in real time.

Day Trading Markets

Choose a brokerage that provides opportunities in your preferred markets.

For many day traders in South Africa, it will be important to have access to local stock exchanges, such as the Johannesburg Stock Exchange (JSE). Additionally, the ability to engage in short-term trading on currency pairs with the ZAR may be important.

Our top picks for South African day trading brokers offer a variety of asset classes, including stocks, forex, commodities, indices, and cryptocurrencies.

These brokerages also often feature products tailored for short-term trading strategies, like contracts for difference (CFDs).

CFDs are a derivative that lets you speculate on price movements, both upward and downward, without actually owning the asset you are speculating on, for instance, Naspers shares listed on the JSE.

- Forex.com has expanded its range of assets over the years to cater to the full spectrum of day traders, offering over 5,500 instruments spanning multiple asset classes, including four currency pairs with the ZAR.

Execution Speed

Sign up with a brokerage that ensures quick and dependable order fulfilment.

For intraday trading especially, choosing a broker that focuses on rapid order execution is crucial. Delays in order processing can lead to lost trading chances or less favorable pricing, all of which can impact your bottom line.

Additionally, execution quality is a critical factor, encompassing aspects like speed, price, and the probability of order completion.

We recommend South African day trading platforms with rapid and reliable order execution, based on our extensive evaluation of their execution policies and analysis of average execution times, where such data is available.

- FxPro emerges as one of the fastest brokers with most orders filled in under 13 milliseconds. This makes the platform superior for short-term setups like scalping and algo trading.

Leverage and Margin Trading

Register with a broker that provides leverage and clearly defined margin requirements.

Opting for a broker that facilitates leverage trading is vital for many day traders. It enhances the potential for higher profits by enabling the handling of larger positions using a small amount of capital.

For instance, your platform might give you 1:5 leverage on South African stocks. This means with an investment of 2000 Rand, you can control a position of 10,000 Rand (5x your investment).

However, this also increases the risk of greater losses, and it is particularly important for novices to be cautious.

Risk management and a good understanding of your broker’s margin requirements are crucial. These requirements determine the capital needed to maintain your positions.

This is particularly important for day traders in South Africa, as the FSCA does not mandate a leverage limit of 1:30, which is commonly found in heavily regulated regions like Europe and Australia. As a result, much higher leverage is often available.

- XM offers very high leverage up to 1:1000 through its global entity – more than most trading platforms based on our tests of hundreds of firms. It has a stop-out level which will automatically close your positions if you don’t maintain enough capital.

Minimum Account Deposit

Select a trading platform with a deposit requirement suitable for your circumstances.

This is especially crucial for beginners with limited funds for online trading. Fortunately, our analysis shows that most leading day trading platforms accepting South African traders typically set their minimum deposit at 5,000 Rand or lower (approximately 250 USD).

There are even platforms with no minimum deposit requirement, such as Pepperstone, making them ideal for traders on a tight budget.

- Trade Nation continues to be a compelling choice here with its ZAR trading account and no minimum deposit. It’s also regulated by the FSCA in South Africa.

Methodology

In our search for the top day trading platforms in South Africa, we relied on both quantitative data and qualitative insights from our comprehensive broker reviews, focusing on several key aspects:

- We made sure the brokerage accepts day traders in South Africa.

- We verified that the company was regulated by the FSCA or another reputable regulatory body.

- We analyzed the fees associated with conducting day trades to make sure they are competitive.

- We tested the platform and/or app to ensure it is conducive to short-term trading strategies.

- We assessed the assets available for day trading, including those in South African markets.

- We examined the speed and effectiveness of order executions.

- We considered the options for leveraged trading and the associated margin requirements.

- We confirmed the minimum deposit to begin day trading in South Africa is accessible.

Bottom Line

Starting with our pick of best day trading brokers in South Africa is an excellent strategy for identifying the best platform for your requirements – we’ve undertaken the rigorous process of testing, assessing, and grading these firms for you.

Should you remain uncertain about which brokerage to choose, consider trying out their platforms through a demo account.

FAQ

What Is Day Trading?

Day trading involves the act of purchasing and selling financial assets, like stocks on the Johannesburg Stock Exchange, all within the span of one trading day.

This approach is adopted by individuals seeking to profit from brief price movements over the short term.

Is Day Trading Allowed In South Africa?

Yes, day trading is allowed and legal in South Africa. The financial markets and trading products like forex and CFDs are overseen by the country’s regulator – the Financial Sector Conduct Authority (FSCA).

Which Brokers Do South African Day Traders Use?

The number of day trading brokers located in South Africa and regulated by the local Financial Sector Conduct Authority (FSCA) is limited.

That’s partly why many day traders choose to sign up with respected global brokers, regulated by other trusted bodies.

Still, local investors should understand that intraday trading with an international broker could restrict your avenues for legal action should problems arise.

How Much Money Do I Need To Day Trade In South Africa?

Our exhaustive analysis indicates that the majority of top day trading platforms catering to South African traders often have a minimum deposit requirement of 5,000 Rand or less, which is roughly equivalent to 250 USD.

Some of the best day trading brokers in South Africa, such as Pepperstone and Trade Nation, even have no minimum deposit, making them an attractive option for beginners.