Best Brokers For Research

Cutting-edge research tools can transform the way you trade. Imagine having a personal trading assistant that provides live charting analysis, insightful market outlooks, timely news updates, and even social sentiment data that reveals whether traders are bullish or bearish on hot stocks like Tesla.

Explore the best brokers for research. We’ve done the heavy lifting for you – investigating and rating the research tools of countless brokers, with each of our recommended trading platforms standing out in the field – providing insights to help you identify short-term trading opportunities.

Top 6 Trading Platforms For Research Tools

Our hands-on tests and analysis show these 6 brokers offer the best research, either through in-house services or third-party integration:

-

1

FOREX.com

FOREX.com -

2

Interactive Brokers

Interactive Brokers -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

Firstrade

Firstrade -

5

Optimus Futures

Optimus Futures -

6

NinjaTrader

NinjaTrader

Here is a short overview of each broker's pros and cons

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- Firstrade - Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

Best Brokers For Research Comparison

| Broker | Research Rating | Trading Central | Auto Chartist | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|---|---|

| FOREX.com | / 5 | ✘ | ✘ | $100 | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | NFA, CFTC |

| Interactive Brokers | / 5 | ✔ | ✘ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| OANDA US | / 5 | ✘ | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | NFA, CFTC |

| Firstrade | / 5 | ✔ | ✘ | $0 | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed | SEC, FINRA |

| Optimus Futures | / 5 | ✘ | ✘ | $500 | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts | NFA, CFTC |

| NinjaTrader | / 5 | ✘ | ✘ | $0 | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) | NFA, CFTC |

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Day traders can enjoy fast and reliable order execution

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- The broker offers a transparent pricing structure with no hidden charges

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

Firstrade

"Firstrade is perfect for beginners looking to trade US stocks with zero commissions. There is a wealth of free education plus premium-quality research, notably through its latest FirstradeGPT tool, plus trading ideas from Morningstar, Briefing.com, Zacks and Benzinga."

William Berg, Reviewer

Firstrade Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Regulator | SEC, FINRA |

| Platforms | Firstrade Invest 3.0, TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | $1 |

| Account Currencies | USD |

Pros

- Excellent broker for budget-conscious traders with low OTC fees

- One of the first brokers to add AI-powered analysis through FirstradeGPT

- Improved platform offering in 2025 with Firstrade Invest 3.0, sporting a cleaner interface and faster order entry for active traders across key areas like watchlists and options chains.

Cons

- Visa credit/debit card deposits and withdrawals are not accepted

- Customer support still needs work following testing with no 24/7 assistance

- Firstrade focuses on stocks at the expense of forex, limiting diversification opportunities

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

Cons

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

How We Chose The Best Brokers

We rate brokers’ research offerings from 1 (lowest) to 5 (highest). Then we’ve ranked them by this research rating to reveal the very best.

To assign a score for a trading platform’s research services we weigh several elements:

- The range of research tools, with a preference for technical and fundamental summaries, market screeners, news streams, pre-open bulletins, forward-looking insights, and community research.

- The quality of providers, with a preference for excellent in-house insights or third-party tools like Trading Central, Autochartist, TipRanks, and Seeking Alpha.

- The frequency of market insights, with a preference for daily coverage via in-app notifications, email alerts and increasingly video channels to support active day traders.

- The usability of the tools, with a preference for beginner-friendly features integrated directly into the trading platform or app for a seamless user experience.

- The breadth of market coverage, with a preference for insights and actionable trading ideas spanning popular financial markets, such as stocks, forex, indices, and commodities.

- The ability to tailor research tools to individual preferences, with a focus on customizable workspaces, market filters, impact ratings, and the option to set up personal notifications.

What Types Of Research Tools Are Available For Trading?

This depends on the broker but can generally be split into in-house and third-party tools.

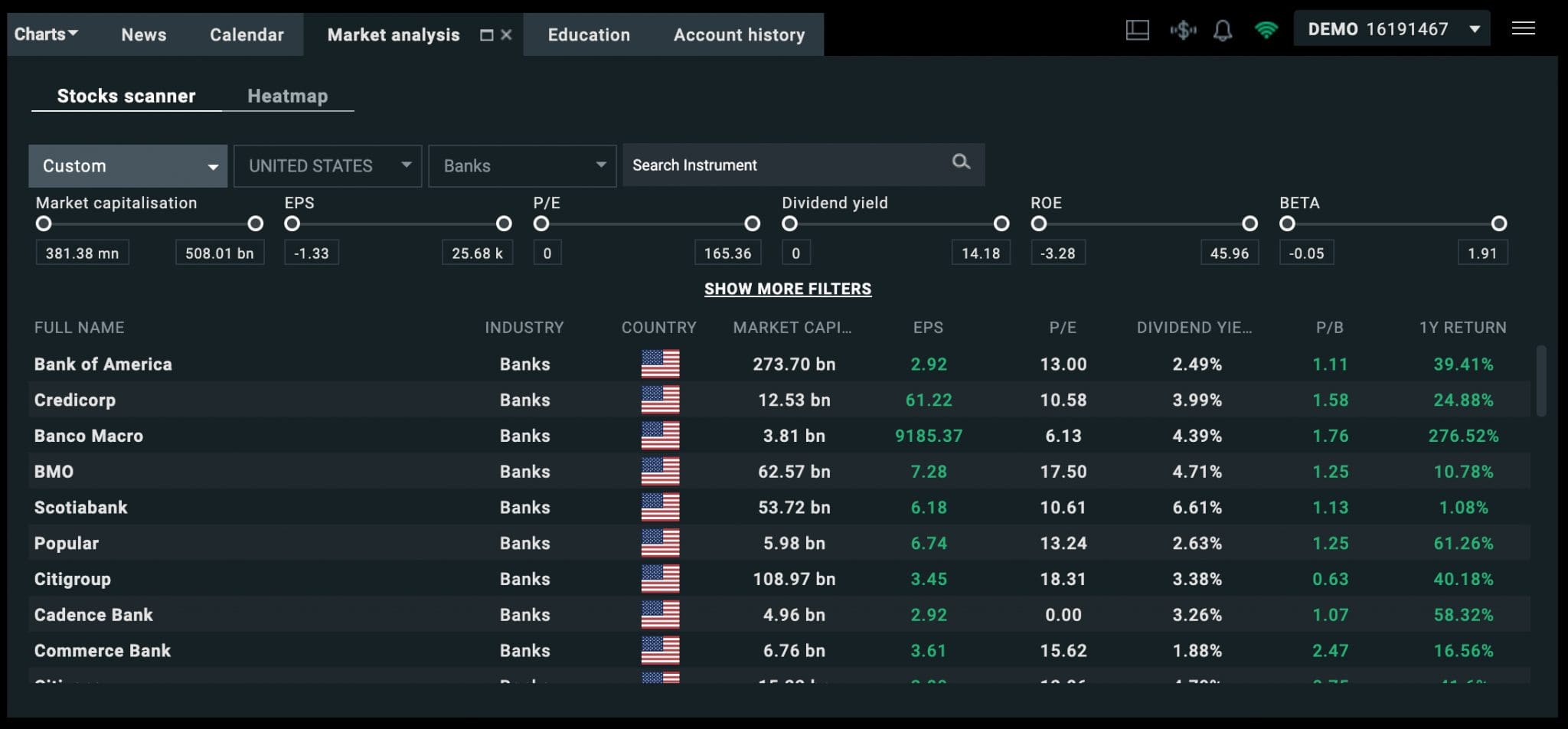

XTB, for example, focuses on insights from its in-house analysts with almost hourly news coverage, a filterable stock scanner, a heatmap (forex, US and EU stocks), plus well-presented charting analysis that’s great for short-term traders.

The user experience is also fantastic – I can access all the tools from the top of the web platform in one click, though I’d like to see them carried through to the XTB app too (there is no calendar, heatmap or stock scanner).

Alternatively, IG supplements its superb in-house research with access to leading third-party tools like Autochartist, Trading Central, TipRanks and Reuters, culminating in the best research tools I’ve seen.

The benefits of integrating third-party resources are plentiful; they specialize in what they do so the depth of market coverage is often excellent.

For day traders, in particular, tools like Autochartist also provide fantastic features for short-term trading, notably chart patterns, horizontal support & resistance levels, extreme movements, hourly volatility analysis, plus risk calculators.

My only criticism of IG’s tools is the scatter gun approach to where they’re stored. While TipRanks is available directly in the platform and I added it to my workspace with ease, the financial calendar takes you to a separate web page, while IGTV, which is brilliant for discussing trading opportunities, is located within the IG Community.

This can all make navigation fiddly and potentially overwhelming for newer traders who will understandably want to access everything from one place, preferably the account area or platform.

How Can I Use Research Tools For Online Trading?

To illustrate how you can use market insights from online brokers, let’s walk through an example using real research from Pepperstone.

A report focusing on the tech momentum following a Federal Reserve meeting highlighted Apple’s 7% surge in after-hours trading due to a positive earnings announcement and a $100 billion share buyback, which pushed its stock price above recent highs.

This bullish signal in technology, especially influencing NASDAQ futures, prompts an idea…

I could place a long position on NASDAQ futures early the next morning, expecting a continued uptrend spurred on by the technology sector.

I could set a stop loss below the recent significant low on a 5-minute chart and target a profit near the next resistance level, around 1.5% higher.

If the tech rally persists, I could close my position near my profit target, benefiting from a well-timed entry into technology stocks thanks to research and data from my broker.

Will Research Tools Improve My Trading Results?

Potentially, but only if you understand what they can, and can’t, do.

- They can help you identify markets where there may be trading opportunities, whether due to news events, geopolitical shifts, sector trends, technological innovations, or other influences.

- However, they can’t be relied upon in isolation. You’ll still need to conduct your own analysis to confirm there is an opportunity and how best to capitalize on the opportunity, for example, whether to go long or short, over what duration, and how to approach risk management.

Ultimately, research services can be a valuable tool in your toolkit, but you’ll need the rest of the tools to trade successfully.

FAQ

Which Online Broker Has The Best Research?

Use our list of the best online brokers for research to find the trading platform that best meets your needs. This is because research tools are only one piece of the puzzle.

It’s also important to weigh the broker’s industry standing (only use tightly regulated brokers), trading fees (short-term traders especially need low-cost brokers), market coverage (make sure the assets you want to trade are supported), education (beginners in particular should look for trading guides and demo accounts), and customer support (day traders especially need fast, dependable assistance should they encounter urgent issues).