Best Brokers For Expats In 2026

The number of expatriates (expats) – people who live and work in the long-term outside their countries of citizenship – has been rising rapidly. With the UN estimating some 280 million immigrants living around the world, the total number together would amount to the fourth largest country after India, China and the US, and a significant portion of these are expats.

Expats have fairly unique requirements from a trading broker owing to their need to move and manage finances across different countries, navigate complex tax requirements and require customer support teams who cater to global traders.

Fortunately, we’ve done the hard work for you – identifying the best brokers for expats. Discover the trading platforms that excel for expat traders in the following areas:

- International presence and multi-regulated

- A diverse range of global financial markets

- Multilingual, international customer support

- Convenient overseas payments and currency conversion

5 Best Trading Platforms For Expats In 2024

The following 5 brokers are standout options for expat traders based on our hands-on investigations:

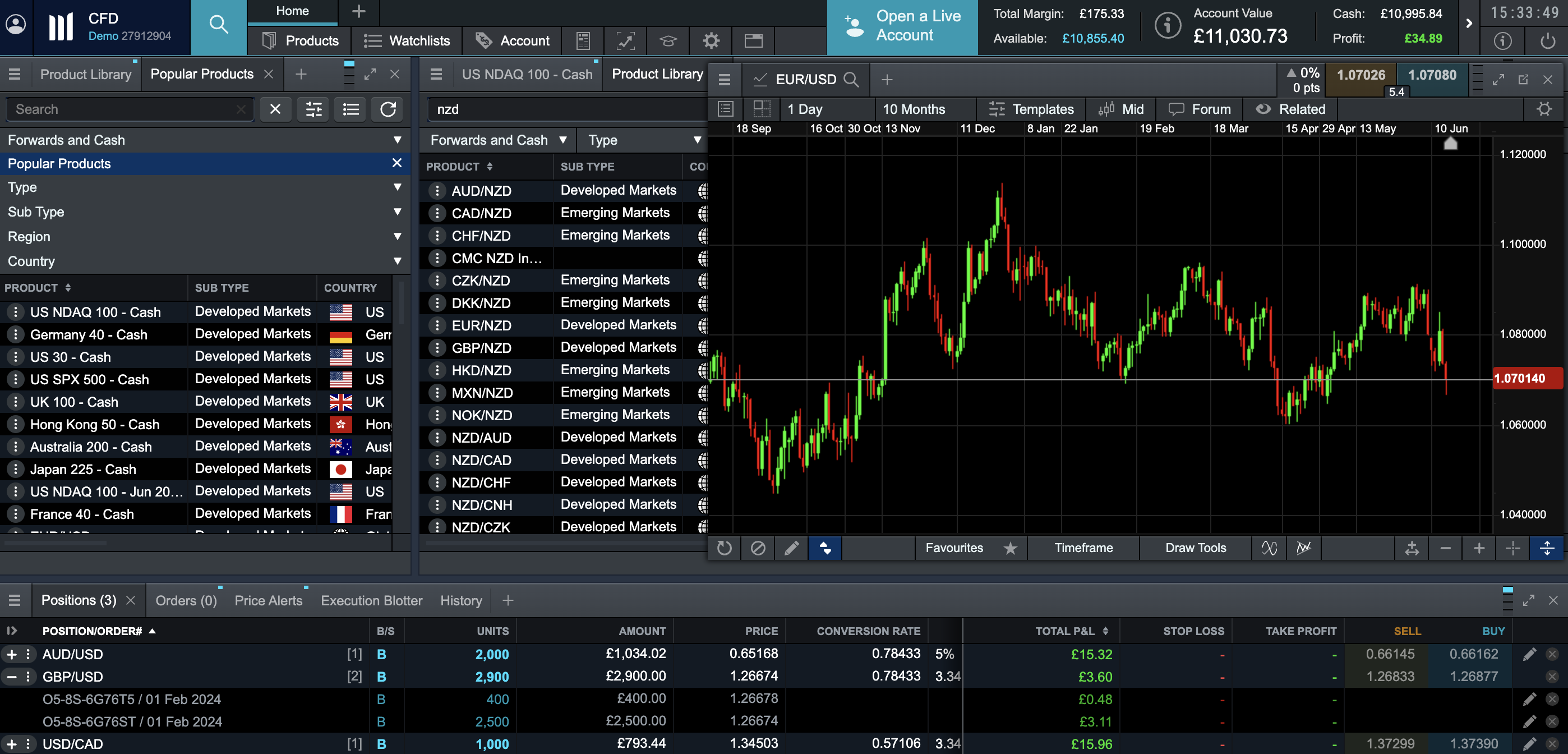

- CMC Markets: 12,000+ global markets. Multi-regulated with 35+ year record. Superb support.

- IG: Award-winning app. Best-in-class research. Weekend and out-of-hours trading markets.

- Pepperstone: Presence in 160+ countries. Deposits in 10 currencies. Spreads from 0.0 pips.

- FOREX.com: Low 0.5% conversion fees. Diverse financial markets. NASDAQ-listed and trusted.

- AvaTrade: Dozens of local support numbers. Multi-regulated. Bespoke risk management tools.

Comparison of Top 5 Brokers For Expats

| CMC Markets | IG | Pepperstone | Forex.com | AvaTrade | |

|---|---|---|---|---|---|

| Regulators | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Number of Assets | 12,000+ | 17,000+ | 1,300+ | 5,600+ | 1,250+ |

| Payment Methods | Visa, Mastercard, Wire Transfer, Credit Card, Debit Card, PayPal | PayPal, Wire Transfer, Mastercard, Credit Card, Visa, Debit Card | Visa, Mastercard, Credit Card, Debit Card, PayPal, Wire Transfer, POLi, UnionPay, BPAY, Neteller, Skrill | Wire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH Transfer | Boleto, Credit Card, Debit Card, FasaPay, JCB Card, Mastercard, MoneyGram, Neteller, Perfect Money, Skrill, Swift, WebMoney, Wire Transfer |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN | USD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN | USD, EUR, GBP, CAD, AUD |

| Customer Support | 24/5 | 24 hrs from 08:00 Sat to 22:00 Fri | 24 hrs Mon to Fri, 18 hrs Sat to Sun | 24/5 | 24/5 |

1. CMC Markets

Why We Chose It

With thousands of global markets, 24/5 support, flexible funding through 10 base currencies, plus tax-efficient products like SIPPs and ISAs, CMC Markets is a cut above the rest for expat traders.

CMC Markets is also one of the most trusted brands, with 5 ‘green tier’ licenses based on our Regulation & Trust Rating, plus a track record stretching back to 1989. Additionally, it’s publicly listed on the London Stock Exchange (LSE), cementing its credibility.

And it isn’t just us that love CMC Markets – over 1 million global traders have signed up with this highly trusted broker since it launched in 1989.

Pros

- With 12,000+ markets including 300+ forex pairs, share baskets and custom indices, expats can build a diverse portfolio. ISAs and SIPPs also offer long-term growth opportunities and encourage disciplined investing, which may benefit expats with fluctuating incomes.

- Funding is convenient for expat traders, with 10 base currencies, including USD, EUR and SGD, plus leading global e-wallets like PayPal. Testing also reveals a competitive 0.5% charge to convert currencies.

- The 24/5 support is among the best I’ve seen, with fast response times averaging under 5 minutes during testing. Additionally, there’s a range of local phone numbers and an in-platform chat, making it straightforward for global traders to resolve issues.

Cons

- Despite offering help in multiple languages, support is only available 24/5, trailing brokers like IC Markets which is available around the clock for international traders.

- CMC Markets’ zero-pip spreads on key assets are only available to ‘FX Active’ account holders, so beginners and low-volume traders may miss out on the tightest spreads.

- Although CMC supports a strong selection of funding options, the lack of Skrill and Neteller – which are popular for overseas transfers – is a drawback, especially compared to alternatives like Pepperstone.

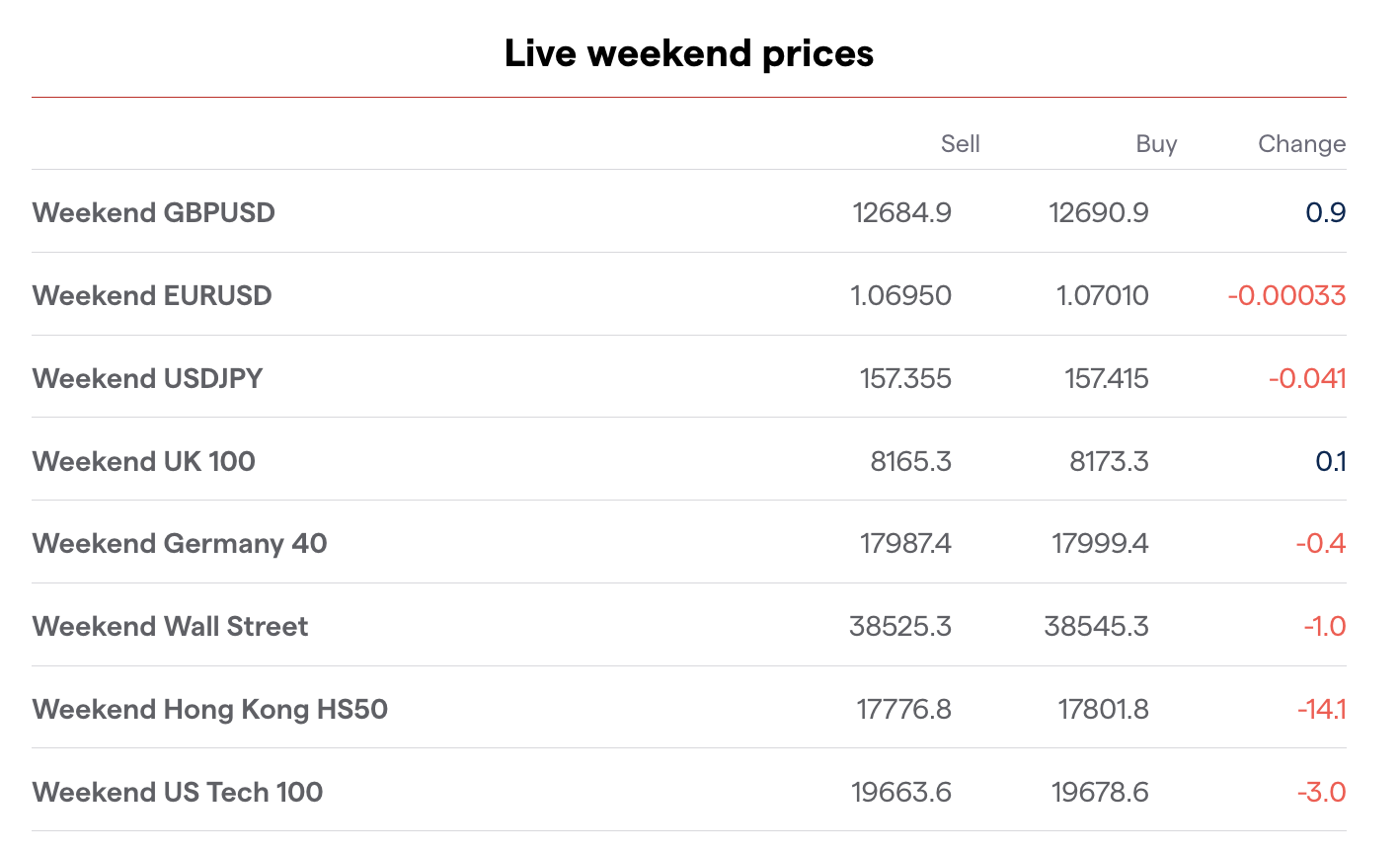

2. IG

Why We Chose It

IG offers an award-winning package for expats, with its intuitive trading app covering a nearly unbeatable range of 17,000+ instruments and best-in-class research tools spanning every major country and market.

IG is also one of the few brokers with long-term investment opportunities alongside short-term products, catering to various trading styles.

Pros

- IG offers trading opportunities to suit all requirements, including stocks and shares ISAs, SIPP accounts, CFDs and spread betting. You can also access weekend trading hours on a range of global markets, so expats can find opportunities around the clock.

- IG delivers the best research tools that I’ve used, including world-leading news sources covering analysis on key markets and regions, for example, oil prices in OPEC countries.

- The firm has been around for 50 years, upholding an unmatched reputation backed by multiple regulatory licenses and a public listing on the London Stock Exchange (LSE).

Cons

- Although IG offers a strong range of payment methods, minimum deposits are on the high side of average at $250. Additionally, deposit fees may apply for some methods depending on your location.

- Despite robust regulatory protections in most jurisdictions, IG does not segregate client money or provide negative balance protection through its US entity, reducing the level of investor protection.

- Whilst the $12 inactivity fee doesn’t kick in for two years, it’s worth being aware of if you move countries and forget to close your trading account. In contrast, Pepperstone does not charge an inactivity fee.

3. Pepperstone

Why We Chose It

Pepperstone secured a top spot in our 2023 annual awards for ‘Best Overall Broker’ for its superior charting tools and diverse selection of markets.

Expats also enjoy easy account funding with 10 convenient base currencies and a superb selection of popular payment methods, notably free international bank transfers.

Pros

- Pepperstone serves clients in over 160 countries, offering support 24/5 plus 18 hours at the weekend. It’s also one of the most trusted brands, with licenses from respected authorities like the FCA and ASIC.

- Expats can easily fund their accounts with a diverse selection of payment methods including PayPal, UnionPay and BPay. And with 10 base currencies, many traders will be able to swerve conversion fees.

- Pepperstone offers all the best third-party charting platforms in the industry (MT4, MT5, cTrader and TradingView) plus superior tools for expats, notably an economic calendar with an intuitive country filter that I enjoy using.

Cons

- Despite offering advanced tools, Pepperstone doesn’t provide any social trading platforms for clients looking to connect with other global traders, a drawback compared to alternative AvaTrade.

- Pepperstone’s crypto offering is relatively small compared to brands like CMC Markets, which may be a drawback for expats looking to diversify into increasingly popular, though high-risk digital currencies.

- Unlike IG, clients outside of the UK and EEA don’t get access to any compensation if the broker goes insolvent, reducing the level of safeguards.

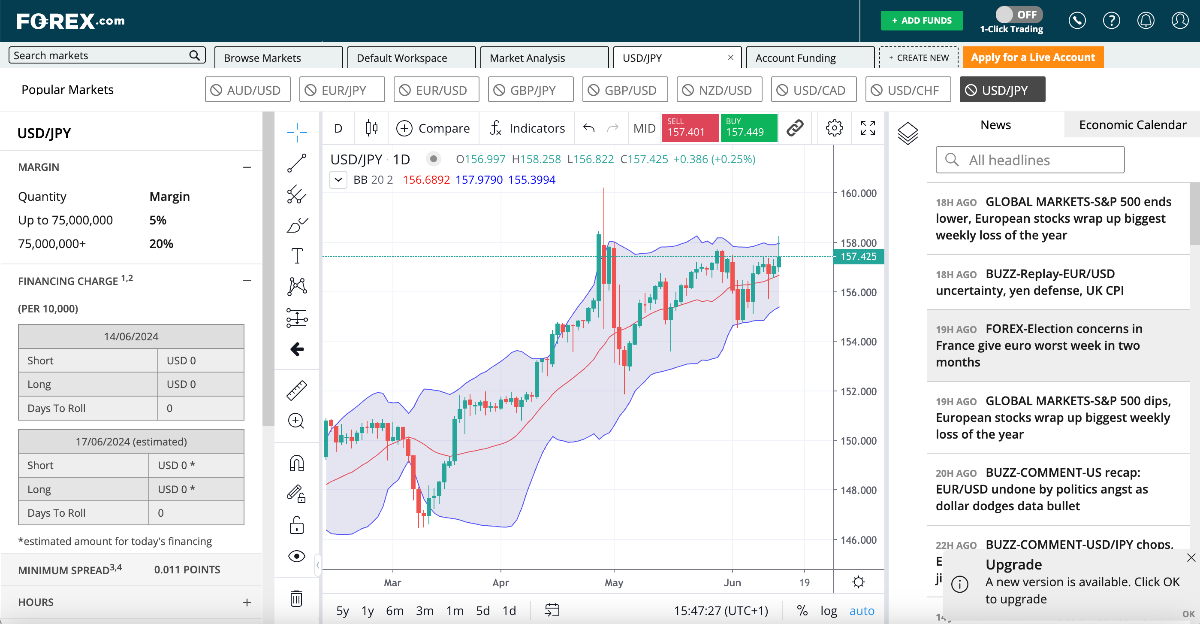

4. FOREX.com

Why We Chose It

FOREX.com continues to offer the full package for expat traders, with its first-rate charting and research tools, a diverse range of international markets and superior funding capabilities for expats.

It’s also one of the most recognizable and trusted trading brands in the world, with a long history, a stock exchange listing, and multiple regulatory licenses ensuring a robust trading environment wherever you’re based.

Pros

- FOREX.com makes it easy for expats to fund trading accounts, with popular methods including ACH transfer and Skrill, alongside 8 base currencies. There’s also a reasonable +/- 0.5% conversion fee if you are trading with a currency other than your base.

- International traders can access thousands of diverse markets, including asset classes not commonly found at alternatives, like bonds, options and interest rates.

- FOREX.com’s reputation is hard to beat thanks to its 25-year track record and its NASDAQ-listed parent company, StoneX. The majority of its licenses also hold ‘green tier’ status, ensuring the strongest protections for global traders.

Cons

- Despite offering a strong range of payment methods for expats, it still lacks popular regional solutions like UnionPay or BPay to compete with top alternatives, notably Pepperstone.

- Although FOREX.com offers a reliable 24/5 chat service, there are not as many local telephone numbers for expats who prefer direct communication, especially compared to our top-ranking expat broker – CMC Markets.

- Unlike other brands in this list, notably IG, FOREX.com doesn’t offer tax-efficient trading opportunities for expats seeking products like SIPPs or stocks and shares ISAs.

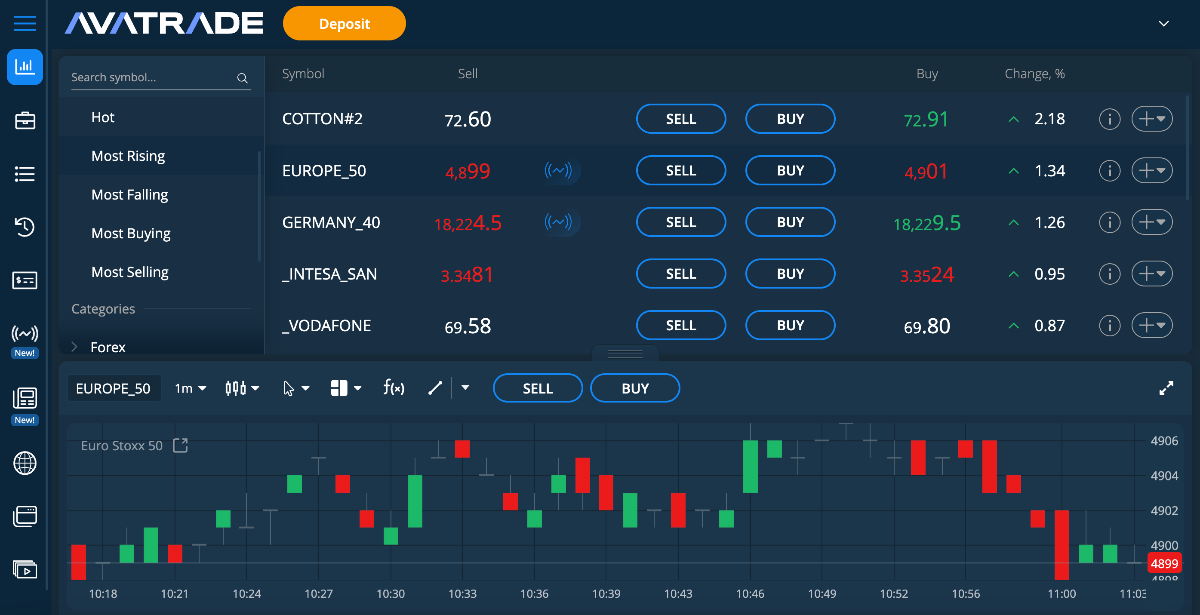

5. AvaTrade

Why We Chose It

AvaTrade has a lot to offer expatriates, especially aspiring traders looking for an extremely user-friendly platform, bespoke risk management tools, plus some of the best localized telephone support I’ve seen.

AvaTrade also distinguishes itself through its diverse payment methods, including digital solutions that aren’t available at most alternatives.

Pros

- AvaTrade continues to uphold its robust, global presence, with regulation across 9 jurisdictions including the UK, Canada and Australia. It’s also one of the only brokers to offer a custom risk management tool, AvaProtect, which insures losses up to $1 million.

- AvaTrade has among the best customer support I dealt with during testing, with dozens of local telephone numbers, alongside help via live chat, email and WhatsApp, all available 24/5.

- There’s an excellent range of global markets for international traders, covering less common opportunities like bonds, treasuries and agricultural commodities. The broker’s latest offering, AvaFutures, also covers an additional 35 markets and caters to a range of strategies.

Cons

- While there are no commissions, pricing at AvaTrade is not as competitive as other expat brokers, notably Pepperstone. For example, spreads are fixed at 0.9 pips for EUR/USD, while leading ECN brokers offer raw spreads from 0.0 pips.

- Despite a diverse array of asset classes to day trade, there are limited long-term investment opportunities for expats and limited tax-efficient products like ISAs or SIPPs, both available at CMC Markets.

- Although AvaTrade offers an impressive range of convenient payment methods, the narrower selection of base currencies means it trails firms like IG with its 12 currencies. Notably, JPY, SGD and CHF accounts may be missed by many expats.

How We Chose The Best Brokers For Expats

To list the best brokers for expats, we:

- Pinpointed the most important considerations and categories for expat traders.

- Rated a large selection of trusted, international brokers out of 5 in each category.

- Hand-picked the best ones based on our analysis and personal experiences during testing.

What To Look For In A Broker As An Expat

International Presence and Regulation

You should choose a broker with a strong global presence and licenses from respected regulators, ensuring financial transparency and protection in whichever country you trade in.

With an abundance of scams operating in the trading industry, you will receive the best safeguards from brokers with ‘green-tier’ licenses, as per our Regulation and Trust Rating. This includes authorities like the UK’s FCA, which reported a record-setting 2,286 scam warnings in 2023 (a 21% rise from the previous year).

I recommend verifying whether a broker is regulated by entering the company name and/or license number into the respective regulator’s public directory.The broker’s license number is typically found at the bottom of the website.

As you can see in our analysis below, all our top platforms achieved trust ratings of at least 4.6/5.

| CMC Markets | IG | Pepperstone | FOREX.com | AvaTrade | |

|---|---|---|---|---|---|

| Regulators | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Negative Balance Protection | Yes (UK & EU only) | Yes (UK & EU only) | Yes | Yes (Except US) | Yes |

| Trust Rating | 4.8/5 | 4.9/5 | 4.6/5 | 4.7/5 | 4.8/5 |

Global Market Coverage

You should choose a broker that offers a diverse range of financial markets, allowing you to explore opportunities from various regions and sectors, whether that’s your native country or the one you’re currently residing in.

After years of using trading platforms, the most widely supported asset classes we see are stocks, indices, forex, commodities and cryptocurrencies.

As you can see in our analysis below, all our recommended platforms offer at least 1000 instruments and achieved a market coverage rating of at least 3.8/5.

| CMC Markets | IG | Pepperstone | FOREX.com | AvaTrade | |

|---|---|---|---|---|---|

| Number of Assets | 12,000+ | 17,000+ | 1,300+ | 5,600+ | 1,250+ |

| Market Coverage Rating | 4.5/5 | 4.5/5 | 3.8/5 | 4.3/5 | 4.5/5 |

Convenient Account Funding

Choosing a broker with accessible payment methods and low conversion fees is essential for expat traders who may frequently move money across borders.

You may also want to find a trading platform with a wide range of base currencies, which can help expats avoid currency conversion fees while ensuring a smoother trading experience.

Let’s say I’m an expat from the UK living in Singapore, trading stocks and currencies. My income is in SGD, but I hold savings in GBP. Using a platform with a range of base currencies can allow me to avoid frequent conversion fees.By keeping my account in GBP or SGD based on market expectations, I can manage my currency exposure and trades seamlessly across international markets without incurring unnecessary costs.

As you can see in our analysis below, all our recommended firms support international wire transfers and cards at a minimum, plus popular e-wallets like PayPal. They also offer at least 5 base currencies, including USD, EUR and GBP, and secured an accounts and banking rating of at least 4.3/5.

| CMC Markets | IG | Pepperstone | FOREX.com | AvaTrade | |

|---|---|---|---|---|---|

| Payment Methods | Visa, Mastercard, Wire Transfer, Credit Card, Debit Card, PayPal | PayPal, Wire Transfer, Mastercard, Credit Card, Visa, Debit Card | Visa, Mastercard, Credit Card, Debit Card, PayPal, Wire Transfer, POLi, UnionPay, BPAY, Neteller, Skrill | Wire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH Transfer | Boleto, Credit Card, Debit Card, FasaPay, JCB Card, Mastercard, MoneyGram, Neteller, Perfect Money, Skrill, Swift, WebMoney, Wire Transfer |

| Base Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN | USD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN | USD, EUR, GBP, CAD, AUD |

| Accounts & Banking Rating | 4.5/5 | 4.5/5 | 4/5 | 4/5 | 4.3/5 |

Customer Support

Expat traders should choose a broker that offers high-quality support through a variety of support channels. This will mean you can get help in various time zones and ideally through a localized support office.

As you can see in our analysis below, all our recommended platforms secured a support rating of at least 4.3/5 following first-hand tests of their customer service.

| CMC Markets | IG | Pepperstone | FOREX.com | AvaTrade | |

|---|---|---|---|---|---|

| Support Hours | 24/5 | 24 hrs from 08:00 Sat to 22:00 Fri | 24 hrs Mon to Fri, 18 hrs Sat to Sun | 24/5 | 24/5 |

| Local Helplines | Yes | No | No | Yes | Yes |

| Customer Support Rating | 4.5/5 | 4.5/5 | 4.6/5 | 4.2/5 | 4.3/5 |

FAQ

Which Is The Best Broker For Expats?

The best broker overall for expats in 2026 is CMC Markets. While many of the trading platforms we evaluated excelled in various categories, CMC went the extra mile for expatriates, ticking the box in every department, from its investment offering and account funding to customer support and global presence.

Runners-up based on our latest tests are IG, Pepperstone, Forex.com and AvaTrade.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com