Brokers With NOK Accounts

NOK trading accounts allow you to hold your funds in Norwegian krone. Particularly popular among active Norwegian traders, they help minimize the risk and cost of converting profits from foreign currencies back to NOK, while ensuring convenient trading transactions in a familiar currency.

See our selection of the best brokers with NOK accounts, thoroughly tested by our experts.

Best Brokers With NOK Accounts

Our evaluations have found that these are the top 6 trading platforms with NOK accounts:

-

1

Interactive Brokers

Interactive Brokers -

2

Zacks Trade

Zacks Trade -

3

Trade Nation

Trade Nation -

4

Markets.com

Markets.com -

5

Skilling56% of retail investor accounts lose money when trading CFDs with this provider.

Skilling56% of retail investor accounts lose money when trading CFDs with this provider. -

6

CMC Markets68% of retail CFD accounts lose money.

CMC Markets68% of retail CFD accounts lose money.

Here is a summary of why we recommend these brokers in February 2026:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- Markets.com - Established in 2008, Markets.com is a long-standing, multi-regulated broker with oversight from the CySEC and FSCA. It offers unique features to track hedge fund moves and insider trades, while providing stock signals to alert traders to market opportunities. Its choice of accounts (Classic to Professional) caters to all levels of active trader. 72.3% of retail accounts lose money.

- Skilling - Skilling is a multi-asset broker founded in 2016 and based in Cyprus. The brand offers hundreds of day trading instruments with competitive spreads from 0.1 pips and beginner-friendly platforms. Skilling are also regulated in Europe and beyond with a transparent pricing structure. You can sign up and start trading in three easy steps.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Brokers With NOK Accounts Comparison

| Broker | NOK Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| Trade Nation | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | FCA, ASIC, FSCA, SCB, FSA |

| Markets.com | ✔ | $200 | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds | CySEC, FSCA, SVGFSA |

| Skilling | ✔ | $100 | Forex, CFDs, Stocks, Indices, Commodities and Cryptos | CySEC |

| CMC Markets | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Demo account

- 20+ account denominations

- Customizable proprietary trading platform and mobile app

Cons

- No forex, commodities or futures trading

- Withdrawal fees apply if removing funds more than once per month

- No MT4 or MT5 platform integration

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

- There is a low minimum deposit for beginners

- Multiple account currencies are accepted for global traders

Cons

- Fewer legal protections with offshore entity

Markets.com

"Markets.com is best suited to retail investors who trade frequently but don’t want to calculate commissions, thanks to its spread-only pricing (EUR/USD around 1.3 pips). It especially appeals to short-term traders who value fast execution, flexible asset choice spanning 2,200+ instruments and proprietary tools like hedge fund confidence indices and insider trade alerts."

Christian Harris, Reviewer

Markets.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds |

| Regulator | CySEC, FSCA, SVGFSA |

| Platforms | Web Platform, MT4, MT5, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK, CHF, PLN, CZK |

Pros

- Markets.com’s Hedge Fund Confidence and Insider Trading tools pulls SEC filings into the dashboard within 24 hours of disclosure, helping to spot fund moves and C-suite buys before most retail newsfeeds updated.

- Within the 2,200+ CFDs, Markets.com offers thematic baskets like the Warren Buffett Blend and Cannabis Blend, which behaved like ready-made mini-ETFs during testing, saving the work of balancing weights manually.

- Markets.com provides commission-free trading on most assets with spreads starting from around 0.6 pips on major forex pairs, making it cost-effective for casual traders.

Cons

- While CySEC and FSCA oversight is solid, the SVGFSA entity offers 1:500 leverage under a light-touch framework, meaning protections like compensation schemes and strict conduct rules lag behind the strictest regulatory standards.

- The proprietary web platform felt a bit basic once we pushed into advanced charting with fewer drawing/indicator options than full TradingView or MetaTrader.

- During sign-up, we hit unclear account type explanations and got stuck in an email verification loop that locked us out for an hour - way less streamlined than other brokers we’ve tested.

Skilling

"Skilling maintains its position as a top pick for beginners looking for a competitive zero commission account with direct access to a copy trading feature. It will also serve experienced strategy providers looking to earn commissions, or anyone looking to trade forex during extended hours."

William Berg, Reviewer

Skilling Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Stocks, Indices, Commodities and Cryptos |

| Regulator | CySEC |

| Platforms | Skilling Trader, MT4, cTrader, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, SEK, NOK |

Pros

- Skilling continues to strengthen its investment offering recently introducing weekend forex trading on 7 currency pairs

- The broker offers smooth account funding with a good range of payment methods with zero deposit fees

- The Skilling Copy solution is accessible directly from the cTrader web terminal, making it easy for strategy providers to manage their portfolios

Cons

- Skilling trails alternatives like IG when it comes to research tools that can help day traders make informed decisions

- You can only access shares in the Skilling Trader platform and fewer instruments are available overall in the MT4 accounts

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Regulator | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Platforms | Web, MT4, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- The brokerage continues to stand out with its wide range of value-add resources, including pattern recognition scanners, webinars, tutorials, news feeds, and research from respected sources like Morningstar.

- CMC Markets has added an AI News feature, using AI to surface and summarise market stories rather than place trades for you, hinting at where broker research tools are heading.

- CMC Markets is heavily regulated by reputable financial authorities and maintains its stellar reputation, helping to ensure a secure and trustworthy trading environment.

Cons

- An inactivity fee of $10 per month is applied after 12 months of inactivity, which may deter casual investors.

- Despite improvements, the web platform still requires enhancements to make it as intuitive to trade on as software from rivals like IG.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

How Did We Choose The Best Brokers?

To find the best platforms with NOK accounts we:

- Scoured our catalog of 140 online brokers and platforms

- Prioritized all those that offer a trading account based in the Norwegian krone (NOK)

- Rated them using 100+ data points and findings from our hands-on tests

What Is A NOK Account?

A NOK account is a trading account where the balance is denominated in Norwegian krone.

This means that your trades, transactions and account statements are held in NOK.

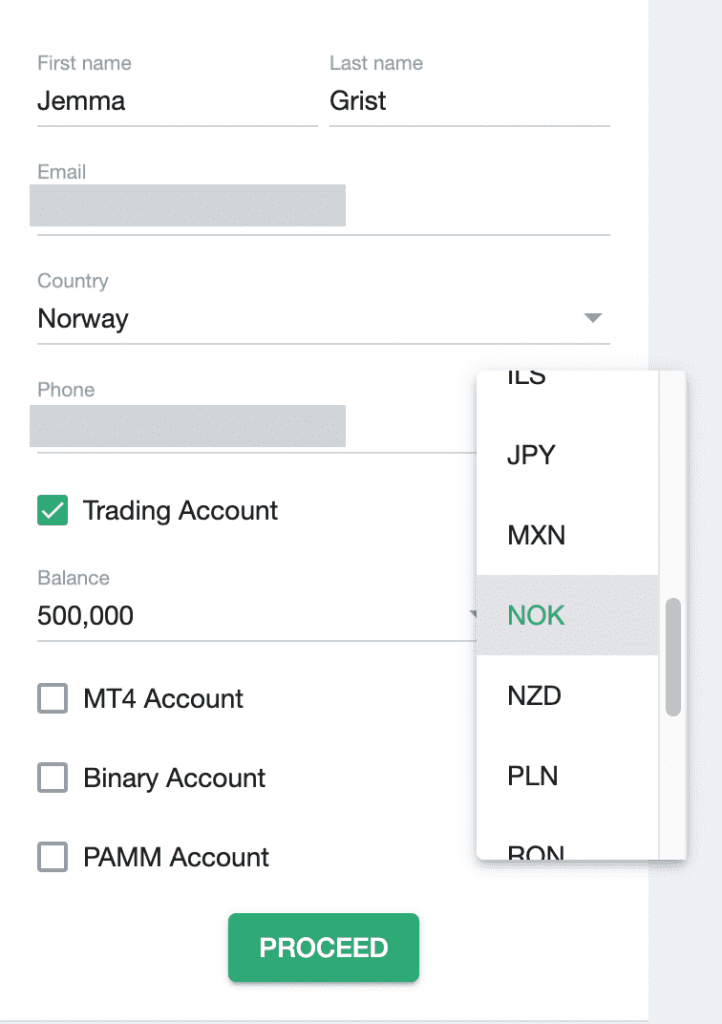

Below is an example of where I opened a NOK account with Dukascopy:

Do I Need A NOK Trading Account?

A NOK-based account may be suitable if:

- You live in Norway and make money or save in NOK because it’s convenient holding an account in the same currency.

- You want to trade NOK currency pairs such as USD/NOK and EUR/NOK because they may be subject to fewer associated charges such as conversions.

- You actively trade Norwegian and Nordic stocks listed on the Nasdaq Nordic, meaning your transactions are faster and normally cheaper in NOK.

How Can I Check If A Broker Offers An Account In Norwegian Krone?

We took these easy three steps to check that all our recommended platforms offer a NOK account, and we suggest you do too:

- Go to the account options section on the broker’s website and locate the selection of available base currencies.

- Confirm that ‘NOK’ is available as a supported account currency in Norway.

- Open a live or demo account and choose NOK as your base currency.

Pros & Cons Of NOK Trading Accounts

Pros

- We’ve found brokers with NOK accounts often provide access to local or regional markets for Norwegian traders. At Dukascopy, for example, you can trade popular Norwegian share CFDs such as Norsk Hydro, as well as currency pairs like EUR/NOK and USD/NOK.

- Active traders dealing in NOK may enjoy reduced conversion fees in a NOK account. Otherwise, some brokers like IG charge up to 0.8% when transferring between NOK and another currency.

- The Norwegian krone is often considered a ‘safe haven’ currency, thanks to key factors like the nation’s prominence in oil and gas production and diverse economy. This means traders can enjoy relative stability while helping to protect against volatile exchange rate fluctuations.

Cons

- Despite its stable history, the Norwegian krone has faced difficulties in recent years – Reuters claims it was the worst-performing G10 currency in 2023 due to the struggling banking sector and concerns over Norway’s future in oil production. Such factors may cause volatility and threaten NOK trading balances.

- NOK accounts are uncommon (accounting for less than 2% of the brokers we’ve personally tested) compared to major base currencies like USD and EUR, giving day traders limited choice when picking a platform.

- You may still face conversion fees when trading assets that are denominated in a currency other than NOK. Skilling, for example, charges a 0.7% conversion on top of the trade’s realized profit.

FAQ

Which Is The Best Broker With A NOK Trading Account?

We’ve thoroughly tested the best trading platforms with NOK accounts. See our list to find a suitable option for you.

How Much Does It Cost To Open A Trading Account Based In Norwegian Krone?

Many brokers will allow you to open an account with less than 250 USD (approximately 2,764 NOK) though our analysis have found many trading platforms offering lower.

Skilling, for example, only requires 100 USD – around 1,105 NOK. It’s also got one of the most intuitive trading platforms I’ve seen, limiting the learning curve for newer traders.

Article Sources

- Nasdaq Nordic Indexes

- Norsk Hydro (NHY) - Euronext

- Norwegian Krone Worst-Performing G10 Currency, 2023 - Reuters

- Stable History of the Norwegian Krone - Faster Capital

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com