Best Bitcoin Brokers & Exchanges In 2026

Bitcoin trading was once confined to specialized crypto exchanges, but nowadays many reliable and regulated brokers also allow traders to speculate on BTC by buying and selling it directly or via derivatives.

Dive into our list of the best Bitcoin brokers and exchanges to find the platforms with excellent reputations, reliable execution, competitive pricing and intelligent features.

Top 6 Bitcoin Brokers & Exchanges In 2026

After testing 140 providers, we’ve identified the 6 best for secure Bitcoin trading :

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

5

FOREX.com

FOREX.com -

6

CEX.IO

CEX.IO

Why Are These Brokers The Best For Trading Bitcoin?

Here’s a brief rundown of why we believe these firms stand out for Bitcoin trading:

- Interactive Brokers is the best Bitcoin broker in 2026 - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- NinjaTrader - You can get exposure to micro Bitcoin futures through the CME Group’s centralized exchange, which is highly regulated by the US CFTC. Micro contracts allow you to trade a fractional size of one Bitcoin, giving you more risk control and order flexibility.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- FOREX.com - You can trade a small range of 8+ cryptos against USD, EUR, GBP and AUD with tight spreads and no virtual wallet required. Algo traders can also utilize Expert Advisors (EAs) to automate their crypto trades.

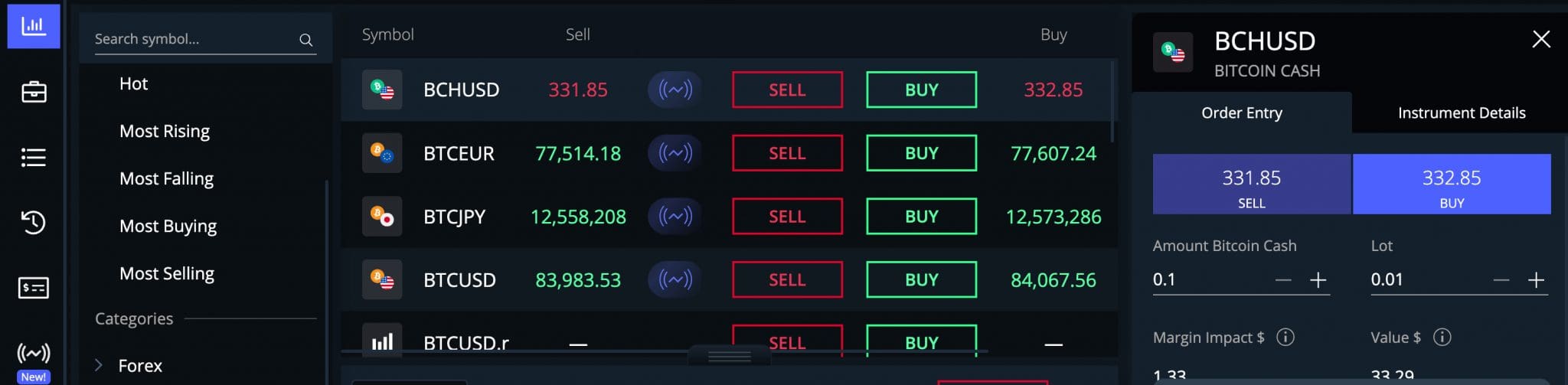

- CEX.IO - CEX.IO offers hundreds of popular cryptocurrencies including big names like Bitcoin, Ethereum and Litecoin. The trading platform is well-designed with sophisticated charting and analysis tools, including 50+ in-built indicators. Traders can also reduce their monthly volumes through the tiered pricing structure.

Compare The Top Bitcoin Brokers And Exchanges In Key Areas

Find the right Bitcoin provider for you based on our comparison of core features important to active traders:

| Broker | Bitcoin Spread | Margin Trading | Payment Methods | Regulators |

|---|---|---|---|---|

| Interactive Brokers | 0.12%-0.18% | ✔ | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| NinjaTrader | Floating | ✔ | ACH Transfer, Cheque, Debit Card, Wire Transfer | NFA, CFTC |

| eToro USA | BTC 0.75% | ✔ | ACH Transfer, Debit Card, PayPal, Wire Transfer | SEC, FINRA |

| OANDA US | $100 | ✔ | ACH Transfer, Debit Card, Mastercard, Visa, Wire Transfer | NFA, CFTC |

| FOREX.com | BTC 1.4%, ETH 2% | ✔ | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer | NFA, CFTC |

| CEX.IO | 0.15% maker & 0.25% taker (Standard) | ✔ | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, PayPal, Skrill, Swift, Visa, Wire Transfer | GFSC |

How Safe Are These Bitcoin Trading Providers?

In a market notorious for scams, consider how the top Bitcoin trading platforms protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| eToro USA | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| CEX.IO | ✘ | ✔ | ✔ |

Compare Mobile Bitcoin Trading

With crypto moving fast, here’s how these Bitcoin brokers perform on mobile following our tests of their apps:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| CEX.IO | iOS & Android | ✘ |

Are The Top Bitcoin Providers Good For Beginners?

Bitcoin trading beginners need brokers with key features for learning - here’s what the top platforms offer:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| eToro USA | ✔ | $100 | $10 | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| CEX.IO | ✘ | $20 | $1 |

Are The Top Bitcoin Providers Good For Advanced Traders?

Experienced Bitcoin traders need advanced tools for a sharper edge - here’s what the top brokerages offer:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| CEX.IO | API | ✘ | ✘ | ✘ | - | ✘ | ✘ |

Compare The Ratings Of Top Bitcoin Brokers And Exchanges

See how the top Bitcoin trading platforms rate in vital categories following our expert-assigned scores:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| eToro USA | |||||||||

| OANDA US | |||||||||

| FOREX.com | |||||||||

| CEX.IO |

How Popular Are These Bitcoin Brokers And Exchanges?

Many Bitcoin traders trust firms with the largest user base - here’s how many clients the top platforms have:

| Broker | Popularity |

|---|---|

| CEX.IO | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Trade Bitcoin With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Why Trade Bitcoin With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

Why Trade Bitcoin With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

Why Trade Bitcoin With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- Day traders can enjoy fast and reliable order execution

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

Why Trade Bitcoin With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 1.4%, ETH 2% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Trade Bitcoin With CEX.IO?

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Coins | ZRX, 1INCH, AAVE, BTC, BCH, ADA, LINK, COMP, ATOM, DAI, DOGE, ETH, GUSD, ICP, LTC, LRC, MATIC, MKR, DOT, SHIB, SOL, XLM, SUSHI, SNX, USDT, XTZ, USDC, UNI, WBTC, ZIL |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.15% maker & 0.25% taker (Standard) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Regulator | GFSC |

| Account Currencies | USD, EUR, GBP |

Pros

- The $20 minimum deposit makes the broker accessible for beginners

- The proprietary terminal features an advanced charting package from TradingView, including 50+ technical indicators

- The broker offers 24/7 support with fast response times during tests

Cons

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

- Deposit and withdrawal fees are relatively high, including 0.3% + $25 for SWIFT withdrawals

- The broker has limited regulatory oversight

How Did DayTrading.com Choose The Best Bitcoin Trading Platforms?

We ranked Bitcoin providers based on total ratings after evaluating over 200 metrics across eight key categories. Our analysis included nine data points specifically tied to Bitcoin trading, ensuring an in-depth assessment.

Exchange Or Broker?

Back in the early days of Bitcoin trading, tokens were bought and sold only between individuals in a peer-to-peer trade, or later on dedicated crypto exchanges.

Today, exchanges still offer the widest range of crypto tokens and will often have the best pricing particularly for less liquid markets.

However, crypto as an asset class still lags behind other assets from a regulatory standpoint, and dedicated exchanges are not as closely overseen as traditional brokers.

The 2022 collapse of FTX, the third-largest crypto exchange at the time, illustrates the risks of trading with an exchange.

Fortunately, Bitcoin has hit the mainstream, and many regulated brokers now support BTC trading with fast execution and low pricing, often by buying and selling BTC directly but also through derivative products such as crypto CFDs.

Brokerages with licenses from ‘green tier’ bodies in our broker regulator database, such as the Cyprus Securities and Exchange Commission (CySEC), must implement client security measures such as segregating client from business funds, and regularly submit financial statements to retain their licences.

That’s why our experts mostly trade BTC via regulated brokers, and generally suggest the same for all but experienced crypto traders.

How To Choose A Bitcoin Provider

Over years evaluating Bitcoin trading via dozens of brokers and exchanges, we’ve identified these as the most important features for BTC day traders:

Trust

As with any other asset, trust comes first for us when we research Bitcoin brokers.

Crypto trading scams have become commonplace on social media sites, as the Commodity Futures Trading Commission (CFTC) warns, so we prioritize Bitcoin brokers that score highly in our Regulation & Trust Rating.

Generally, we’re looking for brokers licenced by ‘green-tier’ regulators that have a long and clean business history and whose services we personally feel secure using.

When choosing a Bitcoin broker or exchange there are also some specific points to look out for:

- Bitcoin isn’t regulated in the same way as other instruments, but you can trade with a reputable broker that’s licenced in other assets like forex, stocks, commodities etc.

- Choose a broker that is well established and serves a large number of clients. Brokers that are listed on large exchanges such as the London Stock Exchange (LSE) add another layer of legitimacy.

- Check the broker’s customer support and trade with one that responds quickly and has an office or contact number in your region.

- Look for a broker that uses cutting-edge security protocols on its website, and that offers clients the option of two-factor authentication.

And there are red flags that mark out brokers you should avoid:

- Never trade Bitcoin with a company or individual that approaches you via a direct message to your phone or email or that you learn about in a social media thread.

- Avoid any company whose website or promotional material is littered with spelling mistakes and/or grammatical errors.

- Don’t fall for promises of guaranteed profits or unrealistic returns – it’s impossible to guarantee any profit on a Bitcoin investment.

- Steer clear of brokers that have no address and/or fake contact information.

I prefer to fund my crypto trades using Bitcoin, and part of my system for protecting my trading capital is to periodically ‘reset’ my trading funds by moving profits out of my brokerage account and into a cold wallet.Since this is offline, it’s much less vulnerable to hacks, so I can feel assured my funds are more secure.

- IG continues to be our most reliable BTC broker as a globally recognized firm with licences from 10+ regulators, 300,000+ clients and a listing on the London Stock Exchange.

Fees

Choose a low-cost firm, especially if you’re an active day trader because fees add up.

These are the most important fees we consider when reviewing Bitcoin brokers:

- Spread fees represent the difference between buy and sell prices

- Commission fees charged by some Bitcoin trading platforms

- Borrowing fees for using margin to amplify purchasing power

- Conversion fees when depositing in certain crypto or fiat currencies

- Inactivity fees if the account becomes dormant

You should remember, though, that the best broker isn’t necessarily the one with the lowest fees, and it’s sometimes worth paying slightly more for better services.

In my experience, a broker with very fast execution and excellent research tools can make it easier to earn money on Bitcoin trades than a bare-bones broker with slightly tighter spreads.

- Pepperstone remains our top pick for trading fees, due to its transparent Bitcoin CFD pricing with competitive spreads on BTC/USD averaging 29.86 in its Razor account. With powerful research resources and tools including auto-trading site service Capitalise.ai, Pepperstone offers a well-rounded BTC trading experience for the money.

Trading Vehicles

You should choose a Bitcoin broker with trading vehicles that suit your trading strategy.

Most Bitcoin brokers we’ve tested offer financial derivatives, allowing active traders to speculate using leverage and amplify their profits from short-term price movements.

The most widely available vehicle is contracts for difference (CFDs), with options to go long or short. However, Bitcoin CFDs aren’t available in certain regions, such as the US and UK.

Another increasingly popular product is Bitcoin ETFs (Exchange-Traded Funds), such as the Bitcoin Tracker Fund, which tracks Bitcoin’s value but trades on traditional stock exchanges.

Micro bitcoin futures (MBTs), which have small contract sizes but still pack a punch in the volatility and liquidity department, are also an option at select firms.

- Interactive Brokers consistently provides the best range of Bitcoin trading vehicles from our tests, offering ETFs, micro futures, and options with competitive margin rates. NinjaTrader also offers micro bitcoin futures and is regulated in the US with low fees with terrific charting tools.

Leverage

Leverage lets traders borrow capital to amplify their Bitcoin positions. While this can boost profits, it also increases potential losses, so you should take great care with leveraged trades and avoid it if you’re a beginner.

Most firms we’ve investigated offer low leverage on Bitcoin owing to its volatility and high-risk nature. In tightly regulated regions like Europe, you can usually trade Bitcoin with leverage of 1:2, or 2x, your investment.

Offshore brokers and exchanges may offer much higher leverage on Bitcoin – some offer 1:500 or more – but we urge traders to stick to low or no leverage on volatile instruments like Bitcoin.

Bitcoin is a volatile instrument that regularly sees prices rise or fall by 5% or more in a single trading session.If you stake $100 on a BTC trade with 1:100 leverage and the price moves 5% against you, you may find yourself in the hole by $500, so you need to be extremely careful and to practice risk management whenever you make leveraged plays.

- Eightcap offers reliable access to leveraged Bitcoin trading with rates up to 1:2 and transparent margin requirements. It’s also scooped multiple DayTrading.com awards in recent years.

Best Exchange

Some of our experts use regulated brokers to make BTC trades, but we recognize the importance and attraction of exchanges, especially for dedicated crypto traders.

Security is paramount, especially following high-profile exchange collapses like FTX in 2022 and the hack of Bybit in 2025, which saw the loss of around $1.5 billion in crypto.

So you should look for an exchange that offers:

- Proof of reserves (ensures firms hold the BTC they claim)

- Segregated client funds (ensures clients’ funds are not used for business purposes)

- Regular checks by a third-party auditor

- Two-factor authentication (2FA)

Besides that, we prefer Bitcoin exchanges that provide transparent pricing, a large range of assets to trade alongside BTC, and intuitive platforms with in-built tools and indicators.

- BitMEX continues to impress our experts as a secure exchange with with its regular proof of reserves reports and strong security measures, while also offering a high-quality customizable platform, good research materials and competitive pricing.

Trading Software

We know from personal experience that a broker’s trading platform impacts ease of use and effectiveness. This is especially important for active traders who may spend a lot of time plugged into the software.

Choose a Bitcoin broker or exchange with platform options that include:

- Indicators and charting tools

- Fast execution speeds

- User-friendly interface

- Demo accounts for practice

- AvaTrade is still our top software pick for Bitcoin traders, offering multiple user-friendly and powerful platforms including AvaTradeGO, AvaOptions, MT4, and MT5.

Customer Support

Reliable support is crucial, especially for fast-moving Bitcoin markets, so you should look for providers with well-informed and professional assistants available via live chat, email and phone.

Remember that Bitcoin trades 24/7, so available hours are especially important for this asset – you will want support to be available at the specific hours you trade at least, if not 24 hours a day.

- We’ve tested IC Markets multiple times and have found it consistently provides superb assistance with short lead times; it’s also an excellent all-round broker that’s won numerous DayTrading.com awards including including ‘Best MT4/MT5 Broker’, ‘Best Overall Broker’, and ‘Best Trading App’.

Account Funding

As a day trader, chances are you’ll want to regularly fund and empty your account, so you should look for a broker that makes this easy, fast and affordable.

For me, it’s important for a Bitcoin broker to also accept payments in BTC, but your preferences will vary and you might want to look for brokers with base accounts in USD or your local currency.

We’ve found that e-wallets like PayPal often bring the most flexibility, as you can use them to convert currencies, link them to your debit or credit card, and often even buy and sell Bitcoin and other crypto tokens.

- Kraken remains our top exchange for account funding methods, with multiple secure payment options and deposits taking <1 hour based on our personal experience.

Bottom Line

Bitcoin brokers and exchanges enable traders to potentially profit off the highly volatile Bitcoin, but selecting the right provider is key to ensure you aren’t being scammed and to get the best trading experience.

To get started, dig into our ranking of the top Bitcoin trading providers.

FAQ

How Do Bitcoin Trading Platforms Make Money?

Bitcoin brokers generally make money through the spread and/or by charging commission fees. The spread is the difference between the buy and sell price, while commission fees are usually a flat fee applied to every transaction.

How Do I Know If A Bitcoin Trading Provider Is Legit Or A Scam?

Legitimate Bitcoin providers are regulated by reputable authorities in DayTrading.com’s Regulation & Trust Rating, such as the Australian Securities & Investments Commission (ASIC) and Cyprus Securities & Exchange Commission (CySEC).

They are also well-established, have positive customer reviews and use security measures like segregated client funds and proof of reserves.

Red flags to watch out for:

- Promises that you can get rich quickly trading Bitcoin and that it’s a low-risk investment.

- Poorly presented websites with limited information about the brand’s regulatory details and management.

- Encouragement on social media, email, telephone or other mediums to deposit money quickly to capitalize on ‘unmissable Bitcoin trading opportunities’.

Article Sources

- The Guardian: ‘Old-fashioned embezzlement’: where did all of FTX’s money go?

- CFTC: 10 Signs of a Scam Crypto or Forex Trading Website

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com