BakerySwap Review 2026

BakerySwap Review

Since the introduction of UniSwap, there has been a boom in the decentralised finance sector and one of the more interesting exchanges to come out of this is BakerySwap. Created on the Binance Smart Chain to avoid the issues associated with the Ethereum network, it offers a variety of features such as trading, yield farming, and an NFT marketplace. This page will review the BakerySwap project and provide you with the necessary information you need to get started.

BakerySwap Headlines

BakerySwap is a decentralised exchange (DEX) that continues the pattern of food-themed exchanges with gamification features, such as ApeSwap, BurgerSwap, SushiSwap and PancakeSwap. Rather than existing on the Ethereum network, BakerySwap is based on the Binance Smart Chain (BSC) which is made for faster and less expensive transactions for DApps and decentralised finance (DeFi) projects.

Decentralised exchanges are different from traditional exchanges as they use liquidity pools to conduct transactions whereby users trade against smart contracts rather than using order books. BakerySwap adopts an automated market maker model (AMM) that utilises algorithms to govern these liquidity pools to carry out orders that users wish to execute.

BakerySwap was the first DeFi platform on the BSC to offer a non-fungible token (NFT) marketplace. This marketplace allowed users to create and mint their own NFTs that could be traded for the exchange’s native token, BAKE, or to be used for yield farming. To this day, the BakerySwap founder remains anonymous, having opened its virtual doors in September 2020.

BakerySwap recently introduced its own merchandise store selling apparel, accessories and drinkware emblazoned with the BakerySwap logo.

Tokenomics

As BakerySwap is owned and governed by a decentralised autonomous organisation (DAO), there was no pre-sale or pre-farm of tokens reserved. Instead, the developers take BAKE shares at a ratio of 100:1, meaning that for every 100 BAKE that is farmed, 1 BAKE goes to the developers. This is considered to be low when compared to other DeFi projects and allows for a fairer distribution of the token.

One big problem that AMM model DEXs experience is high inflation because of the incentivisation of liquidity providers to attract liquidity and a large user base. BakerySwap attempts to solve this issue by burning BAKE to reduce its supply and increase the demand for the token.

In the year since the BakerySwap (BAKE) was introduced, its market cap has had high fluctuations with a peak of $1.17 billion in May 2021. To see the current BakerySwap market cap or price charts and graphs of a BAKE token in USD, visit either CoinGecko, CoinMarketCap or BscScan.

How To Trade

There are a wide range of options for traders to earn capital on BakerySwap’s website.

The Exchange

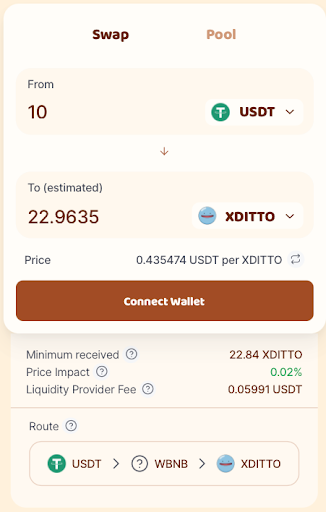

Users looking for a simple method of trading between two different currencies can utilise the BakerySwap exchange. Here, you select the two currencies you wish to exchange (in this case the coins USDT and XDITTO) and select the amount of a coin you wish to trade from or to. BakerySwap then shows you the coin price prediction for the exchange as well as the slippage limit, the difference between market price, predicted price, and the transaction fees.

Provide Liquidity

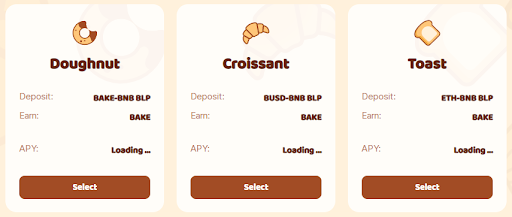

Traders can also earn capital by providing liquidity to a pool and earning fees from each transaction. Liquidity providers (LPs) will also earn specific BakerySwap LP (BLP) tokens for the pair they input into a pool, which can then be staked to earn more capital. There are two types of pool: those that reward in BAKE and those that do not. There are fewer BAKE pools as they require very specific pairs of BAKE and another coin, but they provide traders the opportunity to earn more capital compared to other non-BAKE options through multiplying the BAKE rewards. For example, the BAKE BNB-LP pool (called the Doughnut pool) has a 10x multiplier on BAKE staking rewards.

NFT Marketplace

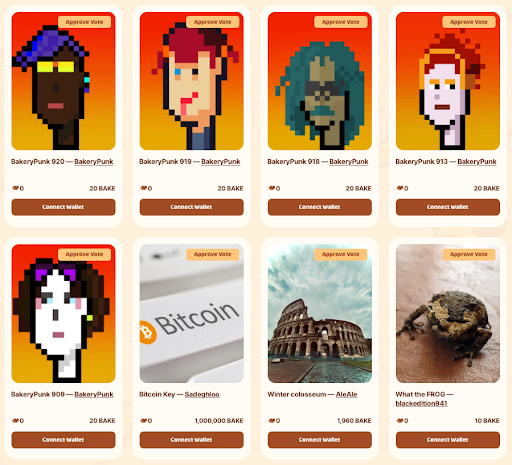

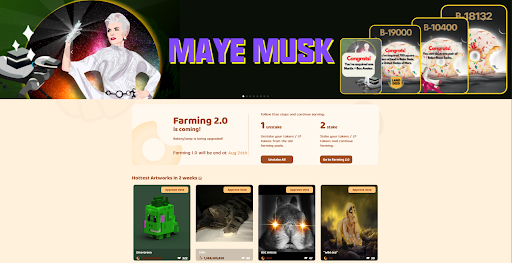

BakerySwap is well-known for its NFT trading facilities that have provided opportunities for emerging artists to earn capital through minting their art. The minting process is simple as the artist must detail the artwork information such as file type, artist name and royalties. It is then pending while it waits for the confirmation and approval vote. Users can choose between either the v1 or the more updated v2 marketplace and purchase NFTs from a range of categories such as ‘Musk & DOGE’, ‘BSC Artists and ‘KAKA One Piece’.

The marketplace works by having users stake BAKE in NFTs as a form of voting to promote the artwork and push it higher up the main marketplace page. The total amount of BAKE that is voted is then split between the NFT owner and the platform.

There is also the Bakery Gallery where only verified artists show their artwork. Users can navigate through the gallery by filtering for individual artists or specific types of NFT. To purchase an NFT, the price in BAKE is quoted on the artwork’s page and then users have the choice of either buying at the quoted price or making a bid on auction.

The BakeySwap NFT marketplace also offers gamification NFTs such as Weapons, Poker NFTs and the Bark NFT. The Bark NFT was released during an ILO (Initial Liquidity Offering) event with a launch date of May 24th 2021 that continued to build the ‘meme’ ecosystem.

Launchpad

The launchpad is where any new listings are found. BakerySwap offers the opportunity for users to launch their own ERC-20 or BEP-20 based tokens via initial DEX offerings (IDOs) to raise funds. To participate, users are required to hold BAKE tokens beforehand. Recent examples of BakerySwap IDOs include the DEFI100, Crypto Doggy, WAR token and Bakery Soccer Ball. Look on the launchpad for details about the next IDO, which is similar to an IFO.

Combo Meals

At the BakerySwap launch, users were allowed to create NFT ‘combo meals’ used for NFT staking to earn more BAKE or to be traded for profit. There are four tiers of combos: Basic (10,000 – 20,000 BAKE), Regular (20,000 – 50,000 BAKE), Luxury (50,000 – 100,000 BAKE) and Supreme (100,000+ BAKE) that correspond to the volume of BAKE that is initially contributed and a random multiplier. Each tier has different staking power, with Supreme combos having the most and Basic having the least. Soon after launch, the ability to mint new combos was removed but this meant that there were fewer trades being executed and so the developers reopened minting between 20th February 2021 and 12th March 2021 to increase their ROI.

Ethereum 2.0

BakerySwap allows users to participate in ETH 2.0 that was launched in December 2020 via the cross-chain token BETH. Issued by Binance on BSC, BETH is a newly wrapped token that is pegged 1:1 to ETH. In order for traders to obtain BETH coins, they must first stake ETH on Binance.

Commission

On all transactions that take place on BakerySwap, 0.3% of the trade is taken as a fee by the platform. 83% of the fee goes to liquidity providers and the rest goes to BAKE holders, i.e those that own the native token. The low fees associated with BakerySwap are what makes it desirable when compared to the other Ethereum based DEXs where gas fees are high. Gas fees are network charges that cover crypto mining costs and are particularly high on the Ethereum network due to its congestion.

Payment Methods

Fiat currency trading is not offered on BakerySwap, and so to trade, you must first set up a digital wallet, which is where the crypto you have purchased is stored. BakerySwap recommends that you use either Trust Wallet or MetaMask and provides guides to connect your wallet to the DEX on their website. You do not need to make a profile to trade on the exchange and so once you have connected your wallet, if you have sufficient crypto then you can commence trading.

For trading on mobile, there is no dedicated BakerySwap app on iOS or Android, but the exchange can be accessed via the DApp store.

Security

BakerySwap was audited by CertiK and found to have strong governance and autonomy, average safety and an overall security score of 88 out of 100. The full report can be read online on CertiK’s website where information, such as the router address, can be found. Additionally, as it is the digital wallet and not BakerySwap that holds your crypto, there is no risk of your coins being stolen by hackers who hijack BakerySwap’s website. This does mean that BakerySwap is deemed to be relatively secure, but smart contracts are risky and there is always the chance for a bug to occur, so never deposit more money than you are prepared to lose.

Customer Support

There is no customer support provided on the BakerySwap website and so if you are having any issues or error messages such as ‘insufficient liquidity for this trade’ or ‘wrong network’ then you should contact the BakerySwap team through their social media channels such as Twitter, Instagram, Telegram or the contact email address on their website. You could also seek help via the community on Reddit, Discord, or by watching YouTube videos. It is also advisable that you keep track of any news either on LinkedIn or the BakerySwap Medium blog.

Benefits

There are a number of benefits to trading on BakerySwap:

- A large array of features that allow users to earn capital

- Low fees compared to other DEXs on the Ethereum network

- Help boost new DeFi projects by raising funds on its launchpad

- The NFT marketplace offers artists opportunities to sell a wide range of art

- Fair distribution method for coins as there is no pre-sale or pre-mining activity

Drawbacks

- No dedicated customer support and so traders are reliant on social media channels for any help

- Potential for bugs and errors to occur which can mean traders lose capital through no fault of their own

- Currently, a limited number of market pairs are available for staking pools but this can be expected to increase in the future

BakerySwap Verdict

BakerySwap is a great option for traders who wish to capitalise on a volatile cryptocurrency market. As DEXs with AMM systems such as BakerySwap are relatively new compared to traditional trading and exchanges, traders should learn how to use the platform by starting off trading smaller amounts to gain some experience. Once you feel ready for bigger and bolder trades then there are plenty of ways to earn capital but remember to be careful and never deposit more than you are willing to lose.

FAQs

What Is Slippage On BakerySwap?

Slippage is the difference in exchange price between the time where the trade is ordered by a user and when the trade is actually executed. As the BSC allows fast transactions, users should be less exposed to slippage. BakerySwap allows users to set a slippage tolerance that operates as a hard limit on the maximum slippage in a trade. If during a trade, the slippage exceeds the tolerance, then the transaction is automatically reverted.

Is BakerySwap A Good Investment?

This is something that you will need to determine yourself by doing your own research into the platform and its features. As BakerySwap does not provide its own staking ROI calculator, to see if a particular trade is worthwhile then you would need to calculate the APY yourself.

Is BakerySwap Open Source?

Yes, BakerySwap has a link to their Github on their website. This has been used to create BakerySwap clone scripts.

What BakerySwap Features Are Coming In The Future?

BakerySwap provides a roadmap on their Medium blog that details any upcoming events such as airdrops, new features and their release dates.

Who Is The BakerySwap CEO?

BakerySwap is run by an anonymous group and so the CEO and founder is unknown. The only team members that are known are Big Baker and Tommy on the BakerySwap Telegram group.

Where Can I Find Info On BAKE Token Trading?

Information such as maximum supply, token address, factory contract address and transaction history for the BakerySwap native coin can be found on Etherscan and BscScan on the Testnet network. BAKE is not yet on yieldwatch.

Best Alternatives to BakerySwap

Compare BakerySwap with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

BakerySwap Comparison Table

| BakerySwap | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 2.5 | 4.3 | 4 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $0 | $0 | $1 |

| Minimum Trade | $0 | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | None | – | 100% Deposit Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | – | 1:50 | 1:1000 |

| Payment Methods | – | 6 | 7 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by BakerySwap and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| BakerySwap | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Stocks | No | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | No |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

BakerySwap vs Other Brokers

Compare BakerySwap with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of BakerySwap yet, will you be the first to help fellow traders decide if they should trade with BakerySwap or not?