Best CFD Brokers and Trading Platforms in Australia 2026

CFD brokers in Australia should be regulated by the Australian Securities & Investments Commission (ASIC), which has strengthened its investor protections in recent years, limiting leverage to 1:30 for retail investors and taking legal action against trading platforms for over-marketing CFDs.

Explore our selection of the best CFD brokers in Australia. Every platform recommended has been exhaustively reviewed, earned the trust of our experts, and caters specifically to Aussie CFD traders.

Top 6 CFD Trading Platforms in Australia

Our tests show that these are the 6 top platforms for Australian CFD traders:

-

1

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

2

Fusion Markets

Fusion Markets -

3

AvaTrade

AvaTrade -

4

Trade Nation

Trade Nation -

5

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

6

FBS

FBS

This is why we think these brokers are the best in this category in 2026:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- FBS - Founded in 2009, FBS is an award-winning CFD broker operating in over 150 countries with a client base exceeding 27 million traders. Traders are supported at every stage of their journey with 24/7 assistance, market analytics, trading calculators, and competitive pricing with zero commissions.

Best CFD Brokers and Trading Platforms in Australia 2026 Comparison

| Broker | CFD Trading | ASIC Regulated | AUD Account | Minimum Deposit | Leverage | Markets |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | $0 | 1:30 (Retail), 1:500 (Pro) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Fusion Markets | ✔ | ✔ | ✔ | $0 | 1:500 | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| AvaTrade | ✔ | ✔ | ✔ | $100 | 1:30 (Retail) 1:400 (Pro) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Trade Nation | ✔ | ✔ | ✔ | $0 | 1:500 (entity dependent) | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Eightcap | ✔ | ✔ | ✔ | $100 | 1:30 | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| FBS | ✔ | ✔ | - | $5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) | CFDs, Forex, Indices, Shares, Commodities |

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support. Pepperstone's comprehensive package, operating under ASIC regulation, makes them an obvious pick for traders in Australia, where it scooped DayTrading.com's 'Best Aus Broker' annual award for 2025."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

Cons

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

- Multiple account currencies are accepted for global traders

- Full range of investments via leveraged CFDs for long and short opportunities

Cons

- Fewer legal protections with offshore entity

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

Cons

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- The trading firm has picked up over 90 awards and amassed more than 27 million clients, making it one of the largest and most established brokers globally.

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

Cons

- Despite enhancing the selection of currency pairs, now providing over 70, FBS still trails industry leaders like BlackBull Markets in its market offering with a particularly narrow selection of commodities and indices.

- There are only two base currencies available - EUR and USD - which isn't practical for minimizing currency conversion fees for many global traders, and is especially striking given the broker’s user base spans over 150 nations.

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

Choosing A CFD Broker in Australia

Our years in the industry and direct experience using CFD trading platforms shows there are several things to consider when selecting a broker:

Trust

We’ve selected CFD providers we trust after verifying they are regulated by the ASIC, ensuring the highest level of safeguards for Aussie traders. We also factored in our personal observations during the testing process, looking for dependable trading platforms with an excellent industry reputation.

The ASIC is the financial authority responsible for regulating CFD trading in Australia. It’s a ‘Green-tier’ regulator, meaning it actively monitors CFD brokers and provides the best investor protections.

Notably, the ASIC requires:

- Brokers market CFDs fairly by assessing traders’ suitability, with a leading copy trading broker coming under its crosshairs in 2023 for its appropriateness test.

- Brokers cap the leverage available to retail investors on popular underlying assets like the AUD/USD at 1:30, limiting potential losses.

- Brokers provide negative balance protection, ensuring investors can’t lose more than their account balance while trading leveraged CFDs.

- Brokers operate segregated accounts with trusted banks like the Australia & New Zealand Banking Group, keeping client money separate from the company should the firm face difficulties.

- Brokers should not entice CFD traders with bonuses, such as free trading credits, a practice popular in Australia during the 2010s.

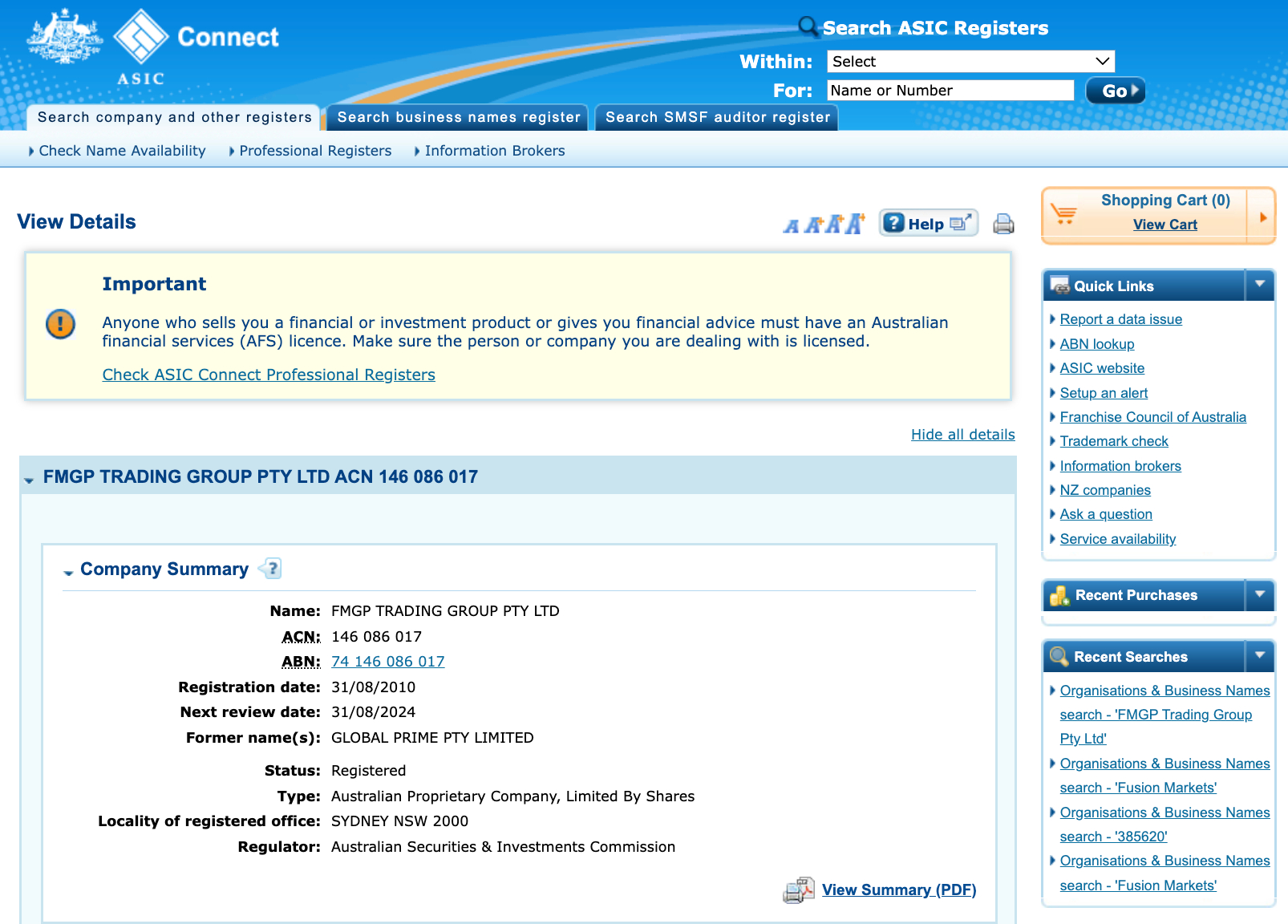

- Fusion Markets (FMGP Trading Group Pty Ltd), is a highly trusted CFD provider in Australia. It’s regulated by the ASIC (AFSL #385620), headquartered in Melbourne, and operates Client Trust Accounts with the National Australia Bank (NAB).

Markets

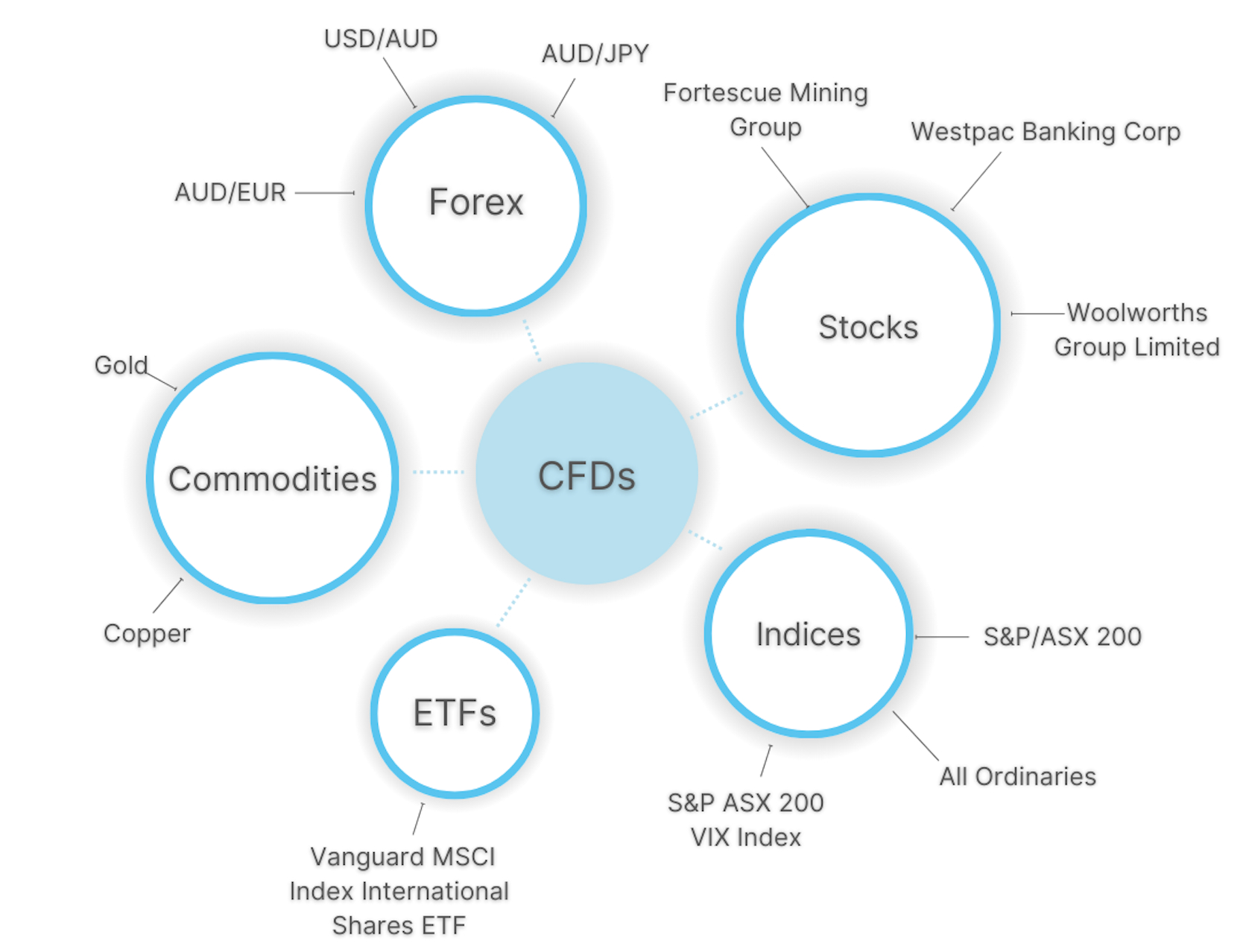

Contracts for difference can be used to speculate on rising and falling prices across a huge range of underlying markets, from stocks and indices to forex, commodities, cryptos, and more.

For Australians, in particular, it may be worth looking for brokers with access to local markets, such as the Australian Stock Exchange and currency pairs with an AUD component.

We’ve recommended CFD trading platforms that provide access to popular Aussie markets, as well as global markets, providing an array of short-term trading opportunities for investors at every level.

The Australian economy is one of the strongest in the world and the country has not experienced a technical recession for over 27 years, the longest of any economy globally.

It is also home to the Australian Securities Exchange (ASX), the largest stock exchange in the southern hemisphere, and the Sydney Stock Exchange (SSX). Its currency, the Australian dollar (AUD), is one-half of the fourth most traded currency pair globally – AUD/USD.

The country is also heavily influenced by trade between the Association of South East Asian Nations (ASEAN), such as Singapore, Thailand and Indonesia, and is part of an economic framework agreement known as ASEAN plus six.

CFD traders interested in commodities will also find Australia an attractive market, with mining making up around 7-8% of the country’s GDP. Iron, gold and copper are among the top commodities mined in the country.

- AvaTrade offers an excellent investment offering, especially for Australian CFD traders, with highlights including the Australia 200 Index and seven AUD currency pairs, including the AUD/USD, GBP/AUD and AUD/JPY. It also offers CFDs on gold and copper.

Leverage

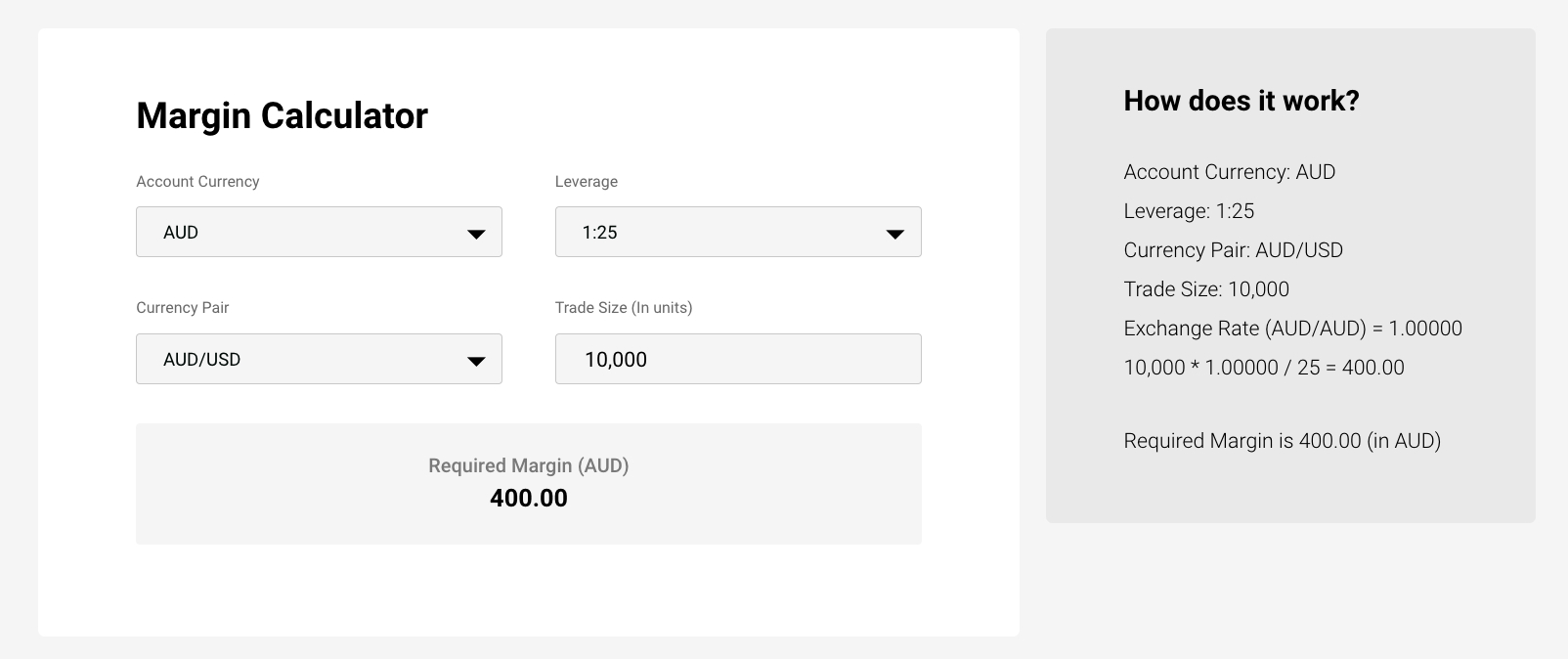

The availability of leverage, which allows you to multiply your trading results (profits and losses) in return for a small outlay, known as margin, is one of the main draws of CFD trading.

However, we only recommend Australian CFD brokers that abide by ASIC’s rules which mandate retail investors can’t access leverage beyond 1:30 for major currency pairs, 1:20 for minor currency pairs, 1:10 for commodities, 1:5 for shares and 1:2 for cryptos.

Let’s say I want to go long on Telstra Corporation (TLS) following an announcement from a respected industry outlet suggesting a promising 5G rollout across Australia.I invest 200 AUD in a stock CFD using 1:5 leverage. This allows me to control 1,000 AUD (5 x 200 AUD).

If Telstra’s stock price rises by 10%, my position increases to 1,100 AUD, resulting in a 100 AUD profit (minus any fees).

- IC Markets offers leveraged CFDs in line with ASIC’s requirements, while excelling with its free Margin Calculator that shows you the required margin in AUD. Our experts have also traded CFDs at IC Markets using real money and praise its lightning-fast execution that caters to fast-paced strategies like day trading.

Cost

Pricing is a critical consideration for CFD traders, especially day traders executing many orders. That’s why we analyze spreads on a range of underlying assets, from forex and commodities to stocks and indices, helping us identify the cheapest CFD brokers for Australian traders.

You’ll typically pay a spread and/or commission when dealing in CFDs. Importantly, newer traders may prefer a spread-only account – these feature higher spreads but keep pricing simple with zero commissions. Alternatively, experienced day traders may favor a low-spread account with a fixed commission.

- Fusion Markets consistently excels as one of the lowest-cost CFD providers in Australia, with average spreads of 0.04 on the AUD/USD and an impressively low $2.25 commission per side. The ASX200 also averages 1.2, while gold (XAU/AUD) averages 2.72.

Funding

The top brokers in Australia ensure a smooth CFD trading experience by facilitating hassle-free deposits and withdrawals, with an accessible minimum investment of up to 250 USD, around 400 AUD.

We’ve researched the payment methods most important to Australian CFD traders and factored their availability into our broker ratings. For example, PayID is one of the most popular methods in Australia, with over a third of Aussies using it for an online transaction in recent years.

- City Index stands out with its excellent selection of convenient payment methods for Australian CFD traders, notably Pay ID and BPAY, alongside traditional bank cards and wire transfers. There is also no account minimum or deposit fees.

FAQ

Which Is The Best CFD Broker In Australia?

Find the best CFD broker in Australia for your needs using our latest rankings.

Every platform recommended has been personally tested by our industry experts, accepts CFD traders from Australia, and is authorized by the ASIC.

Who Regulates CFD Trading Platforms And Brokers In Australia?

The Australian Securities and Investments Commission (ASIC) regulates CFD trading platforms and brokers in Australia.

The ASIC is widely respected for its excellent investor safeguards, notably negative balance protection, limits on leverage, and its active pursuit of brokers for their over-marketing of CFDs and failing to provide appropriate suitability tests, for example, a major copy trading brand was charged in 2023.

How Much Money Do I Need To Open A CFD Trading Account In Australia?

Our analysis shows you typically need up to 400 AUD to open a CFD trading account in Australia.

That said, some brokers cater to budget traders with no minimum investment. The highest-rated are Pepperstone and IC Markets.

Recommended Reading

Article Sources

- Australian Securities & Investments Commission (ASIC)

- CFD Broker Check - ASIC Connect

- Australian Securities Exchange (ASX)

- Sydney Stock Exchange (SX)

- Brand Sued Over Marketing of CFDs - ASIC

- Snapshot of Australian Economy - Reserve Bank of Australia

- How Australians Pay - Reserve Bank of Australia

- Australia's Last Recession - Parliament of Australia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com