Day Trading Alerts

Day trading alerts can be a powerful tool in helping to identify short-term trading opportunities and manage risk. For example, you could set an alert in your broker’s app to notify you when the price of Apple (AAPL) stock reaches a certain level, prompting a buy or sell action.

This guide will catalog the different types of trading alerts out there, explain how they can enhance a day trader’s returns, and discuss the key things to consider when choosing an alert provider.

Best Brokers With Day Trading Alerts

Following our hands-on tests, these are the 6 highest-rated brokers with day trading alerts, available through desktop platforms and mobile apps:

Here is a short overview of each broker's pros and cons

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- xChief - During testing, xChief's MetaQuotes Signals access stood out, letting traders automatically copy top performers or offer their own signals. PAMM accounts allow following experienced traders, while MQL4/5 support enables custom indicators and EAs. The platform’s signals are flexible, practical, and suited for both automated and hands-on strategies.

- Optimus Futures - Optimus Futures delivers strong signal and alert capabilities, with 50+ built-in indicators, volume and TPO analysis, plus TradingView alert integration and SignalStack for automated trade execution.

- IC Markets - When we tested IC Markets’ signals, the real strength was speed - ideas hit MT4/MT5 almost instantly, keeping pace with volatile markets. We found scalpers benefitted most from the low-latency execution tied to these alerts. Signals proved precise enough to complement short-term trading strategies.

- RoboForex - In our tests, RoboForex impressed with its mix of in-house and third-party signals, especially via CopyFX. Execution was quick, and the trade ideas weren’t just recycled patterns - they adapted well to market shifts. We found the diversity of strategies particularly valuable for traders wanting flexible, hands-on signal options.

- XM - When we tried XM’s trading signals, the appeal was their clarity and consistency across multiple timeframes. Delivered through MT4/MT5, the signals felt practical rather than generic, with solid risk levels attached. We noticed stronger reliability on major FX pairs, making them genuinely useful for active traders needing structure.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- The broker trails competitors when it comes to research tools and educational resources

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

Cons

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

What Is A Day Trading Alert?

As a short-term trader, you are presented with many hurdles to overcome. How do you choose between thousands of securities? How do you react to news announcements before the market?

This is where day trading alerts come in. Put simply, they alert you when an event takes place.

This event could be a market development, technical indicators, or reaching a specified price target, for example, a notification if the price of gold declines by 1.5% over a four-hour period.

Armed with this information you’re able to act or react swiftly, increasing your chance of yielding a profit. You may want to pay more attention to a security, or know when to enter or exit a trade.

Alerts will flash up on your trading platform when the conditions are met. They can also be sent by email, SMS, and increasingly by push notification on your mobile phone.

You can get straightforward and free trading signals, that come with your trading platform, and you can get additional, complex alerts that come at a price. The complexity of your notifications will depend on your individual trading style and needs.

Types Of Alerts

As technology has rapidly evolved, effective intraday trading alerts can now be found for nearly all markets, including stocks, forex, commodities, and cryptocurrencies.

That said, trading alerts can be broken down into several categories:

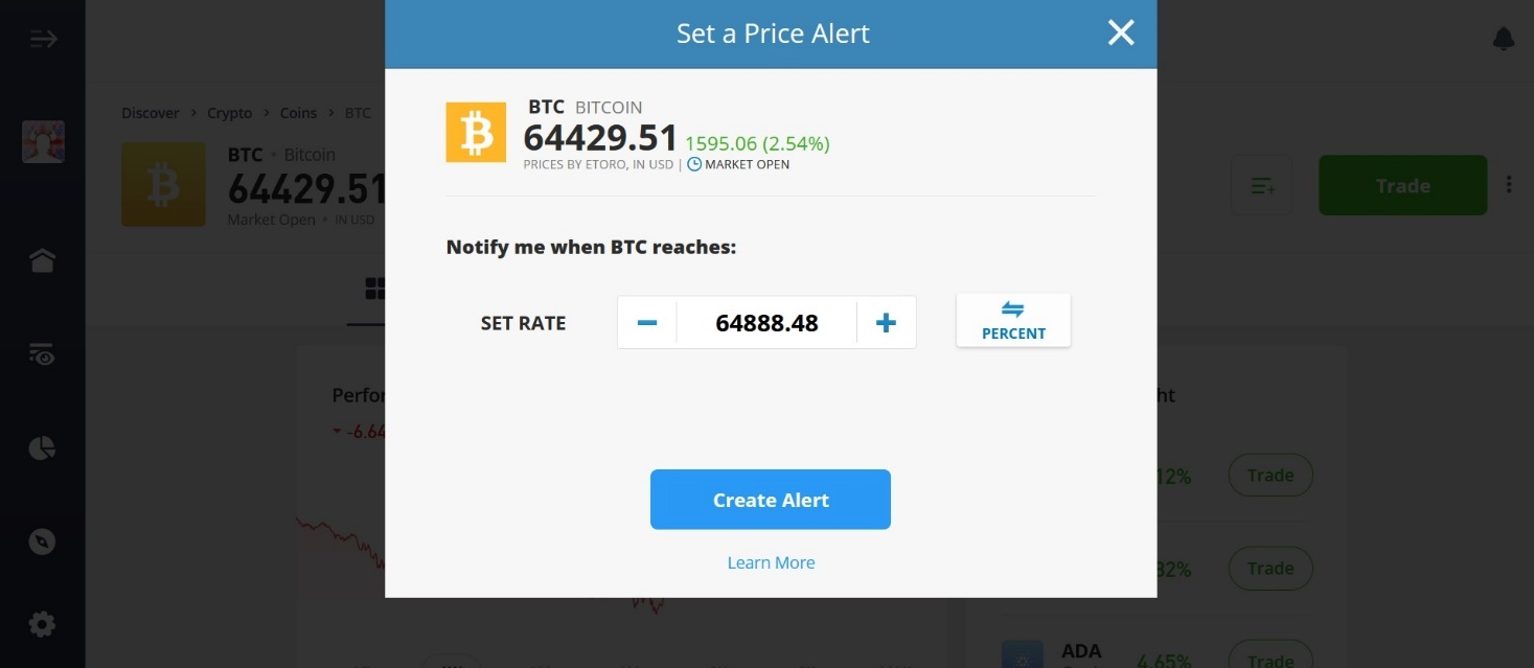

Price Alerts

These inform you when prices move by a certain percentage or hit a specific price level.

They are useful because they can immediately notify you when the market breaches support or resistance levels, or encounters a breakout on a price chart – events that often lead to significant price volatility and opportunity for short-term traders.

Technical Alerts

Technical analysis is used extensively by short-term traders, who – after studying charts – can then set up and buy and sell alerts based on an array of popular technical indicators. These include Moving Average Convergence Divergence (MACD), Bollinger Bands, and Ichimoku Cloud.

You can set alerts based on specific conditions or crossovers of these indicators. For instance, I could establish a copper alert on my trading platform to tell me when the MACD line crosses above or below the signal line.

A cross above is a bullish crossover, and an alert in this instance could encourage me to create a buy order for a copper mining stock, such as Rio Tinto (RIO).

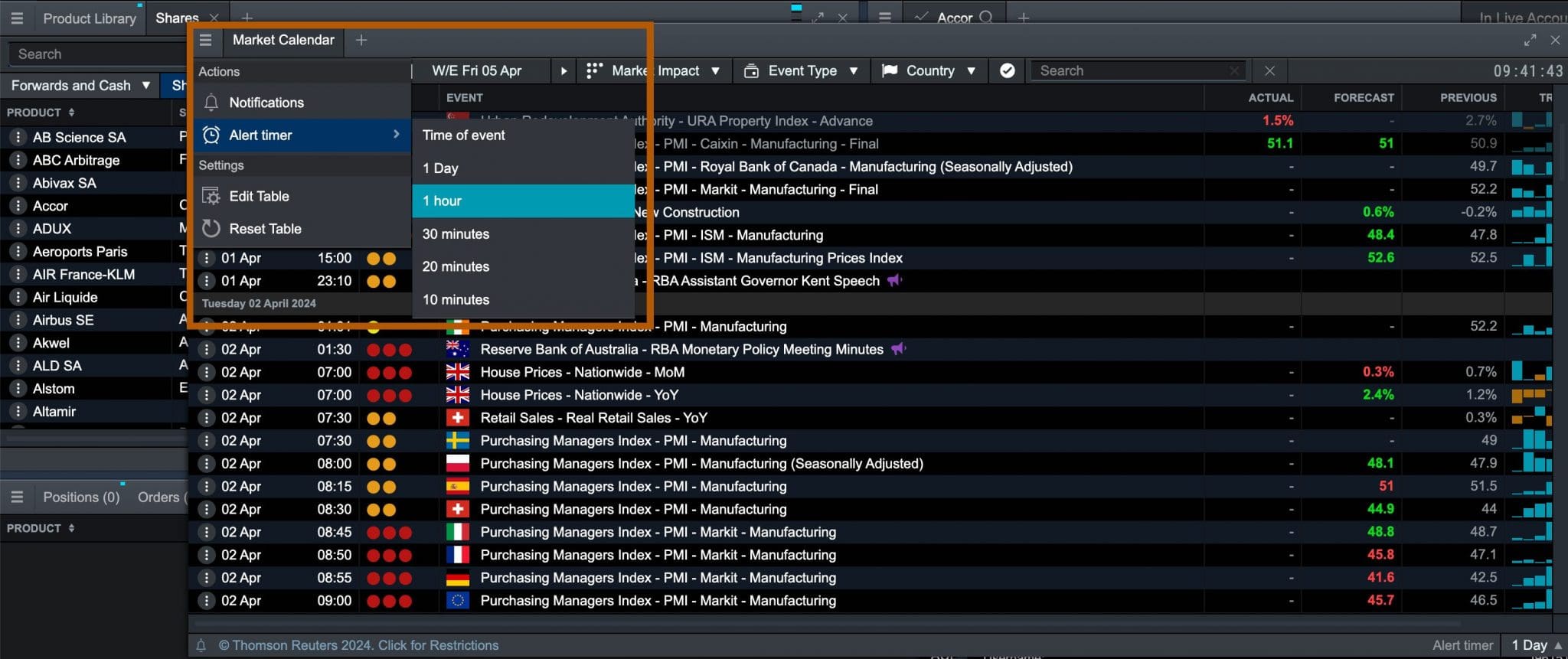

News Alerts

Economic reports, geopolitical updates, corporate announcements, market news and other events can have a significant impact on asset prices. Some of the most watched events in the economic calendar include:

- Market-specific supply and demand data (like the weekly US oil rig count)

- Employment data (such as non-farm payrolls in the US)

- Trade numbers (like export data from China)

- GDP data from major economies

- Inflation numbers

News alerts that cover these events – as well as unexpected off-diary occurrences – can help short-term traders stay informed and react to market shifts.

The best news notifications of this sort will come with commentary and analysis to enhance your trading decisions.

Several platforms also allow you to scroll through a tailor-made economic calendar and then tick the events you’d like to set reminders for. They usually allow you to specify how you’d like to be notified, and how much notice you would like.

Pros And Cons Of Using Trading Alerts

Pros

- Opportunity discovery: By alerting you to certain price movements, technical indicators, or news events, you can identify potential entry and exit points and improve your chances of capturing profitable trades.

- Noise reduction: Alerts can streamline the decision-making process, allowing you to block out random market fluctuations and irrelevant information that can obscure meaningful trends or patterns.

- Time efficiency: By setting up notifications, you don’t have to intensively monitor the markets themselves, giving you time to focus on other tasks and refine your short-term trading strategies.

- Speed and accuracy: Some alert systems are now 100% automated, relying on highly accurate maths and removing the human error margin. This also means that the information you need to make a decision can be provided more quickly.

- Risk management: You can minimize risk to your trades by establishing alerts when markets hit certain thresholds, making them an important tool in your risk management arsenal.

Cons

- Technological problems: While technology is rapidly improving, alerts can still convey incorrect or misleading information that provides false trading signals. Notification delays, platform malfunctions, and connectivity issues may also impact your ability to capitalize on trading opportunities or manage risk.

- Over-dependency: Traders can become excessively reliant on alerts to inform dealing decisions. This may dull your ability to adapt to market conditions, lead to overtrading, and hinder the development of analytical skills.

- Increased trading costs: Many brokers offer free alerts, although you can pay third parties for more sophisticated notification systems. While these tools can boost returns, the associated subscription fees or one-off costs can eat into profits.

Choosing An Alert Provider

Hot competition means that brokerages are all investing heavily to provide the best user experience. This is why many increasingly offer trading alert services to their clients.

But with a lot of different companies operating in this industry, what should you consider when deciding which to use?

Based on our direct experience testing a long row of trading alert providers, there are five key things we, and you, should consider:

- Which asset class are you trading? Some specialist notification companies concentrate on certain markets like currencies, while brokers like CMC Markets provide alerts spanning multiple asset classes, from forex to stocks, indices, and commodities.

- How transparent are they? Only choose a service that provides detailed information on their trading strategies, alert methodologies, and performance metrics, notably win rates and average returns. FOREX.com stands out here with its AI-powered Smart Signals engine that provides short-term trade ideas across 4-, 6-, 8- or 12-hour time intervals with a hit rate out of 10. Whatever you choose, be aware that services provided by brokers licensed by respectable bodies are more likely to be reliable, and read up on the relevant rules and guidance in your jurisdiction.

- Is the alert platform user-friendly? It’s important to select an interface that is easy to use and offers a variety of functions. IG excels here with an intuitive panel in its app that we’ve used to set price alerts, breaking out triggered vs untriggered alerts with accompanying details like price, time and date.

- Do they offer good customer support? Technical problems can be expensive and very frustrating for traders. Try to find out how responsive and effective the provider is in addressing issues, and consider if they provide multiple ways for customers to make contact. XTB has delivered first-class support 24/5 over our years of testing, with integrated live chat in the platform and dedicated account managers.

- What are their fees? Selecting an alert provider requires a trade-off between quality of service and cost. Remember that high fees can take a big bite out of your profits. Opting for a broker with free trading alerts like AvaTrade can help keep fees down. Real-time alerts are available through its web platform and award-winning mobile app.

Many of these questions can only be answered once a provider’s services have been employed. So choosing one that offers a demo account can be a good idea.

We’ve reviewed a growing list of independent trading alert providers over the years, many of which specialize in specific markets and types of trading notifications…

Specialist Trading Alert Providers

Disclaimer – the service providers listed here are not endorsed, or guaranteed, by DayTrading.com to be fit for any purpose. Any use of third-party service providers is at the user’s personal risk. We may receive financial compensation from providers listed here.

Bottom Line

Traders who wish to increase their returns and manage their risk effectively can benefit greatly from day trading alerts.

Yet despite these advantages, traders should also be mindful of the associated costs of using these tools, whilst also remembering to guard against overreliance. They should only be employed as part of a balanced approach to decision-making.

To get started, use our list of the best brokers with day trading alerts.

FAQ

How Can I Receive Trading Alerts?

You can receive your alerts in a number of straightforward ways. You can register for notifications that will pop up when you’re actually in your web-based trading platform, say TradingView. They will usually make a sound to inform you an event of interest has occurred.

Alternatively, you can get mobile SMS notifications. These allow you to respond to important market developments even when you’re on the move.

There is even the option of X, formerly Twitter, alerts. That’s right, you can keep up to date with Donald Trump at the same time as receiving crucial trading information. If that isn’t to your fancy you can set up email alerts and absorb data that way.

Technology now allows you to receive your alerts in whichever medium is most suitable for your needs. For example, an intraday trader glued to the screen all day may benefit most from alerts on their web-based platform.

Can You Profit From Trading Alert Services?

Despite the promise of riches alert service providers claim, there remain downsides to stay aware of. Firstly, remember that however many benefits trading signals and alerts offer, they don’t replace experience and they won’t work without an effective strategy.

Secondly, you need to take into account slippage. There will always be some lag in the alert and your ability to make or exit a trade, and when you’re day trading, every second and tick counts.