Best CFD Brokers and Trading Platforms in 2024

Discover our list of the best CFD brokers and trading platforms. Every CFD broker we recommend has been tested by our research team, earning a high overall rating and the trust of our experts.

Top 5 CFD Brokers

As of May 2024, we have reviewed almost 500 brokers and our hands-on tests show that these are the 5 top CFD brokers:

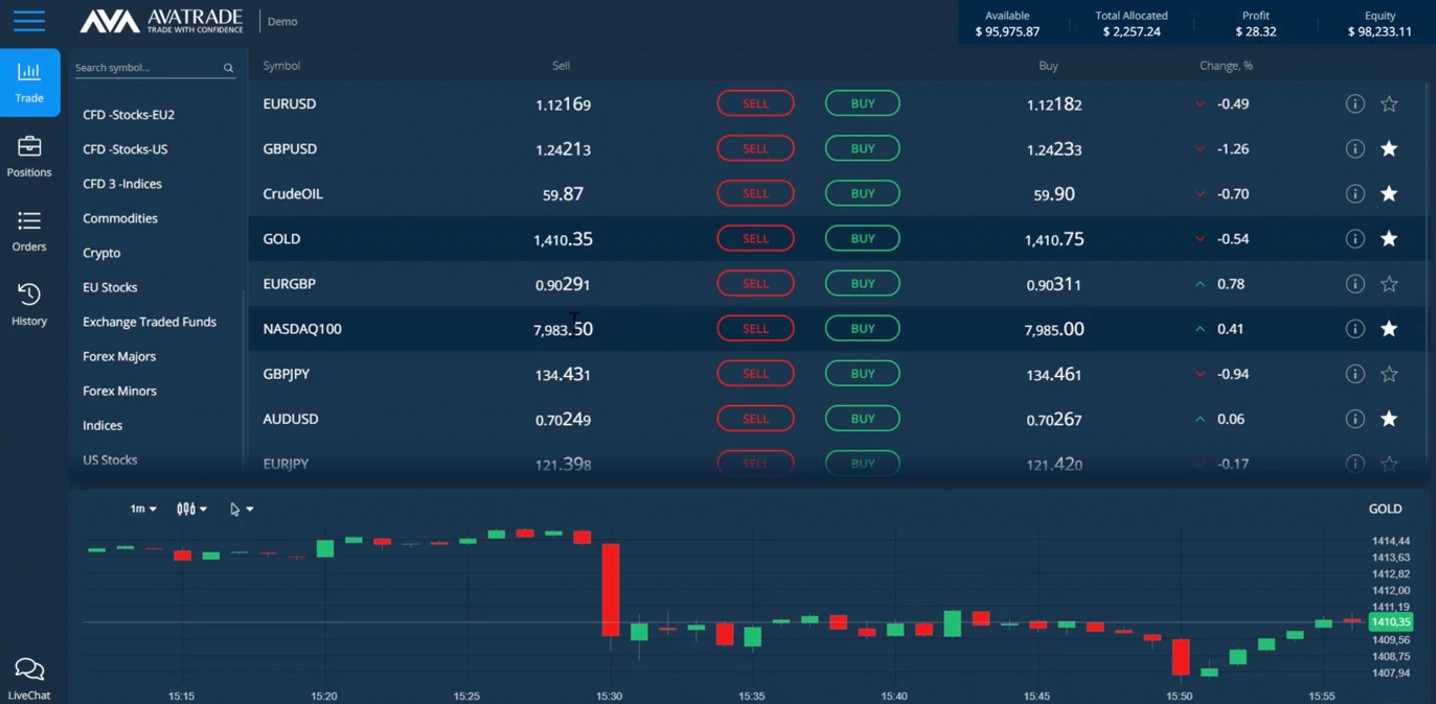

- AvaTrade - AvaTrade's 1250+ leveraged CFD products span a wide range of asset classes including stocks, indices, commodities, bonds, crypto, and ETFs. You can speculate on underlying assets in the broker’s feature-rich web and mobile platforms with market-leading research tools to help discover opportunities.

- Deriv.com - You can trade CFDs on popular markets, including the broker's exclusive synthetic indices which are available 24/7. There are plenty of charting tools available for technical traders, including over 20 indicators in the Deriv Trader platform. New users can also open an account and start trading CFDs instantly.

- Exness - Exness offers a selection of CFDs covering forex, stocks, indices, commodities and cryptos, with leverage up to 1:200. Accounts are geared mainly towards experienced day traders, with over 100 technical indicators available in the broker’s proprietary terminal.

- Pepperstone - Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

- XM - Day traders can speculate on leveraged CFDs with zero commissions, spanning popular markets including currencies, equities and commodities. Additionally, the MetaTrader platforms collectively offer dozens of advanced technical indicators built for short-term strategies.

Best CFD Brokers and Trading Platforms in 2024 Comparison

| Broker | Minimum Deposit | Leverage | Platforms | Regulators | Visit |

|---|---|---|---|---|---|

|

- | 1:30 (Retail) 1:400 (Pro) | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | Visit |

|

$5 | 1:1000 | Deriv Trader, MT5 | MFSA, LFSA, VFSC, BFSC | Visit |

|

$10 | 1:2000 | Exness Trade App, MT4, MT5, TradingCentral | FSA, CySEC, FCA, FSCA, FSC, CBCS | Visit |

|

$0 | 1:30 (Retail), 1:500 (Pro) | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | Visit |

|

$5 | - | MT4, MT5 | ASIC, CySEC, DFSA, FSC, FSCA | Visit |

|

$200 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | ASIC, CySEC, FSA | Visit |

|

$100 | - | MT4, MT5, TradingView | ASIC, FCA, xCySEC, SCB | Visit |

|

$50 | 1:30 | MT4, MT5 | CySEC | Visit |

|

$0 | 1:30 (Retail), 1:50 (Accredited Investor), 1:200 (Sophisticated Investor), 1:300 (Wholesale Investor), 1:400 (Professional Trader). Varies with jurisdiction. | MT4, TradingView, TradingCentral | ASIC, FCA, MAS | Visit |

|

$100 | - | MT4, MT5 | ASIC | Visit |

|

$100 | 1:400 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA | Visit |

|

$50 | - | eToro Web, CopyTrader, TradingCentral | FCA, ASIC, CySEC, FSA, FSRA, MFSA | Visit |

|

$10 | 1:2000 | R StocksTrader, MT4, MT5, TradingView | IFSC | Visit |

|

- | - | MT4, MT5 | - | Visit |

|

$0 | 1:500 (entity dependent) | MT4 | FCA, ASIC, FSCA, SCB, FSA | Visit |

#1 - AvaTrade

Why We Chose AvaTrade

AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

"AvaTrade offers the full package for short-term traders. There is powerful charting software, reliable execution, transparent fees, and fast account opening with a low minimum deposit."

- DayTrading Review Team

- FTSE Spread: 0.5

- GBPUSD Spread: 1.5

- Stocks Spread: 0.13

- Leverage: 1:30 (Retail) 1:400 (Pro)

- Regulator: ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM

- Platforms: WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade

#2 - Deriv.com

Why We Chose Deriv.com

Deriv.com is a low cost, multi-asset broker with over 2.5 million global clients. With just a $5 minimum deposit, the firm offers CFDs, multipliers and more recently accumulators, alongside proprietary synthetic products which can't be found elsewhere. Deriv provides both its own in-house charting software and the hugely popular MetaTrader 5.

"Deriv.com will suit day traders looking to make fast-paced trades using CFDs and multipliers with high leverage up to 1:1000. The broker is also the industry leader in synthetic indices, which simulate real market movements and are available around the clock. "

- DayTrading Review Team

- FTSE Spread: 0.5

- GBPUSD Spread: 0.5

- Stocks Spread: 0.07

- Leverage: 1:1000

- Regulator: MFSA, LFSA, VFSC, BFSC

- Platforms: Deriv Trader, MT5

#3 - Exness

Why We Chose Exness

Exness is a Cyprus-based forex and CFD brokerage established in 2008. With over 260,000 clients, several awards and reputable licensing, the broker has maintained its position as a highly respected global brand. Active day traders can access the popular MT4 and MT5 platforms, raw spreads and multiple account types.

"Exness remains an accessible broker for all experience levels, though experienced day traders will particularly appreciate the ultra-low commission rates, fast withdrawals and high-quality charting software."

- DayTrading Review Team

- FTSE Spread: 15.1

- GBPUSD Spread: 0.1

- Stocks Spread: 0.7

- Leverage: 1:2000

- Regulator: FSA, CySEC, FCA, FSCA, FSC, CBCS

- Platforms: Exness Trade App, MT4, MT5, TradingCentral

#4 - Pepperstone

Why We Chose Pepperstone

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

- DayTrading Review Team

- FTSE Spread: 1.0

- GBPUSD Spread: 0.4

- Stocks Spread: 0.02

- Leverage: 1:30 (Retail), 1:500 (Pro)

- Regulator: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB

- Platforms: MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

#5 - XM

Why We Chose XM

XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC.

"XM is one of the best forex and CFD brokers we have tested. The flexible account types will suit a variety of short-term trading styles while the $5 minimum deposit and smooth sign-up process make it easy to start trading."

- DayTrading Review Team

- FTSE Spread: 1.5 pts

- GBPUSD Spread: 1.9

- Stocks Spread: 0.002

- Regulator: ASIC, CySEC, DFSA, FSC, FSCA

- Platforms: MT4, MT5

How To Choose A CFD Broker

Contracts for difference (CFDs) are a high-risk product available from hundreds of online brokers, however not all firms can be trusted and trading conditions vary. That’s why we, and you, should look at several factors to find the right CFD broker for your needs:

Trust

The most important consideration is choosing a trusted CFD broker.

You risk losing money in scams or from business failure if you sign up with an unreliable broker. This was demonstrated in 2023 when a seemingly credible CFD broker, EverFX, was found to be operating a scam where account managers encouraged traders to move capital to high-risk, unregulated entities, leaving clients with little to no regulatory protection.

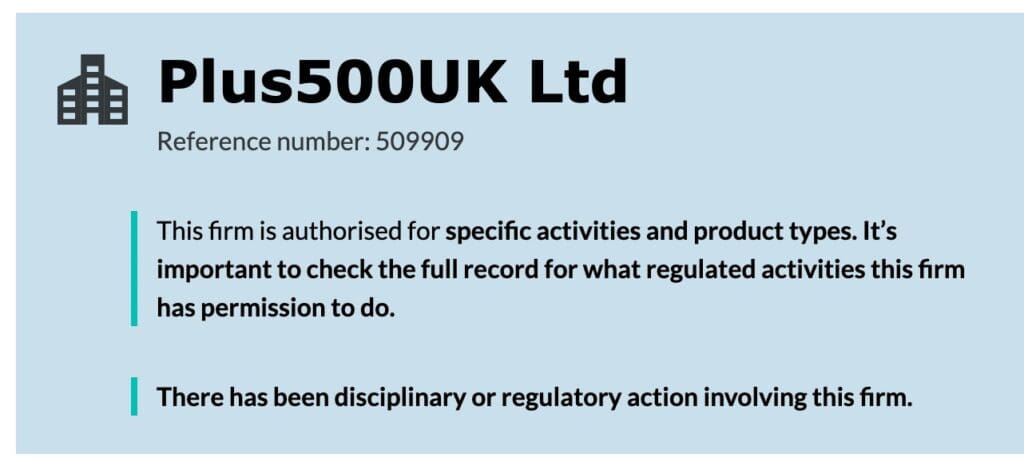

The best sign that a CFD broker can be trusted is oversight from a top-rate regulator like the UK Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), or Cyprus Securities & Exchange Commission (CySEC).

That’s why we review each CFD broker’s licensing details to ensure they have the regulatory authorizations they advertise.

We also test each broker carefully to check for unethical practices and only recommend brokers that earn the confidence of our in-house experts, who have reviewed hundreds of brokers over many years.

- Plus500 maintains a very high trust score of 4.9/5 thanks to its oversight from the likes of the FCA, ASIC and CySEC, listing on the London Stock Exchange, 15+ years of industry experience, transparent trading conditions, and excellent reputation.

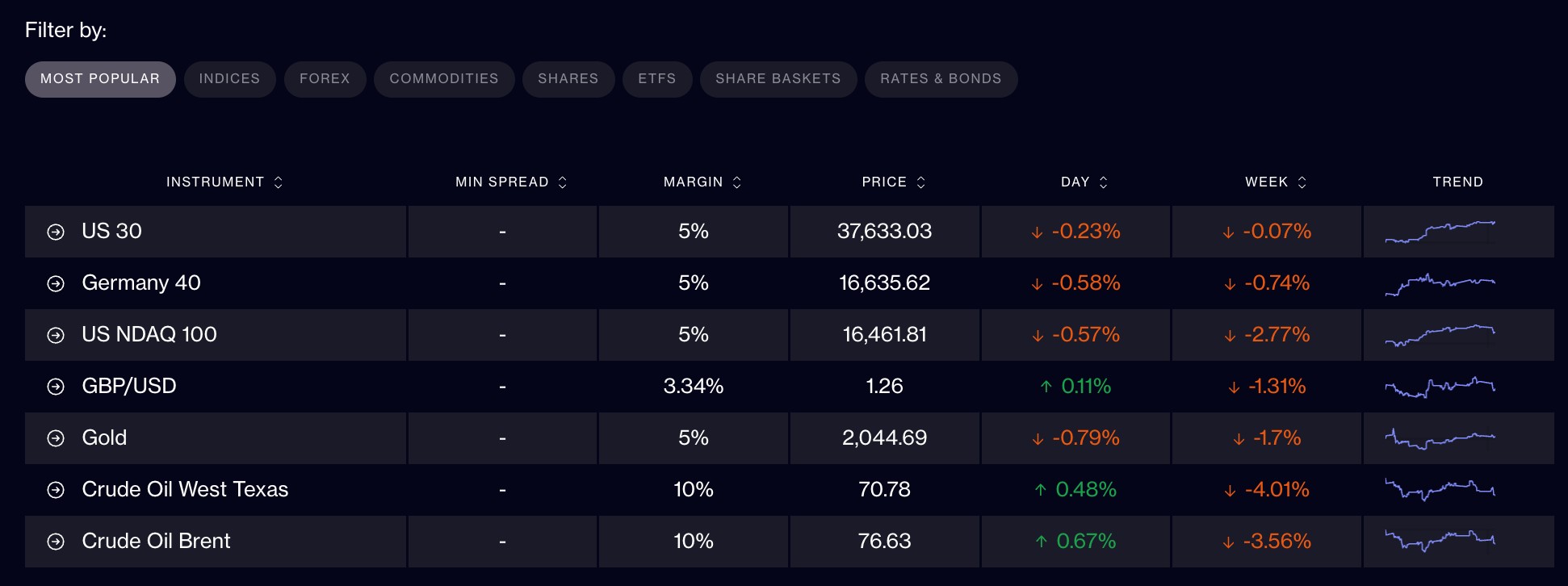

Markets

Selecting a CFD broker that offers access to the financial markets you want to speculate on is key.

CFDs are a versatile trading vehicle that can be used to trade a wide range of asset classes, including stocks, forex, commodities and cryptocurrencies, and we look for brokers that provide enough variety for traders to build a diverse portfolio.

- CMC Markets continues to excel for its above-average selection of 12,000+ CFDs, including 300+ currency pairs – more than every other CFD broker we have tested to date.

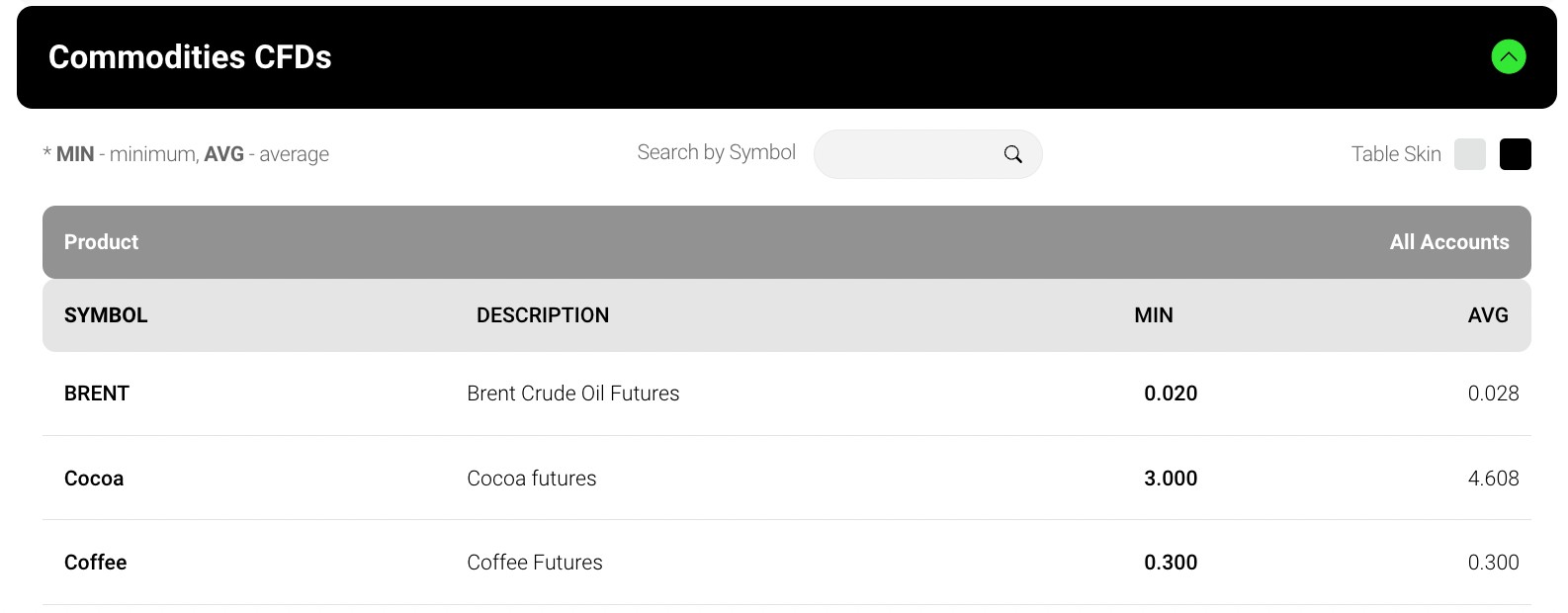

Fees

Picking a CFD broker with competitive fees is an important consideration, especially for active day traders for whom frequent costs can cut into profits.

Most CFD brokers make money through spreads. This is the difference between the quoted buy and sell prices, and real market prices. It’s essentially a markup for the broker’s services.

Fees also come in the form of commissions which take a percentage of each trade. The good news is that to stay competitive, many of the best CFD brokers are waiving commission fees.

CFD brokers also make money through financing. When you trade using margin or leverage, you essentially borrow funds from the brokerage to increase your position size. Most firms factor in a fee for these financing services.

We monitor the trading fees of our top CFD brokers each year to ensure they maintain their edge by continuing to offer tight spreads with low or no commission fees.

We also weigh the trading and non-trading fees (deposit/withdrawal charges and inactivity penalties) against the total package available, including market access and trading tools, on the basis that value for money is more important than simply having the lowest fees.

- IC Markets consistently ranks as one of our cheapest CFD brokers. The Standard account is great for beginners with commission-free CFDs and spreads from 0.8 pips, while the Raw account will serve intermediate and advanced traders with spreads from 0.0, a low commission of $3.50, plus rebates for high-volume traders.

Leverage

Given the risk of high losses with derivatives like CFDs, choosing a broker with transparent leverage and margin requirements is key.

Leverage allows you to greatly increase the potential profitability of trades with a relatively small amount of capital. Leverage is often written as a ratio, for example 1:10. Here, a $100 outlay would give you $1,000 in buying power ($100 x 10).

Importantly, the amount of leverage available can vary greatly among CFD brokers. If your broker is regulated by a top-tier body like the FCA, ASIC or CySEC, then it is likely to be restricted to a maximum of 1:30 for forex and lower amounts for more volatile instruments like crypto.

These regulators also require CFD brokers to provide negative balance protection, ensuring you cannot lose more than your account balance.

Still, many traders choose to sign up with offshore CFD brokers who can offer higher amounts of leverage, sometimes reaching 1:3000.

I do not recommend beginners trade CFDs with high leverage given the risk of substantial losses. And if you do, make use of risk management tools in your broker’s platform like stop-loss orders. These can limit potential losses.

- FXCC is a good example of a reliable CFD broker that offers leverage up to 1:500 for traders who sign up with its global entity.

Platforms and Apps

Choosing a broker with a user-friendly CFD trading platform and the features you need to analyze the markets is essential.

Based on our extensive experience, the top CFD brokers offer popular third-party software like MetaTrader 4, which is great for advanced traders interested in technical analysis and algo trading, alongside user-friendly proprietary platforms and mobile apps that deliver an intuitive user experience for beginners.

- AvaTrade stands out for its excellent platform line-up, from MT4 and MT5 to the in-house WebTrader that performed well during testing with an intelligent design, smooth user experience and a strong charting package comprising 60+ indicators, 14 drawing tools and 10 timeframes.

Value-Add Features

With many CFD brokers offering competitive packages today, considering the additional features available can be a great way to find a firm that best caters to your experience level and strategy.

We’ve seen that the best CFD brokers offer a variety of extra tools to give traders the best chance at success. This can include engaging educational materials and social investing platforms to support new traders, market research tools like Trading Central to help you discover opportunities and virtual private server (VPS) hosting to give advanced day traders the fastest execution speeds with low latency.

- Pepperstone excels for its large suite of extra tools that elevate the CFD trading experience, from daily market news, code-free automation tools like Capitalise.ai, and top-rate education with guides to CFDs for beginners.

Bottom Line

The best CFD brokers provide a secure environment where you can speculate on global financial markets with user-friendly tools and low fees. Choose from our list of top CFD brokers to find the right platform for your needs.

Find out more about how we test CFD brokers.

FAQ

What Is A CFD?

In a CFD trade, you can place a long or short bet on the price movement of an instrument without needing to actually buy or sell it.

The profit (or loss) is determined by the difference between the starting price and the price when you close the contract.

Since CFDs can be traded with leverage, even traders with a relatively small amount of capital can generate significant profits (or large losses).

CFDs can also be a good way for day traders to earn from smaller price movements over short timeframes.

What Is A CFD Broker?

A CFD broker is a financial intermediary that enables you to speculate on price movements in various financial markets without owning the underlying assets.

They facilitate the trading process through an online platform. You sign up for an account, deposit funds, trade CFD products and then withdraw any profits.

Are All CFD Brokers Regulated?

CFDs are legal financial instruments that are tightly regulated in many jurisdictions. That said, brokers are banned from offering CFDs in some countries, including the United States.

Recommended Reading

For Specific Countries

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com