Gold: Why It’s a Good Addition to Your Portfolio

Gold is a type of shadow currency with a valuation proportional to currency and financial asset reserves in circulation divided by global gold reserves.

Put another way, it can be considered the sum of a weighted average of the yields of all global financial assets relative to their volumes divided by the global gold stock.

Put mathematically:

Price (gold) = k / gold stock * ∑ [volume (currencies and reserves) / yield (currencies and reserves)]

(k represents a constant to equitably proportion the two sides)

This means that as yields on financial assets go down, holding all else equal, the price of gold goes up.

As the gold stock increases (again, ceteris paribus), the price goes down because of higher supply.

As the volume of financial assets increases (somebody else’s liability), the price of gold goes up.

The gold stock doesn’t vary much from year to year (1 to 3 percent annualized growth). Accordingly, monetary policy is a big driver of its valuation given central banks’ influence on rates, money supply, reserves and reserves management, and credit creation.

Every country in the developed world needs easier policy or will at least hold steady for now. No global central bank is tightening and countries will eventually get more monetary easing. This means lower yields on developed market currencies and bonds. Negative yielding sovereign debt is now over $15 trillion as of August 2019, a new record.

Accordingly, there is less attraction for these assets as real yields fall, and has brought a higher price of gold in relative terms. In many currencies, gold is the highest it has ever been.

Everywhere you look in the developed world growth is declining and core inflation is flat to down. If you build out growth and inflation projections using leading indicators you know what GDP is likely to be in real and nominal terms over the next 1-2 years. Those are projected to decline, so that means rates will as well. Rates represent the demand for credit, so those decline as output declines. In other words, the path of nominal interest rates must follow the path of nominal economic growth.

Central bankers need to keep nominal borrowing rates below nominal growth rates or the debt servicing becomes too onerous and the credit-creating capacity of the economy drops in conjunction. (The vast majority of transactions in an economy are done with credit.)

Rates all over the developed world will go down as a fundamental reality. That means their currencies become less attractive in absolute terms as they yield less. Same with their bonds. Bonds are simply longer-duration fiat currency flows – that is, bonds (and other debt forms more generally) are a promise to pay currency in the future. For stocks, it depends, because stocks are valued based on the rate of change in the term structure of interest rates relative to the rate of change in future discounted earnings (which is a function of economic growth).

Stocks have done well in 2019, though mostly recouping the drawdown of Q4 2018, and not because of good earnings/growth news but because the term structure of interest rates has changed in a favorable way.

But as interest rates and entire yield curves head to zero, or below zero, and quantitative easing (i.e., central bank asset buying) becomes less effective, alternative monetary easing measures will pick up.

Fundamentally, lower rates and other easing measures will be promoted by central banks to help debtors relative to creditors. This is due to the amount of debt relative to the levels of income on a global level (debt is approximately 320% of GDP).

This will reduce the value of money and inflation-adjusted returns to creditors. It will also provide a test to creditors – and provide a gauge to central bankers – in terms of the extent in which they can lower inflation-adjusted returns to creditors before they (i.e., creditors) are no longer willing to lend, and move into other asset classes.

These types of alternative measures could include debt monetization (wherein the central bank will fund government debt directly rather than the private markets) and currency devaluations.

Based on what we covered earlier, when the values of fiat currencies are being depreciated and financial assets around the world see declining real returns, this directly boosts an asset such as gold, which functions as a type of alternative currency.

Moreover, most traders and investors tend to be underweight these types of assets because they aren’t traditionally known as a source of investment return. (Ostensibly because they “don’t produce anything”. In reality, gold’s return over the long-run has been approximately on par with, or a little bit better than, cash.) Because of its diversification effects, gold tends to hold the purpose of a type of asset that can both enhance returns and/or reduce risk.

Should you own gold?

Sometimes gold is great to own and sometimes it’s terrible depending on what’s happening in the world. In Q4 2018, real rates and rates expectations were rising throughout the developed world as central banks hiked interest rates and yield curves shifted skyward. Gold fell in conjunction with yields on currencies and the yields on longer duration financial assets increasing. In 2019, as central banks have reversed in the other direction, gold has increased in value.

Gold is up some over 27% since its August 2018 relative lows so it’s no longer as cheap. Though as central banks ease – and especially as they ease more than what’s priced into expectations (easing cycles are rarely orderly) – gold is likely to increase further. (Remember that all financial assets are priced relative to expectations, not just whether things are “good” or “bad” but rather how things turn out or are perceived comparative to what is already priced in.)

But independently of viewing it as an alpha generation type of thing because of what’s going on in the world with the easing and money printing – despite temporary respites in the top two reserve currencies (i.e., USD, EUR) and a “tapering” in Japan, and large future liabilities relative to assets (e.g., pensions, healthcare) – most portfolios could use it in a small proportion because of what it does for portfolio metrics.

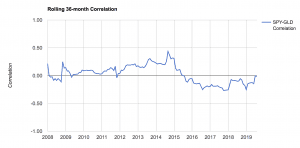

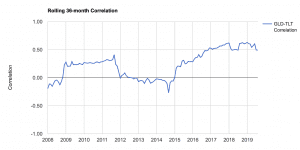

It doesn’t correlate with stocks over the long-run because the fundamental driver of its value is different and only correlates somewhat positively with something like US Treasuries.

Here is a correlation of gold relative to stocks:

Gold’s correlation relative to US Treasury bonds:

Correlation relative to US corporate bonds:

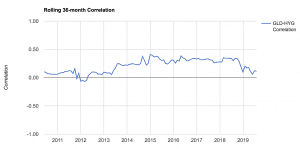

To high-yield bonds:

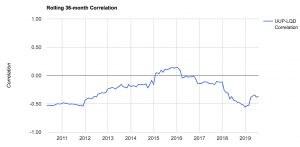

To the USD:

To oil:

Conclusion

Over the long-run, gold is not the best investment. It’s simply a cash alternative so it shouldn’t be overemphasized or be too dominant a position in one’s portfolio.

Moreover, it lacks the capacity to see big inflows of wealth from other financial asset classes because there’s a relatively limited amount of gold relative to financial assets and gold is a comparatively illiquid market. The global gold stock is about 1.9 billion ounces, or about $2.9 trillion. This is quite small compared to global equity markets that are about $100 trillion deep and debt markets $255+ trillion deep, and derivatives markets notionally valued at north of one quadrillion. So, in terms of a flows perspective, it can only absorb wealth on a smaller level.

But in a smaller proportion of most people’s portfolios gold can make sense because of its unique economics and diversification effects.